China, Middle East Ties Accelerating

Beijing Forum Underscores Growing Ties. Oil and Gas Trade Remains Critical, But Ties Go Beyond Energy. US-China Rivalry Looms. Recommended Reads and More.

Buried beneath the headlines of Donald Trump’s latest trial tribulations, India’s surprising elections, and the latest grim news from Gaza and Ukraine, there has been a flurry of activity on China’s engagements with several Middle Eastern states. Let’s explore what went down over the past couple of weeks.

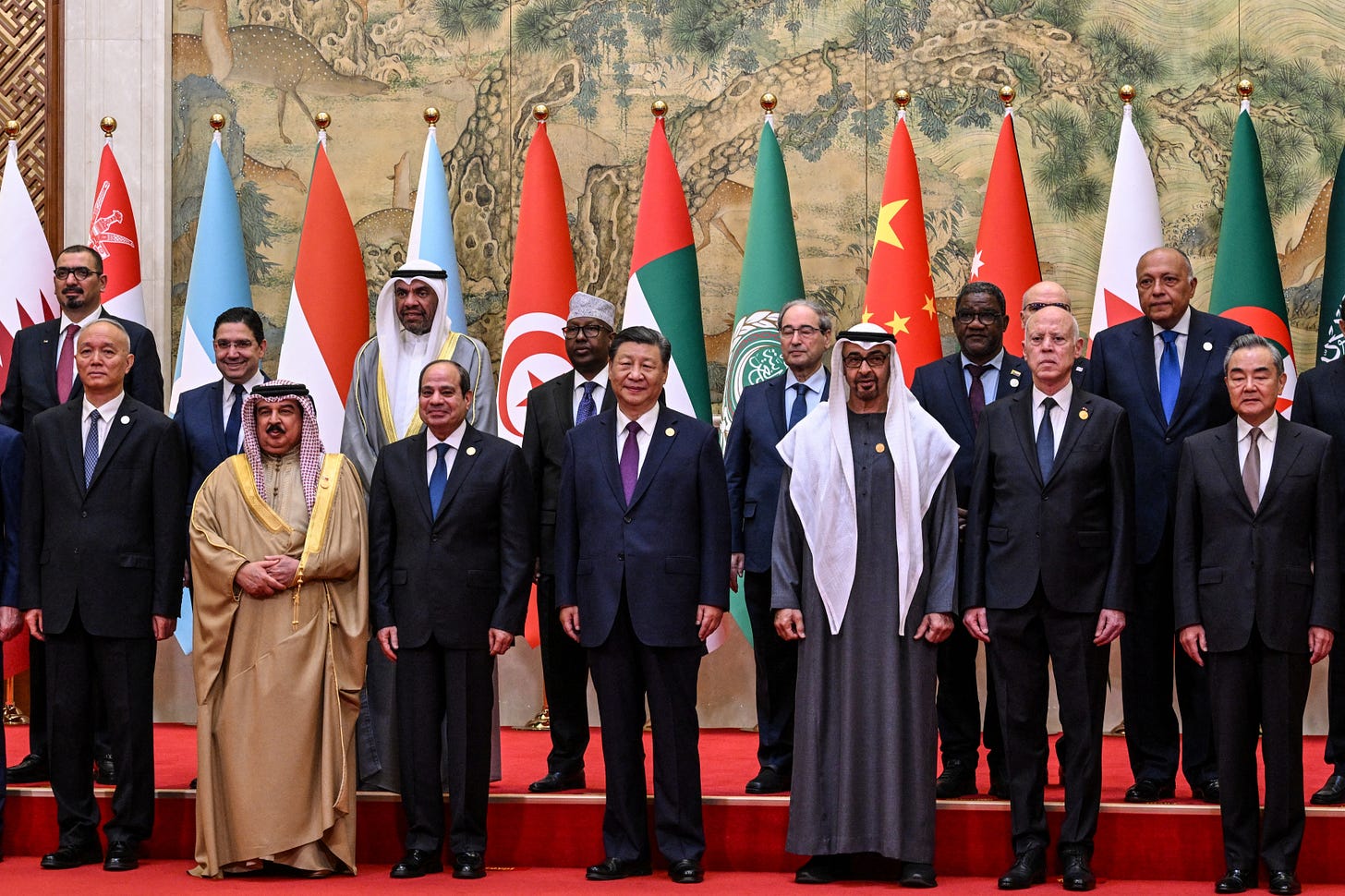

In late May, China hosted the “China–Arab Countries Cooperation Forum” summit in Beijing, and several of the region’s top leaders, including UAE President Sheikh Mohammed Bin Zayed Al Nahyan, Egypt President Abdel Fattah el-Sisi, Bahrain’s King Hamad bin Isa Al Khalifa, and Tunisia’s President Kais Saeid attended the event in person.

Jonathan Fulton, founder of The China-MENA newsletter pointed out that the UAE delegation accompanying Sheikh Mohammed Bin Zayed was particularly strong and influential, which may have been intended to send a placating message to Beijing after the UAE publicly declared that it stands with the United States on technology and AI investments, and a prominent Abu Dhabi AI company, G42 announced its divestment from China.

On a side note, I’m delighted to welcome Jonathan Fulton to Substack. He has been traveling the China-Middle East road for a long time, and his analysis is always superb. Check out and subscribe to his new site at China-MENA newsletter.

Your humble correspondent has also been traveling this road awhile. I dug up an old article I wrote on The New Silk Road for the Washington Post back in 2007. Ah, how the wheel of time flies…Or, as the great Omar Khayyam put it (rendered by the great Edward Fitzgerald)

“…one thing is certain, that Life flies; one thing is certain, and the Rest is Lies; The Flower that once has blown forever dies.”

Ok, I did not mean to get existential there, so let’s get back to the post at hand - developments on China’s engagements with the Middle East and North Africa region.

Oil and Gas Still Vital to the China-Middle East Relationship

Whenever I’ve been asked to tackle this topic — which is a major and growing one — I like to start with this chart below. It’s a good starting point to explore China-MENA ties, particularly since the early 1990s. The chart shows that China’s oil consumption in 1993 was largely the same as its internal production. From that point onward, however, we witnessed the acceleration of what I’ve called the Great China Demand Engine for oil and other commodities

If we were to extend this chart to today, the orange line of consumption would be roughly the same as would the blue line of production. The key point is this: that gap between the blue line and the orange line is where the Middle East oil producers fit in over the past three decades, and drove the early stages of the relationship - one that today has surpassed a simple hydrocarbons-for-manufactued goods one. That gap between the lines remains important for both sides.

China sources about 50% of its oil from the Middle East and North Africa region, and about a third of its natural gas. While China is not as highly dependent on the Middle East for its energy as, say, Japan or South Korea, the region is clearly vital to its future. The flip side is also true. For several Middle East states (including US allies), China is their number one export destination. They include Saudi Arabia, Iraq, Iran, and Qatar.

To wit:

According to IMF figures, Saudi exports to China in 2023 amounted to $54.6 billion, about three and a half times larger than its exports to the United States ($15.4 billion). The majority of that is crude oil.

Iraq earns 4x more in exports to China than to the United States.

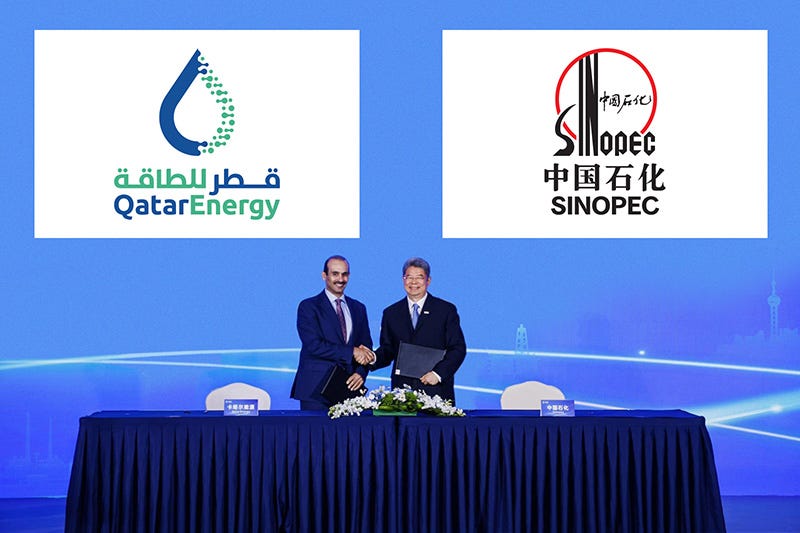

Qatar’s top export destination is China, though liquid natural gas (LNG) dominates the trade rather than crude oil. The Qatar-China gas connection is growing rapidly as the two sides have signed a flurry of long-term (27 years) natural gas deals to ensure the LNG keeps flowing. QatarEnergy also offered Sinopec a five percent interest in in the second phase of the expansion of Qatar’s massive North Field South development.

The vast majority of Iran’s petroleum exports go to China, often sold at a discount to so-called “teapot refiners” that are less linked to the global financial system. Some of that oil is re-labeled as oil imports from Malaysia or Oman, inflating the numbers of both of those countries to China.

According to the U.S Energy Information Administration, China imported 11.3 million barrels per day of crude oil in 2023, a 10% jump from 2022. EIA noted that “Russia, Saudi Arabia, and Iraq were China’s main sources of crude oil imports in 2023.” In terms of growth, Russia, Iran, Brazil, and the United States saw their numbers increase the most to China.

There’s certainly more to the story than just energy, though it remains a big part of it. Always remember that gap between the blue line and the orange line in the chart above. China needs to fill that gap somehow, and Middle East oil producers will remain vital to Beijing’s future - and vice versa. Back in 2021, Saudi Aramco CEO Amin Nasser noted that ensuring China’s energy security will remain the company’s top priority for the next fifty years.

Belt and Road and MENA

What about Belt and Road projects? A good deal of China’s transactions in the Middle East and North Africa region fall under the category of “construction” rather than investment. AEI’s Global China Investment Tracker helpfully distinguishes between the two. Back in 2019, I wrote a piece in Foreign Policy and pointed out the six countries in the region that fall into what I called the $20 billion+ club (more than $20 billion of construction and investment from Chinese firms since 2005.)

We can now declare those same six countries as part of the $25 billion+ club, according to latest figures.

The $25 Billion+ Club

Saudi Arabia - $59.5B

UAE - $42.4B

Iraq - $34.2B

Algeria - $28.4B

Iran - $26.5B

Egypt - $25.2 B

Total construction + investment projects from China (2005-2023). Sourced from China Global Investment Tracker

Again, I recommend diving into the numbers yourself and you’ll see nuance beyond the headline figures like, for example, China’s lack of recent projects in Iran, or the heavy weighting of construction vs investment in its Saudi Arabia projects.

ICYMI - Saudi Invests in China AI, Qatar To Buy 10% Stake in China Mutual Fund, and More

Here are a few other developments in China and the Middle East over the past two weeks.

“A Saudi Arabian fund has backed China’s most prominent generative artificial intelligence start-up, becoming the only foreign investor in the country’s efforts to create a homegrown rival to OpenAI,” The FT reports.

“Qatar's sovereign wealth fund has agreed to buy a 10% stake in China's second-largest mutual fund company, two sources said, underscoring Beijing's increasing ties with the Middle East amid rising tensions with the West.” Reuters reports.

“Saudi Arabia is the latest country to join a multi-country initiative for central bank digital currency (CBDC), amid increasing interest from the Gulf state in futuristic forms of money.…Work on Project mBridge began in 2021 via collaboration between BIS, the Central Bank of the United Arab Emirates, the People's Bank of China, the Hong Kong Monetary Authority and the Bank of Thailand. There are additionally 26 observer members in the project, according to BIS.” Al-Monitor reports.

“China held its stance on three disputed islands in the Gulf on Monday despite Tehran's anger at Beijing for describing the Iran-controlled islands as a matter to be resolved with the United Arab Emirates.” Reuters reports.

And another energy story:

“Qatar has seen ‘promising’ cooperation with China on energy development, from traditional areas of liquefied natural gas (LNG) trade to renewables and construction of a fleet of supertankers, its energy minister said on Tuesday.

‘We have very good relations with the Chinese authorities and companies,’ Saad bin Sherida al-Kaabi said at the ministry’s headquarters in downtown Doha.” South China Morning Post reports.

Further Reading, Listening, and Watching…

Also, check out this excellent report from another fellow traveler on the China-MENA New Silk Road, Camille Lons, of ECFR - East Meets Middle: China’s Blossoming Relationship with Saudi Arabia and the UAE.

Also, see Mohammed Soliman’s recent valuable testimony to Congress on China-MENA, and check out the full line-up of speakers, including friends of Emerging World - the always insightful Karen Young, Jon Alterman, Jonathan Fulton, Grant Rumley and others. And always watch Karen Young’s vital contributions, particularly on new energy dynamics in the MENA region, including articles like this on carbon capture technology, and Jon Alterman’s excellent podcast, Babel: Translating the Middle East.

And while I’m talking podcasts, don’t miss the groundbreaking twice-weekly discussion “China in Africa” podcast, about China's engagement across Africa and the Global South hosted by journalist and friend of Emerging World Eric Olander and Asia-Africa scholar Cobus van Staden in Johannesburg. They are true pros.

And for a bit of video, see below my interview with CNBC on China-MENA and UAE-South Korea, with Dan Murphy. Hat tip to Emma Graham, Dan, and the CNBC team who consistently deliver first-rate reportage on Middle East markets and geopolitics.

You can't cross the sea merely by standing and staring at the water.

Rabindranath Tagore