Emerging Markets Daily - December 10

Dubai: Pandemic Boomtown, Brazil Nubank Shares Jump, Binance Eyes Indonesia-based Crypto Exchange, Yuan-Dollar Decoupling, Brazil CB Hikes Rates Again

The Top 5 Stories Shaping Emerging Markets from Global Media - December 10

High Vaccination Rates, Business Environment Make Dubai Pandemic Boomtown

Ultrarich, entrepreneurs, tourists and ‘old money’ from the West flock to the city

“What has most surprised real-estate agent Khadija El Otmani is the changing nature of her clientele. Once an investment for rich people from the Gulf and India, Dubai is now attracting ‘old money’ from the West, and young tech and crypto millionaires, she said. ‘They come in looking dressed as someone going to play basketball and they ask you for a property worth $10 million,’ she said. ‘It’s really striking.’”

Wall Street Journal

“This city-state of skyscrapers and Persian Gulf beaches is emerging as a pandemic boomtown, drawing in the ultrarich, entrepreneurs and tourists with open-border policies, high levels of vaccination and low Covid-19 infection rates.”

“This year, thousands of millionaires have relocated to the city and the wider United Arab Emirates, drawn by zero income tax and relatively relaxed pandemic restrictions. The city’s bars, restaurants and hotels are packed, real-estate prices have surged, workers are returning to offices, and the Expo 2020 world fair is reeling in foreign tourists.”

“Even as the Omicron variant rattled markets and forced border restrictions across the world, Dubai has doubled down on an open economy that welcomes an increasingly mobile international workforce. On Tuesday, the U.A.E. government said it was switching its workweek to Monday through Friday, instead of the Middle East’s standard Sunday through Thursday, the latest change designed to attract more foreign businesses and expats.”

“Some of Dubai’s new residents say they see the emirate as a haven that stands in contrast with other globally focused cities. Quarantine restrictions remain in Singapore for most travelers, Hong Kong is experiencing political turmoil, repeated Covid-19 waves are roiling European capitals and New York is struggling with crime.”

“Lockdowns, vaccine requirements and travel restrictions have swept Europe amid rising Covid infections and concerns over a variant detected in South Africa, highlighting new challenges ahead for the U.S. as officials want to avoid more shutdowns.”

“Few cities have attracted and welcomed cross-border immigrants like Dubai. Austin and Phoenix have drawn people looking for cheaper real estate and lower taxes but largely internally within the U.S. Kyiv has been a magnet for an international hipster set but hasn’t held the same allure for the wealthy and businesses.”

“Scot Drummond, a British property entrepreneur, decided to move part of his Portugal and U.K.-based business to Dubai during a two-week vacation here in January. “The whole of Europe was closed for business but Dubai was completely open,’ said Mr. Drummond, 57 years old.”

“‘It feels like a perfect moment for Dubai to compete with more established global cities,’ said Alastair Glover, a private wealth lawyer based in Dubai for Trowers & Hamlins. Daily Covid-19 cases have been below 100 for weeks in the U.A.E. after reaching peaks of nearly 4,000 during January, the worst stretch of the pandemic here.”

“Health officials credit a vaccination rate of 90%, one of the highest in the world, and compliance with mandates to wear masks indoors and in some crowded outdoor settings. ‘Restaurants are off the charts. I’ve never found it harder to get restaurant booking,’ said Kunal Savjani, a venture capitalist and financier who moved to Dubai from London in 2014.”

“What has most surprised real-estate agent Khadija El Otmani is the changing nature of her clientele. Once an investment for rich people from the Gulf and India, Dubai is now attracting ‘old money’ from the West, and young tech and crypto millionaires, she said. ‘They come in looking dressed as someone going to play basketball and they ask you for a property worth $10 million,’ she said. ‘It’s really striking.’” Rory Jones and Stephen Kalin report.

Brazil’s Nubank Shares Jump on Day 1 of Trading in New York

With a $50 billion valuation, the digital bank is now the most valuable financial group in Latin America

Financial Times

“Nubank, the Brazilian fintech company backed by Warren Buffett and Tencent, has become the most valuable financial group in Latin America with a valuation of almost $50bn after its initial public offering.”

“Shares in the loss-making digital lender jumped by a quarter when they started trading on Thursday afternoon in New York, after it raised $2.6bn with the sale of a minority stake.”

“The transaction ranks as the fifth-largest US stock market flotation of 2021, according to Dealogic. David Vélez, founder and chief executive, said the proceeds would help fuel growth in its newest markets of Mexico and Colombia as it seeks to become a pan-Latin American lender.”

“Nubank’s initial market capitalisation of $41.5bn was higher than Brazil’s biggest traditional bank, Itaú Unibanco, making the start-up founded in 2013 the continent’s most valuable listed financial institution and one of its 10 largest companies.”

“The debut on public equity markets by Nu Holdings, the Cayman Islands controlling entity behind the share issuance, represents another significant milestone for the region’s booming start-up scene. Japanese technology conglomerate SoftBank was among the new backers that invested in the float.” The FT reports.

Binance in Talks with Indonesia’s Richest Family to Launch Crypto Exchange

Bloomberg

“Binance Holdings Ltd. is in talks with Indonesia’s richest family, the Hartonos, and a state-owned telecom operator to set up a cryptocurrency trading exchange, according to people with knowledge of the matter.”

“The world’s largest crypto exchange has been in discussions with PT Bank Central Asia, controlled by sibling billionaires Budi and Michael Hartono, and PT Telkom Indonesia on the venture, the people said, asking not to be named because the matter is private.”

“A partnership between Binance, BCA and the country’s largest telecom operator would spur wider adoption of cryptocurrencies in Indonesia, the world’s fourth most-populous nation, where many adults have little access to bank lending and other forms of formal finance. Apart from the bank, the Hartonos also own a major cigarette manufacturer, a telecom-services firm as well as e-commerce businesses.”

“A deal would give Binance a greater foothold in the rapidly developing economy, while allowing the nation’s most powerful businessmen to get involved in digital currencies…”

“Banks in Southeast Asia are increasingly looking at taking stakes in crypto ventures as they build out their digital capabilities. The region’s largest lender, DBS Group Holdings Ltd., operates DBS Digital Exchange, which provides services in security token offerings and cryptocurrency trading.” Bloomberg reports.

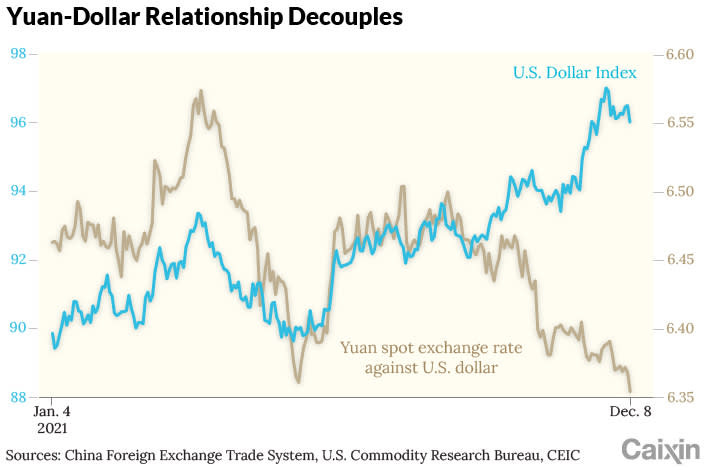

Yuan-Dollar Decoupling Continues, Signaling Rocky Road for Chinese Currency

Nikkei Asia/Caixin

“China's currency has broken its traditional relationship with the U.S. dollar over the past few months, as a combination of surging exports and capital inflows have increased demand for the yuan, pushing its value higher even as the greenback itself strengthened.”

“This unusual currency decoupling, which has been evident since September, has added another element of uncertainty into the debate about where the yuan is headed in 2022, because the appreciation partly reflects the more hands-off approach the People's Bank of China (PBOC) has been taking toward managing the exchange rate.”

“In addition to more fundamental factors affecting the yuan's value -- such as the trade balance, capital flows, and the trajectory of U.S. monetary policy and interest rates -- the question of whether the central bank will continue to refrain from intervening in the market to prevent the yuan from strengthening will partly determine the currency's performance next year.”

“The relationship between the yuan and the dollar has overall been reasonably consistent since 2015 as measured by the movement of the U.S. Dollar Index (DXY) which shows the value of the dollar relative to a basket of currencies of America's biggest trading partners -- the euro, the Swiss franc, the Japanese yen, the Canadian dollar, the British pound and the Swedish krona.”

“The yuan and the DXY tend to have an inverse relationship, with a rise in the gauge accompanied by a weakening of the yuan against the dollar. But that relationship has broken down since September and the Chinese currency has advanced against the dollar even though the index itself has also jumped.” NikkeiAsia/Caixin report.

Brazil Central Bank Aggressively Hikes Rates Again - Highest Since 2017

Folha de Sao Paolo

“The Central Bank's Monetary Policy Committee (COPOM) once again raised the basic interest rate – the seventh increase in a row, of 1.5 points – to 9.25% per year. It is the highest level since June 2017.”

“In a statement, COPOM said that it will increase the rate again, to 10.75%, at the February meeting. The current hike, which started at 2% interest in March, is the most aggressive since 2002 and will produce the biggest difference between the initial and final rate since the creation of the inflation targeting system in 1999.”

“With the shock, the Central Bank wants to inhibit credit and with that to curb the inflationary advance seen since 2020. Even so, in the 12 months to October, consumer prices jumped 10.7%.” Folha de Sao Paolo reports.

"Your time is limited, so don't waste it living someone else's life." -- Steve Jobs