Emerging Markets Daily - December 16

Turkish Lira Tumbles (Again), S. Korea Faces New Lockdowns, UAE Is "Silicon Valley Meeting Wall Street" for EM: IFC Chief, Egypt Rising?, Deceptive EM Benchmarks

The Top 5 Stories Shaping Emerging Markets from Global Media - December 16

Turkey Cuts Rates Again as Erdogan Takes Risky Bet on Weak Lira

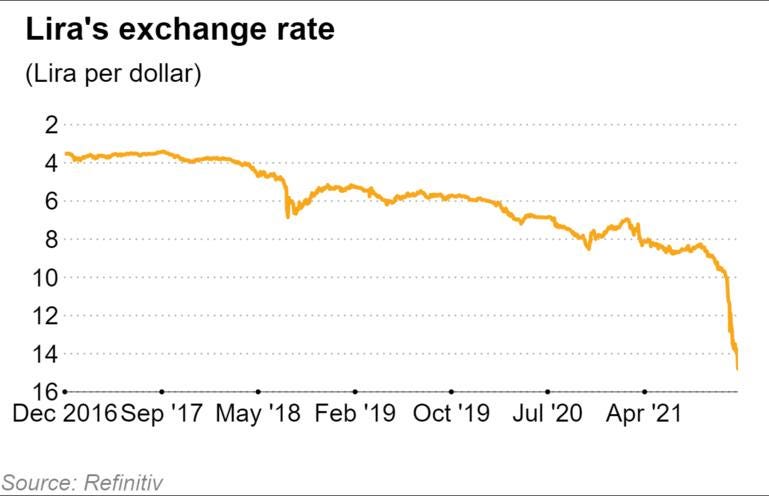

“[The lira] has shed around half of its value against the greenback so far, becoming the worst-performing currency in major emerging markets this year.”

Nikkei Asia

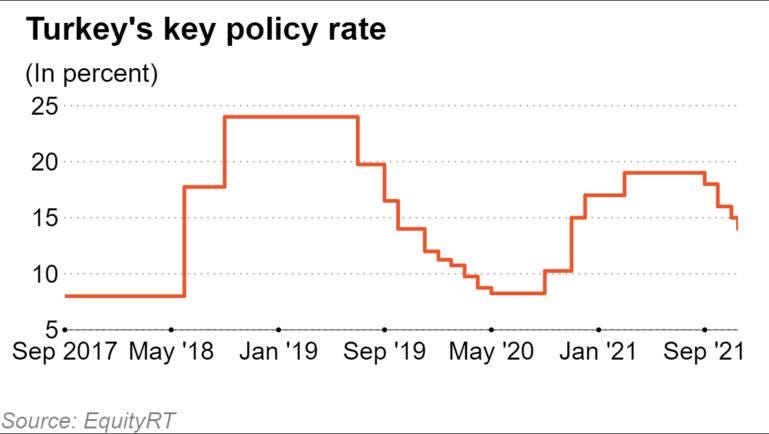

“Turkey's central bank announced on Thursday it was slashing its key benchmark rate by 100 basis points to 14% despite a recent plunge in the lira. The central bank wrapped up the monetary easing cycle it embarked on since September by lowering the interest rate again, taking total cuts to 500 basis points.”

“After the decision, the lira plummeted more than 5% on the day to a record low of 15.6 to the dollar. It has shed around half of its value against the greenback so far, becoming the worst-performing currency in major emerging markets this year.”

“The rate cut was in line with the market consensus after President Recep Tayyip Erdogan defended such a move despite inflation hitting 21% in November.”

“Many emerging countries are in the process of raising their policy rates, wary of rising inflation and bracing for the U.S. Federal Reserve to taper its monetary stimulus much more rapidly than the market had initially expected and hiking rates next year. Turkey is adamant on going in the opposite direction, making the lira vulnerable.”

“Erdogan has repeatedly advocated an economic theory that high interests rate cause high inflation, though it is not endorsed by mainstream economists, and pushed Turkey's legally independent central bank to slash policy rates by firing central bank governors and other monetary policy committee members one after another.”

“In early December, he replaced Treasury and Finance Minister Lutfi Elvan, who was regarded as the last remaining orthodox policymaker -- albeit one with no real power -- with Nureddin Nebati, who seems to be fully embracing Erdogan's views on how to steer the economy.” Sinan Tavsan reports.

Highly Vaccinated South Korea Struggles, Poised for New Lockdowns

“South Korea’s struggles show how difficult containing outbreaks remains, even in a place with a proven record of corralling viruses and where a swath of the population has gotten fully vaccinated. Public-health officials still see vaccines as an effective tool to combat outbreaks, and just a tiny fraction of the recent cases affect those who have received two Covid-19 shots.”

Wall Street Journal

“South Korea had successfully contained Covid-19 throughout much of the pandemic, and it now has one of the highest vaccination rates among wealthy countries. But historic levels of infections, hospitalizations and deaths are prompting the country to reverse plans to reopen and instead take some of the most aggressive measures against the virus of any country in the world.”

“In recent days, health officials accelerated the timetable for adults to get a booster shot, down to three months from a prior wait of five months. Teens now must get vaccinated by February or face penalties. Starting next month, one South Korean city will use facial-recognition technology to automate contact tracing, as a way to speed up investigations.”

“Then on Thursday, South Korean officials pivoted back to clampdowns from earlier in the pandemic. Most businesses will soon have to close by 9 p.m., including restaurants, bars and cafes. Private gatherings are limited to four vaccinated people.”

“South Korea boasts one of the highest vaccination rates among wealthy countries—most of whom administered second vaccine doses in the fall, after having to wait earlier in the year as the U.S., U.K. and other Western countries got the first waves of supply. South Korea has administered vaccines from AstraZeneca PLC, Johnson & Johnson, Moderna Inc., and Pfizer Inc. and BioNTech SE.”

“South Korea’s struggles show how difficult containing outbreaks remains, even in a place with a proven record of corralling viruses and where a swath of the population has gotten fully vaccinated. Public-health officials still see vaccines as an effective tool to combat outbreaks, and just a tiny fraction of the recent cases affect those who have received two Covid-19 shots.” Dasl Yoon reports.

The UAE is ‘Silicon Valley Meeting Wall Street to Talk About Emerging Economies,’ IFC Chief Says

Over here at Emerging World, we’ve often pinpointed the UAE as a major global geo-economic hub. It’s not just the Singapore of the Middle East, as it is sometimes called, but it has long been the Hong Kong of South Asia, and increasingly it is becoming the Miami of Africa - a place where talent and ideas and capital converge and connect. In this remarkable interview below, the World Bank’s International Finance Corporation Managing Director Makhtar Diop speaks with the always sharp editor-in-chief of the National, Mina Al-Oraibi (and good friend of Emerging World), laying out his view of the UAE as something like ‘Silicon Valley meeting Wall Street” for the emerging world. Excerpt below:

The National

“'Silicon Valley and Wall Street, talking about emerging economies’. That is how the International Finance Corporation’s Managing Director Makhtar Diop sees the UAE. Mr Diop is visiting the UAE this week to explore the opportunities in the country, which he described as ‘something quite unique.’”

“In an exclusive interview with The National, Mr Diop said that ‘the pace of technology adoption in the UAE is quite impressive. They are at the forefront of anything technology … at the same time, this is one of the more vibrant capital markets ... also this is a place where everybody is converging’.”

“The three elements, speed of technology adoption, vibrant capital market and convergence of talent from around the world are attracting companies to set up and develop in the UAE. ‘The diversity of what you have here is quite impressive’.”

“Mr Diop said that ‘some companies from some countries are localising to the UAE because they cannot find enough coders in their own countries they believe that settling here in UAE [makes them] able to attract the best of the best in the world’.”

He added that this represents ‘a very powerful proposition because it allows the UAE to diversify its economy’. The fast pace of diversification of the UAE's economy makes it ‘much more resilient to any shock that will happen on commodities’, Mr Diop said. ‘What I see here is a vibrant economy, with a lot of innovation, and always a willingness to be ahead of the curve and to anticipate the next challenges.’”

“Part of that innovation is the UAE’s focus on climate action. Mr Diop said that fact that the UAE is ‘in a region of oil producers but is thinking very seriously about climate change, shows that there is a willingness to anticipate the issues and to make sure that they are part of the of the [climate] movement, and more importantly to lead the movement’. He added that ‘the IFC would like to be part of it. That's why I'm here’.” Mina Al-Oraibi reports.

Emerging World Editor on the UAE at 50

For more on the story of the UAE as a major global hub, Emerging World editor and founder Afshin Molavi spoke with the Middle East Institute’s Ambassador Gerald Feierstein and Emory University’s Courtney Freer to examine five decades of the UAE on the occasion of its 50th birthday. To listen to the podcast - see the UAE at 50.

Egypt Rising? Private Sector Crucial to Recovery

African Business

“After managing to sustain economic growth even at the height of the pandemic, Egyptian GDP looks set to continue increasing over the next three years. Big government projects have underpinned recent growth and although Cairo has promised a change of emphasis from the public to the private sector, the transition is likely to be a slow process.”

“The economy grew at an annualised rate of 7.7% in the three months to the end of June, boosting growth for fiscal year 2020-21. A Reuters poll of economists forecasts GDP growing 5.1% in the year to the end of June 2022, rising to 5.5% for both 2022-23 and 2023-24.”

“Inflation is rising but the annual rate still stood at 6.6% in September, the highest figure for 20 months but comfortably within the central bank’s target range of 5-9%.”

“According to the IMF, high liquidity levels in the banking system and strong reserve levels have helped Egypt recover from the pandemic. The government has also been supported by $8.5bn in IMF financial assistance in the early months of the crisis, with a further $2.8bn due by the end of this year.” Neil Ford reports.

Why Emerging Markets Benchmarks Are Deceptive

Institutional Investor

“When China joined the World Trade Organization in 2001, it only accounted for about 6.5 percent of the MSCI Emerging Markets Index. Twenty years later, the country’s weight in the index has risen to 31 percent.”

“Yet even that five-fold increase in the popular emerging market index does not fairly represent China’s role in the world economy, according to a new report by Acadian Asset Management. The firm estimated that Chinese stocks available to foreign investors account for 53 percent of emerging market capitalization, with Chinese companies delivering 48 percent of developing market revenues. The world’s second-largest economy, China also contributes to almost a quarter of the world’s GDP, with its share falling only 4 percentage points below that of the United States, according to the report.”

“‘Allocators’ views and perspectives are informed by the most popular and common benchmarks,’ said Ram Thirukkonda, senior vice president at Acadian. ‘And many of them are typically large-cap or mid-cap. They are typically focused on a small part of the universe.’”

“One thing that China-focused indices have failed to capture is the $4.5 trillion onshore market, Thirukkonda said. But it’s exactly the A-Shares market that can provide investors with the level of diversification they are looking for from emerging markets, he argued.”

“For the past 30 years, the correlation between the MSCI EM Index and the 15 major developed market equity indices has more than doubled, demonstrating what Acadian called ‘the increased integration of emerging and developed markets.’

“But only 41 percent of China’s onshore market is explained by global risk factors, compared to 74 percent of China’s offshore market and 87 percent of the emerging market as a whole, according to the Acadian report.” Hannah Zhang reports.

“You never fail until you stop trying.” - Albert Einstein