Emerging Markets Daily - April 11

Aramco Sells Pipeline Rights Unit for $12.4 Billion, Alibaba Hit With Record China Penalty, MTN Targets $5B Valuation, China's Didi Preps US IPO, African 'Opinion Leaders' And The World

The Top 5 Emerging Markets Stories from Global Media - April 11

Aramco Selling $12.4 Billion Stake in Pipeline Rights Unit

Bloomberg

“Investors led by EIG Global Energy Partners LLC agreed to acquire a roughly $12.4 billion stake in a Saudi Aramco oil-pipeline rights company.”

“The group will acquire a 49% equity stake in Aramco Oil Pipelines Co., a newly formed entity with rights to 25 years of rate payments for oil shipped through the Saudi oil giant’s network of conduits, EIG said in a statement. The deal implies a total equity value of about $25 billion for Aramco Oil Pipelines.”

“The deal is part of Saudi Arabia’s drive to open up to foreign investment and use the money to diversify its economy. Asset disposals also go some way to helping the energy giant maintain payouts to shareholders, as well as investments in oil fields and refinery projects. The company paid a $75 billion dividend last year, the highest of any listed company, almost all of which went to the state.” Gerson Freitas Jr reports

China Fines Alibaba Record $2.75 Billion for Anti-Monopoly Violations

Reuters

“China slapped a record 18 billion yuan ($2.75 billion) fine on Alibaba Group Holding Ltd on Saturday, after an anti-monopoly probe found the e-commerce giant had abused its dominant market position for several years.”

“The fine, about 4% of Alibaba’s 2019 domestic revenues, comes amid a crackdown on technology conglomerates and indicates China’s antitrust enforcement on internet platforms has entered a new era after years of laissez-faire approach.”

“Besides imposing the fine, which ranks among the highest ever antitrust penalties globally, the regulator ordered Alibaba to make ‘thorough rectifications’ to strengthen internal compliance and protect consumer rights.”

“Alibaba said in a statement that it accepts the penalty and ‘will ensure its compliance with determination.’ The company will hold a conference call on Monday to discuss the penalty.” David Stanway and Scott Murdoch report

MTN Targets Valuation of At Least $5bn for Mobile Money Arm

Financial Times

”South Africa’s MTN, the continent’s biggest mobile phone company by subscribers, is looking to value its mobile money arm at more than $5bn as it prepares to sell or list a minority stake to draw global investors enticed by fast-growing fintech assets.”“Chief executive Ralph Mupita told the Financial Times that the unit, which added almost 12m new users to a total of more than 46m last year, should be worth at least $5bn to $6bn and that the group would spin it out within the next year.”

“We think the best way to run these businesses is to structurally separate them,” Mupita said, adding that the move would unlock value hidden in MTN’s $11bn market capitalisation. The group wants to tap into growing investor interest in the mobile money businesses built by African telecoms in the past decade that allow phone subscribers to send or receive money outside banks and increasingly sell ancillary services such as microinsurance.” Joseph Cotterill reports

China's Didi Prepares for IPO in US

Nikkei Asia

“Didi Chuxing, China's top ride-hailing company, is preparing an initial public offering in the U.S., Nikkei has learned. The IPO is expected to value the company at around $70 billion to $100 billion. Didi is expected to use the billions of dollars it stands to gain from the IPO to fund a global expansion.”

“Japanese conglomerate SoftBank Group is a Didi investor. It is unclear when the IPO might take place and how large it might be. But it could provide a tailwind for SoftBank's investment strategy.”

“There has been speculation that Didi would seek an IPO in Hong Kong, given U.S.-China tensions, and sources say the company is still considering a dual listing in New York and Hong Kong.” Shunsuke Tabeta reports

In Africa, France’s Image Takes a Hit, but Turkey, UAE, and Qatar are on the Up

The Africa Report

“Since 2018, more than 2,400 ‘opinion leader’” from over 12 African countries – which represent half of the continent’s population – have been questioned on the situation of the continent itself, the image they have of the main foreign countries present on it and also to designate which of these countries are the most ‘beneficial partners.’”

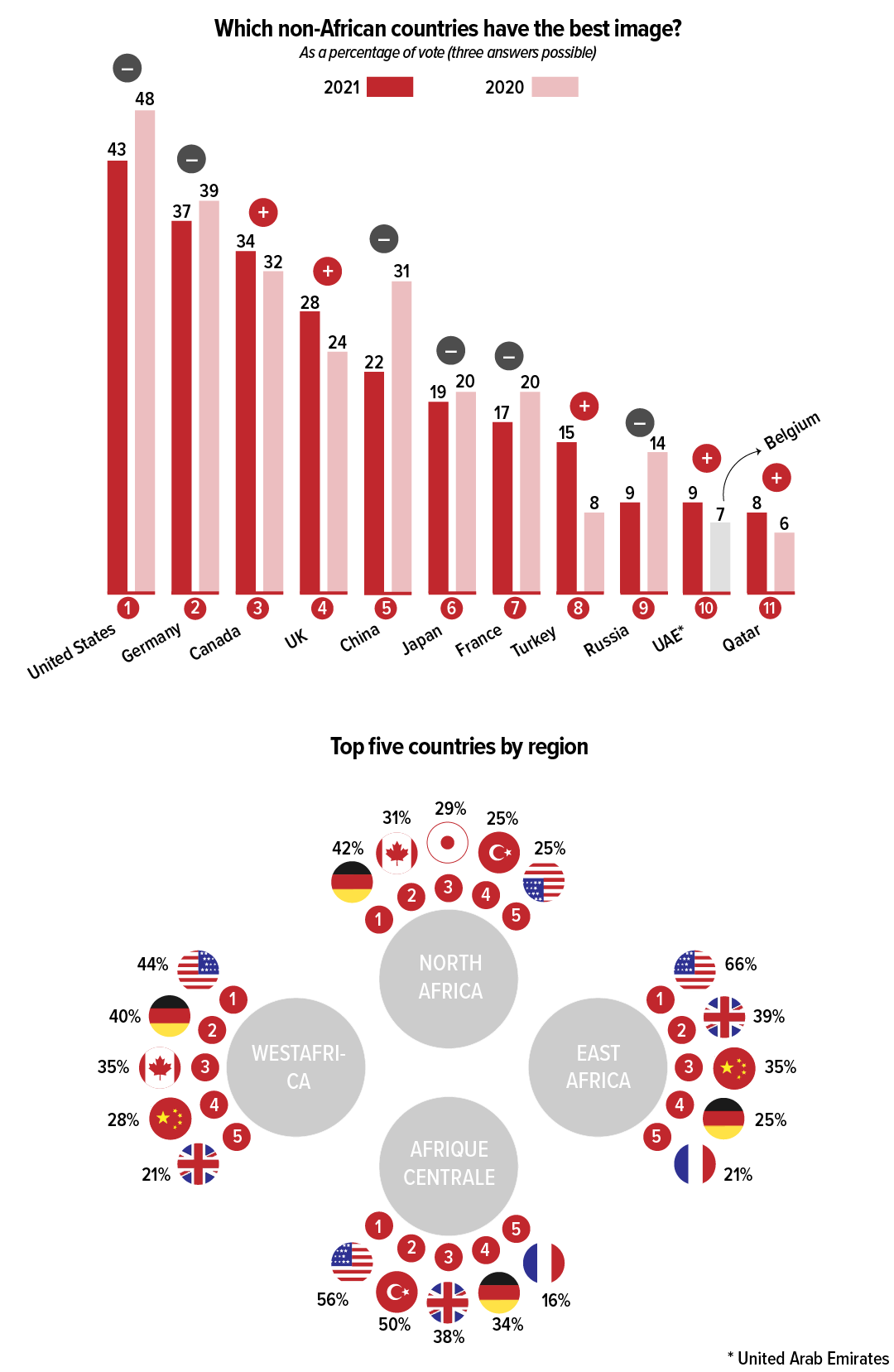

“In the first edition of the poll, which was held in 2019, France was ranked 5th with 21% of interviewees citing it as one of the countries with the best image. In 2020, it fell to 6th place, was overtaken by the UK and dropped to 20%. This year, it has dropped down to 7th place (Japan has moved up in the rankings) and fell to 17%. France is now just ahead of Turkey, which is at 15%.”

“Positions remain stable at the top of the ranking. The US leads, as it does every year, followed by Germany, Canada, the UK and China. ‘The United States is emerging from a turbulent period,’ says Giros. ‘There was the Black Lives Matter movement, we saw President Donald Trump insulting African countries, but nothing changed: American soft power is so powerful that the country’s image does not suffer.’

“The other interesting ranking is that of the continent’s ‘most beneficial partners.’ This time, as in previous years, China comes out on top at 76%. The country’s image may have suffered, notably from the Covid-19 crisis, but when it comes to identifying the most active partners, it nevertheless retains its 1st place ranking. France, on the other hand, falls to 9th place, outranked by the United Arab Emirates (UAE).”

“Turkey and the Arab-Persian Gulf countries’ rise through the ranks is the most spectacular new feature of this 2021 poll. ‘This reflects their strong presence in certain areas of activity such as public works and transport,’ says Giros. ‘When you ask African opinion leaders how they travel, they all mention Turkish Airlines which is constantly announcing new flights to the continent.” Olivier Marbot and Marie Toulemonde report