Emerging Markets Daily - August 8

Aramco Profits Surge, China and Africa FinTech, Northern Sea Routes and Global Trade, ByteDance's Hong Kong IPO, Indonesia's Crypto Boom

The Top 5 Emerging Markets Stories from Global Media - August 8

Saudi Aramco Profits Surge on Oil Price Recovery

Bloomberg

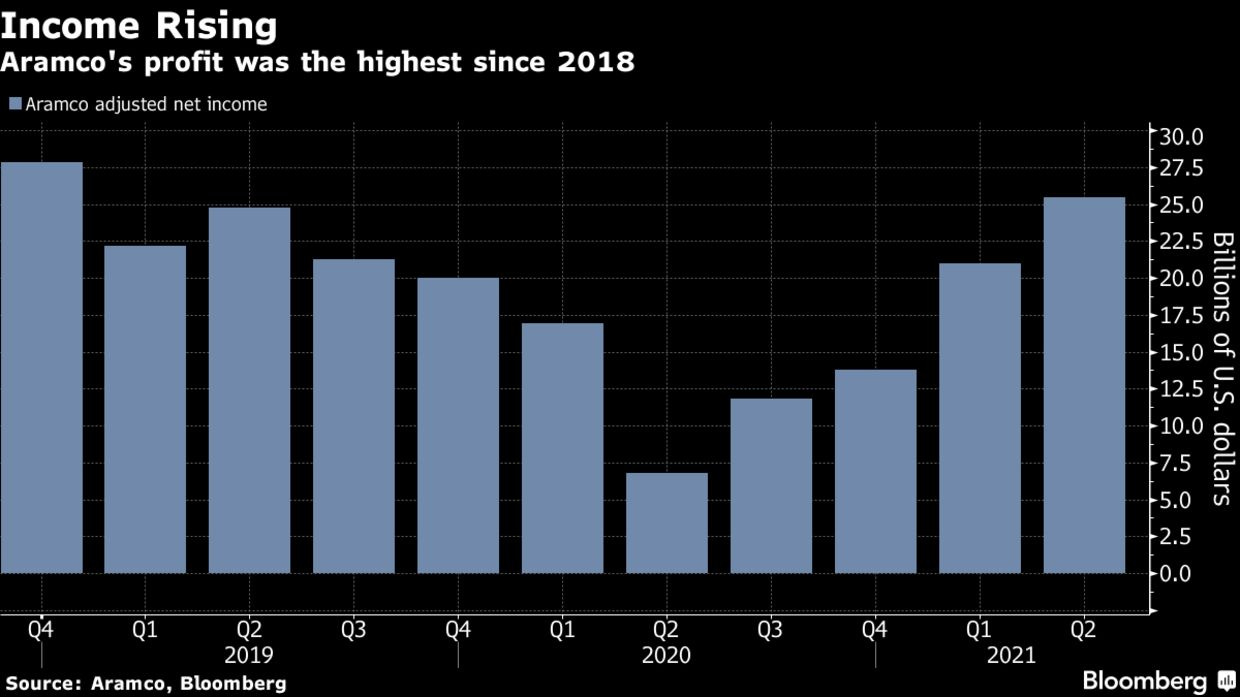

“Saudi Aramco followed its Big Oil competitors with bumper earnings, boosted by a recovery in oil and chemical prices.”

“The world’s biggest energy company made net profit of 95.5 billion riyals ($25.5 billion) in the second quarter, the highest level since the end of 2018. Free cash flow rose to $22.6 billion, above the state-controlled firm’s quarterly dividend of $18.8 billion for the first time since the start of the coronavirus pandemic.”

“The reopening of major economies has triggered a surge in commodity prices, with crude up around 40% this year. In the past two weeks, oil companies such as BP Plc, Chevron Corp. and Royal Dutch Shell Plc have said they will increase share buybacks and payouts, confident the worst of the pandemic is over.”

“Aramco’s annual dividend of $75 billion, the world’s largest, is a crucial source of funding for Saudi Arabia. The government, which owns 98% of the company, is trying to narrow a budget deficit that ballooned last year as energy prices tanked with the spread of the virus.” Paul Wallace and Mathew Martin report.

China’s Tech Giants Drive Quiet Revolution in Africa’s Fintech

South China Morning Post

“A digital revolution is quietly under way in Africa, as dozens of electronic wallets have sprouted on the continent for users to transfer money digitally through their smartphones, some of them powered by Chinese technology.”

“One of the biggest is M-Pesa, a mobile money service established in 2007 by the Kenyan phone company Safaricom, using an enterprise solution provided by Huawei Technologies. The service now transacts more than most banks in Kenya. Huawei also powers Ethiopia’s TeleBirr, launched in May by the former state-owned monopoly Ethio Telecom.”

“M-Pesa and TeleBirr underscore Huawei’s push into Africa’s telecommunications market, where it has expanded beyond building the infrastructure of telephony into a broad array of enterprise solutions and services, including providing its network customers with the technology to run mobile payment applications in as many as 19 countries. The diversification comes as Huawei’s core business of building phone networks comes under increasing scrutiny – and objection – by the United States and its global allies, in an escalation of the US-China technology rivalry.” Jevans Nyabiage reports

How the Northern Sea Routes will Change the World’s Major Traffic Flows

Nikkei Asia

“The Northern Sea Route is gaining prominence because of global warming, and it is the shortest route between East Asia and Europe. It has the potential to rewrite the world's logistics networks. The Arctic is also rich in natural resources, and the U.S., China and Russia have begun to compete for control of the region. It is also becoming important for Japan's energy policy.”

“…The Northern Sea Route will be the shortest shipping path between Europe and Asia. It is 30% to 40% shorter than routes that use the Suez Canal, which save fuel and reduces environmental impact. The route is also easier to navigate as it does not pass through the politically volatile Middle East, and there are no pirate attacks. However, it is expensive. The route comes with additional costs, like hiring the services of Russian icebreakers and building ships with special specifications. Coastal ports also need to be developed to ensure safe navigation.”

China’s ByteDance Aims for Hong Kong IPO Despite Tech Crackdown

Financial Times

“ByteDance, the owner of short-video app TikTok, has revived a plan to go public despite a widening regulatory assault targeting Chinese technology companies, aiming for a Hong Kong listing by early next year.”

“The Chinese group, which raised about $5bn in December at a $180bn valuation, is planning to list in either the fourth quarter of this year or early 2022, said three people with knowledge of the company’s plans.”

“After postponing its overseas listing this year, ByteDance has spent the past few months addressing Chinese regulators’ data security concerns, one of the people said, including providing more detail to authorities on how it stores and manages consumer information.”

“ByteDance, whose video app TikTok is incredibly popular in the west, shelved its plan to list overseas, most likely in the US, this year after Beijing widened a months-long crackdown on the country’s largest tech groups for alleged violations of data security and monopoly laws.” Mercedes Ruehl, Tabby Kinder, and Miles Kruppa report

Indonesia Now has More Crypto Investors than Stock Market Investors

Jakarta Post

“Crypto assets have rapidly gained in popularity among Indonesians despite – or perhaps because of – the global economic slowdown.”

“According to the Trade Ministry, crypto investment transactions grew fivefold in five months to more than Rp 370 trillion (US$25.8 billion) in May.”

“Indonesia had around 6.5 million crypto investors in May, while the number of retail investors registered with the Indonesia Stock Exchange (IDX) stood at just 5.37 million.” Eisya A. Eloksari reports

What We’re Also Reading…

Olympics Japan to Douse Olympic Flame of Games Transformed by Pandemic and Drama

Reuters

“Japan will douse its more than year-old Olympic flame on Sunday, closing out a Tokyo Games that were upended by the pandemic and transformed by the drama of politics, dazzling sport and deeply personal turmoil.”

“For the host nation, the Olympics fell short of the global triumph and financial blockbuster it once sought.”

“Still, organisers appear to have prevented the Games from spiralling into a COVID-19 superspreader event, a remarkable achievement given that some 50,000 people came together amid the pandemic.”

“…China and the United States were tied for the top of the tally with 38 golds as of midday on Sunday, with Japan [in third] at 27.” David Dolan reports