Emerging Markets Daily - December 22

Omicron Hospitalization Levels Low, Rio Tinto Buys Argentine Lithium Asset, China Tech Stocks Rebound, Binance in Dubai Deal, Maersk Expands in Asia

The Top 5 Stories Shaping Emerging Markets from Global Media - December 22

Omicron Victims 80% Less Likely to Be Hospitalized, New Study Finds

Bloomberg

“South Africans contracting Covid-19 in the current fourth wave of infections are 80% less likely to be hospitalized if they catch the omicron variant, compared with other strains, according to a study released by the National Institute for Communicable Diseases.”

“Once admitted to the hospital, the risk of severe disease doesn’t differ from other variants, the authors led by scientists Nicole Walter and Cheryl Cohen said. Compared to delta infections in South Africa between April and November, omicron infections are associated with a 70% lower risk of severe disease, they said. The omicron data was collected for the two months through November.”

“Since being identified by South African scientists on Nov. 25, the omicron variant has fueled record case numbers across the country. Africa’s most developed economy has fully inoculated about 44% of its adult population over a seven-month period.” Bloomberg News reports.

Rio Tinto Buys Major Argentine Lithium Mining Asset for $825 Million

Mining.com

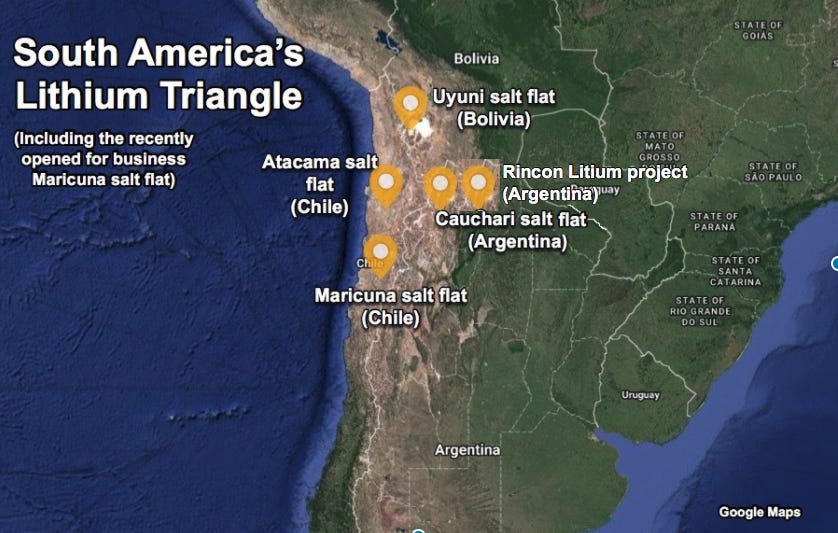

“Rio Tinto (ASX, LON, NYSE: RIO) is expanding its lithium ambitions beyond the Jadar project in Serbia by agreeing to buy the Rincon brine project, located in the heart of the lithium triangle in Argentina’s Salta Province.”

“The $825 million acquisition comes as analysts warn of an imminent and ‘significant’ supply gap for lithium, driven by booming demand for the metal used in electric vehicles (EV) and green technologies.”

“The world’s second-largest miner said the deal demonstrates its commitment to build its battery materials business and strengthens its portfolio for the global energy transition.”

“According to Rincon Mining, which has developed the project and technology since 2009, the novel extraction method allows extracting the battery metal from raw brine in under 24 hours.”

“The project, Rio said, has the potential to have one of the lowest carbon footprints in the industry that can help deliver on Rio’s commitment to decarbonise its portfolio.”

“The company said that market fundamentals for battery grade lithium carbonate are strong, with lithium demand forecasted to grow 25-35% a year over the next decade. EV sales are on track to hit up to 55% of the world’s total light vehicles sales as early as 2030, reaching about 65 million units.” Mining.com reports.

China Tech Stocks Stage Muted Rebound

Financial Times

“Hong Kong-listed Chinese tech stocks rose for the second day in a row on Wednesday, continuing a rebound from a sell-off triggered by regulatory action in the US and China.”

“Video streaming platform Bilibili led gains, rising by as much as 8.3 per cent in early trading. That was followed by ecommerce group Alibaba, which opened 5.3 per cent higher. Both stocks declined last week.”

“Online travel company Trip.com, which fell last week after swinging to a loss in its quarterly earnings, also gained by as much as 5.9 per cent. The Hang Seng Tech index rose as much as 2.5 per cent in early trading, following a comparable rise on Tuesday, after losing more than 7 per cent last week.”

“Chinese tech stocks have been volatile as a result of interest rate rises in Europe and the US and regulatory actions from Washington and Beijing. The Nasdaq Golden Dragon China index, which tracks Chinese companies listed in the US, gained 7 per cent in New York on Tuesday.”

“The latest increases came as some Chinese tech stocks matched a rally in the US, said Jeffrey Halley, senior market analyst for Asia Pacific at OANDA. But Halley warned the tech stock sell-off ‘wasn’t over yet’. ‘[China tech] crawls up but is still falling much faster than it rises,’ said Halley, citing the tension between the US and China as a driving factor of the declines.” The FT reports.

Binance Signs Dubai Deal to Develop Crypto Ecosystem

The National

“The Dubai World Trade Centre Authority and Binance, the world's largest cryptocurrency exchange by trading volumes, signed a preliminary agreement to develop an industry hub for global virtual assets in the emirate, aimed at accelerating their adoption.”

“The initiative will help expedite Dubai’s plans to establish a new international virtual asset ecosystem, which in turn would generate long-term economic growth using new-age digital innovations, Dubai World Trade Centre said on Tuesday in a statement released by Dubai Media Office.”

“The development comes a day after the DWTC said it will be setting up a specialised crypto zone, becoming a regulator for virtual assets and cryptocurrencies, including digital assets, products, operators and exchanges, as adoption of such investments picks up pace in the emirate.”

“‘Innovation is a byword for Dubai and this ‘Future-Economy’ environment is designed to catalyse collaboration, stimulate innovation and most importantly assure protection. In line with Dubai’s vision for a fully digital and inclusive society, this world’s first specialist Authority is Dubai’s active response to the industry’s call for support – so that service providers, technology enablers, and governments can co-create the next generation ecosystem for the global virtual asset economy,’ said Helal Saeed Al Marri, Director General of the Dubai World Trade Centre.” The National reports.

Maersk in Asia Expansion with $3.6 Billion Acquisition

Sea Trade Maritime News

“It seems barely a day goes by without a cash rich container line making another logistics space foray. Maersk’s latest acquisition is Asia focused with it buying Hong Kong-headquartered LF Logistics.”

“It continues the Danish giant’s focus on the e-commerce sector and described LF Logistics as having ‘premium capabilities within omnichannel fulfilment services, e-commerce, and inland transport in the Asia-Pacific region’.”

“While previous acquisitions have been largely focused on Europe and North America LF Logistics strength is very much in Asia. The deal will result in major growth in Maersk’s global warehousing capabilities adding 223 facilities bringing its worldwide total to 549 with an area of 9.5m sq metres.”

“As part of the agreement to acquire LF Logistics, Maersk will enter a strategic partnership with Li & Fung to develop logistics solutions with Li & Fung focusing on the upstream supply chain and Maersk focusing on the downstream supply chain. Li & Fung is will maintain and is expected to grow its global freight management business.” Sea Trade Maritime News reports.

“It does not matter how slowly you go as long as you do not stop.”

― Confucius