Emerging Markets Daily - August 3

South Africa Stocks Near Record Highs, Standard Chartered Profits Soar, US Dollar and Emerging Economies, IMF's Historic Pandemic Response, Asia Recovery Stalls,

The Top 5 Emerging Markets Stories from Global Media - August 3

South Africa Stocks Near Record as Rand Boosts Banks

Bloomberg

“South African stocks kicked off August on a positive note, rising to trade near their all-time high and joining global peers in rallying as some of the concerns over China’s regulatory crackdown eased and progress on a U.S. infrastructure spending plan aided sentiment.”

“The FTSE/JSE Africa All Share Index advanced as much as 0.9%, before paring its gains to 0.5% by 9:56 a.m. in Johannesburg, with the index’s biggest companies -- Naspers Ltd., Anglo American Plc, BHP Group Plc and Richemont -- among those leading the advance. MTN Group Ltd. gained after its Nigerian unit reported increased profit.” Adelaide Changol reports.

Leading EM Bank, Standard Chartered, Sees Profits More Than Double in 2Q

South China Morning Post

“Standard Chartered…said its profit more than doubled in the second quarter as it joined larger crosstown rival HSBC in restoring its interim dividend to shareholders and said it would buy back US$250 million in shares.”

“The London-based bank and other United Kingdom lenders suspended their dividends last year at the request of the Prudential Regulation Authority (PRA), an arm of the Bank of England, to make sure they had enough capital on hand to support the economy in light of the coronavirus pandemic. The suspension spurred a revolt among some investors in Hong Kong.”

“Standard Chartered and HSBC, which both generate much of their revenue in Asia, were allowed to pay a modest dividend for full-year 2020 this year and the PRA removed ‘temporary guardrails’ that restricted how much they can distribute to shareholders in July.”

“The emerging-markets focused bank said it would pay an interim dividend of 3 US cents a share. Analysts expect the bank to pay a dividend of 19.5 US cents a share over the course of the year, according to market consensus.” Chad Bray reports.

Who’s In Trouble, the U.S Dollar or Emerging Economies?

Nikkei Asian Review

“The U.S. dollar has resumed appreciating as currency market participants, prompted by a steep rebound in the U.S. economy, actively buy the greenback, a trend that could worsen the predicament of emerging economies struggling with the resurgent pandemic.”

“The theoretical value of the dollar has also caught a break from the relatively limited worsening of terms for international trade transactions. Crude oil prices, which greatly affect the terms, keep rising because of a global economic recovery. The U.S., however, has made its economic structure more resistant to high crude oil prices, partly by using shale oil production to lower its reliance on oil imports. In 2020, the U.S. exported crude oil and petroleum products in excess of imports, according to the U.S. Energy Information Administration.”

“Economic trends down the road hold the key to whether the dollar remains strong. As the actual value of the American currency is higher than its theoretical value, the dollar could go south if the U.S.'s economic recovery weakens. But other currencies could be forced into direr straits.”

“The World Bank forecasts that the Brazilian economy will grow 4.5% and Russia's 3.2% in real terms in 2021, slower than the projected global economic growth rate of 5.6%. Nevertheless, the countries' central banks decided to raise interest rates at four consecutive policy board meetings in a desperate attempt to prevent the mass exodus of their currencies and the acceleration of inflation.”

“Surging and more virulent coronavirus strains are another concern. Since the start of July, the number of new daily cases has kept setting new highs in Thailand, resulting in nighttime curfews in certain areas.”

“Indonesia is taking a double punch from the dollar's appreciation against its currency and from surging COVID-19 infections. In fact, emerging economies with dollar-denominated debt will face heavier repayment burdens if they fail to contain infections fast enough and if the dollar goes on appreciating.”

IMF Allocates $650 Billion To Boost Pandemic-Hit Economies

Financial Times

”The IMF has agreed to boost the finances of low and middle-income countries to support their pandemic response through a $650bn allocation of its special drawing rights.”“The allocation, which is a form of foreign reserve asset, is the equivalent of newly minted money that will be given to the fund’s 190 member countries roughly in proportion to their share of the global economy.”

“About $275bn of the allocation will go to emerging and developing countries, with the rest earmarked for the world’s biggest economies. ‘This is a historic decision — the largest SDR allocation in the history of the IMF and a shot in the arm for the global economy at a time of unprecedented crisis,’ said Kristalina Georgieva, IMF managing director, in a statement on Monday.”

“The announcement came at a critical juncture for developing economies. Many countries’ recoveries are faltering as they endure rising Covid-19 case counts and death tolls with the spread of the more contagious Delta variant. Citing limited access to vaccines as a significant headwind, the IMF recently slashed its 2021 growth forecast for emerging and developing economies by 0.4 percentage points to 6.3 per cent.” Jonathan Wheatley and Colby Smith report.

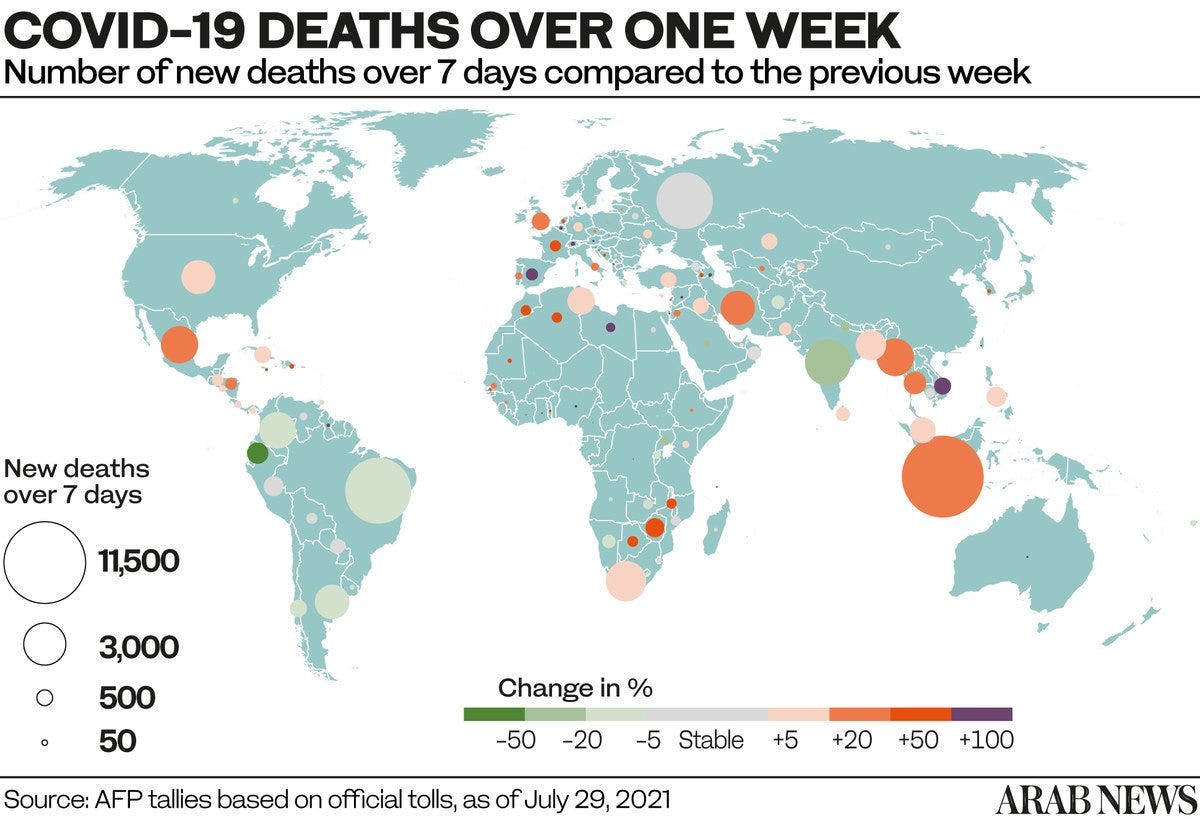

Delta Variant Stalls Asia Recovery After Early Rebound

The Wall Street Journal

“Asia is emerging as a weak link in an otherwise strong global economic recovery, as new pandemic restrictions restrain manufacturing in some countries and the exports that have powered the recovery in China show signs of slowing.”

“With progress on vaccinations slower than in the West, Asia is hitting new pandemic highs driven by the Delta variant of the coronavirus. The spread of the virus is threatening to hurt consumer confidence and erode the advantage of many Asian economies as manufacturing powerhouses.”

“Countries in Southeast Asia have been among the hardest hit, prompting new social-distancing restrictions and lockdowns in countries that had largely avoided those measures earlier in the pandemic. As factory production contracts across Southeast Asia, Indonesia and Malaysia, which have recently faced surging caseloads and Covid-19 deaths, have been among the worst affected, according to IHS Markit.”

“Foreign demand has propelled export economies such as China and South Korea during the pandemic, with factories churning out consumer goods from bikes to furniture and electronic gadgets for overseas consumers. But that engine is showing signs of slowing. In China, both private and official manufacturing purchasing-managers’ Indexes fell to their lowest levels in over a year in July, suggesting that domestic and overseas demand were cooling off.”

“In the West, higher vaccination levels are allowing economic activity to return to normal levels. In the U.S., which has vaccinated 49.6% of its population, economic output rose above its pre-pandemic level in the second quarter.”

“Factories in Europe reported near-record levels of output growth in July. In the eurozone, where economies have loosened social restrictions in recent months, firms hired staff at a record pace in July as inflows of new orders outstripped production to an extent unprecedented in 24 years of surveys by IHS Markit.” Stella Yifan Xie and Jon Emont report.

What We’re Also Reading…

North Africa Grapples With Crippling New Covid-19 Wave

Arab News

“First identified in India, the highly transmissible delta variant of the coronavirus has since been detected in around 100 countries, prompting new waves of infections, travel restrictions and concerns over the effectiveness of vaccines.”

“One region that has been especially hard hit is North Africa, where the economic havoc caused by lockdowns forced governments to reluctantly reopen borders and businesses in recent months despite the slow pace of inoculation.”

“Tunisia, with a population of 11.69 million, has reported 582,638 infections and 19,336 deaths since the pandemic was declared in March 2020, making it one of the worst-hit nations in Africa, alongside Namibia, South Africa, Uganda and Zambia.”

“The collapse of the health system and severe economic hardship triggered mass protests that in turn have plunged the country into a political crisis.”

“War-ravaged Libya has also witnessed an alarming surge of COVID-19 cases over the past month. Because of its two centers of political power with parallel institutions, its response and vaccination rollout have been disjointed and sluggish.”

“The country’s National Center for Disease Control (NCDC) recorded 3,845 new COVID-19 cases on July 25 — at that time the highest daily rate since the onset of the pandemic.”

“Libya has recorded roughly 246,200 cases and 3,469 deaths, but the true figure is likely far higher given the country’s acute shortage of tests and laboratory capacity…”

“However, the picture is not uniform across the region. To date, 1.63 percent of Egyptians and 1.68 percent of Algerians have been fully vaccinated, compared with 27.68 percent of Moroccans, and 8.24 percent of Tunisians. Just 0.43 percent of Sudanese have received two doses, while data for Libya is unavailable.” Jumana Al-Tamimi reports.

Qatar Airways Signs Strategic Partnership with Rwandair

Business Traveller

“Qatar Airways and Rwandair have signed a new strategic partnership including interline agreements and reciprocal loyalty scheme benefits.”

“Rwandair said that the partnership would ‘leverage Qatar Airways’ global network and increase access to African destinations’, through an extensive interline agreement across the carrier’s combined 160 destinations via their hubs in Kigali and Doha.”

“The two airlines recently announced a new loyalty partnership, allowing members of the RwandAir Dream Miles and Qatar Airways Privilege Club schemes to earn and redeem miles across the carriers’ networks.”

“Qatar Airways Group CEO Akbar Al Baker said that ‘Africa is a hugely important market for us’, adding that the partnership ‘will help support the recovery of international air travel and offer unrivalled connectivity to and from a number of new African destinations’.”

“Qatar Airways currently operates five flights per week between Doha and Kigali (via Entebbe), and Rwandair said that customers would be able to transit via Kigali to a diverse range of African destinations including Bujumbura, Brazzaville and Libreville.”

“Both carriers serve London Heathrow from their respective hubs, with Rwandair having switched from Gatwick to Heathrow in October 2020.” Business Traveller reports.