Emerging Markets Daily - April 26

S. Korea Battery Maker In Major IPO, India Covid Spiking, China Renewables Rising, Iran FM Condemns Russia in Leaked Tape, Mubadala Seeks Stakes in Israel Gas Field, and More...

The Top 5 Emerging Market Stories from Global Media - April 26

South Korea Battery Maker in Biggest IPO in Four Years

Financial Times

“SK IE Technology, a unit of South Korean electric vehicle battery maker SK Innovation, raised Won2.25tn ($2bn) in the country’s biggest initial public offering in four years.”

“The company priced the offering at Won105,000 per share or the top of a marketed range, according to a stock exchange statement on Monday. Demand for shares outweighed the number on offer by 1,883 times as institutional investors bet on growth in the global electric vehicle market.”

“The IPO will be South Korea’s largest since mobile games maker Netmarble raised $2.4bn in 2017. The shares are expected to start trading on May 11. The offering comes after SK Innovation agreed to pay $1.8bn in a settlement with LG Energy Solution in the US earlier this month over the former’s illegal acquisition of sensitive technology from the world’s largest electric vehicle battery maker.”

“SK IE Technology plans to use the IPO proceeds to expand its manufacturing capacity in Poland and China as demand for electric vehicle batteries rises. The company last month announced a Won1.1tn plan to build factories in Poland as it seeks to more than double its capacity by 2024.” Song Jung-a reports.

Crematoriums Overwhelmed as Covid Cases Spike in India

Al Jazeera (Live Updates)

“India has set a new global record for a rise in daily coronavirus cases for a fifth straight day, while deaths from COVID-19 also jumped by an all-time high over the last 24 hours on Monday.”

“Several nations, including the United States, the United Kingdom and Germany, have offered support as India’s under-funded healthcare system struggles to cope with the increasing demand for medical oxygen and hospital beds,” Al Jazeera reports.

China’s Biggest IPO of 2021 May Be In Renewable Energy

South China Morning Post

“China Three Gorges Renewables Group is set for an initial public offering that could be the biggest in the country this year after securing regulatory approval.”

“The unit of China Three Gorges Corporation plans to sell up to 8.57 billion shares in Shanghai, it said in a prospectus filed to the Shanghai Stock Exchange, without giving the value of the funds to be raised. The state-owned company has received written approval from China’s securities regulator, according to a China Securities and Regulatory Commission statement Friday.”

“China Three Gorges Renewables announced last year it was seeking to raise 25 billion yuan (US$3.85 billion) in an IPO. The listing could easily be the largest debut in China in 2021 if it starts trading this year, according to data compiled by Bloomberg, topping Tianneng Battery Group’s US$697 million listing in January.”

“The parent is the world’s largest hydropower company and China’s largest clean-energy firm, according to the company website. Its renewables unit’s total assets – mainly solar and wind farms, as well as small hydro power plants – are valued at more than 140 billion yuan.”

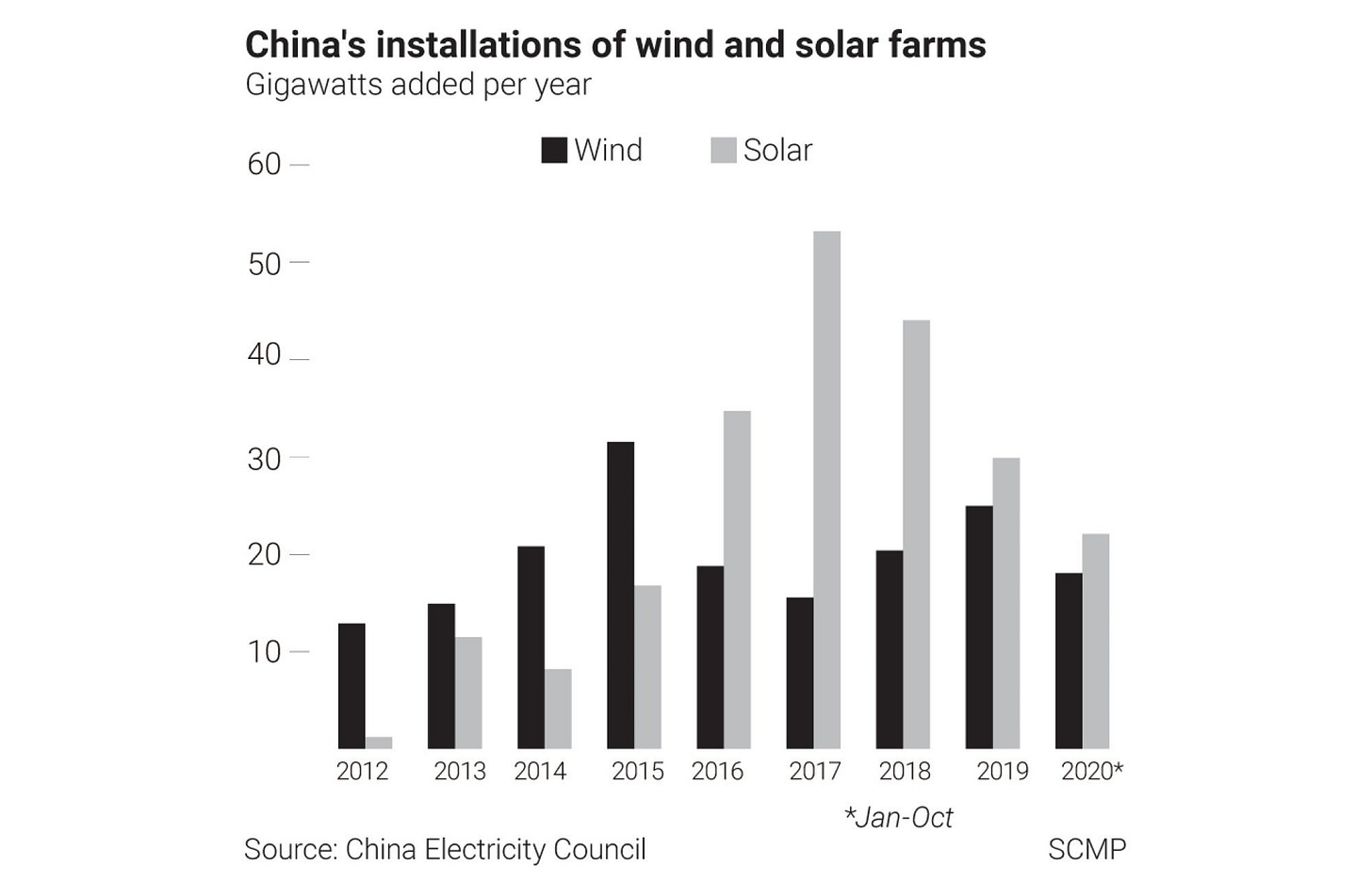

SCMP Graphics

Krystal Chia reports

Geopolitics: Iran’s FM Zarif, in Leaked Tape, Says Russia Blocks Iran Normalization with West and Revolutionary Guards Call Shots in Tehran

The New York Times

“In a leaked audiotape that offers a glimpse into the behind-the scenes power struggles of Iranian leaders, Foreign Minister Mohammad Javad Zarif said the Revolutionary Guards Corps call the shots, overruling many government decisions and ignoring advice.”

“In one extraordinary moment on the tape that surfaced Sunday, Mr. Zarif departed from the reverential official line on Maj. Gen. Qassim Suleimani, the commander of the Guards’ elite Quds Force, the foreign-facing arm of Iran’s security apparatus, who was killed by the United States in January 2020.”

“The general, Mr. Zarif said, undermined him at many steps, working with Russia to sabotage the nuclear deal between Iran and world powers and adopting policies toward Syria’s long war that damaged Iran’s interests.”

“‘In the Islamic Republic the military field rules,’ Mr. Zarif said in a three-hour taped conversation that was a part of an oral history project documenting the work of the current administration. ‘I have sacrificed diplomacy for the military field rather than the field servicing diplomacy.’

“The audio was leaked at a critical moment for Iran, as the country is discussing the framework for a possible return to a nuclear deal with the United States and other Western powers. Talks through intermediaries have been taking place in Vienna.” Farnaz Fassihi reports.

Mubadala Petroleum in Preliminary Talks for 22% Stake in Israel's Tamar Gas Field

The National

“Mubadala Petroleum signed a preliminary non-binding agreement with Israel's Delek Drilling for a 22 per cent non-operated stake in the offshore Tamar field in the Eastern Mediterranean, the Abu Dhabi company said on Monday.”

“The deal is worth $1.1 billion, according to a statement posted by the Israeli company.”

“Following interest in the region's potential, Israel launched a third offshore bid round for oil and gas exploration in June 2020. In the previous round, it awarded 12 new exploration licences. The country is appraising development work in the Karish gas field, adjacent to the Leviathan and Tamar fields.” Jennifer Gnana reports

**************************************************************************************************

What We’re Also Reading…

Qatar Petroleum Plans $10 Billion Bond Sale for Gas Expansion

Bloomberg

“The state producer is inviting banks to arrange what would be its first dollar bonds, the person said, asking not to be identified because the information is private. The company is seeking between $7 billion and $10 billion of five, 10- and 30-year notes, the person said. That would make it one of the largest corporate deals this year and one of the biggest of any kind from emerging markets.” Archana Narayanan reports

Netflix Fires Up Original Production in Latin America

Variety

“Concluding its roadshows in Spain and Latin America, Netflix has confirmed its biggest original production slate ever in Argentina.”

“Made late last week, the update was unveiled just days after the U.S. streaming giant reconfirmed a $300 million investment in 50 productions shot in Mexico and announced mid-April that it was opening offices in Bogotá Colombia and would unveil 30 new projects in Colombia through 2022.”

“It also comes after Netflix confirmed in a letter to investors last week that Mexican mystery thriller “Who Killed Sara?” had become the U.S. streaming giant’s most popular non-English title ever in the U.S. in its first 28 days – racking up an estimated 55 million household account views.” John Hopewell reports

Hong Kong is Becoming Shenzhen’s Backyard for Property Development

Reuters

“While Hong Kong's property market remains red-hot, the city's international economic prestige has come under pressure after prolonged pro-democracy protests in 2019 and sweeping new national security laws last year.”

“Shenzhen's stature, in contrast, keeps growing. During a visit last October, President Xi Jinping touted it as "a model city", flagging plans to increase foreign investment.”

"‘Our long term view is Shenzhen will be the centre and Hong Kong the periphery,’ said an executive at a Chinese developer which bought land in the once less-appealing north, asking not to be named because he was not authorised to speak to media.” Clare Jim reports

For daily Emerging Markets round-ups…