Emerging Markets Daily - February 24

Russian Ruble and Market Plummet on Ukraine Invasion, Oil Tops $100, India and China Stay Quiet on Russia, HK and Other Asian Markets Fall, EM Debt Piles On

The Top 5 Stories Shaping Emerging Markets from Global Media - February 24

Russia Stock Market Dives, Ruble Plunges as Russia Expands Invasion of Ukraine

Bloomberg

“Russian assets nosedived as military attacks across Ukraine prompted emergency central bank action and investors braced for the toughest round of Western sanctions yet, wiping out as much as $259 billion in stock-market value.”

“The ruble sank to a record low, the cost of insuring Russian debt against default soared to the highest since 2009, and stocks collapsed as much as 45% -- their biggest-ever retreat. The Bank of Russia said it will intervene in the foreign exchange market for the first time in years and take measures to tame volatility in financial markets.”

“The military attack on Ukraine cast a shadow over global markets and sparked a fresh bout of risk aversion. Russian assets took the main blow after President Vladimir Putin ordered an operation to ‘demilitarize’ Russia’s neighbor, prompting international condemnation and a U.S. threat of further ‘severe sanctions’ on Moscow.”

“The Russian central bank made no mention of raising interest rates, but said it will provide additional liquidity to banks by offering 1 trillion rubles ($11.5 billion) in an overnight repo auction. Policy makers have increased the benchmark rate by 525 basis points in the past 12 months to tame inflation.”

“The central bank may be asked for more support if major Russian companies and banks are targeted by the West. In a late-night statement, U.S. President Joe Biden said that he would announce ‘further consequences’ for Russia later Thursday, in addition to sanctions unveiled earlier in the week.” Bloomberg reports.

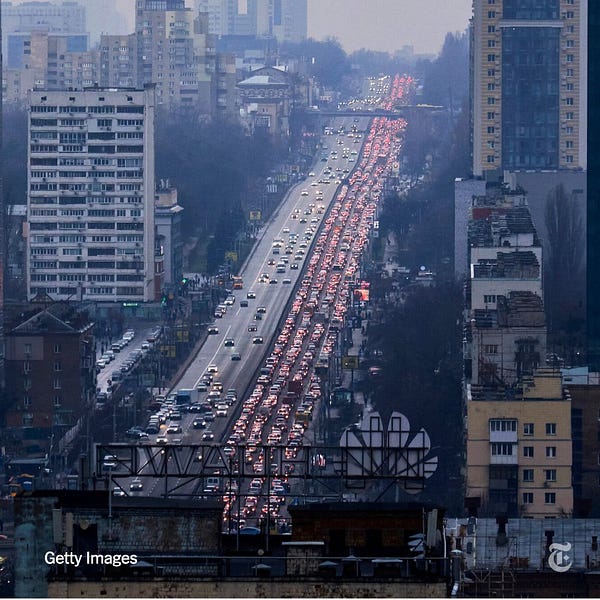

Oil Tops $100, European Shares Tumbles as Russian Tanks Roll Toward Kyiv

Financial Times

“Brent crude oil topped $100 a barrel, European stocks fell sharply, shares in Moscow plunged and gold hit a 17-month high after Russian president Vladimir Putin launched a military invasion of Ukraine.”

“The regional Stoxx Europe 600 share index lost 3.6 per cent, taking it through a technical correction, defined as a 10 per cent decline from a recent peak. Germany’s Xetra Dax fell 3.7 per cent, with similar falls across most European bourses.”

“Brent crude oil rose as much as 8.9 per cent to $105.45, the first time the international benchmark has crossed the $100 threshold since 2014, as traders assessed the likelihood of western sanctions cutting supplies from Russia.”

“European natural gas contracts surged more than a third to €113 per megawatt hour. The escalation of the conflict in Ukraine is dominating the global market narrative because of the potential for sanctions to cut Russia’s energy and resources out of global supply chains, exacerbate the surge in inflation and prompt central banks to raise interest rates.”

“‘A situation which seriously chokes off energy supplies from Russia will affect the world as a negative supply shock,’ said Sunil Krishnan, head of multi-asset funds at Aviva Investors. ‘Geopolitical tension is raising oil prices, meaning the inflation that was deemed transitory a few months ago could last even longer,’ added Trevor Greetham, head of multi-asset at Royal London Asset Management. ‘A big inflation impact in the US and Europe means central banks could raise interest rates further than anticipated, which brings a risk of economic stagflation.’” The FT reports.

India and China Stay on Sidelines as Russia Invades Ukraine

(Photo, May 2019)

Nikkei Asia

“As Russia and the West face off on Ukraine in perhaps the biggest crisis on the European continent since World War II, the globe's two largest emerging powers, China and India, have remained largely on the sidelines.”

“China on Thursday refused to categorize Russia's actions as an ‘invasion,’ instead calling the move the result of a ‘complex historical background.’ India has been conspicuously cautious, eager not to burn bridges with Russia, a historical friend from which it buys much of its weaponry.”

“On Wednesday, India's permanent representative to the United Nations, T. S. Tirumurti, said at a Security Council meeting that the situation ‘is in danger of spiraling into a major crisis….We call on all parties to exert greater efforts to bridge divergent interests. I would like to underline that the legitimate security interests of all parties should be fully taken into account,’ Tirumurti said.”

“Prime Minister Narendra Modi has not said much, except for an indirect reference to the crisis during a poll campaign on Tuesday….Dissatisfied with the so-far lukewarm response from India, Ukraine's envoy to New Delhi, Igor Polikha, on Thursday said he was ‘pleading’ for Modi to intervene.”

“…India is in a very tricky situation, Harsh Pant, head of strategic studies at the New Delhi-based Observer Research Foundation, told Nikkei Asia, having to strike a balance between its ties with Russia and the West. Russia, he pointed out, is extremely important to India as a defense and strategic partner, and New Delhi values the historical relationship that exists with Moscow.”

"‘India doesn't want to abandon Russia at this point and jeopardize that relationship,’ he said. In the short term, Pant said, it needs Russia for defense equipment and supplies as it is 60% dependent on Moscow for these. But in the long term, Pant said, ‘it needs the West's presence in the Indo-Pacific to manage China.’ Nikkei Asia reports.

Hong Kong Stocks Slide to 2 Month Low, Other Asian Markets Hit on Ukraine Fears

South China Morning Post

“Hong Kong stocks slumped to a two-month low as Chinese Big Tech led losses while global markets sank and safe haven assets surged after Russia attacked Ukraine. Concerns about weaker corporate earnings also hurt sentiment.”

“The Hang Seng Index retreated 3.2 per cent to 22,901.56 at the close of Thursday trading, the steepest drop since September. This week’s losses amounted to US$104 billion of market value through Wednesday. The Tech Index sank 4.3 per cent, while the Shanghai Composite Index lost 1.7 per cent.”

“Alibaba Group Holding… tanked 6.7 per cent to a record-low HK$104.90 before its earnings report on Thursday. Tencent Holdings and Meituan declined by more than 3.6 per cent. Hong Kong Exchanges and Clearing slipped 5.4 per cent to a one-year low as earnings in 2021 trailed consensus.”

“Asian markets suffered. Australian shares slid 3 per cent while Japanese and Korean equities lost at least 1.8 per cent. Russian forces fired missiles at several Ukraine cities after President Vladimir Putin authorised a military operation that Ukraine described as a ‘full-scale invasion.’” Cheryl Heng reports.

EM Borrowing Drives Global Debt to Record $303 Trillion

Reuters

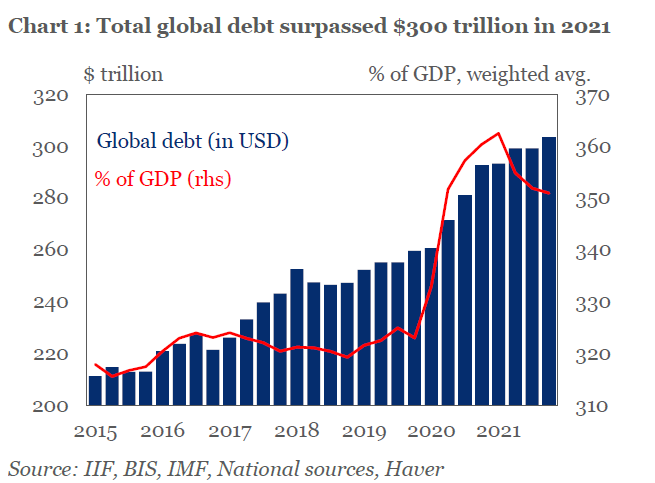

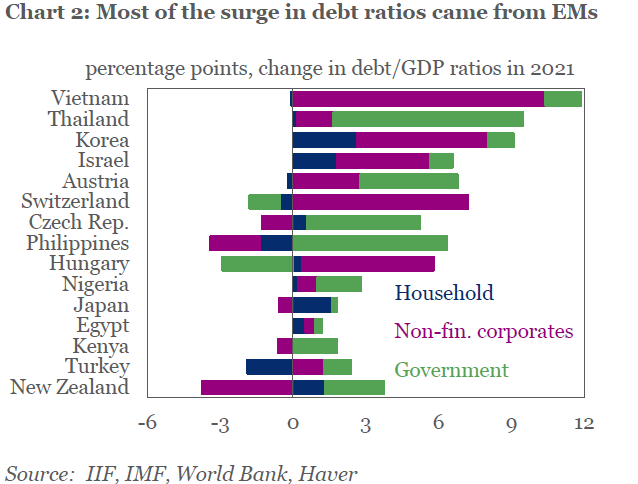

“Emerging market borrowing led by China inflated the global debt mountain to a record $303 trillion in 2021, although the global debt-to-GDP ratio improved as developed economies rebounded, the Institute of International Finance said on Wednesday.”

“The $10 trillion rise in the global debt pile was down from the $33 trillion increase in 2020 when COVID-19-related expenditure soared.”

“But more than 80% of last year's new debt burden came from emerging markets, where total debt is approaching $100 trillion, the IIF said in its annual global debt monitor report.”

“…Most of the jump in individual country debt-to-GDP ratios occurred in emerging markets.”

“The IIF also noted that the vast majority of additional emerging market debt last year was in local currencies, and its share the highest since 2003.” Tommy Wilkes reports.

Tweet of the Day

"Well Prince, so Genoa and Lucca are now just family estates of the Buonapartes. But I warn you, if you don't tell me that this means war, if you still try to defend the infamies and horrors perpetrated by that Antichrist— and I really believe he is Antichrist—I will have nothing more to do with you and you are no longer my friend, no longer my 'faithful slave', as you call yourself! But how are you? I see I have frightened you—sit down and tell me all the news." Opening lines, from Leo Tolstoy’s

War and Peace