Emerging Markets Daily - February 27

Sanctions Noose Tightens on Russia, Mobius: Buy Gold & China Equities, India's Blockbuster IPO, TotalEnergies Discovers Namibia Oil, Bolsonaro Vs. Lula in Brazil

The Top 5 Stories Shaping Emerging Markets from Global Media - February 27

Sanctions Noose Tightens on Russia, Investors Exit, and Possible Peace Talks

Bloomberg

“EU foreign ministers endorsed a plan to ban all transactions involving Russia’s central bank, in a move designed to deal a severe blow to the country’s financial system. The agreement paves the way for the measure to come into force as soon as Sunday and will prevent Moscow from tapping some currency reserves held outside Russia.”

“The EU has also joined an international agreement to mostly shut Russia out of SWIFT, the messaging system used for trillions of dollars in transactions around the world.”

“…Norway has decided to start the process to remove Russian assets from its $1.3 trillion sovereign wealth fund, Prime Minister Jonas Gahr Store told reporters in Oslo on Sunday.”

“The government decided to freeze Russian holdings in the wealth fund in response to Russia’s actions in the Ukraine, the prime minister said. The fund held $3.3 billion in shares and bonds in the country at the end of 2020.”

“The EU will seek to reach agreement Sunday to provide Ukraine with military aid, and for the first time in the bloc’s history that will include lethal weapons in addition to non-lethal supplies, according to the EU’s foreign policy chief, Josep Borrell.”

“…British oil company BP Plc will exit its shareholding in Russian oil company Rosneft, a dramatic reversal after Russia’s invasion of Ukraine. BP has come under pressure from the U.K. government over its stake in the Russian oil major, with Western nations seeking to inflict as much economic pain as possible on Moscow.”

“…Officials from Kyiv will meet Russian counterparts at the Belarus border, hours after President Vladimir Putin put Russia’s nuclear forces on higher alert and even as fighting continues inside Ukraine. Ukrainian President Volodymyr Zelenskiy voiced skepticism that talks would yield results but said he was willing for them to happen if it meant any chance at peace.” Bloomberg reports in its rolling Ukraine update.

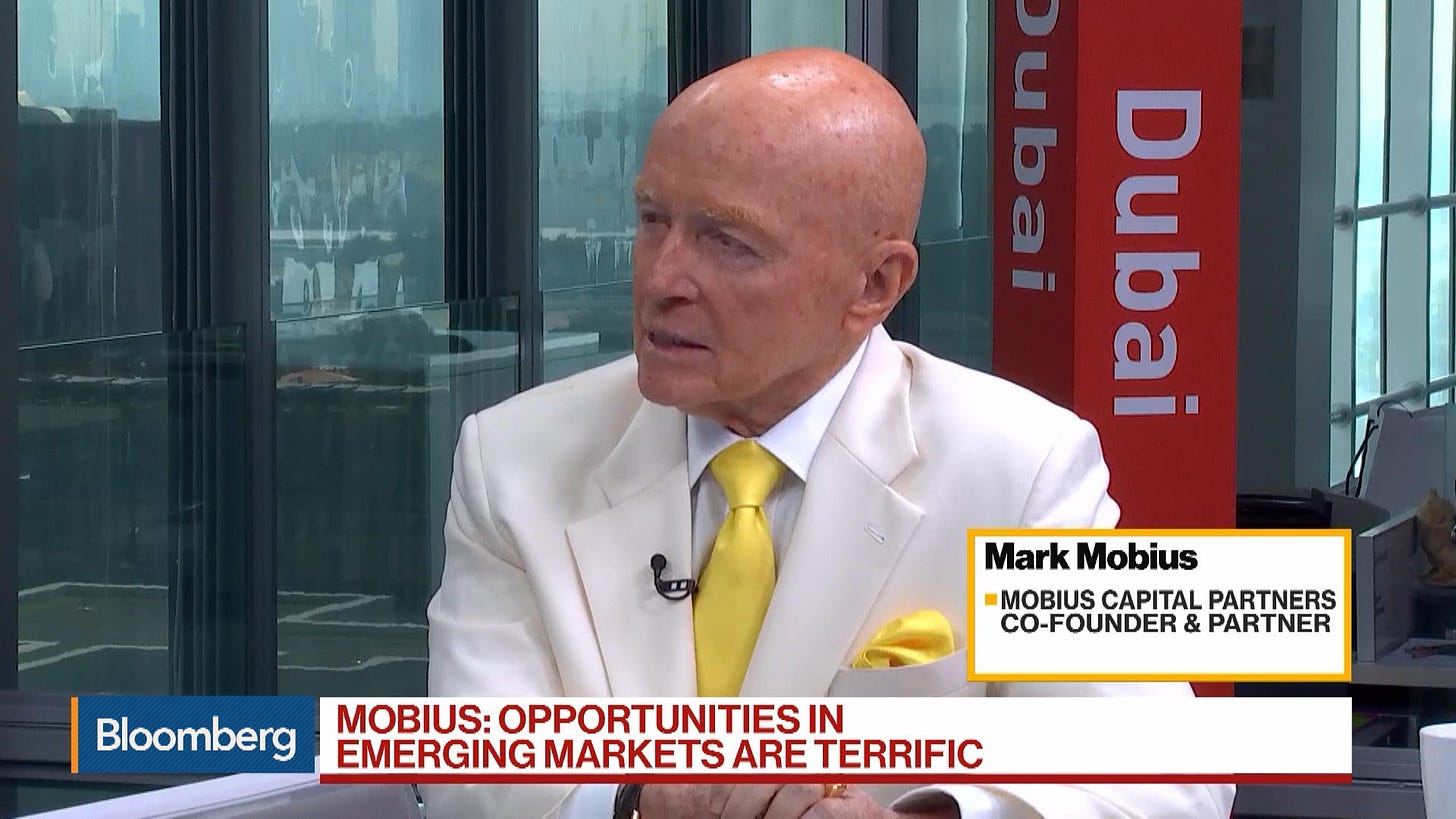

Mark Mobius: Buy Gold, Chinese Equities, Asian Markets

Markets Insider

“Famed investor Mark Mobius suggested adding Chinese and emerging market stocks to the list of traditional safe havens for investors looking to find more stable investments as Russia's spiraling conflict with Ukraine adds uncertainty to financial markets.”

"‘China will probably be in a fairly good position, given the fact that they are not exposed to the situation in Europe so much,’ he told Bloomberg in an interview Thursday. ‘I think China is going to be a safe haven, because they're going to continue to produce, they'll continue to grow,’ he said, adding that the economy is expected to cut interest rates.”

“Mobius, who has previously recommended portfolios should hold 10% in gold, reiterated support for the yellow metal. ‘I think (gold) is going to continue to go higher in view of the situation,’ he said, referring to a backdrop of soaring inflation and the rise of cryptocurrencies.”

“…Other Asian countries including Thailand, Vietnam, Malaysia, Indonesia, the Philippines, Taiwan, and Korea are also potentially insulated from the Russia-Ukraine conflict, according to him.” Markets Insider reports.

The “Michael Jordan” of Emerging Markets Investing

For a deeper dive into Mark Mobius’ views, as well as his life-long journey as an investor and his views on other assets today, check out our extensive interview with Mobius here:

India Preps Its Largest IPO Ever; 5% Stake in LIC Insurance Could Net $8 Billion

Reuters

“India's cabinet approved on Saturday a policy amendment allowing foreign direct investment of up to 20% in Life Insurance Corp of India (LIC), a government source said, a change aimed at easing the listing of the state-run insurer.”

“India's biggest insurance company plans to float a stake of 5% to raise about $8 billion next month for the south Asian nation's largest initial public offering (IPO) by far.”

“The amendment would allow foreign direct investors to buy up to 20% of LIC's shares through an automatic route, said the government source, who spoke on condition of anonymity after the cabinet meeting.”

“Under current rules, foreign investment is not allowed in the LIC, governed by the special parliament act, while 74% foreign direct investment is allowed in other private insurance companies.”

“…In the IPO, the firm will also earmark a certain percentage of shares for policyholders, not exceeding 10% of the offer size, while the portion reserved for employees will not be more than 5% of post-offer equity share capital, according to the IPO filing. LIC employed 114,498 people as of end-March, 2021.” Reuters reports.

France’s TotalEnergies Announces “Significant Discovery” Offshore Namibia

Al-Arabiya Business

“France’s TotalEnergies announced a ‘significant discovery’ of light oil and associated gas off the coast of Namibia, saying it would start assessing potential exploration.”

“The discovery comes after the International Energy Agency (IEA) warned last year that all fossil fuel exploration projects must cease immediately if the world is to keep global warming under control.”

“‘This discovery offshore Namibia and the very promising initial results prove the potential of this play in the Orange Basin, on which TotalEnergies owns an important position both in Namibia and South Africa,’ Kevin McLachlan, senior vice president for exploration at TotalEnergies, said in the statement.”

“…The French energy giant is the operator of the block with a 40 percent working interest, alongside QatarEnergy with 30 percent, Britain’s Impact Oil and Gas with 20 percent and Namibia’s NAMCOR with 10 percent.”

Centrist Candidates Far Behind Bolsonaro and Lula in Brazil Election Polls

Financial Times

“For a fleeting moment, Sergio Moro appeared poised to throw open Brazil’s presidential election. But with more than six months to go before the polls, the crusading anti-graft judge’s campaign is stumbling.”

“Buffeted by anaemic public support, fracturing political alliances and a reported lack of money, Moro’s inability to gain traction is the latest sign of how the much-heralded ‘third way’ candidates have failed to break the dominant grip of incumbent rightwing president Jair Bolsonaro and his main rival, longtime leftwing leader Luiz Inácio Lula da Silva, known as Lula.”

“Lula, who served two terms as president between 2003 and 2010, maintains pole position, with more than 40 per cent voter support. Backing for Bolsonaro has also begun to rise, with recent polling suggesting the former army captain has about 30 per cent support of the electorate.”

“Moro and the handful of other centrist candidates, meanwhile, are stuck in single digits.” The FT reports.

“There is no greater misfortune in the world than the loss of reason.”

― Mikhail Bulgakov, The Master and Margarita