Emerging Markets Daily - December 28

EM Seen Rising in 2022, 'Constructive' Year Ahead for EM: Franklin Templeton, China Economy to Grow 5.1%, India Vaccination Campaign, Ambani's Leadership Transition

The Top 5 Stories Shaping Emerging Markets from Global Media - December 28

Emerging Markets Seen Rising in 2022, But Not Until July

Bloomberg

“Emerging-market assets are set to rise in 2022 as moderating inflation and accelerating growth trigger gains, but it won’t happen until the second half of the year.”

“That’s the consensus among investors like Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co. who spoke with Bloomberg on the outlook for developing-nation stocks, bonds and currencies in the new year. As for specifics, they are looking for a Chinese equity rally and gains in local-currency bonds in countries such as Poland, Czech Republic and Hungary.”

“A mid-year recovery would mark a turnaround for a sector that’s about to wrap up its worst year since 2018. While this year’s narrative has been dominated by rising consumer prices, disparate Covid-19 vaccine rollouts and gains in the U.S. dollar driven by expectations of Federal Reserve tightening, better variables may come into play later in the year. Investors already see signs of recovery as policy makers get tough on inflation by boosting rates, while a peak in U.S. growth may hand the advantage back to developing economies, they say.”

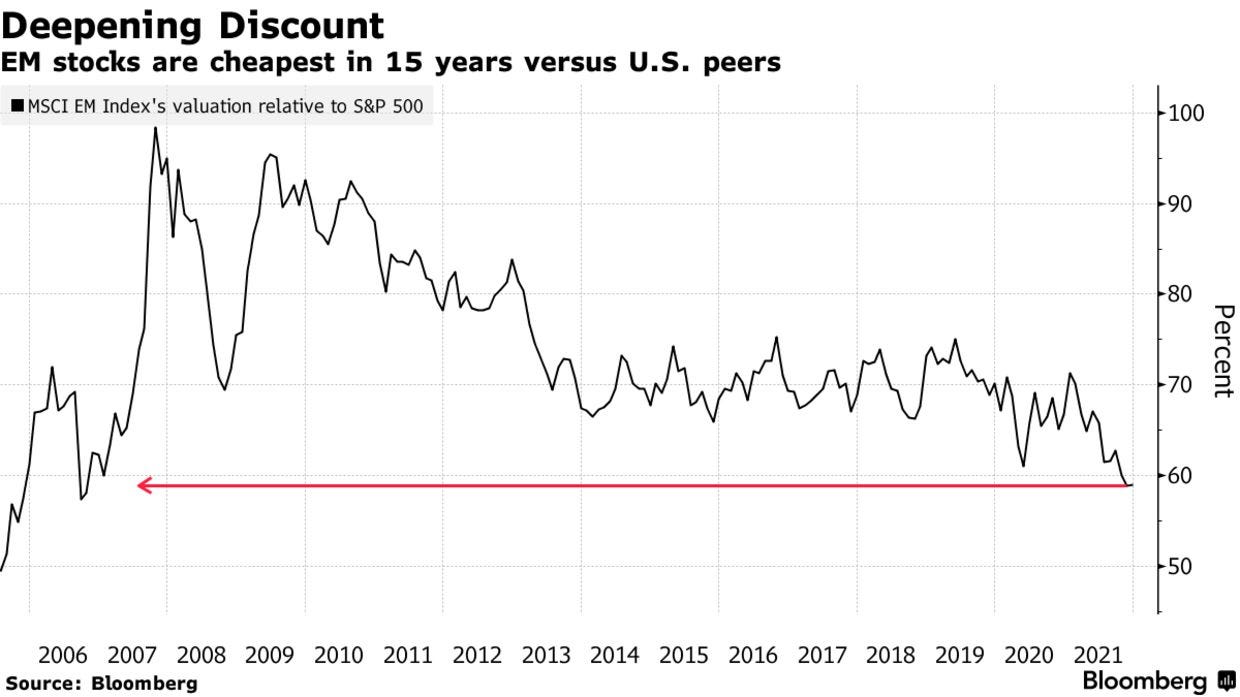

“That would be a welcome change in fortunes for investors in countries whose economies account for more than half of the world’s gross domestic product. The MSCI gauge of emerging-market stocks has dropped almost 5% this year, trading near the lowest level since 2001 relative to U.S. stocks. Local-currency debt is on course for the worst year since 2015, while dollar bonds are heading for only their third loss since the global financial crisis of 2008…”

“At least 23 emerging and frontier nations have raised rates this year, which could have a moderating impact on inflation and boost real returns from emerging-market assets, especially stocks and local-currency bonds. At the same time, rising shipments from Asia suggest supply-chain bottlenecks may be easing, which also eases pressure on prices.” Bloomberg reports.

Emerging Markets: A Constructive 2022 In Sight

Seeking Alpha

“There are several reasons to be constructive about emerging markets (EMs) heading into 2022.”

“Equity valuations appear to have priced in much caution and indicate attractive long-term value.”

“China’s market valuations appear to be near a floor and should be well-supported from here following significant negative news over 2021. While near-term headwinds from regulatory uncertainty and its “zero-COVID-19” stance could extend into 2022, policymakers stand ready to stabilize economic growth if needed.”

“Across EMs, positive structural forces remain apparent and are likely to foster fresh investment opportunities. Digitalization and decarbonization are key themes to watch.”

“Fiscal and current accounts are also in better shape than before, potentially ruling out a repeat of the severe market stresses that hit EMs in previous down cycles.”

“2021 has been a challenging year for EMs. Mixed vaccination progress across countries contributed to false starts in exiting the pandemic. Economic reopenings in EMs and reopening trades in their stock markets subsequently lagged those in developed markets (DMs).” Manraj Sekhon of Franklin Templeton Investments writes in a report, published on Seeking Alpha.

China Economy: 5.1% Growth in 2022, Nikkei Survey Finds

Nikkei Asia

“China's economy is expected to expand 5.1% in 2022, according to the average of forecasts from 33 economists in a survey conducted by Nikkei and Nikkei Quick News.”

“The slumping property market and strict COVID-19 measures are expected to continue acting as headwinds to the growth of the world's second largest economy.”

“China's gross domestic product was forecasted by the economists to grow 3.3% in the October-December quarter of 2021, giving 7.9% for the entire year. The seemingly high full-year forecast is attributable to the steep slowdown in 2020 when the COVID-19 pandemic set in. Starting from a lower base, the economy saw 12.7% expansion during the first half of 2021.”

“The projected final quarter growth in 2021 represents a meager rise of one percentage point from the preceding quarter, evidence of a lack of momentum in the national economic recovery.”

"‘Continued concerns in the real estate activity and the zero-COVID strategy will keep domestic demand below-trend in 2022,’ Francoise Huang, senior economist for Asia-Pacific at Euler Hermes, said. ‘Policy easing has started, but the economic slowdown could continue into the first half of 2022 before the impact of accommodative measures kicks in more visibly.’”

“Anti-COVID measures before the upcoming Winter Olympics in Beijing ‘will put a brake on consumption recovery next year,’ Bert Burger, principal economist at Atradius, said.”

“Growth forecasts for 2022 ranged from 4% to 5.9%. Of the 33 economists, 11, including those at American investment banks such as BofA Global Research, Goldman Sachs and JP Morgan, predicted growth of less than 5% -- lower than China's potential of around 5.5%.” Nikkei Asia reports.

India Expands Vaccination Program as Omicron Surges

New York Times

“India is expanding its Covid vaccination drive to include everyone 15 or older and making health workers and some older citizens eligible for booster shots, as the country grapples with the prospect of another wave fueled by the Omicron variant.”

“Prime Minister Narendra Modi, in an address to the nation late on Saturday, said vaccines would available to those 15 to 18 years of age as of Jan 3. He also said booster doses would be offered as a ‘precaution’ to health workers and those 60 years and above with comorbidities starting on Jan 10.”

“India has fully vaccinated about 60 percent of its adult population of roughly 900 million people, while about 90 percent have received at least one dose of vaccine. After a sluggish start marred by mismanagement, the country’s vaccination drive picked up pace in recent months. But the government is short of the declared goal of fully vaccinating all adults by the end of the year.” New York Times reports.

Billionaire CEO Ambani Talks of “Momentous Leadership Transition.”

LiveMint India

“Richest Indian Mukesh Ambani on Tuesday mentioned about leadership transition at his energy-to-retail conglomerate, saying he wants the process to be accelerated with seniors, including him, yielding to the younger generation.”

“Ambani, 64, who has previously not spoken about succession plans at the country's most valuable company, said Reliance is ‘now in the process of effecting a momentous leadership transition.’”

“Ambani has three children -- twins Akash and Isha, and Anant. Speaking at the Reliance Family Day, which marks the birth anniversary of the group's founder Dhirubhai Ambani, he said Reliance Industries Ltd will become one of the strongest and most reputed Indian multinational companies in the world in the coming years, propelled by forays into the clean and green energy sector as well as retail and telecom business reaching unprecedented heights.”

"‘Achieving big dreams and impossible-looking goals is all about getting the right people and the right leadership. Reliance is now in the process of effecting a momentous leadership transition... from seniors belonging to my generation to the next generation of young leaders,’ he said. And this process, he would like ‘to be accelerated.’

“The speech was reported by Ambani-owned news outlet News18.com. The company did not immediately respond to an e-mail seeking comments on Ambani's remarks about succession.” LiveMint reports.

“We must let go of the life we have planned, so as to accept the one that is waiting for us.” - Joseph Campbell