Emerging Markets Daily - February 11

Copper Price Breakout Looms, Rosneft Booms on Surging Oil, UAE Energy Co's Invest to Meet Demand, Malaysia Recovery Apace, India Elections a Test for Modi

The Top 5 Stories Shaping Emerging Markets from Global Media - February 11

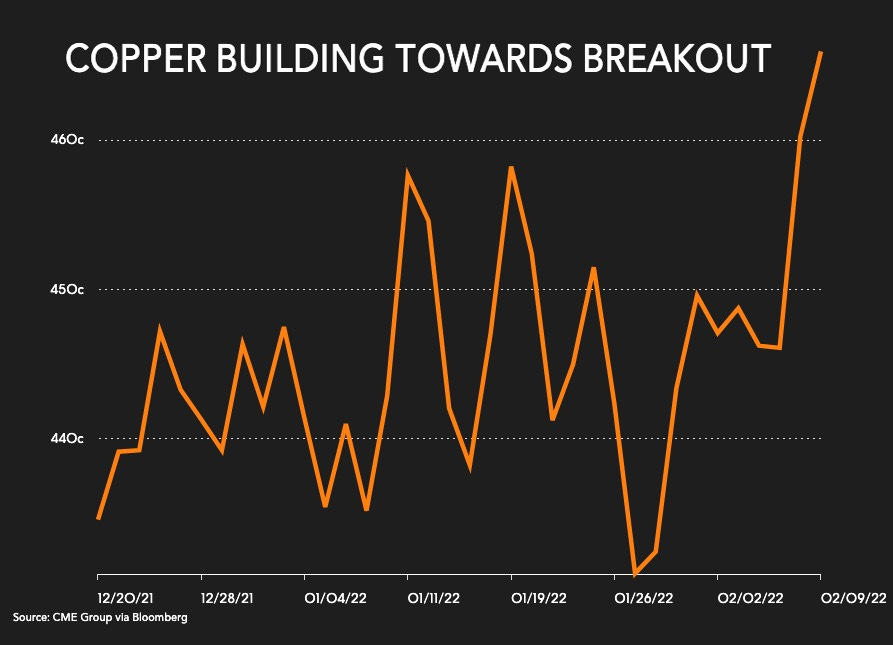

Goldman Bullish on Copper, Sees ‘Price Breakout’ Due to ‘Extreme Scarcity’

Mining.Com

“In a new research report Goldman Sachs, a bank, says the copper price is ‘building towards a breakout’ as worries about the global economy, particularly China’s engine of growth – property, begin to ease:

“..Goldman says the limited seasonal build-up of copper inventories from record low levels – currently at just over 200,000 tonnes scarcely enough to cover three days of global consumption – is ‘entirely insufficient to tackle’ its expected deficit of 197,000 tonnes for this year.”

“‘The longer this continues, the higher the risk of extreme scarcity episode by the end of the year,’ Goldman said in its report released Tuesday. Mid-October copper futures jumped to an intra-day high of $4.82 a pound or $10,633 a tonne in New York after available LME inventories fell to its lowest since 1974.”

“Goldman believes the copper market has just two years of primary production growth left. After fresh tonnes from the likes of Ivanhoe Mines Kamoa-Kakula in the Congo, Anglo American’s greenfield Quellaveco project in Peru and Teck Resources Quebrada Blanca Phase 2 in Chile hit the market, the investment bank sees ‘an open-ended decline in mine supply.’”

“Amid long-standing issues such as declining grades and a dearth of new projects there is also growing uncertainty in Chile, the world’s top producer by a long stretch, about onerous taxation and threats of state appropriation.”

“In the report Goldman reiterated its bullish forecast for copper to average $11,875 a tonne ($5.40/lbs) in 2021, rising steadily to $15,000 ($6.80/lbs) during 2025.” Mining.Com reports.

Surging Oil Prices Push Rosneft to Record Prices

Financial Times

“Surging oil prices and the global economic recovery propelled Rosneft, Russia’s leading oil producer, to record profits last year, offsetting cuts in production because of Opec+ restrictions.”

“Like other oil producers around the world, the company benefited from recovering demand in 2021 after the Covid-19 pandemic hit consumption in 2020. Rosneft, which accounts for about 40 per cent of Russia’s total crude oil output, said its net profit increased nearly seven-fold year on year in rouble terms to Rbs883bn and nearly six fold-in dollar terms to $11.9bn.”

“Rosneft was helped by increases of 60-70 per cent in the price of the main crude blends that it exports, and by a weakening of the rouble. The company’s costs are paid in roubles, while revenues from exports are in dollars.”

“‘We anticipate the company will easily lead all of its Russian peers in oil production growth,’ said Ron Smith, senior oil and gas analyst at BCS Global Markets. He expects Rosneft’s production to rise 9 per cent in 2022, against a 5 per cent increase for the company as a whole. Analysts at Aton expect the Vostok oil project to bolster Rosneft’s production for the rest of the decade.” Nastassia Astrasheuskaya reports.

UAE Energy Companies Ramp Up Spending to Meet Soaring Demand

Bloomberg

“The largest listed energy companies in the United Arab Emirates are ramping up spending to meet soaring demand for everything from fuels to electricity.”

“Adnoc Drilling Co. boosted capital expenditure by 34% last year to $505 million, the unit of Abu Dhabi’s government-owned oil giant said in an earnings statement on Friday. Abu Dhabi National Energy Co., the government-owned utility known as Taqa, raised capex by 26% to $1.3 billion to build new power lines.”

“Investment plans by state-owned oil producers illustrate a stark contrast in their priorities with those of the oil majors, who are opting to return more cash to shareholders. The UAE and Gulf neighbors like Saudi Arabia, Iraq and non-OPEC member Oman are working to get the most out of their reserves before global demand for oil and gas wanes over the coming decades.”

“For now, spending is likely to continue as a blistering commodities rally highlights a global shortage in commodities from oil to gas and metals, with Goldman Sachs Group Inc’s veteran analyst Jeff Currie saying he’s never seen anything like it. Adnoc Drilling also reiterated its guidance to achieve a 5% annual increase in dividends per share through 2026.”

“Adnoc Drilling’s parent company, Abu Dhabi National Oil Co., is spending billions to raise oil-production capacity by a quarter to 5 million barrels a day this decade, requiring new drilling rigs at desert fields in the Middle Eastern emirate and at offshore deposits in the Persian Gulf.”

“The UAE is the third-largest producer in OPEC. Even as it invests to raise production of oil and gas, it has pledged to reach net-zero carbon emissions by the middle of the century. It’s a massive challenge in a region with some of the world’s highest per capita energy use and emissions.” Anthony Di Paola reports.

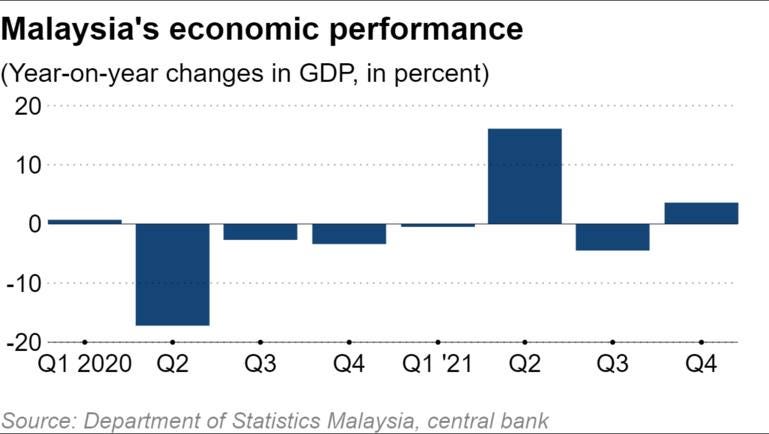

Malaysia Growth Hits 3.1% in 2021 As Recovery Gathers Pace

“Malaysia's gross domestic product expanded 3.1% in 2021, after logging 3.6% year-on-year growth in the fourth quarter, the central bank announced on Friday. The result keeps the Southeast Asian economy on a recovery path after about two years of the COVID-19 crisis, which left thousands jobless and forced businesses to close up shop.”

“According to the Department of Statistics, the manufacturing sector was the main contributor in the quarter, growing at a 9.1% clip after shrinking 0.8% in the third term. The growth was led by electrical, electronic and optical products followed by petroleum, chemicals, rubber and plastics.”

“The central bank had slashed its 2021 growth estimate to 3% to 4%, from an ambitious 6% to 7.5% previously. In 2020, the economy contracted 5.6%.”

“For 2022, the bank estimates GDP will grow between 5.5% and 6.5%, backed by continued expansion in global demand and higher private-sector expenditure. The country is also looking to revive its battered tourism industry, with plans to reopen the border to vaccinated travelers as early as next month.” Nikkei Asia reports.

Voting Begins in India in Assembly Elections That Will Test Modi’s Popularity

Al Jazeera

“Residents of India’s most populous state, Uttar Pradesh, have voted in the first phase of the seven-phase assembly elections expected to be a bellwether of the popularity of Prime Minister Narendra Modi and his Hindu nationalist Bharatiya Janata Party (BJP).”

“Uttar Pradesh, a state of about 200 million people in India’s north, has long been a stronghold of the BJP, which has been accused of stoking Hindu nationalist sentiment that has resulted in violence against minority groups, particularly Muslims.”

“Some opinion polls indicate the party is likely to stay in power, with a victory likely to give a boost in its bid for a third successive victory at nationwide parliamentary polls due by 2024.”

“Meanwhile, a defeat or slide in support in Uttar Pradesh or the other two states controlled by the BJP that have elections in February could spell trouble in the national elections due in 2024.”

“The BJP has seen multiple defections to the Samajwadi Party, whose secular appeal has swayed voters from a wide range of castes as well as the Muslim community.”

“Farmers, an influential section of voters, are still furious at Modi for supporting agriculture laws that loosened rules around the pricing and sale of produce. They took to the streets in a year of protests before the Modi government bowed to their pressure in November.”

“The BJP is also facing allegations of mismanagement during the COVID-19 pandemic in the state after a calamitous surge in infections last year saw numerous corpses floating in the Ganges.” Al Jazeera reports.

“Living Life Tomorrow's fate, though thou be wise, Thou canst not tell nor yet surmise; Pass, therefore, not today in vain, For it will never come again.” - Omar Khayyam