Emerging Markets Daily - August 24

China Tech Stocks Rally, Afghanistan's Economy, East Africa Tourism Losses, Latin America Digital Divide, China Mining in Papua New Guinea, CIA Chief Meets Taliban

The Top 5 Stories from Global Media Shaping Emerging Markets - August 24

Chinese Tech Stocks Rally; Cathie Wood Joins Bargain Hunters

Bloomberg

“Chinese technology stocks rallied for a second day as bargain hunters returned, emboldened by Tencent Holdings Ltd.’s share buyback and strong results from JD.com, which drew Cathie Wood back into the market.”

“The Hang Seng Tech Index advanced more than 7%, adding to a 2% gain on Monday, after a five-week rout that took the gauge to the lowest level since its inception last year. Heavyweights Tencent and Alibaba Group Holding Ltd. climbed 8.8% and 9.5%, respectively. In New York, The Nasdaq Golden Dragon China Index jumped 5.2% at the open.”

“While there’s no indication that the nation’s increased oversight on tech and other fast growing businesses will ease, the absence of new initiatives in recent days opened the door to investors who see longer-term value in China stocks. Some are also taking a cue from technical charts that show the index plunged into oversold territory last week.” Abhishek Vishnoy and Jeanny Yu report.

Afghanistan’s Newest Threat: Economic Collapse

Wall Street Journal

“No longer facing serious military opposition, Afghanistan’s new Taliban rulers are grappling with a new threat: an economic collapse that could fuel renewed challenges to their rule and has already put pressure on them to share power.”

“There has been no legitimate government of Afghanistan since President Ashraf Ghani and most ministers escaped Kabul on Aug. 15. In the eight days since then, the banks and money exchanges have remained shut and prices for basic commodities have surged. Economic activity has ground to a halt.”

“‘People have money, but it’s in the bank, which means they no longer have money now. It’s hard to find cash,’ said Bahir, a Kabul resident who worked as a financial officer for a construction company. ‘That’s why the whole business in Kabul has stopped.’”

“Prices for basic commodities, such as flour, cooking oil and gas have risen by as much as 50%, residents say. The afghani-to-dollar exchange rate quoted by the few street money-changers still operating has fallen by about 10%, with dollars increasingly hard to find, they add. Some imported items, too, have disappeared from shelves.” Yaroslavl Trofimov reports.

East Africa Tourism Losses: $4.8 Billion and 2 Million Jobs

The East African

“The East African region lost more than $4.8 billion and two million jobs in the tourism sector in 2020 due to the pandemic, according to a new report.”

“The August report titled ‘EABC Studies on Impact of Covid-19 on Selected Sectors: Tourism & Hospitality Industry; Light Manufacturing Sector and Agriculture & Food Security’ found that 4.2 million foreign tourists were not able to travel to their preferred East African Community destinations.”

“The impact has also been felt across affiliated industries and other sectors of the economy. Tourism is one of the leading foreign-exchange earners and fastest-growing sectors in the EAC.”

“‘It is estimated that tourism jobs in the region dropped from about 4.1 million to 2.2 million,’ said John Bosco Kalisa, EABC chief executive officer…The majority of the tourists originate from Europe, the USA and parts of Asia.” Luke Anami reports.

The Low Cost of Closing the Digital Divide in Latin America

El Pais

“Having a stable and continuous internet connection can now be seen as a matter of life and death. Education, health, work, all these sectors depend on good access to digital media that allow us to be connected and cope with the pandemic. In Latin America , the region of the world hardest hit by covid-19 , digital access is far from ideal: less than half of Latin Americans have fixed broadband connectivity and only 10% have high-quality fiber in the home.”

“How to overcome the digital gaps in the region? In this interview, Franz Drees-Gross, Director of Infrastructure for Latin America and the Caribbean at the World Bank, offers an overview of the sector in the region and recommendations on how inequality in access can be reduced.”

“…Before talking about the challenges, I would like to highlight a few facts. Currently, almost half of the adult population in the region is unbanked. Some 170 million students across the region were affected by school closings during the pandemic. And 71% of countries experienced interruptions in the provision of noncommunicable disease care during the first months of the COVID-19 crisis. If we add to this that less than 50% of the population of Latin America and the Caribbean has fixed broadband connectivity and only 9.9% have high-quality fiber at home, the outlook itself is worrying.” Maria Jose Gonzalez Rivas reports

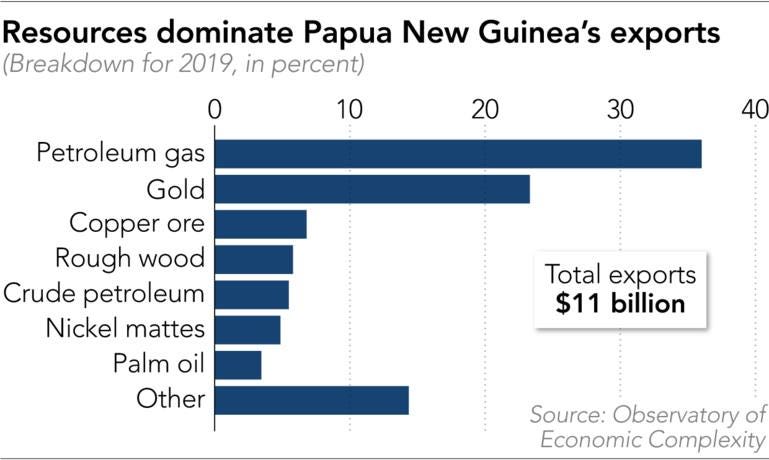

China-backed Mining Deepens Papua New Guinea's Golden Dilemma

Nikkei Asia

“When the COVID-19 pandemic shrank Papua New Guinea's economy, the country looked to what one top official branded the ‘devil’ for answers.”

“In April, the PNG government reversed its long-running efforts to stop Canadian conglomerate Barrick Gold and Chinese partner Zijin Mining from running the Porgera gold mine in the highlands. It opted instead to renew its partnership with the companies and end its legal dispute with them.”

“…As traditional Pacific allies like Australia look on with unease, a number of island states have signed up to China's Belt and Road Initiative, including PNG. While Samoa's new Prime Minister Fiame Naomi Mata'afa has said she would scrap $100 million Chinese-backed port development plans, she also called China a ‘very good development partner.’ The Solomon Islands has leaned into closer ties with China, severing relations with Taiwan in 2019.” Elizabeth Beattie reports

BREAKING NEWS: CIA Chief Meets With Taliban Leader in Kabul, multiple news organizations report.

The Wall Street Journal reports that “The meeting between Mr. Burns, a seasoned diplomat and former deputy secretary of state, with Mr. Baradar appears to be the highest-level engagement between the Biden administration and the Taliban to date.”

“It was the CIA chief’s second visit to Afghanistan. Weeks after taking office in March, he traveled to Kabul for talks with the now-defunct government of President Ashraf Ghani in the wake of President Biden’s announcement that he would withdraw remaining U.S. troops from Afghanistan.”

What We’re Also Reading….

Samsung to Create 10,000 Jobs in $205 Billion Three-Year Spree

Bloomberg

“Samsung Group has unveiled a 240 trillion won ($205 billion) expansion that will create 10,000 new jobs over three years, a sprawling investment blueprint intended to build the South Korean conglomerate’s lead in next-generation technologies.”

“Samsung Electronics Co. and affiliates like Samsung Biologics aim to lead research and spending in areas from telecommunications and robotics to corporate acquisitions. The country’s largest conglomerate is setting aside 180 trillion won for its home country alone and now aims to hire another 10,000 people over the period, taking its total hiring to 40,000 positions, the group said in a statement.”

“The envisioned spending includes expenditures outlined previously, such as Samsung Electronics’ long-term goal of investing $151 billion through 2030 to delve deeper into advanced chipmaking. But the announcement comes days after Samsung scion Jay Y. Lee walked out of jail. The conglomerate’s de facto leader, who was serving a sentence on graft charges, won release on parole just months ahead of South Korea’s presidential election.” Sohee Kim reports

Apple and Google’s Fight in Seoul Tests Biden in Washington

The New York Times

“For months, Apple and Google have been fighting a bill in the South Korean legislature that they say could imperil their lucrative app store businesses. The companies have appealed directly to South Korean lawmakers, government officials and the public to try to block the legislation, which is expected to face a crucial vote this week.”

“The companies have also turned to an unlikely ally, one that is also trying to quash their power: the United States government. A group funded by the companies has urged trade officials in Washington to push back on the legislation, arguing that targeting American firms could violate a joint trade agreement.”

“The South Korean legislation would be the first law in the world to require companies that operate app stores to let users in Korea pay for in-app purchases using a variety of payment systems. It would also prohibit blocking developers from listing their products on other app stores.”