Emerging Markets Daily - February 22

Oil Marches Toward $100 on Ukraine Tensions, Germany Halts Nord Stream 2, China Tech Crackdown, India's Swiggy Eyes IPO, China's Quest for Indonesian Nickel

The Top 5 Stories Shaping Emerging Markets from Global Media - February 22

Oil Continues March Toward $100 as Russia-Ukraine Crisis Escalates

The National

“Oil prices rose sharply along with gold on Tuesday on energy supply worries as the Russia-Ukraine crisis escalated after Moscow recognised two breakaway regions of Ukraine and ordered troops into the two territories.”

“Brent, the global benchmark for two thirds of the world's oil, climbed 3.91 per cent to $99.12 a barrel at 1.39pm UAE time while West Texas Intermediate, the gauge that tracks US crude, rose 4.86 per cent to $95.50 a barrel.”

“Gold, a safe haven against rising inflation, hit an eight-month high at more than $1,900 an ounce. The price of the yellow metal was already increasing before the latest developments. ‘It seems inevitable that Brent crude will test $100 a barrel sooner rather than later,’ said Jeffrey Halley, senior market analyst for the Asia-Pacific region at Oanda.”

“‘A full-scale Russian invasion likely sees it spike to $130 [at least], dragging WTI with it. It is hard to see Brent moving back below $90 a barrel anytime soon now, with Opec+ capacity limited in its ability to pump more.’”

“In his televised address on Monday, Russian President Vladimir Putin recognised the Kremlin-backed separatist regions of Donetsk and Luhansk as republics and said he would send ‘peacekeeping forces’ to protect them. It has yet to be known how many troops Moscow is sending.”

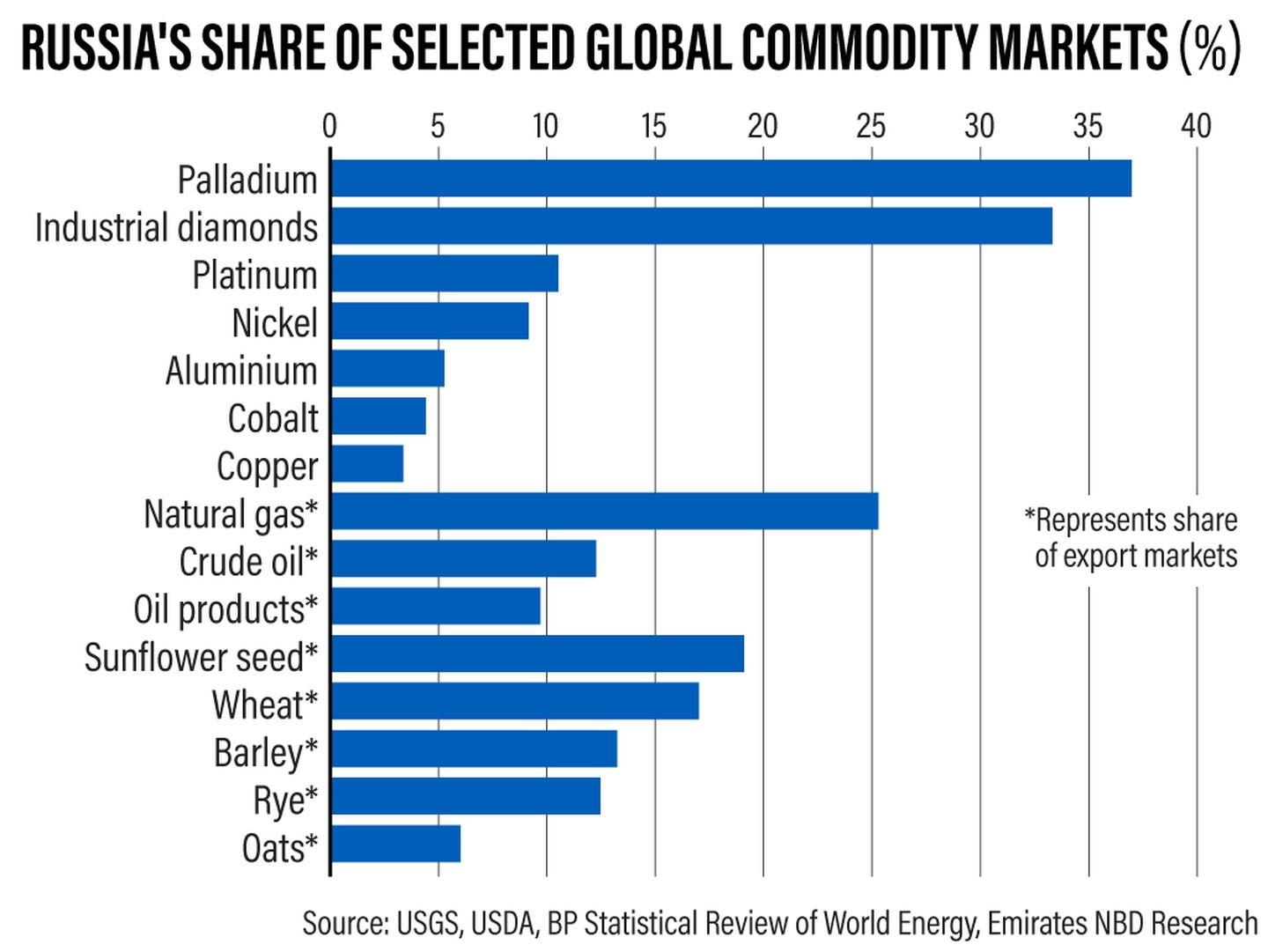

“Russia accounted for about 12 per cent of global crude oil exports in 2020 and about 10 per cent of total oil product exports, according to Emirates NBD. It supplies 25 per cent of the world's natural gas exports and is also a major producer of industrial metals.”

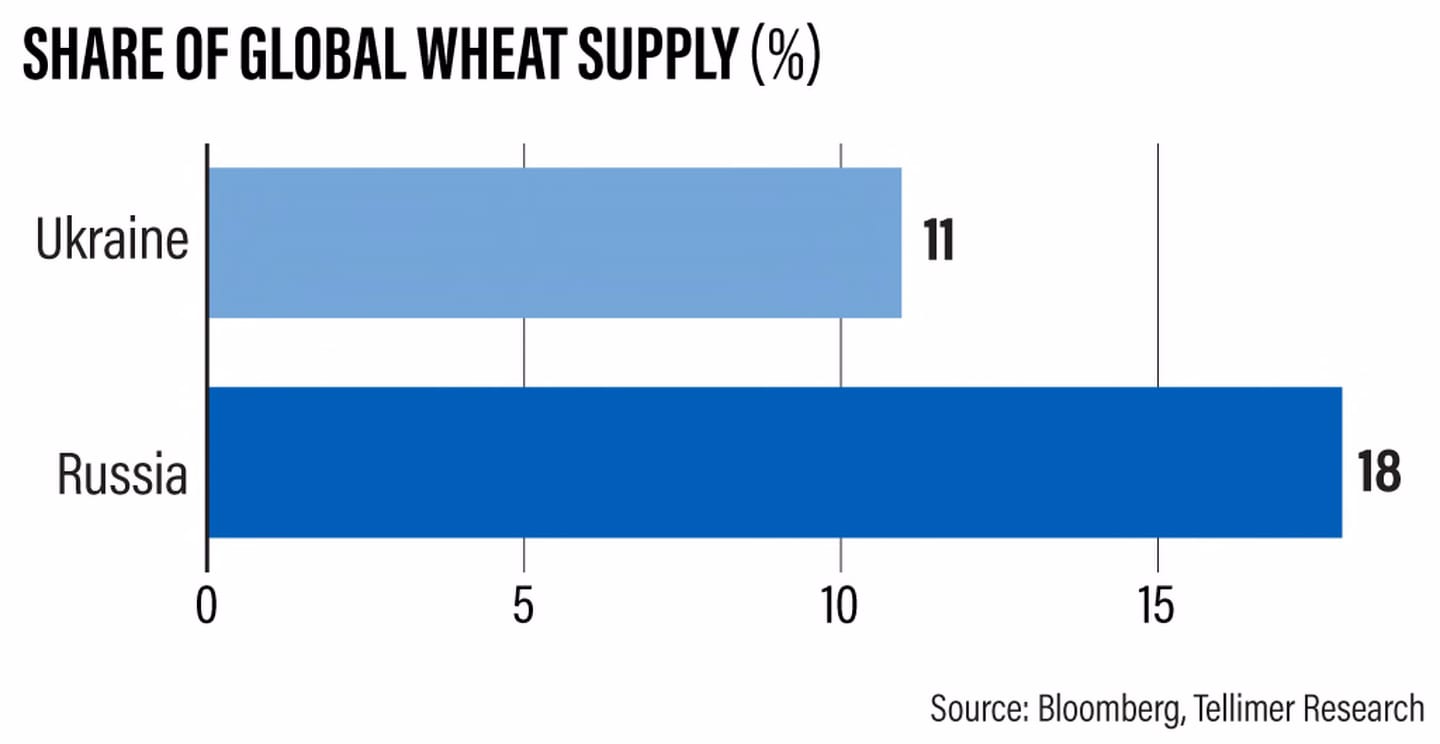

“The country export agricultural commodities, accounting for about 17 per cent of global wheat exports between 2020 and 2021, and more than 10 per cent of feed grains such as barley. It is also a dominant supplier of sunflower seed used in vegetable oil production, according to Emirates NBD.”

“‘At a time when many major economies are already enduring decade high inflation, the threat of a major supplier of raw materials being sidelined from markets due to sanctions would add further upward pressure on prices,’ said Edward Bell, senior director of market economics at Emirates NBD.” Sarmad Khan and Massoud A Derhally report.

Germany Halts Nordstream 2 Pipeline After Russia Orders Troops into Ukraine

Financial Times

“Germany halted the approval of the Nord Stream 2 gas pipeline on Tuesday, the first in a volley of western sanctions against Moscow after Vladimir Putin ordered troops into Ukraine.”

“The Russian president’s decision to send in military support after recognising separatist rebel enclaves in eastern Ukraine’s Donbas region has heightened western fears of a broader offensive, triggering widespread international condemnation and the initial moves to punish Russia.”

“German chancellor Olaf Scholz said Berlin would not approve Nord Stream 2 given Moscow’s actions, in effect freezing Europe’s most controversial energy project. ‘The situation today has fundamentally changed,’ he said. ‘And that’s why we must re-evaluate this situation, in view of the latest developments.’”

“….The sanctions packages under preparation by the US, UK, EU and Japan were expected to stop short of the toughest economic curbs available, which diplomats said would be triggered if Russia were to drive deeper into Ukraine.”

“…Sergei Lavrov, Russian foreign minister, shrugged off the threat of sanctions as he questioned whether Ukraine had a right to sovereignty because its government emerged through a ‘coup d’état’.” The FT reports.

China Crackdown Risk Roars Back With Probe of Jack Ma’s Empire

Bloomberg

“From Alibaba to Tencent, China’s largest companies are once again at the center of a market storm, spurred by speculation that Beijing is readying another assault on the world’s biggest internet arena.”

“Three of China’s most valuable businesses -- Alibaba Group Holding Ltd., Tencent Holdings Ltd. and Meituan -- have shed more than $100 billion in the span of three turbulent days. It’s a remarkable reversal from just a week ago, as investors like Charlie Munger spotted bargains among China Tech Inc. after a $1.5 trillion selloff in 2021. Macquarie issued a report this month headlined ‘peak crackdown.’”

“Now, investors are frantically attempting to parse a series of events that suggest Beijing is once more preparing to rein in its giant private sector. When Alibaba reports earnings Thursday, its executives will again face questions about Beijing’s intentions for a sector subjected last year to unprecedented regulatory curbs and punishments, after Xi Jinping’s administration launched a ‘common prosperity’ campaign to curb tech-sector excesses and force them to share the wealth.”

“The bloodletting began Friday, when the top state economic planner demanded Meituan and its peers lower the fees they charge restaurants in pandemic-hit regions. On Monday, a pair of unverified online posts that went viral suggested Tencent -- which weathered 2021’s onslaught better than most -- was facing a major regulatory crackdown, forcing its public relations chief into an unusually aggressive denial.”

“…While many investors were counting on an end to the relentless regulatory pressure, fundamental questions remained about the ability of China’s tech giants to resume the growth they had enjoyed during a decade of near-unfettered expansion. Alibaba and Tencent had already been expected to record their slowest pace of quarterly revenue rises since listing.”

“‘The golden period of Chinese internet is probably already behind us,’ said Jessica Tea of BNP Paribas Asset Management.” Bloomberg reports.

India’s Swiggy Eyes $800 Million IPO Amid Zomato Rivalry in Tough Market

Nikkei Asia

“Indian food delivery company Swiggy has begun preparations to raise at least $800 million in an initial public offer early next year, three people familiar with the situation told Nikkei Asia.”

“Swiggy is hoping to raise the funds to expand market share amid stiff competition with Zomato in food delivery, while its newly launched quick commerce business is being challenged by Reliance Industries-backed Dunzo, Tata Group's BigBasket, Zomato-backed Blinkit and Y Combinator-funded Zepto.”

“Swiggy has raised about $3.3 billion since it began operation in 2014 from marquee investors that include SoftBank, Prosus Ventures, Invesco and Accel Partners. The firm was valued at $10.7 billion earlier this year after it raised $700 million. That valuation is nearly double the $5.5 billion it garnered in July last year, when it raised $1.25 billion.”

“Swiggy's IPO preparation comes as India's benchmark stock index is trending down after a steep ascent in 2021, on signs of potential rate hikes by the U.S. Federal Reserve, a slowdown in global economic recovery and geopolitical tensions. The index is down 6.5% since mid-October, while foreign investors have turned net sellers of Indian stock since October.”

“The shares of Indian startups, such as Paytm, Zomato, Policybazaar and Nykaa, that listed amid much fanfare last year, have since tanked. Zomato's shares have slumped 41% since October 1, while Paytm shares are trading at under half its list price of 1,950 rupees apiece. Nykaa's shares have slumped 33% from its list price while Policybazaar's have fallen 36%.” Nikkei Asia reports.

Commodities Watch: Chinese Firms Face Worries in Quest for Indonesian Nickel

Caixin

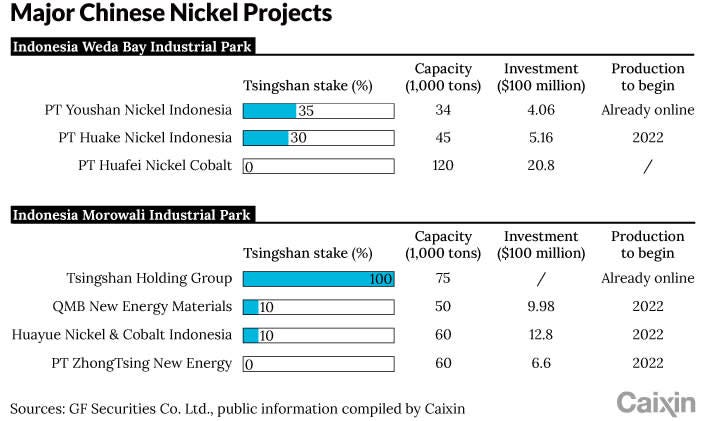

“Morowali, an Indonesian county with fewer than 200,000 residents, has attracted billions of dollars in investment from Chinese companies. The list of Chinese investors includes battery materials producers Zhejiang Huayou Cobalt, Eve Energy and Guangdong Brunp Recycling Technology. In 2021 alone, they put nearly $4 billion into the county.”

“All the money went to the same place: industrial parks established by Chinese stainless steel giant Tsingshan Holding Group to set up nickel smelters. The silvery-white metal has wide applications in the stainless steel industry, as well as in the ternary lithium battery, the power source of new-energy vehicles (NEVs).”

“China, the world's largest auto market, saw NEV sales continuously break new ground last year, almost tripling from 2020. Like many other raw materials in the sector, the trend has driven up nickel prices. In mid-October, nickel futures on the Shanghai Futures Exchange hit a record high of 158,000 yuan ($24,845) per ton, and have since reached new heights.”

“However, China doesn't actually have much in the way of nickel deposits. According to a report by the United States Geological Survey, China produced 120,000 tons of nickel at home in 2020, as the country's reserves make up less than 3% of the world's total. Indonesia, on the other hand, which is home to 23.7% of the world's nickel ore reserves, produced 853,000 tons, accounting for nearly one-third of global output.”

“Tsingshan has now secured access to all three primary raw materials for NEV batteries -- lithium, nickel and cobalt -- as the compound forms of cobalt usually occur in nickel deposits.” Caixin reports.

“It is forbidden to kill; therefore all murderers are punished unless they kill in large numbers and to the sound of trumpets.” - Voltaire

From the iStock photo files - Crimea, Summer 2020