Emerging Market Daily - August 4

'Robinhood' Investors Drive India Stock Rally, Pakistan PM Still Waiting on Biden Call, India Bars Full and Masks Optional, Aramco Raises Asia Price, Fastest Unicorns

The Top 5 Emerging Markets Stories from Global Media - August 4

Indian Stocks Sizzle, Driven by ‘Robinhood’ Investors

LiveMint India

“Indian stock markets have soared to record high levels led by gains in index majors, positive trend in global markets and macro factors. Benchmark index BSE Sensex today crossed 54,000 mark for the first time, a day after Nifty surpassed the milestone of 16,000, and continued to trade above the all-time high level.”

“Experts believe that retail investors and mutual funds flush with funds from NFOs (new fund offers) are driving this market despite selling pressure from foreign institutional investors. As per data compiled by Bloomberg, domestic institutional investors such as mutual funds and insurance firms have bought about $2.5 billion of Indian stocks in July.”

"‘Sometimes amateurs beat professionals. This is happening in the Indian stock market now. FIIs, often regarded as representing smart money, have been pushed back by the sheer momentum of retail investors. FIIs who have been consistently selling in July on rational hopes of a correction in the overvalued market have been forced to buy on fears of losing out on the momentum,' said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.”

“As first-time investors turned up to the stock markets amid the covid pandemic, the number of retail investor account surged nearly 35% in the financial year ended March to reach 55 million, led by Robinhood investors (the term used for millennial/retail investors), a trend similar to what is being seen in developed markets like the US.”

“With the institutional money pouring in, Vijayakumar expects large caps to outperform if the market continues its upward momentum. '‘Having broken the 15950 Nifty upper band decisively, sheer momentum may take the market higher. Leading banking stocks, which have been underperforming in this rally, are likely to catch up.’”

“Today, the Nifty Bank sub-index was up nearly 2% with HDFC Bank, ICICI Bank and Kotak Bank leading the charge.” LiveMint reports.

In Pakistan, Imran Khan Still Waiting on a Call from Joe Biden

Financial Times

“Pakistan’s national security adviser has complained about Joe Biden’s failure to contact Prime Minister Imran Khan as Washington seeks help to stop the Taliban taking over Afghanistan following US troop withdrawals. The cold shoulder from Washington comes as the Taliban has captured swaths of territory across Afghanistan in a ruthless offensive emboldened by the US pullout.”

“The government of Afghan president Ashraf Ghani has openly accused Pakistan of supporting the Taliban to secure its strategic interests in the region. Washington has leaned on Pakistan in recent years to help bring senior Taliban leadership to the negotiating table and secure a deal to exit the country with few attacks on US soldiers.”

“But despite calls from Khan to broaden US-Pakistan relations beyond Afghanistan, Biden has yet to call him since taking office this year. ‘The president of the United States hasn’t spoken to the prime minister of such an important country who the US itself says is make-or-break in some cases, in some ways, in Afghanistan — we struggle to understand the signal, right?’ Moeed Yusuf, Pakistan’s national security adviser, told the Financial Times in an interview at Pakistan’s embassy in Washington.”

“‘We’ve been told every time that . . . [the phone call] will happen, it’s technical reasons or whatever. But frankly, people don’t believe it,’ he said. ‘If a phone call is a concession, if a security relationship is a concession, Pakistan has options,’ he added, refusing to elaborate.”

“Pakistan has cultivated deep ties with its ‘iron brother’ China, which has invested billions in infrastructure projects as part of its Belt and Road Initiative. A senior Biden administration official said: ‘There are still a number of world leaders President Biden has not been able to speak with personally yet. He looks forward to speaking with Prime Minister Khan when the time is right.’” Katrina Manson reports.

As Covid-19 Recedes in India, Bars Are Full and Masks Are Optional

The Wall Street Journal

“A little over two months ago about 4,000 people were dying every day from Covid-19 in India. Yet, on a recent Friday, a rooftop bar in New Delhi was once again packed with crowds of young adults mingling without masks.”

“…For some Indians, life has already returned to normal after a devastating spring surge. In New Delhi and other cities across the country, shoppers are once again crowding stores, diners are squeezing into restaurants, and bars are hosting crowds of revelers. Many have already abandoned safety precautions such as social distancing and wearing a mask.”

“Coronavirus infections have steadily fallen—despite a sluggish vaccination rollout—after hitting a peak of more than 400,000 cases a day in early May. For weeks, daily confirmed cases have plateaued around 40,000. Only about 7% of the country’s more than 1.3 billion people have received both shots of a Covid-19 vaccine.” Shan Li reports

Aramco Raises Asia Oil Prices, Signaling Confidence in Demand

Bloomberg

“Saudi Arabia raised oil for prices for buyers in Asia and the U.S. for September in a sign the world’s largest crude exporter sees demand continuing to recover despite a surge in coronavirus cases in some of the world’s main energy importers.”

“OPEC+, the oil-producers’ group led by the Saudis and Russia, agreed last month to ramp up production over the rest of the year and supply a market that most analysts see as facing a dearth of barrels amid a global economic recovery from the worst of the pandemic.”

“Saudi Aramco will increase its key Arab Light grade for Asia by 30 cents from August to $3 a barrel above the state company’s benchmark, according to a statement. That’s slightly less than the 50-cent increase seen in a Bloomberg survey. Aramco is raising pricing for other grades to the region by between 20 and 60 cents.”

“Saudi Arabia sends more than 60% of its crude exports to Asia, with China, South Korea, Japan and India the biggest buyers.” Bloomberg reports.

Asia Takes Top 4 Spots in How Fast Start-ups Become Unicorns

The Straits Times

“Singapore came in joint fourth in the world for how fast its start-ups turned into unicorns, according to a global ranking by British price comparison website Money.co.uk.”

“Singapore's six unicorns took an average of six years and 11 months to cross US$1 billion (S$1.35 billion) in valuation, according them that status.”

“China topped the ranking. Its 155 unicorns took an average of just five years and 10 months to reach the US$1 billion mark.”

“The second fastest economy for start-ups turning into unicorns is Hong Kong, where they took an average of six years and one month, followed by Japan with six years and three months.”

“Singapore shares the fourth spot for fastest time with the United States, which has 378 unicorn companies, and Australia, with six.” The Straits Times reports

What We’re Also Reading…

Year after Beirut Port Blast Families of Victims Push for Truth

Financial Times

“A year since her 15-year-old son was killed by an explosion in the port at Beirut, Mireille Khoury still does not know the real reason for his death — why the chemicals that led to the largest non-nuclear blast in history had been so badly stored for so long in the heart of the city.”

“Worse still, she said, Lebanese officials in power appeared indifferent to calls for the truth from the family and friends of the more than 200 people who died when hundreds of tonnes of ammonium nitrate exploded early in the evening of August 4. The blast ripped through the capital city, injuring thousands more and causing about $4bn worth of physical damage.”

“…So far, no one has been held accountable for the decisions to allow the explosives to remain in the heart of the city. The failure of the investigation for many epitomises the failure of the state that led to the explosion in the first place. ‘Delays, delays, and more delays,’ tweeted Aya Majzoub, Lebanon researcher at Human Rights Watch, in response to recent moves to avoid lifting immunity. ‘Classic strategy to avoid accountability.’” Chloe Cornish reports

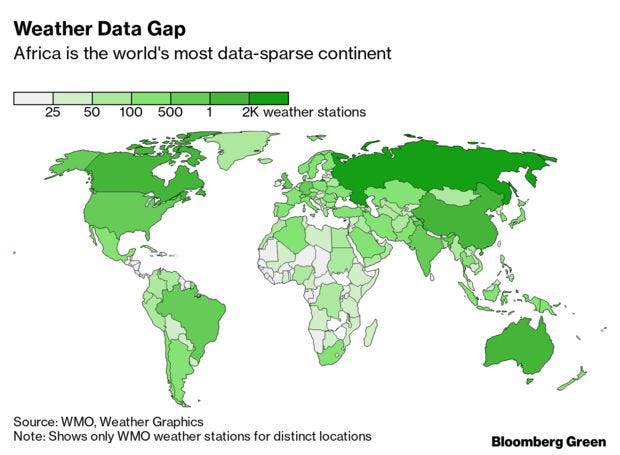

How Timbuktu’s Ancient Manuscripts Impact Africa’s Climate Map

Bloomberg

“Weather station 61223 had been faithfully recording data on the temperature, wind and rainfall in the legendary city of Timbuktu for 115 years before March 30, 2012.”

“…But the loss of Station 61223 was keenly felt by the community of scientists trying to better understand the impact of global warming on the Earth’s climate—especially in Africa, where weather phenomena are chronically understudied. The complex mathematical models climate scientists depend on are fed with millions of data points from thousands of stations scattered across the planet—from the dunes of the Sahara desert to the busy streets of Beijing. Measurements of temperature, rainfall, humidity, solar radiation, as well as wind intensity and direction, allow scientists to test the accuracy of their models. The closer their forecasts hew to changes on the ground, the more confidence researchers have in their ability to make predictions.”

“…That’s one of Africa’s biggest problems when it comes to tackling climate change, according to the WMO’s inaugural State of the Climate report released last year. The continent has the world’s least developed land-based weather observation network, amounting to only one eighth of the minimum density recommended by the WMO. The issue will be under the spotlight next week as the UN’s Intergovernmental Panel on Climate Change releases the first part of its Sixth Assessment Report, which summarizes scientific discoveries about climate change from the past seven years and will form the basis for further policy discussions, including the UN-sponsored COP26 conference planned for November.” Laura Millan Lombrana reports