Emerging Markets Daily - August 18

US and China Tech Battle over ASEAN, UAE Sells Blue Ammonia to Japan, Tencent Profits Surge, China and Russia in Afghanistan, Indonesia Infrastructure Spending

The Top 5 Stories Shaping Emerging Markets - August 18

US and Chinese Tech Juggernauts Battle Over ASEAN Clouds

Nikkei Asia Review

“Amid the great U.S.-China tech divide, Southeast Asia and its fast-growing digital markets have become a main battleground for the digital behemoths of both superpowers.”

“There, Amazon.com, Microsoft, Google, Alibaba Group Holding and other players are investing heavily in cloud computing -- services that provide processing power and data storage to all sizes of corporations and government institutions.”

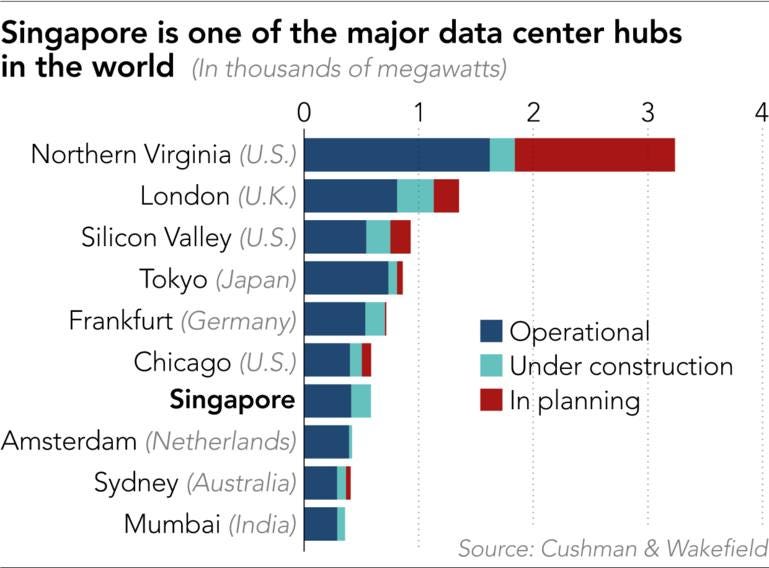

“…It is one of many data centers that global tech giants are building in Southeast Asia. With a stable political system, an abundance of skilled tech workers and its connection to an undersea communications cable that links to the rest of the world, Singapore has become a prime spot for the big players of tech vying for slices of Southeast Asia's swelling need for cloud services.” Akin Tanaka reports.

UAE Sells Blue Ammonia to Japan in Hydrogen Push

Bloomberg

“The United Arab Emirates sold its third shipment of blue ammonia to Japan, as the oil producer looks to build a hydrogen industry and plans for the global energy transition.”

“Abu Dhabi National Oil Co. will send a cargo to Inpex Corp. for use in power generation in Japan, according to a statement. Fertiglobe, a partnership between Amsterdam-based OCI NV and Adnoc, will produce the fuel in the emirate of Abu Dhabi.”

“Blue ammonia is made from hydrogen, a gas seen as key to the global energy transition since it emits only water vapor when burned. It’s called a blue fuel because the carbon emissions from the conversion process are captured. Turning hydrogen into ammonia allows it to be shipped more easily.”

“Several energy companies are investing in such fuels, though they’ve only just started setting up manufacturing, carbon capture and export facilities. Production costs are still far higher than those for oil and gas.” Anthony Di Paola reports.

Tencent Profits Surge Despite Regulatory Crackdown

Financial Times

“Tencent has reported a jump in second-quarter profits, as one of China’s biggest tech groups bucked expectations of a deeper hit from a regulatory crackdown by Beijing.”

“The strong earnings, which topped analysts’ expectations, came despite some signs of slowing growth and broad investor concern that the social media and fintech group would be engulfed by the regulatory storm battering much of China’s technology sector.”

“The measures by the Chinese government, which have targeted groups ranging from video games makers to education providers, have knocked tens of billions of dollars off the value of Chinese companies, including Tencent.”

“Shares in the Shenzhen-based business have fallen more than 40 per cent over the past six months. Tencent said on Wednesday that net profit for the three months to June rose 29 per cent year on year to Rmb42.6bn ($6.6bn). This was well ahead of analysts’ estimates published by Refinitiv of about Rmb34bn.” Edward White reports.

Geopolitics: China and Russia Poised to Step into the Afghan Gap

Financial Times

“The Taliban’s takeover in Afghanistan redraws Asia’s geopolitical map and hands China and Russia — two of America’s staunchest strategic rivals — an opportunity to project their power in the wake of Washington’s chaotic withdrawal, analysts in several countries said.”

“‘China has benefited from the irresponsible behaviour of [the US] which has deeply undermined the international image of the US and the relationship between Washington and its allies,’ said Zhu Yongbiao, a Chinese government adviser on Central Asia and professor at Lanzhou University.”

“Arkady Dubnov, a political analyst and expert on Central Asia in Moscow, had a similar take. ‘We can align our interests [with China] in opposing the US,’ he said. ‘What is good for us is bad for Americans, what’s bad for us is good for Americans. Today the situation is bad for Americans and so it is good for us.’” James Kynge, Nastassia Astrasheuskaya, and Sun Yu report

Indonesia to Spend Big on Infrastructure amid Pandemic Pressures

The Jakarta Post

“The government is adamant about spending more than Rp 100 trillion rupiah (US$6.96 billion) to save ailing state-owned construction firms to turn its ambitious infrastructure dreams into reality.”

“The massive capital injections, which accounts about 4 percent of the total of the draft 2022 state budget (RAPBN 2022), is pending final approval by the House of Representatives.”

“The proposed state capital injections amount to an additional Rp 33 trillion to top up 2021 spending and another Rp 72 trillion for 2022. According to data from the State-Owned Enterprises (SOEs) Ministry, more than 70 percent of the funds are earmarked for construction SOEs involved in toll road projects.” Vincent Fabian Thomas reports