Emerging Markets Daily - February 1

SE Asia Startup Funding Booms, India to Spend Big to Grow Fast, Commodities Supercycle Revs Up, Biden Taps Qatar Major 'Non-Nato Ally', Mexico Remittances

The Top 5 Stories Shaping Emerging Markets from Global Media - February 1

Southeast Asia Startup Fundraising Booms, 25 New Unicorns Minted

“With private equity and venture capital firms looking for investment opportunities to deploy capital they raised over the past year, experts say the Southeast Asian ‘gold rush’ will continue in 2022…”

Nikkei Asia

“Southeast Asian startups raised a record $25.7 billion in funding last year, more than double the previous year as cash-rich global investors seek to tap the region's potential amid digitalization driven by the COVID-19 pandemic.”

“With private equity and venture capital firms looking for investment opportunities to deploy capital they raised over the past year, experts say the Southeast Asian ‘gold rush’ will continue in 2022, stoking momentum in the region's startup ecosystem. But a recent tech sell-off in public markets globally highlights a changing environment, potentially affecting the valuation of growth-driven startups.”

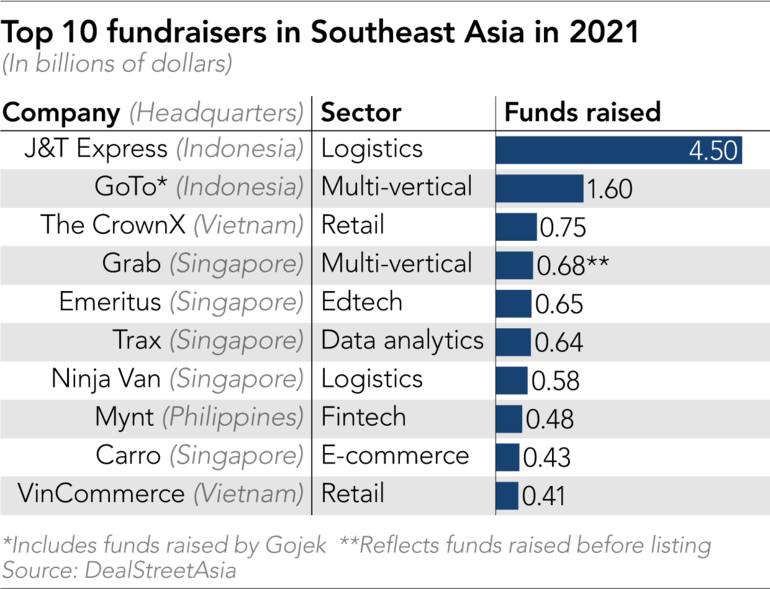

“According to the SE Asia Deal Review report compiled by Singaporean startup information platform DealStreetAsia, the region's startups raised $25.7 billion in 2021, 2.7 times the $9.4 billion in 2020. That also topped the previous peak of about $14 billion in 2018.”

“…Southeast Asia's startup ecosystem started to grow in the early 2010s -- five to 10 years behind China -- in tandem with smartphone penetration in the region. Until just before the pandemic, most funds went to a handful of the most prominent startups such as Singapore's ride-hailing-business-turned-super app Grab and its Indonesian rival Gojek.”

“….These companies continued to be big fundraisers in 2021: Indonesia's GoTo, a tech group created through the merger of Gojek and Tokopedia, raised $1.6 billion, including money raised by Gojek before the deal, making it the second-largest fundraiser. Grab also raised $675 million before its U.S. public listing in December, the fourth biggest.”

“But 2021's results show that Southeast Asia now has promising startups across more sectors and in more geographies, underscoring how the region's startup ecosystem has entered another expansion phase.”

“By sector, fintech startups led the region last year, raising $5.83 billion in total -- quadrupling from $1.46 billion in 2020 -- as the pandemic accelerated cashless payment and other online financial services. Those services have a bigger social impact on Southeast Asia relative to developed markets because fewer people have a bank account in the emerging world.”

“Increased investments came with higher valuations as well. All of these four companies -- Mynt, MoMo, J&T Express and Ninja Van -- reached a valuation of $1 billion last year, joining the growing list of ‘unicorns’ in the region.” Kentaro Iwamoto reports.

India Pledges Big Spending to Reclaim Spot as World’s Fastest Growing Economy

Financial Times

“India will ramp up investment by more than a third in an attempt to reclaim its place as the world’s fastest-growing large economy, spending heavily on infrastructure to recover from the Covid-19 pandemic.”

“Indian finance minister Nirmala Sitharaman in her budget speech on Tuesday also announced that the central bank would launch its own digital currency along with a hefty tax on cryptocurrency profits, indicating that the government was scrapping a mooted proposal to ban the assets.”

“In the budget for the year starting April, Prime Minister Narendra Modi’s government plans to increase capital expenditure to Rs7.5tn ($100bn), up 35 per cent on the previous year and about double the pre-pandemic figure, a sum that would be partially funded by debt.”

“…The government expected India’s gross domestic product to grow 9.2 per cent in the year ending March and 8 to 8.5 per cent in the 12 months from April, faster than any other large economy. Much of the additional outlay would go towards India’s vast railway network, building the country’s highways and rural housing, along with other initiatives such as climate financing.”

“The budget comes only days before the start of a series of important state elections, including in India’s largest state Uttar Pradesh. Modi’s Bharatiya Janata party has made large-scale infrastructure and rural development spending a central part of its pitch to voters. Analysts said businesses would also benefit directly and indirectly from the infrastructure schemes.” The Financial Times reports.

Multiple Commodities Prices Blasting Through Multi-Year Highs

“All in all, the evidence is mounting that a new commodity supercycle is underway. It goes without saying, that commodities are definitely one of the hottest and most exciting asset classes to watch in 2022.”

FX Empire

“Last week, a long-list of commodities blasted through multi-year highs.”

“Aluminium prices hit an all-time record high. Nickel prices hit 10-year highs and Uranium prices surged to 8-year highs – surpassing a record 7-year high, set only a month ago.”

“The bullish momentum also split over into other commodities with Natural Gas rallying over 16% to post its biggest weekly advance since August 2020.”

“Meanwhile, WTI Crude Oil soared above $88 a barrel and Brent Crude hit $90 a barrel – notching up a gain of over 35%, since the start of this year.”

“Elsewhere in the commodity market, Palladium prices hit a four month high – taking this year’s gains to over 25%. Palladium’s explosive rally also pulled up Lithium – sending prices skyrocketed to an all-time record high. Lithium prices are now up 497% from this time last year.”

“There are plenty of reasons why commodities are on the move, these include; rapidly surging global inflation, tightening supply vs soaring demand, logistical bottlenecks to ever growing supply chain issues – all combined with a very disruptive economic recovery from the pandemic that shows no signs of fading anytime soon.”

“And let’s not forget the switch toward a greener world, which is fuelling fierce demand for Commodities such as Aluminium, Copper, Palladium, Nickel, Lithium and Uranium as economies race to decarbonize the world by 2030.”

“All in all, the evidence is mounting that a new commodity supercycle is underway. It goes without saying, that commodities are definitely one of the hottest and most exciting asset classes to watch in 2022.” Phil Carr writes.

Geopolitics: Biden to Designate Qatar a ‘Major Non-Nato Ally’

Wall Street Journal

“The Biden administration is designating Qatar to be a special U.S. ally as it presses Doha for assurances the country could help provide energy supplies to Europe if Russia invades Ukraine.”

“President Biden on Monday said he would seek ‘major non-NATO ally’ status for Qatar, which he said reflects the strength and importance of the bilateral relationship before meeting with Sheikh Tamim bin Hamad al-Thani, the emir of Qatar, at the White House.”

“‘Qatar is a good friend and a reliable and capable partner,’ Mr. Biden said. ‘I’m notifying Congress that I will designate Qatar as a ‘major non-NATO ally’ to reflect the importance…of our relationship; I think it’s long overdue.’”

“The designation opens the door to more exercises, joint operations and potential arms sales, defense officials said later. As the U.S. has shrunk its military footprint in the Middle East, allies and partners such as Qatar, the United Arab Emirates and Saudi Arabia have sought support from Washington over security threats posed by Iran and Iran-backed rebels inside Yemen.”

“Rebels in Yemen have launched rockets and drone attacks in the region, and the emir’s visit comes as rockets targeted Qatar’s neighbor, the U.A.E., from inside Yemen on Monday.”

“The U.S. has been attempting to persuade Doha and other nations to help secure energy supplies to Ukraine and other parts of Europe should Russian President Vladimir Putin invade Ukraine. Several North Atlantic Treaty Organization countries are reliant on gas flows from Russia through pipelines that cross Belarus and Ukraine.” Gordon Lubold reports.

Mexico Remittances Received Hits All-Time Record, Nearing $52 Billion

“Mexico received a record $51.6 billion in remittances last year, helping to soften the impact on consumers from a stalled economy.”

“The money sent by Mexican workers abroad jumped 27% compared to 2020, according to central bank figures published Tuesday. That increase was driven by a variety of factors including U.S. stimulus checks to residents, a desire by Mexican workers to assist their struggling families back at home, and money for foreign migrants stuck in Mexico.”

“‘This historic quantity of remittances is not an achievement of the Mexican economy because it is due to the U.S. recovery. In Mexico, the recovery is going slowly,’ said Gabriela Siller, director of economic analysis at Banco BASE. ‘But remittances do help growth because they drive consumption.’”

“‘…The better-than-expected growth rate for remittances has been seen in almost all parts of the world,” said Dilip Ratha, the head of The Global Knowledge Partnership on Migration and Development, a project of the World Bank, who expects remittances to continue to rise. ‘In the next five or ten years, there is no scenario involving a fall in the stock of international migrants. That is going to grow because of income differences and demographic change.’” Bloomberg reports.

"It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat."

— Theodore Roosevelt