Emerging Markets Daily - February 15

EM: All Risk and Few Rewards?, Sea Ltd Facing Ocean of Troubles, India Inflation, NATO Sees No Sign of De-Escalation, African Tech Startups Could Attract $90B

The Top 5 Stories Shaping Emerging Markets From Global Media - February 15

Emerging Markets: All Risk and Few Rewards?

The Financial Times

Editors note: This is an important piece by an influential journalist tackling a topic that is front and center in the emerging markets investing conversation. Namely, the question: what is the compelling reason to invest in EM if the growth story is no longer as prominent? Readers of these pages obviously know that the emerging markets universe is large and varied and complex, and an over-reliance on the macro story will obscure the dynamism displayed across sectors and markets and firms in the emerging world. No doubt, a growth slowdown coupled with rising debt and inflation will hit several EM and Frontier Market economies hard, but the key is to find the pearls beyond the macro clouds. Still, this is a vital piece that will shape the broader conversation, particularly among those who allocate to various funds, and thus deserves to be our top story today.

”The difference between the pace of growth in developing and advanced economies is set to narrow to its lowest level this century. For emerging markets seeking investors, that is a problem: the point of investing in a developing economy is that it offers markedly quicker growth than developed ones. Without that, the money will go elsewhere,” Jonathan Wheatley writes.

“Emerging market assets traditionally have greater yields than those available in rich countries for two reasons. One is that their economies are growing faster. The other is that they are riskier. ‘Without growth, it’s just [all] risk,’ says David Lubin, head of emerging market economics at the American bank Citi.”

“The case for investing in emerging market stocks and bonds has rarely been weaker — something the IMF data on growth rates reinforces. The coronavirus pandemic is ongoing, often in places where vaccination rates are stubbornly low, and economies have been weighed down by debts incurred to help cope with its impact on public health and businesses.”

“Higher interest rates in the US and a stronger dollar are looming on the horizon, making those debts harder to service and defaults more likely. And across large parts of the developing world, inflation has risen alarmingly, forcing policymakers to raise interest rates aggressively to avoid a spiral into the hyperinflation that has plagued many of these countries in the past.”

“…Larger emerging economies appear to be in less immediate danger. But Ed Parker, head of global sovereign research at Fitch Ratings, a credit-rating agency, talks of ‘a long tail of weak, fragile frontier markets’ that look to be at risk. Investors are particularly concerned about countries such as Ghana, El Salvador and Tunisia — not to mention Ukraine, should Russia invade.”

“Six countries have already defaulted during the pandemic: Argentina, Belize, Ecuador, Lebanon, Suriname (twice) and Zambia. Yet even while larger countries are not at immediate risk of default, many have suffered a deterioration in credit conditions.”

“…So many foreign investors have retreated from emerging market stocks and bonds that there is little risk of a further sell-off, and prices have fallen low enough to tempt some back in. Some asset managers are even predicting a bumper year ahead — or at least a quiet comeback.”

“…Especially problematic is the slowing pace of output growth in China, which for many years has been the biggest single engine of economic expansion for other developing countries. Changing priorities in Beijing mean that future growth will be both slower and also less import dependent, delivering a double blow to those reliant on Chinese demand.”

Sea Limited — SE Asia’s Brightest Tech Firm — Facing an Ocean of Troubles?

Bloomberg

“Sea Ltd. lost more than $16 billion of value in its biggest daily market drop after India abruptly banned its most popular mobile gaming title. Investors are growing concerned the ban may just be the start of the company’s troubles.”

“Singapore-based Sea went public in 2017 and quickly became the most valuable company in Southeast Asia, based on its potential to expand its offering of gaming, e-commerce and financial services beyond its home turf. New Delhi’s decision to ban Free Fire -- a lucrative title for the company -- highlighted Sea’s challenges from geopolitical tensions as well as mounting competition from rivals like Alibaba Group Holding Ltd.’s Lazada.”

“India has banned hundreds of Chinese apps over the past two years, but the expansion of that policy to Sea took management and investors by surprise. The startup was founded by Forrest Li, who was born in China but is now a Singaporean citizen. Its biggest shareholder is Tencent Holdings Ltd., the Chinese social media giant.”

“‘India is seen as one of the next major growth drivers for Sea’s e-commerce and gaming arm outside Southeast Asia,’ said Angus Mackintosh, founder of CrossASEAN Research, which publishes reports on Smartkarma. ‘With the Free Fire ban, there’s a risk that the authorities would also turn on the Shopee app, and Sea could lose that upside for growth.’”

“Sea remains one of Southeast Asia’s biggest success stories, an online retail and entertainment empire that generates almost $10 billion of annual revenue. Some 32 of 33 analysts still maintain buy or overweight ratings on the stock. Its stable of global backers include Cathie Wood’s Ark Investment Management. The superstar fund manager bought more than 145,000 shares on Monday, according to Ark data compiled by Bloomberg.” Bloomberg reports.

Rising Inflation Haunts Indian Consumer

Quartz India

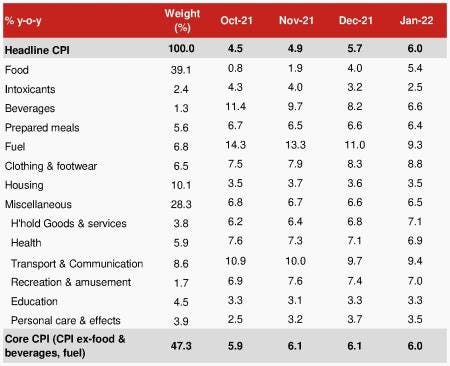

“The Reserve Bank of India (RBI) is trying to assuage concerns on rising prices, but Indian households may inevitably have to bear the brunt. On Feb. 14, India’s retail inflation accelerated to 6.01% in January, just above the upper limit of the RBI’s tolerance band, driven by rising prices of food and manufactured items.”

“Consumer goods companies may continue to pass on input costs to consumers in the January-March quarter. Biscuits, beauty products, and home appliances are expected to get costlier as companies battle sustained high commodity and freight costs and margin pressures.”

“While household inflation expectation has eased since the last survey, the current perception at 9.7% is still higher than the projection made a year ago. What’s worse, the figure is in double-digits for the next three months and a one-year period, according to the RBI’s survey.” Mimansa Verma reports.

NATO Sees ‘No Sign of De-Escalation’ on Russia-Ukraine Crisis

Financial Times

“Russia’s defence ministry has signalled hopes of easing tension on Ukraine’s border by saying some troops were returning to their bases after the end of exercises, though Nato warned it had not seen signs of a reduced military presence and that Moscow still had the means to mount an attack.”

“Jens Stoltenberg, secretary-general of the western security alliance, said he had not so far seen ‘any sign of de-escalation’ by Russian troops near Ukraine. But he said there was reason for ‘cautious optimism’ given signs from Moscow that Russia wished to continue with diplomacy.”

“…Meanwhile, Olaf Scholz, Germany’s new chancellor, held talks with Vladimir Putin in Moscow in the latest in a series of last-ditch efforts by western leaders to talk the Russian president out of invading Ukraine. The two men sat at opposite ends of a long table, which the Kremlin said was a social-distancing measure after Scholz opted not to take a Russian-administered Covid-19 test.”

“…Russia has threatened ‘the most unpredictable and grave consequences’ if the west does not agree to two draft security protocols that would roll back Nato’s presence in eastern Europe. Foreign minister Sergei Lavrov said Moscow would continue dialogue with the west and expressed interest in holding further talks on topics such as intermediate-range nuclear missiles and deconfliction measures.” The FT reports.

African Tech Start-ups Could Unlock $90 Billion Over Next Decade With Reforms

African Business

“Africa could secure tech startup funding of more than $90bn by 2030, if policymakers pursue significant reforms to drive growth, according to a new report from the Tony Blair Institute for Global Change.”

“Using data that covers the past six years, the former UK prime minister’s institute projected a business-as-usual scenario versus an improved policy-environment scenario. Projected until 2030, this scenario sees African startup funding reaching $93.9bn, based on the assumption that gains from the past few years are maintained.”

“To achieve the goal, governments need to enable more tech financing, cultivate the business environment and strengthen networks, says the institute. The improved policy-environment case is based on the compound annual growth rate of venture-capital funding to Africa between 2015 and 2020.”

“‘If current positive trends are sustained, and the transformative potential of technology is unlocked, Africa could secure tech-startup funding of more than $90bn by 2030,’ the report says.” David Thomas reports.

"There are two types of pain you will go through in life: the pain of discipline and the pain of regret. Discipline weighs ounces, while regret weighs tons." - Jim Rohn