Emerging Markets Daily - December 6

Thailand Leads SE Asia IPO Rush, Omicron Mild in S. Africa?, UAE-Iran Warming Reflects New Geopolitics, The State of Globalization, Argentina and the IMF

The Top 5 Stories Shaping Emerging Markets from Global Media - December 6

Thailand Leads Southeast Asia IPO Rush

Nikkei Asia

“Southeast Asian companies have raised more than $10 billion from initial public offerings this year for the first time since 2017 as executives sought capital for expansion and stock exchanges worked hard to woo new listings.”

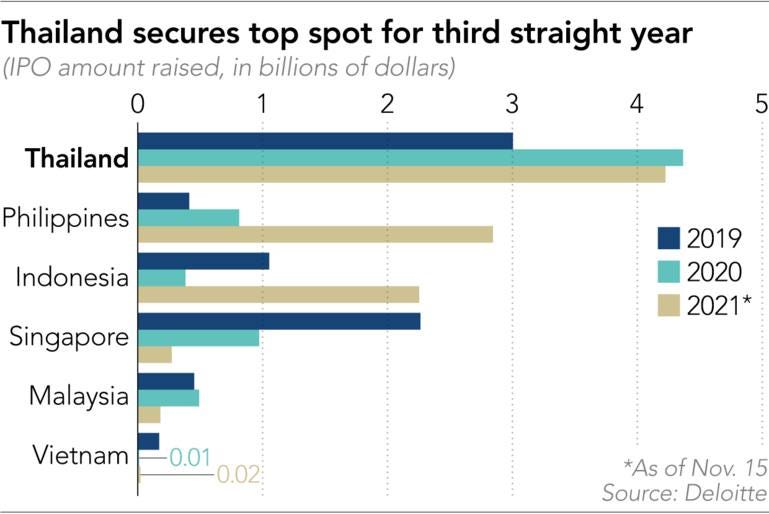

“According to data compiled by accounting firm Deloitte, Thailand continued to lead the region by a large margin, with 35 companies and real estate investment trusts raising $4.2 billion as of Nov. 15, while the Philippines and Indonesia leapfrogged Singapore to take second and third place, respectively. The amount raised through IPOs in the Philippine market more than tripled, while in Indonesia it almost sextupled.”

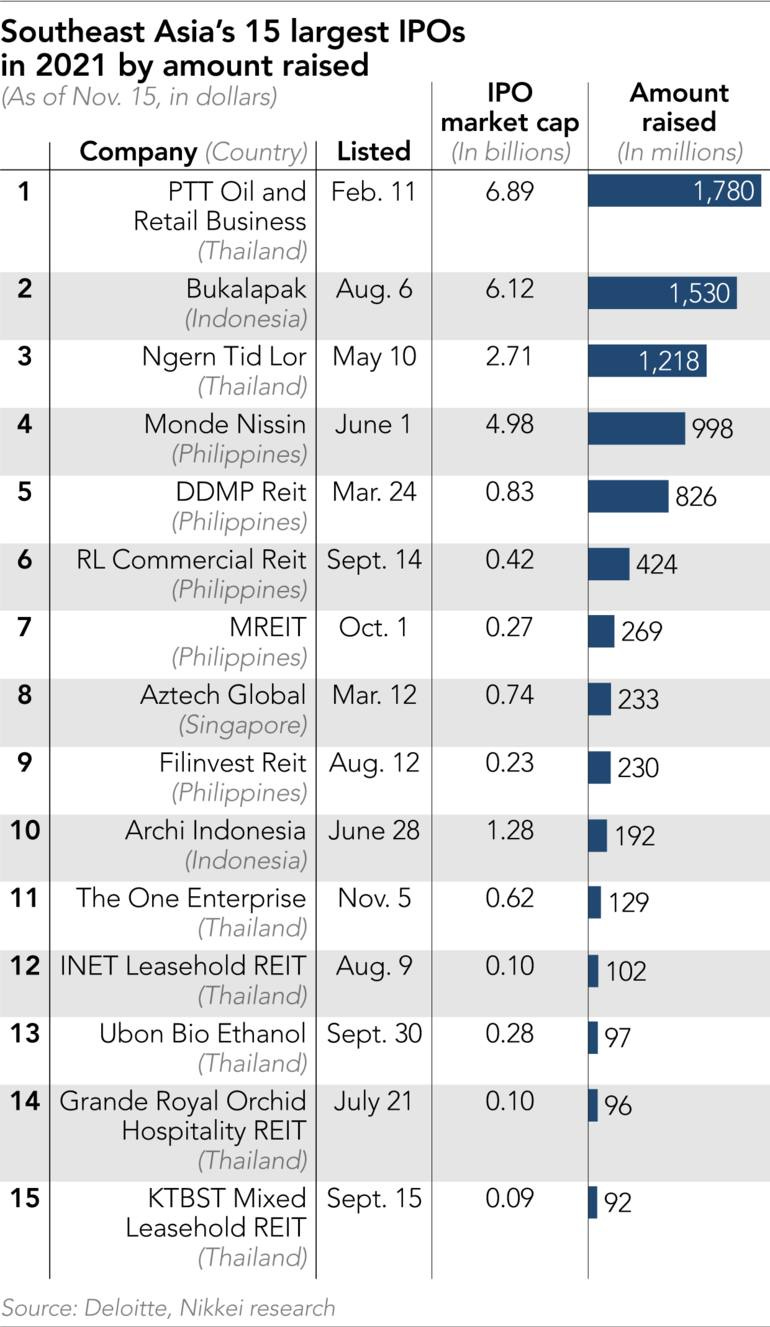

"For Thailand, the year 2021 kicked off with a giant IPO: The state oil conglomerate's retail arm, PTT Oil and Retail Business (PTTOR), raised 54 billion baht ($1.6 billion) in a February listing…Compared to regional peers, Thailand is a relatively mature economy, leading companies to try to outpace competitors by venturing into other countries or equipping themselves with better digital offerings.”

“Meanwhile, as many as 43 companies have made their market debuts on the Indonesia Stock Exchange so far this year, raising a total of 51.16 trillion rupiah ($3.57 billion) -- the biggest annual IPO fundraise in the Jakarta bourse's history. These include the record-breaking IPO of e-commerce unicorn Bukalapak, which raised 21.9 trillion rupiah in August.” Masayuki Yuda reports.

South Africa’s Low Omicron Hospitalization Elicits Cautious Optimism

Bloomberg

“South Africa’s surge in Covid-19 cases following the emergence of the omicron variant hasn’t overwhelmed hospitals so far, prompting some cautious optimism that the new strain may cause mostly mild illness.”

“Initial data from South Africa, the epicenter of the outbreak of the omicron variant, are ‘a bit encouraging regarding the severity,’ Anthony Fauci, U.S. President Joe Biden’s chief medical adviser, said on Sunday. At the same time, he cautioned that it’s too early to be definitive.”

“Scientists and public-health officials are scouring available data to try to predict omicron’s impact as many questions about the new strain and its multiple mutations remain unanswered. The variant, now dominant in South Africa, has made its way from Tokyo to Oslo since its discovery was announced on Nov. 25.” Bloomberg reports.

Top UAE Official in Tehran Visit Reflects Shifting Middle East Geopolitics

Financial Times

“The United Arab Emirates’ national security adviser met Iranian leaders in Tehran on Monday in the first official visit by a senior Emirati politician to the Islamic republic in almost a decade as the two countries seek a de-escalation of tensions.”

“Iran’s top security official Ali Shamkhani voiced hope that the visit by Sheikh Tahnoon bin Zayed — the UAE’s spymaster and one of the Gulf monarchy’s most influential figures — would open ‘a new chapter’ in bilateral relations.”

“‘Having warm and friendly relations with neighbours and exchanging economic, trade and investment capacities are Iran’s top priorities in foreign policy,’ Shamkhani said in his meeting with Sheikh Tahnoon. ‘Dialogue should replace military approaches to tackle differences [among regional states],’ Shamkhani added…”

“Monday’s official visit takes place in the context of slow progress at indirect talks between Iran and the Biden administration in Vienna to resurrect the nuclear accord Tehran signed with world powers.”

“Relations with Saudi Arabia — Iran’s main regional rival — may take longer to return to normality. While four rounds of Iran’s talks with Saudi Arabia this year have not yet resulted in a restoration of relations, tensions have decreased. Saudi Crown Prince Mohammed bin Salman on Monday visited Oman, the first port of call on a tour of all five other Gulf states, including Qatar, in his first visit since ending an embargo on the gas-rich state earlier this year.” Najmeh Bozorzgmehr and Simeon Kerr report.

Argentina’s Fernandez Warns IMF Ahead of Crucial Debt Talks

Buenos Aires Times

“Ramping up the rhetoric on the eve of crucial talks in Washington, President President Alberto Fernández has called on the International Monetary Fund to carry out a critical ‘evaluation’ of the record US$57-billion standby loan it granted Argentina in 2018.”

“Firing off another pointed barb at Mauricio Macri, his predecessor in office, and his nation’s creditors Fernández pointed the finger firmly at the IMF for Argentina’s ongoing economic woes this week, saying the Fund should ‘do everything possible to prevent something like what happened with the programme signed by the previous government, which did so much damage to Argentina, from happening again.’”

“In 2018 the IMF granted the government led by Macri, then seeking re-election, a US$57-billion loan, whose outstanding disbursements were rejected by Fernández after he took office December 2019. A 2020 Central Bank report alleged that between December 2015 and the end of 2019, capital flight exceeded US$86 billion.”

“His comments came just a day after Economy Minister Martín Guzmán told the leaders of the CGT, the nation’s largest umbrella union grouping, that ‘there will be no austerity’ in any future agreement. Vowing to ‘create jobs and lower inflation,’ the minister said Argentina would not adopt austerity as it would ‘mean preventing economic recovery from being given any continuity.’” Buenos Aires Times reports.

Globalization Recovers Strongly Amid Pandemic ‘Stress Test’

DHL Global Connectedness Index

“In early 2020, the world faced the worst pandemic in a century, triggering one of the greatest global challenges of our time. As Covid-19 spread across the planet, trade in goods plummeted at a record pace. Sharp drops in travel and transportation caused trade in services to suffer an even larger decline. The crisis also hit flows of capital and, unsurprisingly, people. Only the digital flow of information surged as we exchanged in-person interactions for on-screen interfaces.”

“The good news is that, overall, globalization is recovering from the initial shock – and far stronger than many expected. Trade in goods bounced back quickly in mid-2020 and even surpassed pre-pandemic levels by the end of the year. By early 2021, global trade volumes set new records.”

“Trade in services other than travel and transportation has been resilient, and forecasts call for trade growth (both goods and services) to outpace GDP in 2021 and 2022. Capital flows rebounded quickly as financial markets stabilized early in the pandemic, and the globalization of information flows returned to its pre-pandemic slowing growth trend. Only people flows have been slow to recover, but we see glimmers of hope as international travel begins to pick up again.” From the DHL Global Connectedness Index (GCI) 2021 Update.

When we seek to discover the best in others, we somehow bring out the best in ourselves. - William Arthur Ward