Emerging Markets Daily - December 23

US, Russia Talks Over Ukraine in January, Global Execs 'Upbeat' About 2022, Turkey's Banks Key to Crisis, China Hoards World Grain, Kenya Flower Exports in Full Bloom

The Top 5 Stories Shaping Emerging Markets from Global Media - December 23

Putin Says US, Russia To Meet Soon on Ukraine Talks

As tensions mount, Putin says western powers are seeking to “make Russia collapse from within” and stoking conflict by supporting Ukraine’s military and “brainwashing the population”.

Financial Times

“Vladimir Putin said the US and Russia would meet in January in Geneva for talks over Ukraine, which he said were essential to protect Moscow from what he claimed were existential threats from Nato.”

“Speaking at his annual press conference in Moscow on Thursday, the Russian president welcomed a ‘positive reaction’ from the US to two sets of draft proposals on European security that Moscow published last week, which he said the sides would discuss at bilateral talks early next year. ‘Our American partners are telling us they’re ready to start this discussion, these negotiations,’ Putin said.”

“He added: ‘The ball’s in their court. They need to tell us something in response.’ The proposals include a request that Nato pledge to stop admitting any members from the former Soviet Union — chiefly Ukraine — and that it curb military deployments.”

“The US has said several of these proposals are non-negotiable but that it was open to discussing other demands made by the Kremlin as it seeks ways to deter Russia from military action…”

“…on Thursday, Putin refused to rule out another military solution to the tensions with Ukraine. Kyiv, he claimed, was planning an offensive to reclaim Donbas, the eastern border region now controlled by Russia-backed separatists, that broke away in 2014 following Moscow’s annexation of Ukraine’s Crimean peninsula.”

“More than 14,000 people have died in the slow-burning conflict in the Donbas. The west is working to ‘make Russia collapse from within’, Putin went on, and is laying the grounds for war by arming Ukraine’s military and ‘brainwashing the population’.” The FT reports.

Global Executives “Upbeat” About 2022 Despite New Covid Variants

The National

“Company executives around the world are optimistic about the outlook for the global economy and their own countries in 2022, despite concerns about risks from new Covid-19 variants and rising inflation, a survey by McKinsey & Company shows.”

“More than half of respondents (57 per cent) expect both the global economy and their countries’ economies to improve in the next six months, though this proportion declined since the summer, said the latest McKinsey Global Survey released in December.”

"‘Respondents in India, greater China and Asia-Pacific are the most optimistic: more than three-quarters in each of those locations predict improvements in their countries,’ the report said. Only 26 per cent of company executives in Latin America were upbeat about economic improvements in their nations.”

“Echoing a similar sentiment to the executives' bullish outlook, the US investment bank JP Morgan said 2022 will be the year when the world registers a full global economic recovery. The Covid-19 pandemic will end next year, ushering in a return to the economic and market conditions the world had before the outbreak, the bank said in its 2022 Year Ahead Outlook report.”

“Global corporate executives were also largely positive about the outlook for economic conditions in their own countries, with 64 per cent of respondents expecting customer demand to increase in the next six months, down from 74 per cent in the June survey. Nearly two-thirds of respondents expect profits to rise, compared with 74 per cent in June and September.” The National reports.

Turkey Has Calmed Economic Crisis For Now. Here’s What Could Restart It

Wall Street Journal

“A new policy to relieve Turkey’s currency crisis puts a spotlight on a historically robust area of the economy: the banks.”

“Faith in the local banking system has remained resolute despite repeated currency depreciations, sackings of central bank chiefs and boom-bust cycles. The country’s lenders are at the center of the government’s rescue plan for the lira unveiled this week. The plan pays Turks to keep their bank deposits in lira and not pull money out of the banking system no matter what happens in currency markets.”

“For now, the lira’s selloff has calmed, with the currency regaining a chunk of the massive losses it sustained against the dollar this year. But some are skeptical about the long-term prospects. Spiraling inflation and heavy dollarization in the banking system leave this major emerging market vulnerable.”

“What could trigger a worsening of the situation? A depositor run on the dollars held in Turkey’s banking system or Turkey’s banks losing access to international dollar markets would freeze the financial system. This could prompt even more drastic action from the government, including capital controls.” The WSJ reports.

China Hoards More Than Half the World’s Grain, Pushing Up Prices

Nikkei Asia

“Less than 20% of the world's population has managed to stockpile more than half of the globe's maize and other grains, leading to steep price increases across the planet and dropping more countries into famine.”

“The hoarding is taking place in China. COFCO Group, a major Chinese state-owned food processor, runs one of China's largest food stockpiling bases, at the port of Dalian, in the northeastern part of the country. It stores beans and grains gathered from home and abroad in 310 huge silos. From there, the calories make their way throughout China via rail and sea.”

“China is maintaining its food stockpiles at a ‘historically high level,’ Qin Yuyun, head of grain reserves at the National Food and Strategic Reserves Administration, told reporters in November. ‘Our wheat stockpiles can meet demand for one and a half years. There is no problem whatsoever about the supply of food.’”

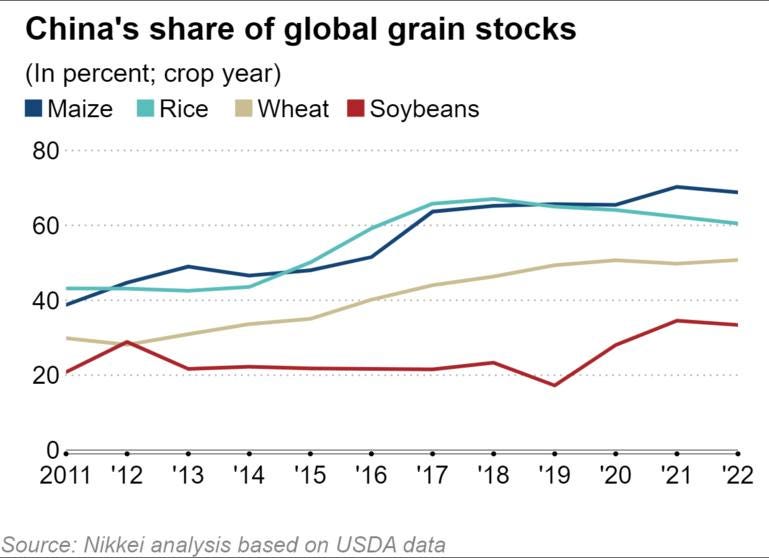

“According to data from the U.S. Department of Agriculture, China is expected to have 69% of the globe's maize reserves in the first half of crop year 2022, 60% of its rice and 51% of its wheat.”

“The projections represent increases of around 20 percentage points over the past 10 years, and the data clearly shows that China continues to hoard grain. China spent $98.1 billion importing food (beverages are not included) in 2020, up 4.6 times from a decade earlier, according to the General Administration of Customs of China. In the January-September period of 2021, China imported more food than it had since at least 2016, which is as far back as comparable data goes.”

“Over the past five years, China's soybean, maize and wheat imports soared two- to twelvefold on aggressive purchases from the U.S., Brazil and other supplier nations. Imports of beef, pork, dairy and fruit jumped two- to fivefold.” Nikkei Asia reports.

Kenya Flower Exports in Full Bloom

“Kenya is regarded as one of the ‘rising stars’ of the global floriculture industry, alongside Colombia, Ecuador and Ethiopia. Currently, the country is already Africa’s largest — and the world’s third-largest — exporter of cut flowers.”

Logistics Update Africa

“With a perfect all-year growing climate, affordable labour and access to temperature-controlled air freight, Kenya has all the ingredients to become one of the top flower producers in the world.”

“For an emerging nation like Kenya, being the third-largest exporter of cut flowers in a multi-billion-dollar global industry is a big deal. And something worth growing, so to speak.”

“Traditionally, the bulk of flowers from Kenya are moved into European markets through the long-established Dutch auctions, making Kenyan growers largely dependent on second parties. In Aalsmeer, Netherlands where the world’s largest flower auction is based, dealers receive 42 floral cargo flights from Kenya alone in a regular week.”

“But the emergence of direct sales via e-commerce platforms means Kenyan growers can now potentially disrupt the flower export industry by reducing its reliance on the powerful flower auctions across Europe.”

“With the advancement in cold chain logistics, high-growth markets such as India and China are now within reach for the country’s flower exports. ‘We’ve seen quite a number of exporters focusing on the Far East. It is one of Kenya’s fastest-growing export markets for fresh flowers. Imagine if every Chinese bought a flower, that’s a huge potential to tap on,’ said Pramod Bagalwadi, CEO, DHL Global Forwarding, East Africa.”

While targeting the right markets is key, timing is just as crucial. ‘Valentine’s Day is a classic example. In that particular week, it is common for companies to reach their record volume in terms of handling fresh flowers,’ said Bagalwadi on managing seasonal demand…”

“Europeans spend even more on flowers — upwards of €20 billion a year. For the sheer quantity, local growers cannot possibly meet all of the demand. That is where Kenya comes in.”

“Kenya is regarded as one of the ‘rising stars’ of the global floriculture industry, alongside Colombia, Ecuador and Ethiopia. Currently, the country is already Africa’s largest — and the world’s third-largest — exporter of cut flowers.” Logistics Update Africa reports.

“Hold fast to dreams,

For if dreams die

Life is a broken-winged bird,

That cannot fly.”

― Langston Hughes