Emerging Markets Daily - April 11

Shahbaz Sharif: Pakistan's New PM, Europe Moves to Arm Ukraine, Oil Drops Below $100, Egypt Inflation Spikes, Commodity Traders and the Pandemic and War

The Top 5 Stories Shaping Emerging Markets from Global Media - April 11

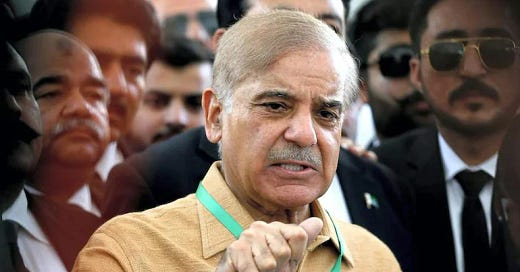

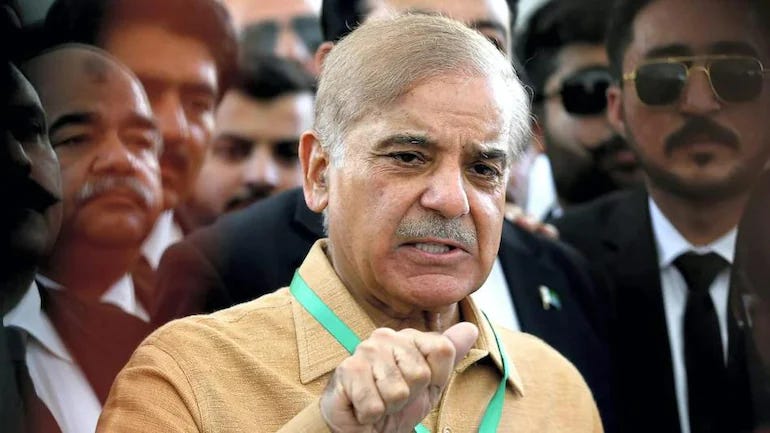

Who Is Shehbaz Sharif, Pakistan’s New Prime Minister?

The Guardian

“He is known as a diligent administrator with such a great love of poetry that he often opens official meetings with recitals of famous revolutionary Urdu poets. After Shahbaz Sharif was appointed as Pakistan’s 23rd prime minister on Monday, his first words to parliament were those from a poem by Ata ul Haq Qasmi, a modern Pakistani poet and commentator, speaking of ‘justice’ and ‘freedom from oppression’.”

“His ascension to the prime minister’s office marks the return of the wealthy Sharif family as one of the most powerful political dynasties in Pakistan. His brother, Nawaz Sharif, was prime minister three times between 1990 and 2017, during which time Shabaz served as the chief minister of Punjab, Pakistan’s most populous state.”

“While Nawaz was often seen as the one who could pull in crowds and win over voters, Shahbaz became known more for his practical skills in implementing policy and for his ambitious development agenda in Punjab.”

“‘It has long been a dream of Shahbaz Sharif to become the prime minister to demonstrate his administrative and political skills,’ said Cyril Almeida, a journalist and analyst. ‘He wanted to be the prime minister in 2013, but his brother Nawaz kept him in Punjab.’”

“Shahbaz Sharif, 70, initially worked in the family industrial business and then entered politics in 1988, becoming Punjab chief minister in 1997. But after his brother was toppled from power in a 1999 military coup, the Sharif family went into exile in Saudi Arabia. He returned to the country in 2007 and once again became chief minister of Punjab.”

“While Khan was known for charisma, Sharif’s reputation is one of capability. Hussain said Sharif’s leadership style would probably mark the end of the ‘confrontational’ and populist politics Khan came to be known for, where he made grand promises of reform and would hold large rallies, and instead be a prime minister who ‘talks less and works more’.”

“…Sharif’s relationship with the military is also likely to differ from both that of Khan and of his brother Nawaz. While there was little love lost between Nawaz and the military establishment, and the relationship became increasingly confrontational in his third term in power, Shahbaz is seen to have a much better working relationship with this army while not being as beholden to them as Khan was seen to be during most of his time in office.” Hannah Ellis-Petersen and Shah Meer Baloch report.

Europe Moves to Arm Ukraine as Sanctions Fail to Sway Putin

Bloomberg

“Ukraine’s allies in Europe are moving beyond their usual emphasis on diplomacy and sanctions in response to Russia’s invasion of Ukraine, with a new focus on urgently arming Kyiv as the best chance at changing Vladimir Putin’s decision-making.”

“After six weeks of a war that sanctions have done little to ease -- and no sign that negotiations with Russia will produce any result -- some of the bloc’s least likely warriors are calling for more weapons.”

“On Monday Germany’s foreign minister, Annalena Baerbock -- from the traditionally pacifist Green Party -- called for sending ‘more military equipment, above all heavy weapons.’ She added: ‘There is no time to make excuses.’”

“The shift partly comes as European nations accept that sanctions have done little to crimp Russia’s ability to fund its military operations, and several nations continue to resist the toughest actions over fears they would also hit their own economies. Many of the measures introduced by the EU, such as restrictions on technology exports, are designed to impact the Russian economy over time.”

“In terms of short-term impact, the bloc has few tools left at its disposal other than sanctioning Russia’s oil and gas -- and on that member states remain divided. An EU diplomat also noted that the bloc’s assessment of how to inflict pain on the Russian government doesn’t always square with Putin’s own strategic calculations.” Bloomberg reports.

Oil Drops Below $100 on China Covid Lockdowns and Reserves Release

The National

“Oil prices slid about 4 per cent on Monday to remain below $100 a barrel as demand concerns grow amid continuing Covid-19 lockdowns in China, the world’s largest importer of oil, and supply fears eased after the International Energy Agency and the US announced the release of additional emergency reserves.”

“…Oil prices have retreated from 14-year highs in mid-March after the US banned Russian energy imports and the UK said it would phase out its purchase of Moscow's oil in retaliation for Russia's military offensive in Ukraine. Prices, which nearly touched $140 per barrel, are still up roughly 26 per cent since the beginning of this year.”

“…China is experiencing a wave of Covid-19 infections and has implemented strict lockdowns in Shanghai, raising fears about waning consumption that is weighing on oil prices. The Opec warned on Monday that the current geopolitical developments in Europe, coupled with the pandemic, have created an ‘extremely volatile market’ and that these ‘non-fundamental factors’ are beyond its control.”

“The Opec+ alliance will add another 432,000 barrels per day of crude to the market in May, staying the course of incremental increases in global oil supply, it confirmed on March 31.” The National reports.

Egypt Inflation Spikes in March Amid Ukraine War Fall-Out

AfricaNews

“Egypt’s annual inflation rate rose to over 12% in March, up from 10% in February this year. This was driven by Russia's war in Ukraine, which has largely affected global markets and sent oil prices to record highs, officials said on Sunday.”

“…According to data released by the CAPMAS the price hikes cut across many sectors: from fuel, electricity and food items to housing, medical services and entertainment. The figures cover the period from April 1, 2021, to March 30, 2022.”

“Consumers, especially lower-income earners are most faced with the brunt of these hikes. Most of the over 103 million people living in Egypt have suffered from price hikes since the government embarked on a reform program in 2016 to overhaul the country's battered economy.”

“While Cairo is discussing a new loan with the International Monetary Fund (IMF), the Central Bank revealed on 7 April that its foreign exchange reserves had fallen from 41 billion dollars in February to 37 billion in March.”

“Inflation has been rising in Egypt since the launch in 2016 of an austerity package demanded by the IMF in exchange for a 10.8 billion euro loan, which included a sharp devaluation and an overhaul of subsidies on essential commodities.”

“Hit by the economic impact of the war in Ukraine and huge public spending on infrastructure, Egypt recently devalued its currency by 17%. Immediately, Saudi Arabia, a major ally of Abdel Fattah al-Sissi's regime, deposited five billion dollars in the Egyptian Central Bank.” AfricaNews reports.

Putin’s Bomb and the Global Shrapnel

For more on the Russia/Ukraine war and rising inflation afflicting the world, see our weekend Emerging World column:

Commodity Traders Prospered During the Pandemic. What Next?

Financial Times

“Commodity traders prospered during the pandemic using their global network of terminals, storage facilities and shipping fleets to cash in on supply disruptions and rising demand.”

“Vitol generated record net income of more than $4bn last year, according to people who have seen the results of the world’s biggest independent oil trader, with rival Mercuria making $1.25bn. Trafigura also enjoyed record numbers, as did Glencore’s trading arm.”

“The big question now is whether the industry can repeat the trick and capitalise on the market chaos unleashed by the war in Ukraine. That will not be straightforward. While the hard-hitting sanctions imposed on Russia have created lucrative arbitrage opportunities and a reordering of global trade flows, a liquidity squeeze makes it difficult to take advantage of them.”

“As the price of commodities from crude and gas to copper and corn has surged, traders have faced huge margin calls — or demands for cash — to cover hedges taken out for future sales. That has forced some to reduce activity and others to seek back-up funding to protect themselves against another bout of market turbulence.” The FT reports.

“I Will Make You a Billionaire”

For more on the swashbuckling and perilous world of commodity traders, see this Emerging World piece, one of our earliest columns:

It is during our darkest moments that we must focus to see the light. -Aristotle