Emerging Markets Daily - April 27

European Gas Prices Soar, Oil Exporters To See $818 B Windfall, A Lost Decade for Emerging Economies?, India Downsizes Massive Insurance IPO, Africa Climate Finance

The Top 5 Stories Shaping Emerging Markets from Global Media - April 26/27

European Gas Prices Soar After Gazprom Halts Supply to Bulgaria and Poland

Financial Times

”European gas prices rose by as much as a fifth on Wednesday after Russia’s Gazprom suspended supplies to Poland and Bulgaria, saying the countries had failed to make rouble payments that were due a day earlier.”

“Futures contracts tracking Europe’s wholesale gas price gained about 20 per cent, before paring gains to trade 8 per cent higher at €106 per megawatt hour. Prices are more than six times higher than a year ago. The euro, which has declined steadily since February, fell to a five-year low against the dollar on Wednesday.”

“Ursula von der Leyen, European Commission president, accused Russia of attempting to use gas as ‘an instrument of blackmail’ after Gazprom’s decision to suspend deliveries. In a statement, she called its action ‘unjustified and unacceptable’ and said it pointed to Russia being an unreliable gas supplier.”

“Von der Leyen said the EU was prepared for the scenario, however, as tensions rise between Russia and the west over its invasion of Ukraine. The EU had been working to ensure alternative deliveries and the ‘best possible’ gas storage levels, she added. Europe depends on Russia for more than a third of its gas needs. Gazprom holds a monopoly on pipeline gas supplies in Russia.” The FT reports.

Oil Exporters Bagging $818 Billion Windfall Are Cautioned By IMF

Bloomberg

“The International Monetary Fund has sharply raised its view of the revenue windfall that the oil-exporting nations of the Middle East and Central Asia will collect in 2022, urging policies that would make their economies less vulnerable to the boom and bust in energy prices.”

“Oil revenue in the region this year will reach $818 billion, an increase of $320 billion from the IMF’s assessment in October, according to its regional outlook published on Wednesday. The Middle East and Central Asia include five of OPEC’s biggest producers led by Saudi Arabia.”

“…While putting importers such as Egypt under pressure and raising the threat of longer-lasting inflation around the world, the run-up in energy prices is a boon for governments that rely on sales of crude and gas for most of their budget income.”

“The IMF said it expects the bonanza ‘to improve fiscal and external balances’ in a region that includes 13 exporters in total -- from the United Arab Emirates to Turkmenistan. It predicts oil will average $106.83 a barrel in 2022 and $92.63 next year.”

“The Washington-based fund estimates official reserves in the region will amount to $1.3 trillion in 2022, an upgrade of about $235 billion from October. Current-account balances are set to improve to 12.2% of output, it said.” Bloomberg reports.

Another Lost Decade for Emerging Economies?

The Economist

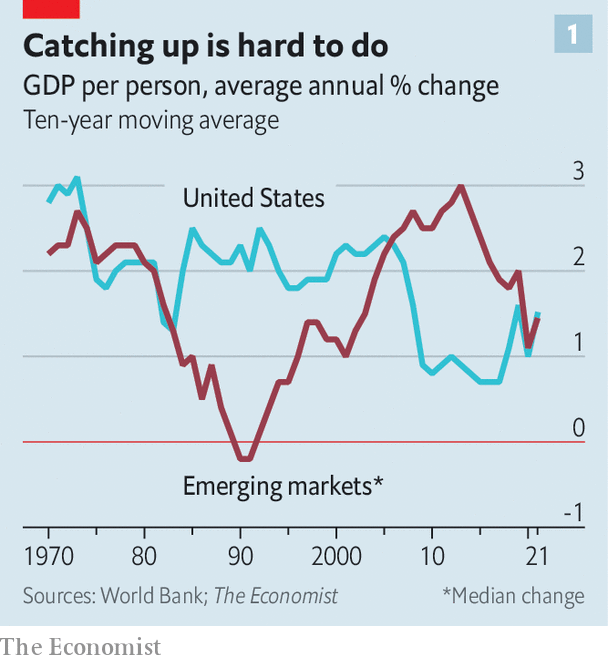

“EMERGING ECONOMIES hoping to grow their way into the ranks of the rich have faced a seemingly never-ending series of setbacks in recent years. Trade tensions, a pandemic, supply-chain snarls, inflation and war have together dealt them serious blows. Over the past three years more than half the population of the emerging world lived in countries where income growth, on a purchasing-power-parity basis, lagged behind that in America—the first such episode since the 1980s.”

“The IMF forecasts that economic output across emerging markets will expand by 3.8% this year and 4.4% in 2023, figures that have been revised down sharply since last year and which fall short of the 5% average annual rate in the decade before covid-19. As the contours of the post-pandemic landscape come into focus, a lost decade—a period of slow growth, recurring financial crises and social unrest—for the world’s poorer countries looks increasingly plausible.”

“…Financial pressures pose the most acute threat. In the early 1980s the Federal Reserve raised interest rates dramatically as it sought to tame inflation. For poor economies that had borrowed heavily in the preceding years, the ensuing tightening in financial conditions and strengthening of the dollar were too much to bear. Waves of debt and banking crises followed.” The Economist reports.

India Downsizes Insurance Giant’s Massive IPO

Quartz India

“India is doing all it can to make the initial public offer (IPO) of the country’s insurance behemoth Life Insurance Corporation of India (LIC) a success. But the headwinds seem simply too strong.”

“Following various regulatory tweaks, the IPO has been trimmed to 221.4 million shares as the Ukraine war dampens investor demand. This is equivalent to a mere 3.5% stake in the company, compared to the 5% planned earlier.”

“LIC hopes to raise $2.7 billion (20,684 crore rupees) when the IPO opens next week at the top end of the price range of 902-949 rupees per share, according to a revised IPO prospectus. This is a third of what was hoped for in February.”

“From the Indian government’s perspective, the listing must necessarily succeed. After all, its proceeds of around Rs21,000 crore will help plug the country’s budget deficit, worsened by rising fuel costs.” Quartz India reports.

African Development Bank to Double Climate Funding by 2025

The East African

“The African Development Bank (AfDB) plans to double its funding for climate resilience projects across the continent to $25 billion by 2025, helping countries mitigate and adapt to the effects of climate change.”

“This comes ahead of the group’s 57th annual meeting in Accra in May. AfDB Group Secretary General Vincent Nmehielle said climate change will be the centre of discussion in this year’s annual meeting as it is currently the most pressing issue that impacts Africa’s socioeconomic development.”

“‘We know that climate change is a game changer for how development trajectory proceeds globally, and Africa, as usually, will have significant implications from the climate transitions that is happening,’ added Prof Kevin Urama, AfDB’s chief economist.”

“In the last five years, AfDB has spent about $13 billion on climate financing, mostly focusing on enabling countries to respond appropriately to climate change-related risks and calamities.” The East African reports.

“Whatever you are looking for is also looking for you. You see, don't only look. Be available and ready when it shows up” ― Sahndra Fon Dufe