Bullish on "Incredible India"

Global investors seem to be forming a consensus: India is the next big thing in emerging markets - and it still has room to grow.

Remember the “Incredible India” tourism campaign? It’s been more than two decades since the Ministry of Tourism launched it, and you’ve probably seen one of their slick ads on CNN International, or maybe Instagram or Youtube, or a photo in a magazine like this one above.

Today, there seems to be another gathering campaign, but this one is not led by India’s government. It’s led by investors. A herd of investors, it seems, are bullish on India - and they are charging forward. Let’s call them the “Incredibly Bullish on India” crowd, one with many believers — and growing fast.

Over the past ten days, I’ve attended and spoken at institutional investor conferences in Scottsdale, Arizona and Fort Lauderdale, Florida and a broader global summit in Dubai in the United Arab Emirates. I’ve racked up a lot of miles, and will share some of what I heard in future posts. While none of the three events were specifically focused on India, the South Asian giant often came up in discussions around global investments.

At The World Governments Summit in Dubai — an event that is shaping up to be one of the most dynamic and diverse gatherings on the planet — I attended a session that included Khaldoon Al Mubarak, the sharp chief executive of Mubadala, one of the world’s largest sovereign wealth funds with some $275 billion of assets under management. When he was asked by CNBC moderator Dan Murphy about areas where he is most bullish for the future, he specifically pointed to India, citing its growing middle class, robust growth, and rapid digitalization with growing access to 5G.

Khaldoon Al Mubarak is not alone. From various stages in Scottsdale and Fort Lauderdale, I heard a similar sentiment among some of the world’s leading portfolio managers and hedge fund leaders, speaking before audiences that controlled trillions in pension funds and endowments. India was on their minds. They often cited India’s favorable demographics, its tech talent, its infrastructure build-out, relative political stability, and its potential for further growth. To wit: India’s GDP is roughly a fifth of China’s, though its population exceeded the Middle Kingdom in 2023 and it will not look back. As such, India still has a lot of room to grow, teh argument goes, and there are many factors driving that growth from rising digitalization to growing consumer demand to investor jitters over China leading to more India flows.

Of course, none of this is new. Smart money emerging markets investors have been bullish on India for at least two years now. Indeed, in these very pages, emerging markets investment pioneer Mark Mobius cited India as one of his biggest holdings more than two and a half years ago.

The Michael Jordan of Emerging Markets Investing: A Conversation with Mark Mobius

By Afshin Molavi Emerging World Interview If emerging markets investing had a hall of fame, Mark Mobius would be a first ballot, unanimous entry. The trouble is that most sports hall of fames only induct you after retirement, but the legendary investor is still going strong, at age 85, after a highlight-filled career. Imagine Michael Jordan still at the t…

Mobius remains bullish on India. When he was asked by Bloomberg in June 2023 where he would invest $1 million, he said: India.

To me, India is the real future. Of course, the market has done very well and we’re near the top of the recent past, but nevertheless we are finding big bargains in wonderful companies.

India’s growth rate is 7%-plus, which is among the highest in the world. A rule of thumb is that if the country has a 7% growth rate, then a reasonably good company should be able to double that. We expect 14% earnings per share growth, and we insist on a return on capital or return on assets of 20% or more.

To understand what some of the world’s leading investors are thinking about India, I’ve compiled some excerpts from recent reports touting the India growth story.

Among the India bulls, the most bullish of the “Incredibly Bullish on India” campaign might be Morgan Stanley. The U.S-based investment bank had this to say about India back in 2022.

India is already the fastest-growing economy in the world, having clocked 5.5% average gross domestic product growth over the past decade. Now, three megatrends—global offshoring, digitalization and energy transition—are setting the scene for unprecedented economic growth in the country of more than 1 billion people.

“We believe India is set to surpass Japan and Germany to become the world’s third-largest economy by 2027 and will have the third-largest stock market by the end of this decade,” says Ridham Desai, Morgan Stanley’s Chief Equity Strategist for India. “Consequently, India is gaining power in the world order, and in our opinion these idiosyncratic changes imply a once-in-a-generation shift and an opportunity for investors and companies.”

All told, India’s GDP could more than double from $3.5 trillion today to surpass $7.5 trillion by 2031. Its share of global exports could also double over that period, while the Bombay Stock Exchange could deliver 11% annual growth, reaching a market capitalization of $10 trillion in the coming decade.

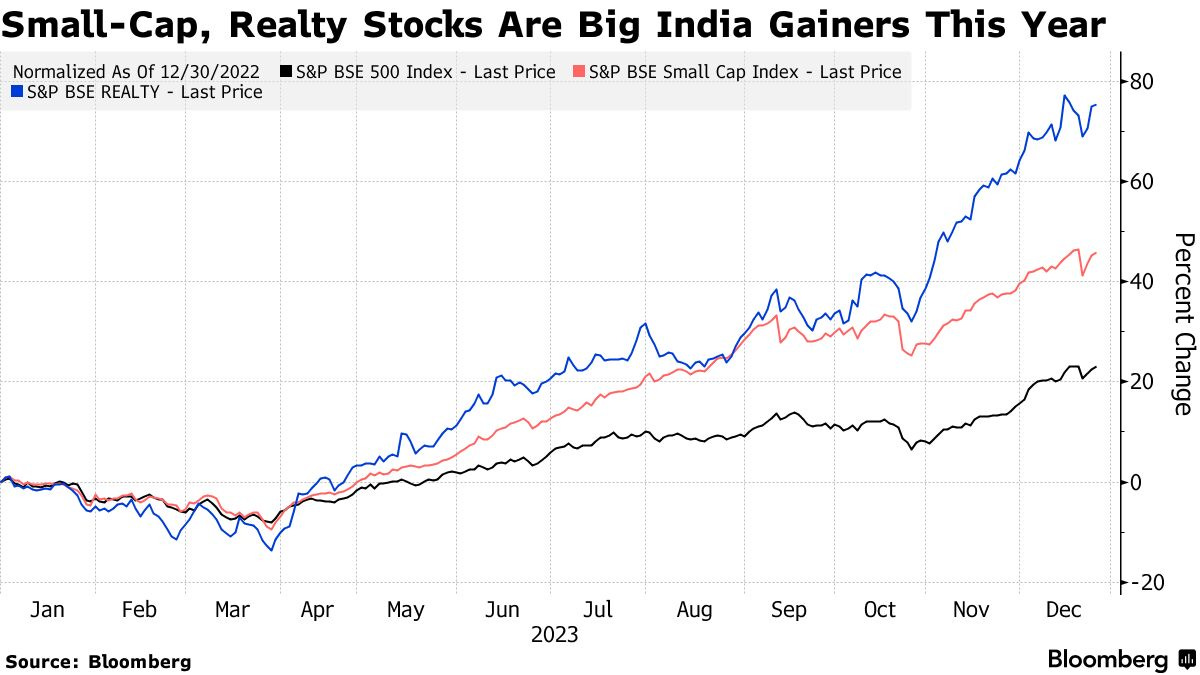

Most bets on India stocks paid off handsomely in 2023. See this chart below from Bloomberg

And this from WisdomTree Investments, published on February 17, 2024.

Over the last five years, India has delivered strong fundamental performance, growing sales by nearly 8% per year. While multiples have expanded by 2.3% per year over during this period, they are far from overvalued, in our view. As long as India can continue to deliver solid growth versus other markets, we believe we may be in the early innings of a dramatic repricing of Indian assets versus China. We feel that China is currently on the verge of experiencing a lost decade. For many investors, India may be a strong option to counter a challenging macro environment and self-inflicted wounds from Chinese policy makers.

Many investors regularly make the China comparison, declaring that India may be where China was in the late 1980s, already growing, but about to have a dizzying decade. Bloomberg reported that five times more money has poured into India-focused ETFs' than China funds.

The always sharp Malcolm Dorson, a friend of Emerging World, and head of emerging markets strategy at Global X by Mirae Asset, is also an India believer. In an excellent “on the ground” report co-authored with Paul Dmitriev in late 2023, they write:

We continue to see India as the best structural growth opportunity in emerging markets (EM), if not the world… As a sign of momentum, on the eve of our arrival in Mumbai, JPMorgan announced it would begin including India in its widely tracked JPMorgan Chase Government Bond Index – Emerging Markets from June 28, 2024, on. If the same move is replicated by FTSE and Bloomberg, we estimate that the potential U.S. dollar (USD) inflow to India could add up to USD 45bln over the next two years. This would likely support the currency, keep inflation in check, and provide additional liquidity to boost the ongoing capex cycle. To us, this is a clear signal that capital markets are deepening, investment will likely continue, wages are apt to grow, and consumption could increase exponentially.

So, should we be worried about the consensus forming?

Fidelity adds a word of caution in a recent note, stating:

INVESTORS routinely draw a distinction between the expensive but high growth US stock market and others in Europe, Japan and the UK, which look less exciting in growth terms but seem to offer better value. One of the key questions is whether the S&P 500 justifies its premium rating.

There is, however, another similar comparison which receives less attention. The gap between the valuation of the Indian stock market and those of other emerging markets mirrors that between the US and the rest of the world. India’s stock market is far and away the most expensive of its developing world peers, standing on around 20 times expected earnings, which is in line with Wall Street and twice the 10 times earnings multiple of the out of favour Chinese stock market. As with the US, the jury is out on whether this is justified by the country’s better prospects.

The India “might be overvalued narrative” is also gathering pace. Andy Mukherjee, the seasoned columnist for Bloomberg writes:

…there are signs of nervousness around smaller companies. The iShares MSCI India Small-Cap ETF, which holds stocks with a median market value of $2.4 billion, hasn’t had inflows in nearly two months, whereas the iShares MSCI India ETF, whose median holding has a capitalization of $30 billion, is witnessing steady interest. The reason is not hard to see. Smaller Indian companies are more expensive now than larger firms."

Many other nay-sayers worry that the India good news story is already baked in. “India is no longer investment’s best-kept secret,” as Fidelity noted and its valuations are “on par with the US, but with significantly less mature institutions.”

Still, India has much going for it. Consider its roughly 700 million people under the age of 30 and a broader population that is increasingly wired, banked, and connected. There has been a digital banking revolution over the past decade that has linked hundreds of millions of un-banked Indians into the financial grid, notably women. This digital banking revolution followed one of the most dramatic revolutions of connectivity in history when Reliance Jio launched its telecom service in 2016, amassing some 440 million subscribers in seven years, and wiring the world’s most populous nation. Only China has more mobile subscribers than India.

The World Bank has reported that India recorded the second highest rate of growth among G20 economies last year and is set for another strong year, with a 6.3% forecast. Growing investor fears about China has also certainly boosted India’s prospects, both in terms of manufacturing and investment flows. Apple is producing iPhones in India and aims to dramatically boost its share of global manufacturing to 25% of the total from 5-7% today.

As Capital Group noted, “we anticipate India will become a desirable location for companies looking to diversify their supply chains outside of China, a strategy commonly known as China plus one.” Capital Group lines up with the bulls, noting that “we believe that India is poised for a period of secular growth, fueled by significant expansion in direct and fixed asset investment.”

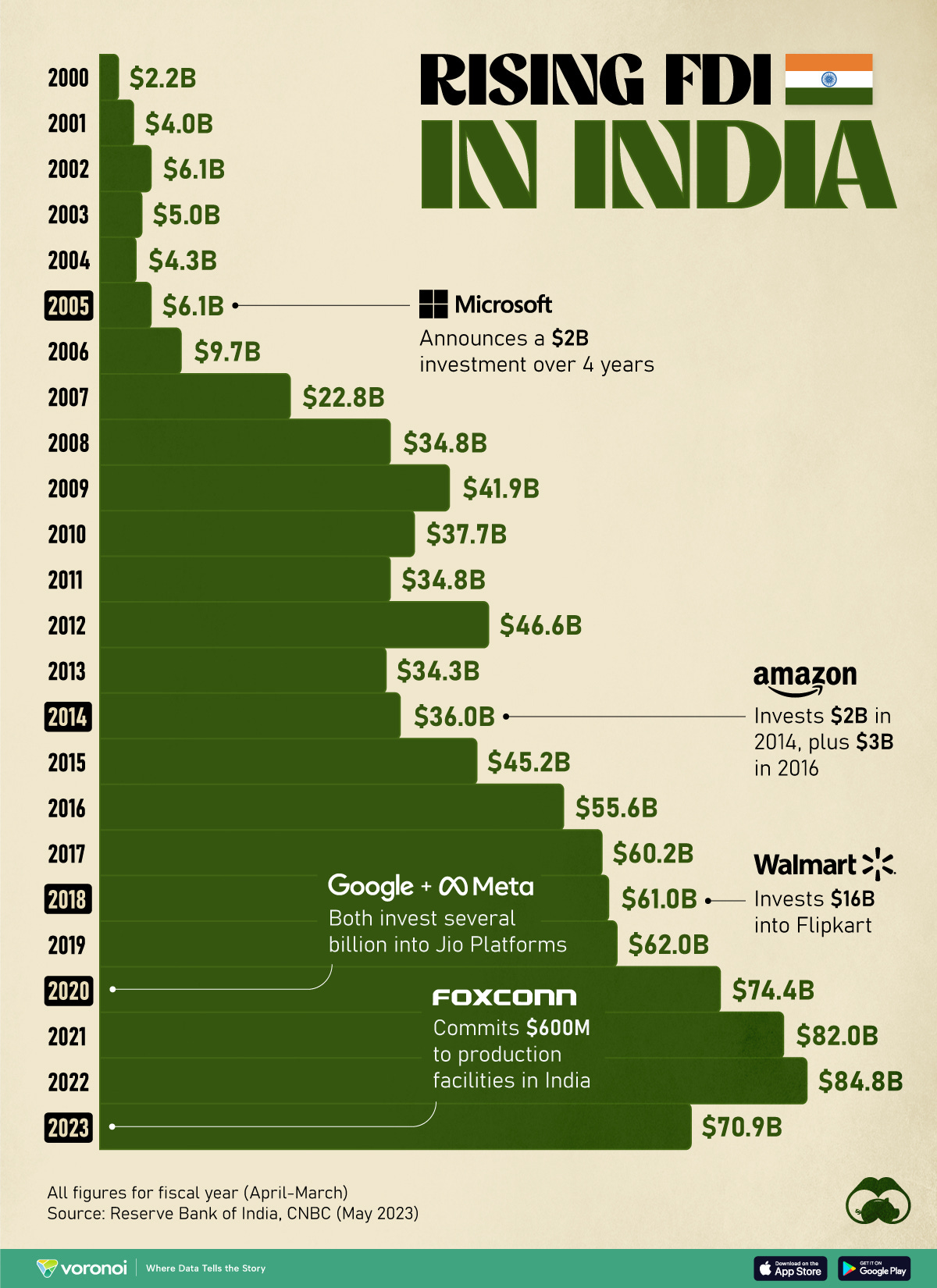

Of course, the India buzz is also attracting record amounts of foreign direct investment, and putting India on the global unicorn map. After the US and China, India has the most tech unicorns (unlisted companies valued at $1billion+) in the world.

What’s more, in a good sign for any emerging market, its billionaires are not looking to park their cash elsewhere or flood markets in Europe or the United States. They are investing at home, most notably Mukesh Ambani of Reliance Industries and Gautam Adani of the Adani Group. Meanwhile, one of India’s most storied business families, the Tata Group, are making a big bet on Indian air travel, reviving flag carrier Air India with multi-billion dollar aircraft purchases and services upgrades.

In February of last year, as I wrote in Forbes, Air India placed the largest aircraft order in history - a potentially $80 billion bumper deal for 470 aircraft almost split evenly between Boeing and Airbus.

It’s a big bet on India’s rising middle classes and the kind of bet that many are making today in the “Incredibly Bullish on India” campaign. The question remains: how early are we in the “rise of India” cycle, and what could derail it? This year’s election seems poised to bring Prime Minister Narendra Modi a third term in office. The India bulls will appreciate that, but we’ve learned that geopolitics can be bumpy, and Mike Tyson’s Law of Planning should be top of mind: “Everyone has a plan, that is, until you get punched in the face.”

India is bobbing and weaving and jabbing effectively, for now, and I find the “India Rising” narrative a compelling one with room to grow, but there are many rounds to go, and the punches will come.

Stay tuned. We’ll be watching this space.

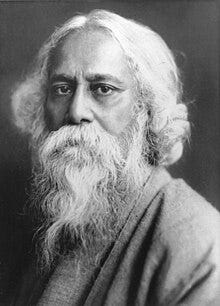

We often post quotes at the end of our articles, so in honor of this piece, here’s some wisdom from late 19th and 20th century Indian writer/poet Rabindranath Tagore, one that has some resonance to me these days

“You can't cross the sea merely by standing and staring at the water.”

Great post.

Any resources on India's competitive factors like infrastructure, complexity of its supply chains, education of its population?