Emerging Markets Daily - April 21

BlackRock Bullish on EM, Covid Surge Spills into Asian Markets, Local Market SE Asia IPOs Lag, Chad President Dies, ByteDance vs Tencent Gaming War

The Top 5 Emerging Markets Stories from Global Media - April 21

BlackRock Positive on Emerging Markets After Rough ‘21 Start

Reuters

“The BlackRock Investment Institute said on Monday the economic restart, stabilizing U.S. Treasury yields and relatively cheap valuations will boost emerging market assets after a choppy start to 2021.”

“BlackRock acknowledged that some developing economies faced near-term challenges including a virus resurgence, slow vaccine rollouts and rising inflation that may force the hand of their central banks. However, this would translate into their economic restart being delayed, rather than derailed.”

"‘We see greater stability in yields and in the U.S. dollar over coming months,’ Wei Li, global chief investment strategist at the BlackRock Investment Institute, said in a note to clients. This should support EM local-currency debt, in our view. Its valuation appears attractive relative to other income sources such as high yield debt…’”

“On the equities side, BlackRock was overall positive on broad emerging markets stocks and Asia ex-Japan equities in particular.” Reuters reports.

Coronavirus Surge Spills Over Into Asian Markets

Bloomberg

“Asian markets, blighted by rising cases from Japan to India, have underperformed their global peers since the start of March, just when they looked set to benefit from an acceleration in the global recovery. Currencies of nations stung by the virus have been underperforming those where vaccinations are surging ahead. And now the angst is starting to spread, with recovery trades under pressure and U.S. stocks sliding for two successive days.”

“The World Health Organization said Tuesday that cases are rising in all regions except Europe, with the largest increase last week seen in Asia as India battles its biggest wave. Japan moved closer to declaring a virus emergency as infections spread in its two-biggest and economically important urban areas, Tokyo and Osaka, while health authorities in Toronto will order workplaces across Canada’s biggest city to close if they have more than five confirmed cases.” Cormac Mullen and Abhishek Vishnoi report

Singapore and Philippines trail in Asia IPOs amid SPAC boom in US

Nikkei Asia

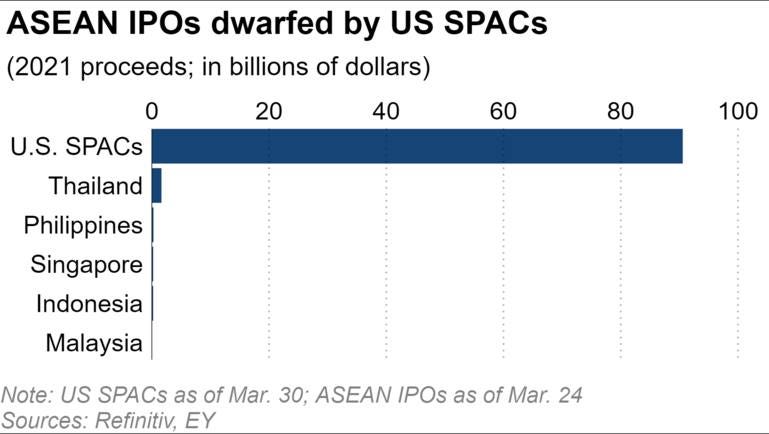

“Stock exchanges in the Association of Southeast Asian Nations appear to be getting little love, even as the bloc's tech startups eye opportunities to go public by combining with special purpose acquisition companies, or SPACs, listed in the U.S.”

“The number of companies that went public in Singapore and the Philippines was lower than regional peers, with each country having only one IPO during the quarter. In contrast, Indonesia saw 12 IPOs bringing in $218 million while Thailand raised $1.6 billion from five and Malaysia $47 million from four.”

“All Southeast Asian IPOs stacked together in the three months, however, have been dwarfed by the region's biggest unlisted startup, Singapore ride-hailing giant Grab, which is going public in the U.S. via a SPAC deal under Silicon Valley-based Altimeter Capital for a whopping $39.6 billion valuation.” Dylan Loh reports

Chad’s President Dies on the Frontline

African Business

“Chad’s long-serving president Idriss Deby Itno has died from injuries sustained on the frontline, an army spokesman said on Tuesday. The news came hours after provisional election results confirmed that the 68 year-old had won a sixth term, after three decades in power.”

“Deby’s 37 year-old son, Gen. Mahamat Idriss Deby, will lead a transitional military council for 18 months until “free and democratic elections” are held, the army said.”

“Chad grapples with spillover from conflicts in bordering countries, as well as the impacts of climate change, which compounds desertification and the drying up of Lake Chad, according to the World Bank.” Shoshana Kedem reports

Gaming War Between ByteDance and Tencent a Windfall for Independent Chinese Studios

South China Morning Post

“ByteDance’s acquisition of Moonton in March increased the studio’s value sevenfold from a few months earlier and came after it cancelled a deal with Tencent.”

“Tencent has already invested more in gaming studios this year than in all of 2020 amid a bidding war with ByteDance.”

“Gaming has become a top priority for ByteDance. It has proven to be an effective way of monetising social media users from other apps – a strategy used by Tencent – and a steady stream of gaming revenue works as insurance against TikTok someday falling out of fashion.” Josh Ye reports