Emerging Markets Daily - February 16

Iran Preps for Return to Oil Market, Signals Flash Red on S. Korea/Turkey Currency, China and Asia Local Currency Trade, New Gulf of Suez Oil Found, Africa's Gamers

The Top 5 Stories Shaping Emerging Markets from Global Media - February 16

Iran Visits Korean Oil Buyers: A Sign Nuke Deal Agreement is Near?

(Editor’s note: We’re all trying to read the tea leaves on the Iran nuke talks in Vienna. This story from Bloomberg below might be a sign that the sides are getting closer to a deal. While Iran is not the kind of producer that could dramatically shift oil markets, adding an extra million barrels or so of Iranian oil per day in a tight market will help push down prices, making a dent in inflation, the most consequential story of our time. That’s why this Bloomberg piece is our top story.)

Bloomberg

“Iran appears to be taking steps for its official return to the international oil market after more than three years.”

“Officials from state-owned National Iranian Oil Co. are meeting at least two South Korean refiners to discuss a potential return of supply from the Persian Gulf producer, according to people with knowledge of the talks. The discussions are at a preliminary stage with volumes and a possible timeline yet to be specified, one of the people said.”

“South Korea used to be one of the biggest buyers of Iran’s ultra-light oil. The move comes as the Islamic state said it’s rushing to get a good nuclear deal in negotiations in Vienna and the European Union’s top diplomat said that he believed an accord was ‘in sight.’ An agreement between Iran and world powers would allow the return of 500,000 barrels a day of oil to international markets in April to May, eventually rising to 1.3 million barrels by year-end, according to Citigroup Inc.”

“An Iranian delegation made up of officials from the central bank, oil ministry and the NIOC are in Seoul on Feb. 15-16 for working-level talks that would touch upon financial and oil-related matters, according to a statement on the South Korean foreign ministry’s website. The two nations were planning to target talks over Iran’s frozen assets in the Asian country, Yonhap reported on Jan. 29.”

“South Korea imported as much as 18.5 million barrels a month from Iran before U.S. sanctions in 2018. While the biggest buyers of Iranian oil including Korea were able to continue purchases thanks to waivers, these weren’t renewed and imports halted in the first half of 2019.” Sharon Cho reports.

Signals Flash Red for Turkey and South Korea on Currency Pressure

Emerging World

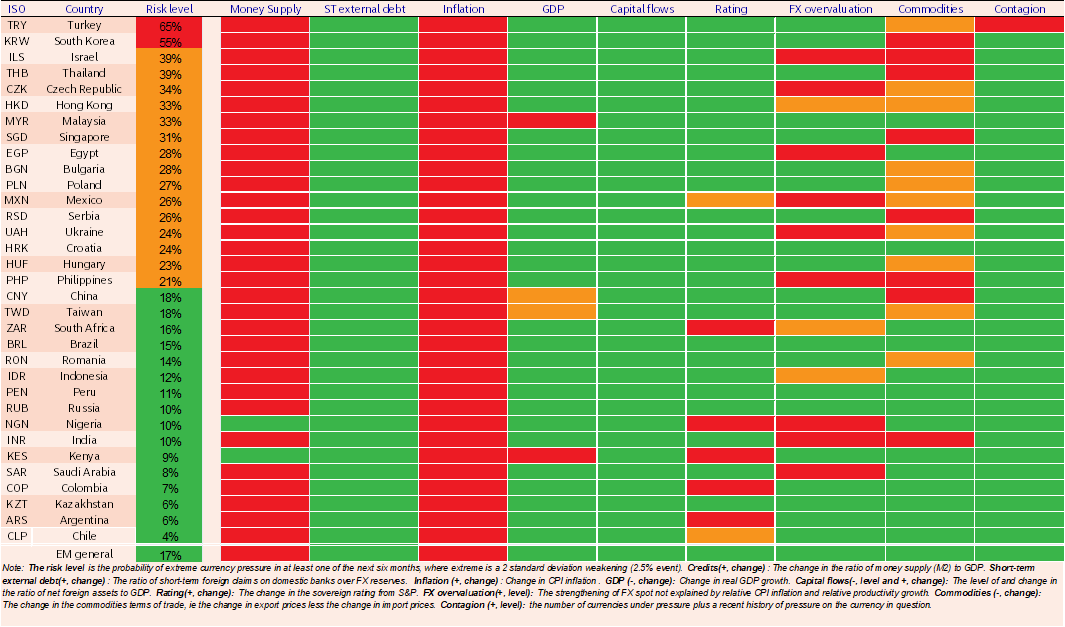

Nordea Bank puts out a very useful EM Traffic Light report every month. They rank 33 emerging market currencies on their relative risk profile. They are looking to find “indicators to assess the risk of extreme FX pressure in the period ahead.”

They assess the “probability that the currency will come under extreme pressure in at least one of the next six months, where extreme pressure compares to the worst of the last 40 months.”

The red light is the highest risk, implying “a more than 40% probability of extreme pressure,” while a yellow light “implies 20-40% probability of extreme pressure”

and a green light “implies less than 20% probability of extreme pressure.”

According to the latest EM Traffic Light Chart, Turkey and South Korea pose the highest risk, while Chile, Argentina, and Kazakhstan the least. Check it out below.

Also, take a look at the bleeding red on the inflation indicator. It’s an epidemic of inflation in the emerging world. For more on this EM Traffic Light chart, see this Nordea Bank report.

Emerging World Update

Dear Friends, Colleagues, and Fellow Travelers

Before we move on to the next story, I wanted to point out a nice milestone on our Emerging World journey together.

There is a powerful, information-rich new platform that specializes in curating the best markets and macro commentary and analysis in cyber-world. It’s called Harkster. Their tagline is “knowledge without the noise.” My head is still humming (quietly) with all the knowledge on the site. I was scrolling recently and was delighted to see that they, too, have joined our humble caravan of fellow travelers here at Emerging World. They are subscribers and we are now featured on their information-packed platform (Screen Shot below)

I’d say also we are in good company in their curated news section, alongside the Financial Times, the Economist, the Wall Street Journal, the New York Times, and Axios. Thank YOU, fellow travelers, on this Emerging World journey. We still have a long way to go, but the caravan keeps growing - so please keep sharing with your friends and colleagues interested in emerging markets, geopolitics, and key global trends.

And here’s what the Harkster folks have said about our flagship product, the Emerging Markets Daily - “curated from the global media, including sites and sources off the familiar path.” We are particularly pleased with that last part - as we try to curate “off the familiar path” as much as possible - and glad they noticed.

OK, now back to business, and the third story of today’s Emerging Markets Daily - the top 5 stories shaping emerging markets from the global media, brought to you six days a week. Cheers, Afshin.

China To Work With Asian Nations to Grow Use of Local Currency in Trade

Bangkok Post/Reuters

“China will work with Asian countries to beef up use of local currencies in trade and investment, Yi Gang, the governor of the central bank, said on Wednesday, as part of plans to strengthen regional economic resilience.”

“‘‘Emerging markets should improve their resilience,’ Yi said by video at the event hosted by Indonesia. ‘This is where regional co-operation has a key role to play.’ Bilateral currency swaps among the Asean regional grouping, China, Japan and South Korea have reached $380 billion, he said.”

“Last month, the People's Bank of China (PBOC) extended a bilateral currency swap pact with Bank Indonesia for three years to deepen financial cooperation and promote investment.”

“…Economists believe China and other emerging economies could face the risk of capital outflows once the US Federal Reserve starts to tighten policy. A Reuters poll showed the Fed will kick off its tightening cycle in March, with an interest rate hike of 25 basis points, but a growing minority say it will opt for a more aggressive half-point move to tamp down inflation.” Bangkok Post reports.

China will keep its accommodative monetary policy flexible, as economic growth is likely to return to its potential rate this year, Yi added.

Dubai’s Dragon Oil Makes Major Gulf of Suez Oil Discovery

The National

“Dubai’s Dragon Oil has made its first oil discovery in Egypt's Gulf of Suez, state-owned news agency Wam reported. The discovery is one of the largest in the area in the past 20 years and the field could contain about 100 million barrels in reserves.”

“The announcement was made on the sidelines of the 2022 Egypt Petroleum Show. Dragon Oil, a subsidiary of state-owned Emirates National Oil Company, is an upstream oil and gas exploration, development and production company.”

“In October 2019, it committed to investing $1 billion over five years in upstream assets in Egypt after acquiring BP’s stake in the Gulf of Suez. Dragon Oil intends to reach production rates of 65,000-70,000 barrels per day this year, compared to an average of 60,000 bpd in 2021.”

“The hydrocarbons explorer operates concessions in Turkmenistan, Algeria, Egypt, Afghanistan, Tunisia and the Philippines. Oil prices have remained buoyant in recent months and have rallied to their highest since 2014 on tighter supply, higher demand and production constraints. Geopolitical tension related to Ukraine have also supported a rally in prices.”

“Brent, the global benchmark for two thirds of the world's oil, was trading at $93.95 per barrel at 3.04pm on Tuesday, while West Texas Intermediate, the gauge that tracks US crude, was at $92.80 per barrel.”

“The International Energy Agency expects oil demand to rise by 3.2 million bpd this year to reach 100.6m bpd as global economies recover from the pandemic.” Alkesh Sharma reports.

Why Africa Will Be the Fastest Growing Video Game Market

Quartz Africa

“Just over five years ago, African gamers were mostly playing games on consoles and personal computers at either cyber cafes or gaming joints, with very few people enjoying the games—most of which were foreign creations—at home.”

“Fast forward to 2022 and smartphones are the new primary platform and you can play your favorite game anywhere, with most characters, assets, and even languages adopting African characteristics.”

“The number of gamers on the continent has also more than doubled over the past five years and the growth of gaming industry in all aspects is taking an upward trajectory.”

“A 2021 study commissioned by Newzoo, a games analytics company and Carry1st, a South African gaming platform, shows that the number of gamers in sub-Saharan Africa has risen to 186 million people from 77 million in 2015.”

“With 24 million gamers, South Africa tops the continent having 40% of its population playing followed by Ghana (27%) and Nigeria (23%) in second and third places respectively. Kenya and Ethiopia finish fourth and fifth in the continent with 22% and 13% of their population into gaming respectively.”

“Majority of the playing population (95%) are mobile gamers with the covid-19 pandemic and increasing digitization across the continent said to be the biggest drivers to the numbers. ‘Gaming in Africa is exploding. Crucially, this applies not only to people playing games, but also those willing to pay as well,’ said Carry1st CEO and Co-founder, Cordel Robbin-Coker.”

“Another study by Newswagg’s points to a growing appetite for trading in gaming assets using digital currencies with 38% of 41.9 million gamers owning crypto across the world being millennials aged 21-38 years old.”

“Africa and Middle East have a combined 5.9 million gamers owning crypto, with a potential to shore up these numbers in Africa given that the continent will have one of the largest youthful population by 2050.”

“Nigeria has leaped ahead of its African peers in adoption of cryptocurrencies following the launch of Africa’s first Central Bank-backed digital currency- the e-Naira in 2021.” Conrad Onyango reports.

“We are what we repeatedly do. Excellence then, is not an act, but a habit.” -Aristotle, philosopher