Emerging Markets Daily - February 23

Singapore Banks Bet on Asia Growth, Russia Pledges Uninterrupted Gas Flows, Ukraine on War Footing, Sri Lanka Stocks Plummet, Copper Crunch Looms in 2025

The Top 5 Stories Shaping Emerging Markets from Global Media - February 23

Singapore Banks Bet on Post-Covid Asia Growth

Nikkei Asia

“Southeast Asia's largest banks -- DBS Group Holdings, Oversea-Chinese Banking Corp. and United Overseas Bank -- are setting their sights on Asia to ensure their future growth, wagering that the worst effects of the coronavirus pandemic are behind them.”

“All three Singapore lenders this month reported stellar profits for 2021, confirming that a steady recovery is on track from the downturn induced by the global health crisis the year before.”

“….DBS, the biggest lender in the 10-member Association of Southeast Asian Nations (ASEAN), also last week, reported a net profit of SG$6.8 billion in 2021, up 44% from 2020.”

“With their earnings barely hinting at the economic hardship imposed by the pandemic, the banks are turning their focus to markets outside Singapore to take advantage of early signs of an Asian recovery.”

“DBS and UOB early this year announced decisions to scoop up Citigroup's retail banking assets in the Taiwanese and ASEAN markets, with a view to expanding their clout in locations with wealthy residents or sizable consumer bases.”

"‘We are buying a quality franchise -- four target markets at one go with a complementary base of customers, people and capabilities -- a powerful combination that will accelerate our growth ambitions,’ UOB Chief Executive Wee Ee Cheong said during an earnings conference last week.”

"‘Our decision to acquire Citigroup's consumer business in Indonesia, Malaysia, Thailand and Vietnam affirms our confidence in the long-term potential of ASEAN,’ he said. ‘We see upside potential from trade and investment corridors between ASEAN and China.’

“OCBC is also looking to wealth management to drive income growth outside Singapore. CEO Helen Wong affirmed Wednesday during an earnings briefing that courting Asian wealth will be a priority for driving results… ‘We do see Asia continu[ing] to be most likely the outperformer in economic recovery,’ Wong said. ‘We see the affluent population continu[ing] to grow in Asia. That leads us to shape, refresh, our strategy in this direction.’ Dylan Loh reports.

At Doha Forum, Russia Pledges Uninterrupted Gas Supplies to World

Arab News

“The sixth Gas Exporting Countries Forum conference is being held in Doha against a backdrop of rising tensions between Russia and Western powers over Ukraine.”

“The forum, which has 11 members and seven additional countries with a watching brief, represents 71 percent of the world’s proven natural gas reserves, as well as 43 percent of its marketed production, 58 percent of LNG exports and 52 percent of pipeline trade across the globe.”

“Russia will continue to deliver uninterrupted natural gas supplies to world markets, President Vladimir Putin said in a letter to the conference. The comments came before Germany announced it would be halting the progress of the Nord Stream 2 gas line between the two countries.”

“…Soaring gas prices in Europe started ‘way ahead of the issue in Ukraine’ and are due to a lack of investment in the sector, Qatar’s Minister of State for Energy Affairs Saad Al-Kaabi said, adding: ‘Gas is definitely needed in the future.’ He also said fossil fuels will need to be part of the solution in the transition toward renewables.”

“…Qatar’s Emir Sheikh Tamim bin Hamad Al-Thani said Qatar’s liquefied natural gas production capacity will rise to 126 million tons a year by 2027. He renewed calls for further dialogue among member countries of the gas forum, as well as gas importers and exporters to ensure the security of global gas supply.” Arab News and Reuters report.

Ukraine on War Footing as West Steps Up Sanctions

Wall Street Journal

“Ukrainian President Volodymyr Zelensky ordered the mobilization of reservists as Russian troops poured into Ukraine’s eastern Donbas region and Western nations announced measures to punish Moscow for recognizing two Russian-controlled statelets there as independent, signaling the potential rising economic price on Russia for further aggression.”

“Mr. Zelensky, in a televised address, said Russia’s threat to Ukraine’s sovereignty is forcing him to recall contract military personnel to active duty and to mobilize members of the newly created territorial defense brigades for exercises. He said Ukraine wouldn’t carry out a general mobilization of civilians, urging them to continue normal life.”

“‘We are certain of ourselves, we are certain in our country, we are certain in our victory,’ he said. ‘We are here to overcome, not to cry.’ Earlier Tuesday, Germany said it halted moves to open the Nord Stream 2 pipeline that would allow Russia to bypass Ukraine in exporting natural gas to Europe.”

“The Biden administration, which on Tuesday characterized the Russian troop movements as the start of an invasion, announced sanctions targeting two Russian financial institutions. The U.S. also is imposing sanctions on Russia’s sovereign debt, which President Biden said would cut the government off from Western financing, and on Russian elites and their families.”

“The European Union proposed a ban on purchases of Russian bonds, sanctions on all members of the Russian Parliament who voted in favor of supporting recognition of the two breakaway areas and an asset freeze for three Russian banks with links to the two statelets. Japan, Australia and Canada also announced sanctions against Russia.” The WSJ reports.

Sri Lanka Halts Stock Trading Twice After Index Slides

Bloomberg

“Sri Lanka’s stock market trading was halted twice on Wednesday after a gauge of blue-chip shares tumbled more than 8%, highlighting the mounting economic crisis prompted by a shortage of dollars and surging inflation.”

“The benchmark Colombo All Share Index settled 2.7% lower at 11,285.37 after a slide in a measure of the nation’s top 20 stocks by market capitalization triggered a circuit breaker. The stock exchange suspended trading for 30 minutes twice, first when the gauge fell 5%, then when it declined to more than 7.5%.”

“‘Macro-worries are increasing. There are margin calls and forced selling,’ said Udeeshan Jonas, chief strategist at CAL Securities in Colombo. ‘The ability of companies to pass on costs to customers is reducing.’”

“A surge in energy prices as tensions around Ukraine mount has added to the woes of Sri Lanka, which is already facing Asia’s fastest pace of inflation while grappling with dwindling foreign-exchange reserves that have raised concerns about the risk of defaults.”

“Sri Lanka’s central bank on Tuesday released dollars to pay for diesel imports for at least the second time this year, according to Governor Ajith Nivard Cabraal.” Bloomberg reports.

Copper Crunch Coming By 2025, Bank of America Says

Mining.com

“In a new report, Bank of America (BofA) Global Research analysts say they expect the copper market to flip back to a deficit from 2025 onwards following the completion of the current wave of project buildouts.”

“While global copper output is set to grow by 7.7% in 2023, following an expected deficit in 2022, the risks are skewed to the downside, the bank says, given the underperformance of new copper mine builds in recent years.”

“BofA sees a range of issues constraining production growth. These were mirrored by a presentation of Edgar Blanco Rand, vice minister of mining in Chile’s previous government, during the recent LME Week.”

“The official showed a portfolio of Chile-based projects set to be realized by 2029 at the cost of $74 billion to achieve a total production of 7 million tonnes. Focussing on copper, Edgar Blanco highlighted that production has flat-lined since 2000 at around 5.7 million tonnes, after a decade of rapid growth, starting in 1990.”

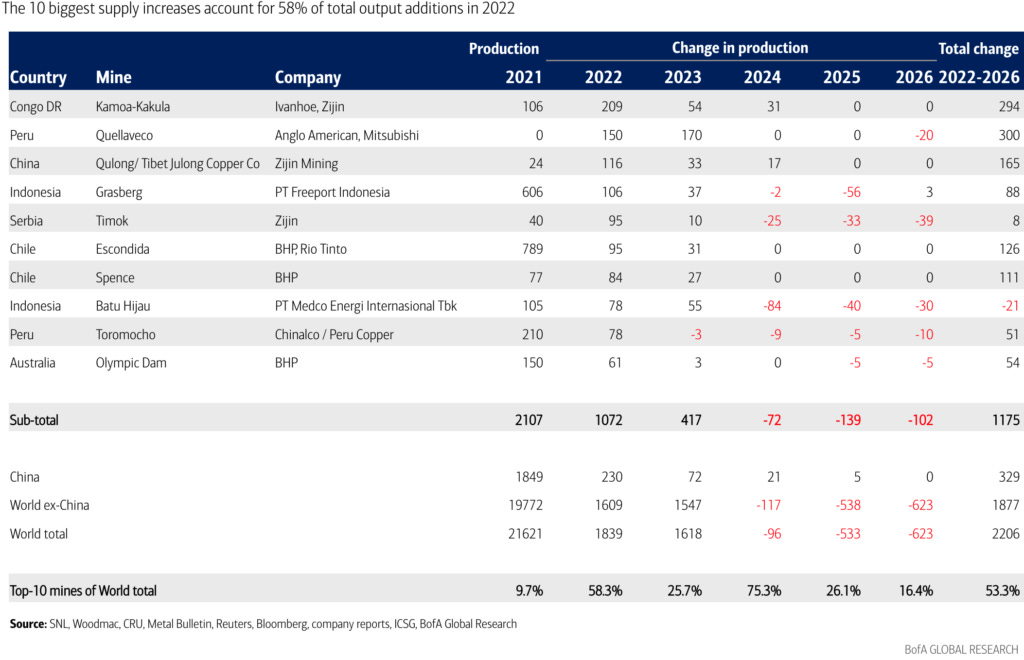

“According to BofA, the 10 most significant supply increases will account for 58% of total output additions in 2022.”

“This supports BofA’s view that expansions are very concentrated, with two implications. Firstly, operational issues at just one or two sites could profoundly impact market balances, which means the trajectory of those 10 mines is critical.” Mining.com reports.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb