Emerging Markets Daily - April 30

S. Africa Rand Unlikely EM Winner, EV Sales Up 140%, Copper Hits 10 Yr. High, JD.Com Unit IPO Set for Hong Kong, China Recovery Slows, And "What We're Reading: Policy Wonk Edition."

The Top 5 Emerging Market Stories from Global Media - April 30

South Africa’s Rand An Unlikely Winner Among EM Currencies

Reuters

“The rand has emerged as an unlikely winner among emerging market currencies since the COVID-19 pandemic swept the globe, despite South Africa's high levels of debt and unemployment.”

“U.S. sanctions have rumbled Russian bond markets, Turkish assets have been hit by monetary policy concerns and other big developing countries such as India and Brazil have taken a hard hit from the coronavirus crisis.”

"‘The rand has been trading very, very well, like a safe haven almost, within the high-yield part of the index,’ James Lord, global head of FXEM strategy at Morgan Stanley, said.”

“The South African currency has strengthened 2.4% this year and soared some 30% over the past 12 months, while an index of emerging market currencies is down around 2% and rand-denominated government bonds have delivered handsome returns despite this year's hefty rise in U.S. Treasury yields, which roiled other emerging markets.”

“South Africa offers some of the highest real yields in major emerging markets, with 10-year government bonds yielding just over 9% with inflation at 3.2% year-on-year ‘Russia and Turkey obviously have huge amounts of domestic risk ... and people are a little bit hesitant to get too involved in these markets, which leaves South Africa as the default option if you want to invest in a big, liquid market that has yield,’ Lord added.”

“Morgan Stanley calculations show that South African bonds grew to 1.8% overweight - the largest in the index - by the end of March. Lord says this trend has accelerated again in the first two weeks of April.” Karin Stroheker reports.

Electric Car Sales Up 140% in Q1, IEA Says

The National

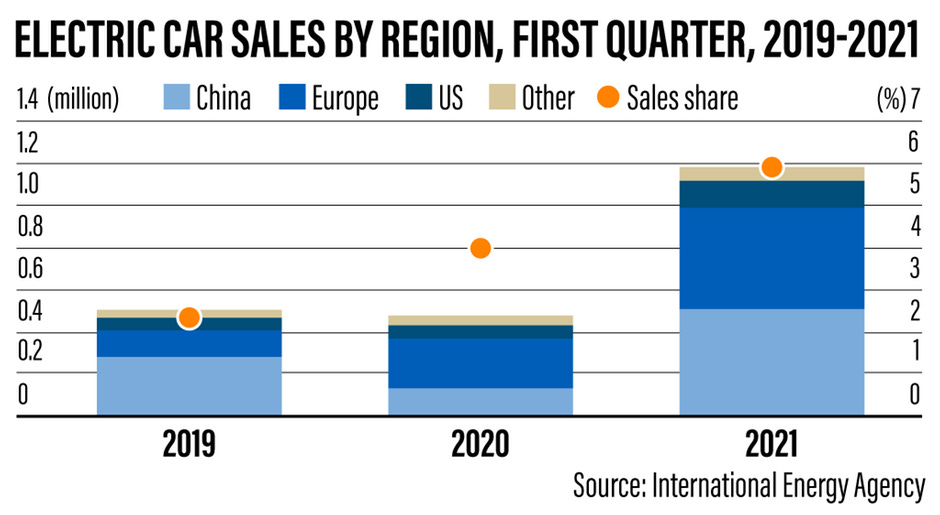

“Electric car sales surged 140 per cent in the first quarter of the year, with China emerging as the biggest spender, according to the International Energy Agency. Around 500,000 electric vehicles (EV) were sold in China, the largest market for automobiles globally, followed by 450,000 across Europe, the Paris-based agency said in its Global EV Outlook 2021 report.”

“Sales in the US also doubled compared to the same three-month period last year. However, the increase was from a relatively lower base, the IEA said. Higher EV sales this year come as demand for sustainable transport options grows. In 2020, consumer spending on EVs hit $120 billion while car registrations rose 41 per cent amid the pandemic...”

“Global car sales fell 6 per cent in 2020, but around 3 million EVs were sold, accounting for a 4.6 per cent share in vehicle sales.”

“The IEA report noted that Europe overtook China as the largest market for EVs last year. However China still saw the largest number of sales for electric cars in the first quarter of 2021...”

“In its sustainable development scenario, the Paris-based agency expects to see 230 million EVs, including two- and three-wheelers on the roads by 2030.” Jennifer Gnana reports.

Copper Hits 10 Year High on China, Developed World Demand Surge

Financial Times

“Copper, the world’s most important industrial metal, has traded above $10,000 for the first time in a decade as the rebound from the coronavirus pandemic unleashes a surge of demand from China and the developed world that could not be matched by supply.”

“After a wobble in March due to concerns about fresh lockdowns in Europe and a strengthening US dollar, copper has resumed the powerful rally that started a year ago when it sank to $4,300 a tonne. The price has climbed 11 per cent since the start of the month and is now closing in on the record high of $10,190 set during a commodity boom in 2011.”

“It reached $10,008 on Thursday before paring gains and trading at $9,850. ‘With reflation signals on fire, copper could test all-time highs,’ said Bart Melek, head of commodity strategy at TD Securities. Copper is used in everything from household appliances to electric vehicles and wind turbines. As the most cost-effective conductive metal, it is expected to play a crucial role in the shift away from hydrocarbons to more sustainable sources of energy, including solar and wind.” Neil Hume reports.

JD.com Logistics Unit Set for $3-$4 Billion Billion Hong Kong IPO

South China Morning Post

“The logistics unit of Chinese e-commerce giant JD.com received the green light on Thursday to proceed with an initial public offering (IPO) that could raise between US$3 billion and US$4 billion on the Hong Kong stock exchange, according to people familiar with the matter.”

“The IPO would mark the latest JD arm to tap the Hong Kong markets in the past year. JD Health raised US$3.5 billion in an IPO in December and its Beijing-based parent JD.com raised US$4.5 billion in a secondary listing in Hong Kong in June 2020, the biggest fundraising in the city last year.”

“The JD Logistics spin-off is one of several highly anticipated offerings by China’s technology companies this year…The potential listing, however, comes at a time when some investors have been questioning the sky-high valuations of technology companies. Video-streaming and mobile gaming site Bilibili raised US$2.6 billion in a secondary listing in Hong Kong in March, slightly below the US$2.8 billion it had targeted.”

“Baidu, the Chinese search engine and artificial intelligence giant, flopped on its first day of trading after raising US$3.1 billion in a secondary listing in the city last month.” Chad Bray and Georgina Lee report.

China’s Robust Economic Recovery Loses Momentum

Wall Street Journal

“Official gauges across China’s economy fell short of expectations in April, hit in part by semiconductor shortages, suggesting that the economy’s strong pandemic bounceback is starting to lose some momentum more than a year into the recovery.”

“China’s official purchasing manager’s indexes showed manufacturing activity falling more sharply than expected, dropping to 51.1 in April, according to data released Friday by the National Bureau of Statistics—lower than March’s 51.9 reading and falling short of the 51.6 median forecast expected by economists polled by The Wall Street Journal…”

“The weaker-than-expected readings from across China’s economy come after a year in which the country largely defied expectations to become the only major global economy to grow in pandemic-scarred 2020.” Jonathan Cheng reports.

******************************************************************************************************

What We’re Reading… “The Policy Wonk Edition”

Chatham House on Middle East Regional Security

Why US Policy Should Focus on Urban Africa

Who is Briefing Antony Blinken on the China in Africa Story?

Christopher Schroeder: “America Is Back!” But to What?

Important Paper Watch: Steps to Enable a Middle East regional security process: Reviving the JCPOA, de-escalating conflicts and building trust

Chatham House

A sober, insightful, and well-informed research paper by Saman Vakil and Neil Qulliam, both of Chatham House in London. Sanam and Neil conducted 210 confidential interviews with experts and current and former policymakers from 15 countries from the Middle East, Europe, the U.S, and Asia. They make a compelling argument that a regional security framework is vital now and what they see as US disengagement from the region poses a challenge to regional order.

Clocking in at 73 pages with highly useful survey results and charts, it’s informed by logging tens of thousands of miles in travel in the BC (Before Covid) world to meet and interview people, and hundreds of hours of Zoom interviews since then, and shaped by two thoughtful and well-traveled analysts of the region.

An excerpt:

“Relevant to understanding the current climate of tensions and conflict in the Middle East are three critical points: the 2003 Iraq war, the 2011 Arab Spring, and the signing of the JCPOA — the Iran nuclear agreement — in 2015. All of these have dramatically altered regional security dynamics in the Middle East, further unleashing inter-regional competition, the growth of extraterritorial sponsored non-state actors, and regionally led foreign policy initiatives.”

They note that the “multipolar nature of regional conflicts makes achieving any resolution more challenging.” What’s more, “a further aggravating factor has been a growing US focus and prioritization of geopolitical competition with Russia and China. As the US has increasingly outsourced the management of regional challenges to its partners, the outcome has been more rather than less instability, amid waves of popular protests and governance challenges.”

I’m old school, so I printed out the PDF here, and took my time reading it through. It’s well worth your time.

Sanam is an Emerging World fellow traveler. You can follow her on Twitter here.

Smart Initiative: Why US Policymakers Must Focus on Urban Africa

A powerhouse trio of thoughtful Africa, emerging markets, and development specialists — Judd Devermont, Gyude Moore, and Todd Moss — have teamed up to launch a spot-on proposal for US policymakers to focus on African cities as the nexus for a new development agenda.

They argue that “Africa is on the cusp of an urban revolution. By 2050, the majority of Africans—some 1.5 billion people— will live in cities. More than 30 African cities will top 5 million people by 2050. The region’s most pressing foreign policy challenges and most enticing commercial opportunities will consequently unfold across these rapidly urbanizing landscapes.”

“Unfortunately, U.S. policy toward Africa has been unprepared for this transition,” they write. “It has overwhelmingly focused on rural development and security. According to the United States Agency for International Devel- opment’s (USAID) foreign aid dashboard, Washington spends more than twice as much on rural areas than urban areas in sub-Saharan Africa. Cities, however, are engines of productivity, epicenters of creativity, and generators of wealth. But many are also poorly designed and governed while suffering from crime, traffic, pollution, and food insecurity. Ultimately, they underserve the potential of their citizens. The United States needs to pivot now.”

Given the attention on China’s role in Africa and how the US might counteract it, this might be one idea the Biden Administration will seize upon…Let’s hope the Biden Administration is listening.

But..Does Antony Blinken Even Understand the China in Africa Story?

Emerging World fellow traveler Eric Olander had some sharp words for US Secretary of State Antony Blinken in a piece this week with a self-explanatory title: “Antony Blinken Revealed He Doesn’t Really Know Much About What China’s Doing in Africa.”

Olander - another powerhouse and thoughtful thinker on China and Africa matters notes - U.S Secretary of State Antony Blinken needs a primer on the China in Africa story today. Olander writes:

“U.S. Secretary of State Antony Blinken revealed yesterday that when it comes to understanding the dynamics of China’s engagement in Africa, he really doesn’t know very much.”

“When a young person floated him a softball question about how the U.S. plans to compete with China in Africa, a topic he must have expected, the Secretary gave a meandering answer that clearly showed that he’s not at all well-versed in the issue.”

“Most of his answer was a re-hash of the tired debt trap and Chinese labor narratives that have long been disproven and, for the most part, have been abandoned by much of his own State Department.”

“These are the same message points that his predecessors relied on, dating back all the way to 2011, when Hillary Clinton was Secretary. Ten years ago! A decade later and the U.S. is still relying on the same narratives…”

“The fact that the Secretary is so clueless on the basics of Chinese engagement in Africa and the Global South is worrisome.” He lays out some possible reasons why Blinken has not been well-briefed (link above).

Christopher Schroeder: “America Is Back!” But To What?

Speaking of US policy, the Biden Administration would do well to listen to Christopher Schroeder, the super smart investor, author and thoughtful analyst of all things emerging markets and global economy.

He wrote a vital piece for International Economy, republished on his Substack newsletter here. An excerpt:

“In recent years, America has taken a very different role and tone in our engagement in the world, one that may forever change the way the world views us structurally if not psychologically. Joe Biden’s first tweet once learning he had won the 2020 election was, ‘America is back!’”

“But back to what?”

“Today’s world has shifted profoundly since well before Covid-19. A fraction of shifting events well in process and only accelerated by the pandemic include the rise of China and Asia more broadly; Brexit and a rethinking of a new future in Europe; and astounding technology and new generations pushing societies bottom up across the globe and in parts of the world America often ignores.”

“As a global venture investor who until last year flew 250,000 miles a year and now tours the worlds of innovation through hours on Zoom each day, I have a very specific lens on this shift. And it is right at the heart of where historically America has had its greatest strategic advantage—technology and innovation leadership.”

“I’m often asked what are the most important tech revolutions today, and certainly spend much time thinking of the ramifications of artificial intelligence, machine learning, robotics, genomics, and more. But for me the greatest and least-understood revolution is not the tech itself, but the near-universal access to it.”

“Across the world, 70, 80, 90 percent of mobile users have a smart device. This of course is not merely a phone or way to check social media, but a super computer in each device many times more powerful than all NASA had in 1969 to put a man on the moon.”

“This has meant—globally—unlimited access to all human knowledge, insight, and experience. It has offered an unparalleled ability to share and learn from each other and collaborate. It has unleashed an unprecedented period of empowerment where the more individuals see people like them building something and succeed, they believe they too can achieve it. As talent is everywhere, so innovation to solve problems is anywhere. And away from the West—from Jakarta to Cairo to Lagos to São Paulo—it is as if billions of new customers have appeared almost overnight craving products and services on their terms.”

Chris is also an Emerging World fellow traveler. Follow him on Twitter here.

To become a fellow traveler in our Emerging World caravan…