Emerging Markets Daily - February 21

Asian Ports Clogged, Tencent Denies New Tech Crackdown Coming, Inflation Creeps into Asia, A Murky DRC Coup Attempt, Brazil to Sell State Lithium Miner

The Top 5 Stories Shaping Emerging Markets from Global Media - February 21

Asian Ports See Rising Congestion, Global Supply Chain Woes to Continue

FreightWaves

“The hairballs in the pipes of trade are multiplying.”

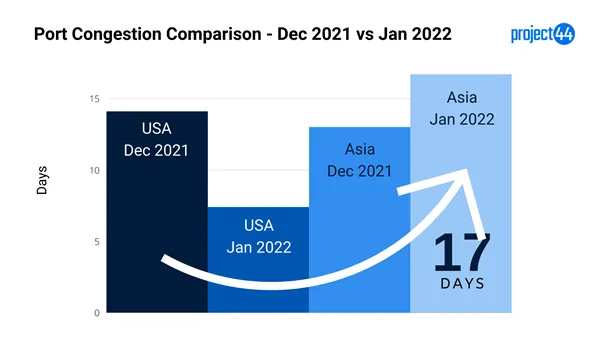

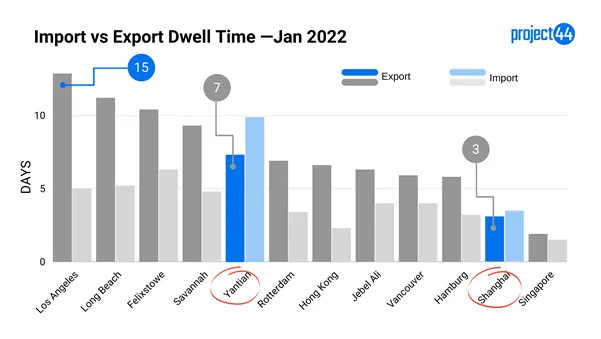

“New data analyzed and released by project44 shows vessels waiting to berth in Asia recorded an average increase from 13 days in December to 16.7 days in January. Hong Kong, which has seen an increase in COVID cases, tops the list with the largest increase from 17.5 days to 22.5 days.”

“‘The omicron variant of COVID-19 continues to impact port workers and other supply chain stakeholders,’ said Josh Brazil, director of supply chain insights at project44. ‘This will continue to impact supply chain operations around the world and will be a major contributor to delays.’

“This nauseating merry-go-round of congestion shows no signs of stopping. Even the lower volumes of Lunar New Year did not help the Port of Los Angeles clear out the tower of containers.”

“Michael Trans, head of digital intelligence at RBC Capital Markets, warned in a recent note the path toward ‘normalization’ is ‘lumpier and significantly less linear than most realize.’”

“Added Trans: ‘The bottom line is that the supply chain stretching from Asia to California is simply not constructed to handle the current level of consumer demand for goods. Despite the Ports of LA & LB unloading a record number of ships and a record utilization of containers on ships last year, the infrastructure and logistics simply cannot handle the elevated volume, agnostic of COVID.’”

“In 2021, the Port of LA exported 3.95 million empty containers compared to 1.18 million full containers. At the end of January 2022, approximately 62,253 empty containers were waiting at the Port of Los Angeles to be shipped out.” Lori Ann LaRocco reports.

Tencent Quashes Talk of New Crackdown as Tech Wipeout Deepens

Bloomberg

“Tencent Holdings Ltd. denied online speculation that it’s facing a major regulatory crackdown, issuing an unusually aggressive public response after fears of more tech-sector restrictions tanked markets on Monday.”

“Zhang Jun, Tencent’s head of public relations, disputed a widely circulated post that suggested the company would weather another heavy blow from regulators in the near future. The account carrying the rumor has since been suspended, Zhang said on his semi-public WeChat feed.”

“‘Ask me next time, at least that’s more legit. And I’m not afraid of going on record,’ Zhang said, poking fun at the post citing an anonymous Tencent employee. Before its removal, the post was widely shared on Chinese social media and stock-trading forums. It hinted at another big step in China’s internet crackdown, without providing specifics. Tencent closed 5.2% lower on the day.”

“Chinese technology shares had their worst two-day drop since July due to renewed fears Beijing may roll out more restrictions for private enterprise. Traders pointed to everything from regulatory warnings over the weekend about scams in the metaverse -- a virtual-reality based social media concept -- to unsubstantiated talk about more curbs on the gaming industry. Tencent is a leader in metaverse development.” Zheping Huang reports.

Inflation Creeps in Across Asia

Wall Street Journal

“Early warning signs of inflation are appearing in some parts of Asia, as higher energy and food prices start to bite in countries that recently seemed immune to cost pressures.”

“India’s inflation accelerated to 6% in January, well above the trend of around 3.6% in the three years leading up to the Covid-19 pandemic, while Sri Lanka’s inflation hit 14.2% that month, the highest in more than a decade. In South Korea, core consumer inflation recently rose to 3%, its highest level since January 2012.”

“Thailand’s consumer price inflation is now 3.2%—after averaging less than 1% in the three years leading up to 2020—even though the tourism-reliant country has one of Asia’s weakest economies. Angry truck drivers recently clogged streets in Bangkok to pressure the government to lower diesel prices.”

“Inflation across most of Asia is still well below levels seen in some western economies, including the U.S., where consumer prices rose 7.5% from a year earlier in January, a four-decade high.”

“Consumer price pressures are particularly weak in China, despite recent cost increases for factories. While industrial inflation remains high in China, it has eased recently and factories have struggled to pass expenses on to consumers as the broader economy struggles to recover from a property market slowdown and other problems.” Stella Yifan Xie reports.

Murky DRC Coup Raises Suspicions of Foul Play

African Business

“Very few details have emerged of a coup attempt reported by the Democratic Republic of Congo’s government earlier this month, leading to speculation that it was fabricated in a ploy to remove influential opponents of the current president.”

“The government said it found ‘serious evidence’ of a national security threat after arresting François Beya, one of DRC’s most influential intelligence figures with links to former president Joseph Kabila on February 5.”

“Beya, who was a special security advisor to president Félix Tshisekedi, held influential positions in the former regimes of Mobutu Sese Seko, Laurent-Désiré Kabila and Joseph Kabila. He is reportedly still being held at the headquarters of the National Intelligence Agency (ANR) in Kinshasa.”

“More than a week after his arrest 5,000 heavily armed members of the national army walked through the streets of the capital city in a show of force, but the government has not made any more arrests or released any other information on the perpetrators or possible motives.”

“The lack of information has led to speculation that the coup was orchestrated by the government in a bid to remove Beya from his position of influence. ‘Beya has been becoming a pest to Tshisekedi. He was more or less the last remnant of the Kabila regime and he was proving near impossible to oust. I’ve said for a long time a coup attempt is super unlikely. And this remains true for now, I think,’ says a DRC analyst, on condition of anonymity.” Tom Collins reports.

Brazil’s Minas Gerais State To Sell Stake in Lithium Miner

Mining.com

“Brazil’s minerals and metals-rich state of Minas Gerais is looking to sell its 33.3% stake in Companhia Brasileira de Lítio (CBL), the country’s only producer of lithium carbonate and hydroxide.”

“The state’s Development Company (Codemge), which acquired the stake in CBL in 2018 for an undisclosed sum, said it will hold next week two events to outline details of the sale to potential investors. The presentations in Belo Horizonte and São Paulo, will also be broadcast live, Codemge said.”

“The move is in the opposite direction of Brazil’s neighbours. While Argentina keeps boosting foreign investment in the sector, Mexico wants to create a state company with exclusive rights to mine the metal. The same goes for Chile, whose incoming left wing president Gabriel Boric, is also planning to create a state-run firm, but would leave existing operations untouched.”

“CBL is one of Brazil’s pioneers in underground hard-rock lithium from high grade spodumene pegmatites. The broader objective of the proposed sale, Codemge president Thiago Toscano said in the statement, is to boost the competitiveness of the state’s assets and seek alternatives for the best use of public resources.

“The South American nation, known for its vast deposits of iron ore and potash, has been boosting its lithium sector as of late.”

“Chinese lithium carbonate prices tracked by Asian Metal Inc. rose to a fresh record last month, as data showed a 35% month-on-month jump in EV registrations in December.” Mining.com reports.

“Doubt is an uncomfortable condition, but certainty is a ridiculous one.” - Voltaire