Emerging Markets Daily - April 18

China Economic Growth, Swinging Oil Prices, IMF to Sri Lanka: Sustainable Plan or No Funds, China's Didi Loses Ground at Home, Mexico Prez Loses Key Energy Vote

The Top 5 Stories Shaping Emerging Markets from Global Media - April 18

China’s Economy Grew 4.8% in First Quarter 2022

Financial Times

“China’s economy grew faster than expected in the first quarter but official data revealed a recent contraction in consumer activity as lockdown measures to counter the spread of Covid-19 weighed on the country’s outlook.”

“China’s gross domestic product rose 4.8 per cent compared with the same period a year earlier, after expanding by 4 per cent in the final three months of 2021. On a quarter-on-quarter basis, GDP grew 1.3 per cent.”

“Retail sales, a gauge of consumer spending, fell by 3.5 per cent in March — its first contraction since July 2020 — as authorities hardened restrictions to counter the country’s worst coronavirus outbreak in more than two years.”

“The data will add to pressure on the government of President Xi Jiping, which has reaffirmed its commitment to a zero-Covid policy despite its mounting costs and disruptions across the country’s biggest cities. Infections across China rose in April and Shanghai, its main financial hub, has remained largely sealed off.”

“The outbreak erupted at a precarious moment for China’s economy following a debt crisis in its real estate sector and a wider loss of momentum. The government has targeted growth of 5.5 per cent in 2022, its lowest in three decades.”

“…In contrast to the weakness in consumer spending, industrial production, which was a big driver of China’s initial recovery from the pandemic in 2020, added 5 per cent year-on-year in March. Fixed asset investment rose 9.3 per cent in the first three months of the 2022 compared to the same period last year.” The FT reports.

Oil Prices Swing Amid Ukraine Crisis, Libya Cuts, and China Covid Lockdown

The National

“Oil prices continued to swing on Monday as investors weighed growing supply concerns amid crude production halting in Libya and the increasing likelihood of stiffer western sanctions on Russian oil exports against the impact of continued Covid-19 lockdowns in China on global oil demand.”

“Brent, the global benchmark for two thirds of the world's oil, which has been fluctuating in the $110.71 to $113.80 range on Monday, rose 0.22 per cent to $112 a barrel at 2.48pm UAE time. West Texas Intermediate, the gauge that tracks US crude, climbed 0.13 per cent to $107.01 a barrel.”

“Libya's National Oil Corporation (NOC) was forced to declare force majeure and shut down its Zueitina oil port, including all fields and producing stations associated with the port and shipping facilities, on Monday, due to political protests.”

“Force majeure points to an unforeseen set of circumstances preventing a party from fulfilling a contract. NOC was also forced to shut down its El Feel oilfield in the south-west of the country on Sunday, after a group of individuals entered the site on Saturday and prevented employees from working.”

“…Brent is still more than 40 per cent higher since the start of this year but the continued lockdown in China, the world's biggest oil importer, is weighing on demand outlook. The Chinese economy showed signs of softening in March as consumption, real estate and exports were affected due to pandemic-related restrictions and a slowdown in its export markets due to the Ukraine war. Retail sales in the country fell 3.5 per cent annually in March, the first contraction since 2020.” Sarmad Khan reports.

IMF to Sri Lanka: Show A Sustainable Debt Plan, or No Bail-out

Bloomberg

“When Sri Lankan officials arrive in Washington this week to meet with the International Monetary Fund amid an economic and political crisis, the main question they’ll need to answer is how the country plans to manage its billions in debt.”

“Sri Lanka is seeking up to $4 billion this year to help it import essentials and pay creditors. To get any of that through the IMF’s various programs, the government of President Gotabaya Rajapaksa must present a sustainable debt program…”

“The downward economic spiral -- dwindling foreign reserves and soaring inflation -- has triggered political unrest in Colombo, where Rajapaksa has resisted calls to step down despite growing protests and a loss of coalition partners in parliament. Over the weekend, the army denied speculation it planned to crack down on protesters, while the local stock exchange announced it would shut this week amid the uncertainty.”

“The outlook makes a default inevitable, as acknowledged by S&P Global last week when it downgraded Sri Lanka’s credit rating and warned of another cut if the nation misses coupon payments due Monday. Meanwhile, investors are trying to figure out how much they might recover on $12.6 billion of foreign bonds, and if there’s even profit to be made.”

“…Rajapaksa’s government has also appealed to China, one of its biggest creditors, for an additional $2.5 billion in support. While President Xi Jinping has pledged to help, an apparent reluctance reflects both a rethink in its external lending practices and a hesitancy to be seen interfering in messy domestic political situations.”

Chinese Ride-Hailing Giant Didi Chuxing Loses Ground At Home

South China Morning Post

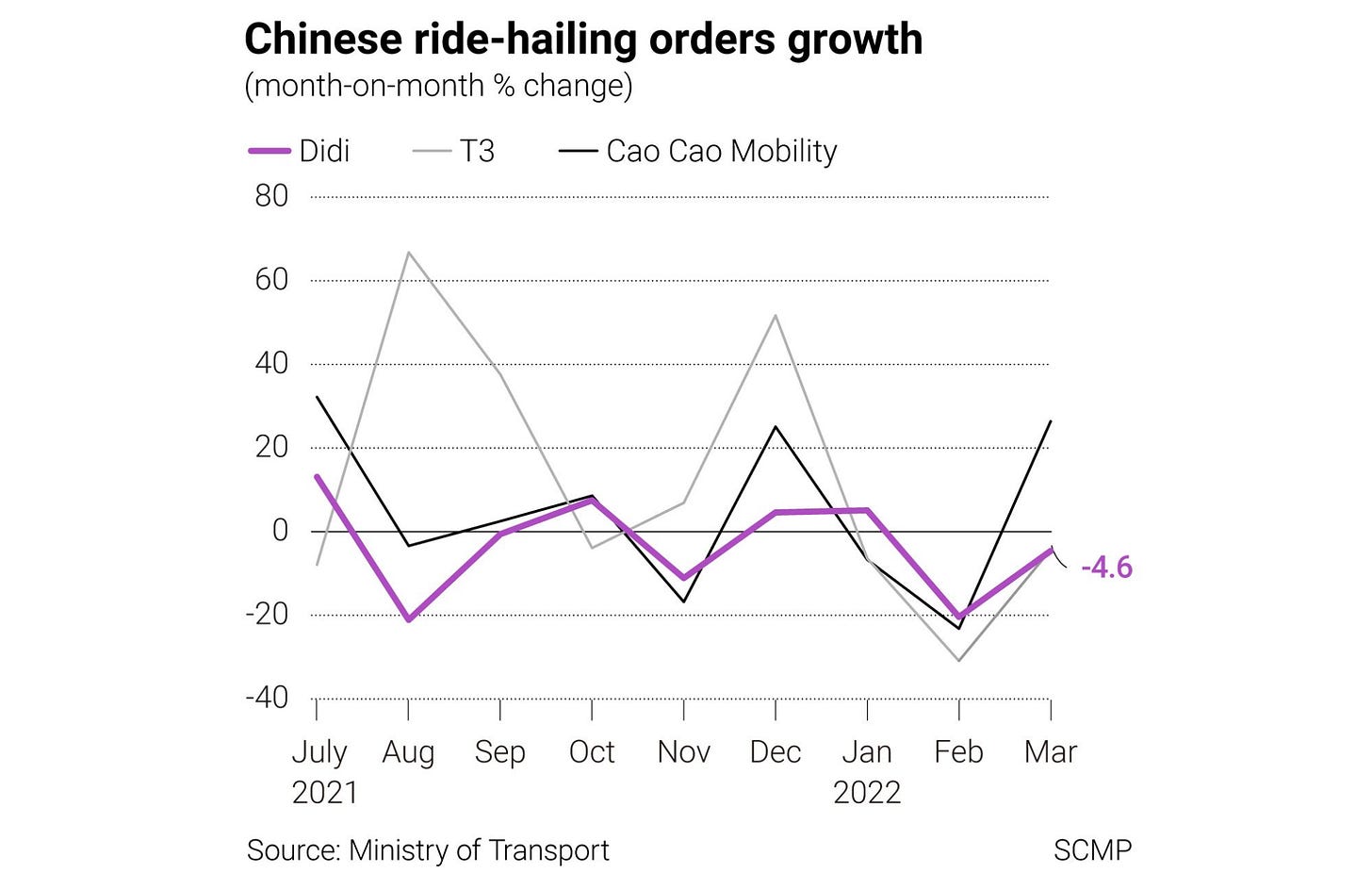

“Chinese ride-hailing giant Didi Chuxing has been slowly losing its market dominance since last summer, when Beijing forced the removal of dozens of its apps from app stores and banned the company from taking new users, according to data from China’s Ministry of Transport and other third-party research institutions.”

“Didi orders fell 4.6 per cent in March from the previous month, the transport ministry’s latest figures show. By comparison, rival Cao Cao Mobility, backed by carmaker Geely, saw its orders jump 26.4 per cent. The ministry’s numbers do not cover all of Didi’s services.”

“The weakened position of a technology giant once seen as indomitable threatens further losses for investors after Didi’s stock has plunged to below US$2.50 over the past week from its initial public offering price of US$14 last year. An unsettled Chinese cybersecurity investigation, launched days after its New York Stock Exchange listing last June against warnings from regulators, and a plan to delist in the US without having a new listing lined up elsewhere continue to weigh on the company and have dampened confidence in Chinese tech stocks.”

“Since its US$4.4 billion IPO, Didi’s order volume plummeted by 29 per cent through March, according to a calculation of monthly growth rate figures published by the transport ministry.” SCMP reports.

Mexico President’s Contentious Electricity Bill Defeated in Congress

Reuters

“Mexican President Andres Manuel Lopez Obrador's plan to increase state control of power generation was defeated in parliament on Sunday, as opposition parties united in the face of a bill they said would hurt investment and breach international obligations.”

“His National Regeneration Movement (MORENA) and its allies fell nearly 60 votes short of the two-thirds majority needed in the 500-seat lower house of Congress, mustering just 275 votes after a raucous session that lasted more than 12 hours.”

“Seeking to roll back previous constitutional reforms that liberalized the electricity market, Lopez Obrador's proposed changes would have done away with a requirement that state-owned Comision Federal de Electricidad (CFE) sell the cheapest electricity first, allowing it to sell its own electricity ahead of other power companies.”

“Under the bill, the CFE would also have been set to generate a minimum of 54% of the country's total electricity, and energy regulation would have been shifted from independent bodies to state regulators.”

“The contentious proposals faced much criticism from business groups and the United States, Mexico's top trade partner as well as other allies who argued it would violate the regional trade deal, the United States-Mexico-Canada Agreement (USMCA).”

“Lopez Obrador had argued the bill would have protected consumers and made the country more energy independent, saying the legislation was vital to his plans to ‘transform’ Mexico.” Reuters reports.

“Never let the fear of striking out keep you from playing the game.” -Babe Ruth