Emerging Markets Daily - April 21

EM Earnings Season Shows Pain, Moscow Looks East to Shift Energy, Robust Saudi Growth: IMF, Safaricom to Grow in Ethiopia, China's Thirsty Coffee Consumers

The Top 5 Stories Shaping Emerging Markets from Global Media - April 21

Poor Start to Earnings Season Shows Pain in Emerging Markets

Bloomberg

“Emerging-market companies are missing earnings expectations for the first time in four quarters, signaling that poorer countries are hurting more than rich nations from Covid lockdowns, surging inflation and the war in Ukraine.”

“The weighted average earnings per share for firms in the MSCI Emerging Markets Index are coming in 6.5% below estimates made 12 months ago, according to data compiled by Bloomberg. Of the 93 companies that have reported quarterly results so far, only one in every four is beating dollar-based forecasts, compared with four out of five in the S&P 500 Index.”

“The earnings setback is the strongest indication yet that emerging economies’ pain from slower growth and supply disruptions is greater than any boost from the ongoing commodity bull market. That’s leading to a divergence within the benchmark index: raw material, energy and real estate companies are beating profit projections, while those in consumer sectors, industrials and utilities are trailing the most.”

“While developed nations are moving on from Covid, emerging economies are still in the thick of it, suffering crippling shutdowns and slower activity. Real economic growth is projected to fall 2.4 percentage points to 4.1% this year. China is among the worst-hit: March data showed the biggest contraction in retail sales and a surge in unemployment to the highest since early 2020, even before curbs were imposed on Shanghai.”

“Emerging economies are in the throes of a supply-led inflation shock, especially countries like India and Turkey which depend on energy imports. Even China isn’t immune to the pressures. The nation’s energy consumption controls have caused vast power shortages and a spike in factory-gate inflation. Bloomberg Economics’ analysis shows a supply-side shock that has production and prices moving in opposite directions.” Srinivasan Sivabalan reports.

Moscow’s Race Against Time to Divert Energy Exports from Europe to Asia

bne IntelliNews

“Europe’s unprecedented push to sever all energy ties with Russia has left Moscow scrambling to re-orientate its vast oil, gas and coal exports to Asian markets. But achieving such a monumental feat would likely take years, not to mention tens of billions of dollars in new infrastructure, and Asian buyers may simply not have the appetite of the ability to absorb the extra supplies. Nevertheless, Russia finds itself in a race against time to redirect energy flows eastwards before taking too great a financial hit from Europe rejecting them.”

“On April 19 Russian President Vladimir Putin ordered his government to draw up plans by June 1 to switch Russia’s pipeline infrastructure from west to east and build the necessary new energy infrastructure.”

“Since it was set up in 1970s Russia’s existing infrastructure has always been heavily geared towards serving European markets and has long largely ignored delivery channels targeting Asia. The Soviet-era Druzhba pipeline and Russia’s north-west and Black Sea typically deliver around 5mn barrels per day of oil, condensate and other petroleum products, while only about 2mn bpd are shipped to markets in Asia.”

“Likewise, Russia’s pipelines sometimes send over 200bn cubic metres of gas to Europe, whereas China – the only other major market with a pipeline link to Russia – took only 10.5 bcm last year. And the Power of Siberia that carries that gas only came online in December 2019 after ten years of negotiations.” bne IntelliNews reports.

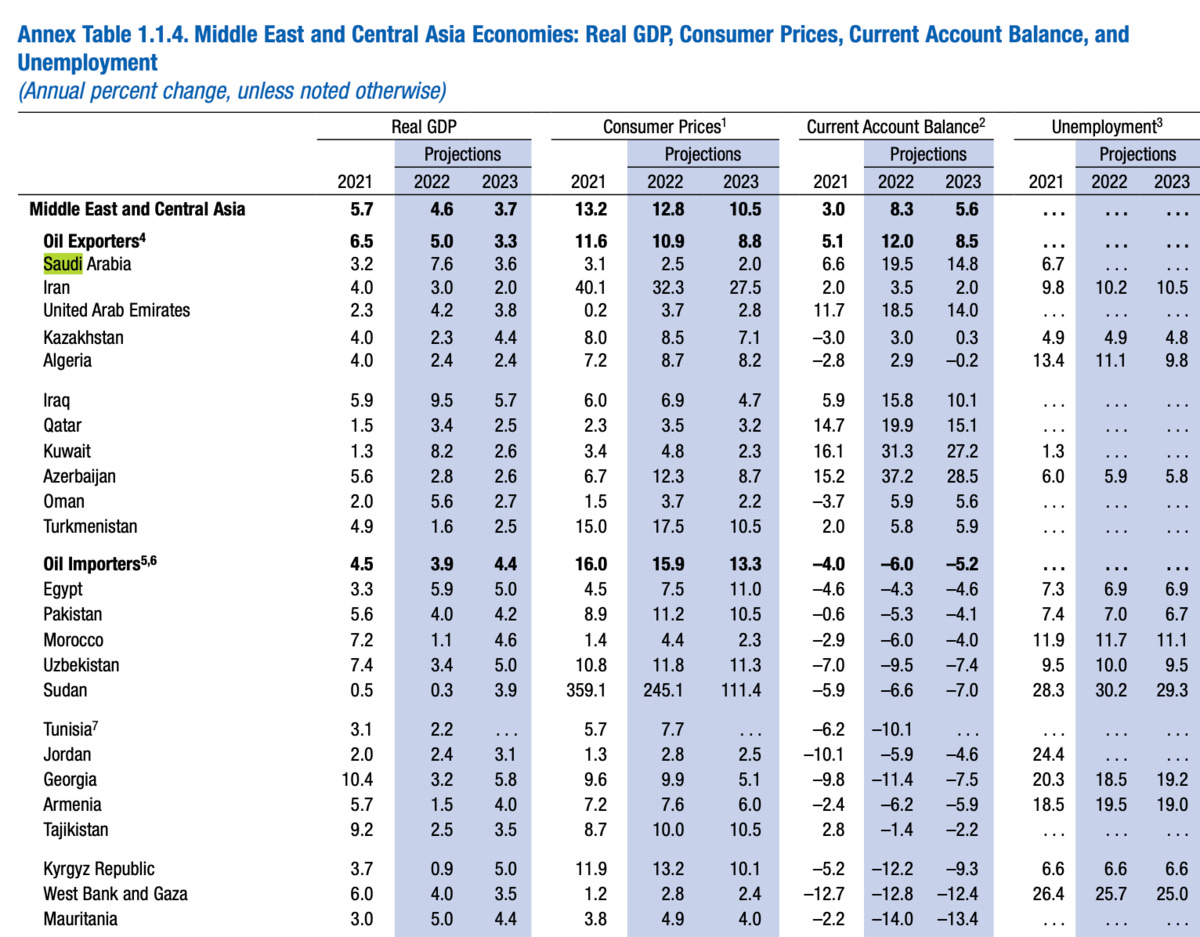

IMF Forecasts Robust Saudi 2022 Growth, Hitting 7.6%

Arab News

“The International Monetary Fund expects Saudi economy to grow by more than double in 2022 as oil prices are hitting multi-year high. The Fund, known as IMF, has raised its forecast for the growth of the Saudi GDP by 2.8 percent from last time to 7.6 percent this year.”

“In its World Economic Outlook published today, the IMF expects the GDP to fall to 3.6 percent in 2023, after raising this up from an earlier estimate of 2.8 percent.”

“The IMF also forecasted Saudi inflation to be around 2.5 percent in 2022 down from last year, a trend that will continue in 2023 as well.”

“War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7 percent in advanced economies and 8.7 percent in emerging market and developing economies — 1.8 and 2.8 percentage points higher than projected last January, the report pointed out.” Arab News reports.

Kenya’s Safaricom Joins with Ethiopian Telco on Major Network Sharing Deal

The East African

“Safaricom will access the giant network of Ethiopian State monopoly Ethio Telecom allowing the telco to roll out its services across the vast Horn of Africa nation. This follows an Ethiopian government-backed deal that paves the way for Safaricom to start commercial operations in the market of 110 million people, Safaricom Ethiopia officials now say.”

“‘The deal is very important and critical for our commercial viability and launch. Hopefully (we will launch) soon but we don’t have a date yet,’ Safaricom chairman Michael Joseph told the Business Daily.”

“Under the deal, whose financial terms are yet to be publicly revealed, Ethio Telecom will provide Safaricom Ethiopia with access to cell sites, masts and other active elements such as network roaming.”

“Ethiopian Communications Authority (ECA) director-general Balcha Reba said the network sharing deal will be crucial for Safaricom as it will enable Safaricom customers to also call across Ethio telecom’s vast network.” The East African reports.

China to Boost Coffee Imports as Young Professionals Drink More

Bloomberg

“China is increasing purchases of coffee from other countries to meet the growing demand from young professionals in Shanghai and Beijing.”

“Promotional efforts of Luckin Coffee Inc., Nestle SA and Tim Hortons helped boost nation’s consumption of the caffeinated drink about 45% in the past four years. Still, many local farmers aren’t satisfied with the profits they get from growing coffee and switch to other crops , according to a report from the U.S. Department of Agriculture.”

“As a result, China’s purchases of coffee from foreign sources are expected to grow 5 percent this marketing year and Yunnan, a major China’s coffee- producing province, may be considering programs to increase farmer incomes and make coffee production more appealing, the USDA said.”

“Coffee consumption in China is likely to grow faster than in other countries. The average coffee consumer in China drinks two to three cups of joe per week. It’s usually a person in their twenties or thirties, living in a large city, with higher education and income levels. For comparison, an average American coffee drinker has more than three cups a day.” Marvin G Perez reports.

Coffee is “Globalization in a Mug”

For more on the rise of global coffee consumption, see our Emerging World column

“And still, after all this time,

The sun never says to the earth,

"You owe Me."

Look what happens with

A love like that,

It lights the Whole Sky.”

― Hafiz