Emerging Markets Daily - February 4

Aramco Eyes $50 Billion Listing, Xi and Putin Tighten Ties, Top EM Debt Trade: Turkish Banks, India's Indigo Soars to Profit, Lat-Am Leaders Seek China Support

The Top 5 Stories Shaping Emerging Markets from Global Media

Note to friends and fellow travelers: This was sent out Friday Feb 4 at 9:08 AM. For some reason, it failed to land in in-boxes for many of you. Thank you for those who reached out. Hopefully, this one lands.

Saudi Aramco Looks to Sell Record-Breaking $50 Billion in Shares

“The listing of shares would be by far the largest in the history of capital markets and could prove difficult to pull off. The company set the previous record for the world’s largest initial public offering in 2019, when it raised $29.4 billion on the Tadawul, or the Saudi stock exchange.”

Wall Street Journal

“Saudi Arabia has restarted plans to list more shares of Aramco, the world’s most valuable oil company, according to people familiar with the company’s strategy, with an ambition to sell as much as a $50 billion stake, which at current valuations would be 2.5% of the company.”

“Executives at state-owned Saudi Arabian Oil Co., as Aramco is known, have held discussions internally and with outside advisers about selling additional shares on the Riyadh stock exchange and a secondary listing, possibly in London, Singapore or other venues, the people said.”

“The listing of shares would be by far the largest in the history of capital markets and could prove difficult to pull off. The company set the previous record for the world’s largest initial public offering in 2019, when it raised $29.4 billion on the Tadawul, or the Saudi stock exchange.”

“The stake-sale effort is still in the planning stage, and could still be delayed or changed, the people said. Riyadh has floated several different plans over the years aimed at raising funds via Aramco, some of which have ultimately faltered or been abandoned.”

“The 2019 listing was a scaled-back version of the company’s original ambitions, which were to sell 5% of the company for as much as $100 billion, including on a major international exchange. But international investors were wary of governance issues and the priciness of the shares, which valued the company at $1.7 trillion. The domestic-only IPO ultimately listed 1.5% of the company.” Summer Said and Julie Steinberg report.

Geopolitics: Putin and Xi Tighten Their Embrace, Blast U.S and NATO

Nikkei Asia

“Russia's President Vladimir Putin and China's President Xi Jinping have condemned the U.S. and its allies for stoking the arms race in Asia-Pacific, and expressed opposition to the expansion of the North Atlantic Treaty Organization (NATO) in eastern Europe.”

“In a joint statement released after a bilateral meeting in the Chinese capital on Friday, both leaders vowed to strengthen cooperation within the framework of multilateralism and push back efforts by ‘individual states' to impose democratic standards on other countries.”

"‘The parties are seriously concerned about the creation by the U.S., the U.K. and Australia, or AUKUS, of a triangular security partnership,’ the statement said, adding that nuclear submarine cooperation would increase the risk of a regional arms race and nuclear proliferation.”

“The statement comes amid mounting tension over Ukraine. U.S. President Joe Biden has ordered that more than 3,000 troops be deployed to NATO members Germany, Poland and Romania. This was in response to Russia's mobilization of over 100,000 troops along its border with Ukraine. ‘[China and Russia] oppose further expansion of NATO, calling for it to abandon the ideological approaches of the Cold War era,’ the statement said.”

“Putin's talks with Xi on Friday mark the first in-person meeting between the two leaders since June 2019, when they met on the sidelines of the G-20 summit in Japan. It will also be Xi's first face-to-face meeting with a foreign leader since Cambodian Prime Minister Hun Sen visited Beijing in February 2020, just after the COVID-19 pandemic started.”

“According to earlier media reports -- including those from state sources in China and Russia -- Putin arrived on Friday afternoon and immediately began talks with Xi, reportedly offering a new deal to supply China with 10 billion cubic meters of natural gas.”

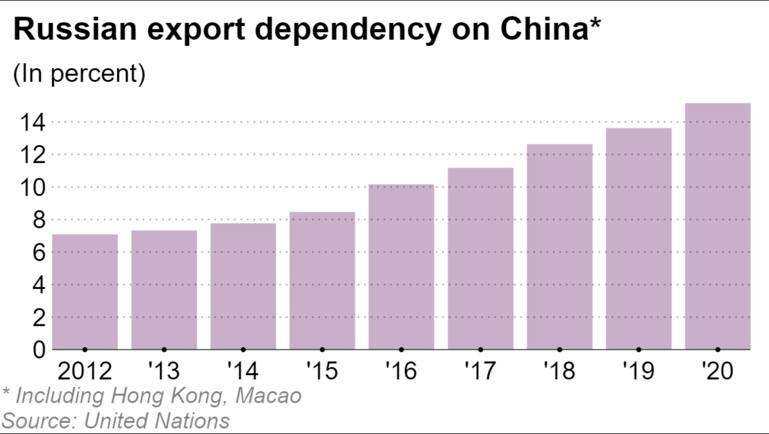

“Xi and Putin are expected to deepen economic and political ties, especially gas imports by China amid Western sanctions on Russia, which are restricting Moscow's sources of foreign currency.”

In his statement published by Xinhua on Thursday, Putin wrote that ‘we have plans to implement a number of large-scale joint projects,’ including constructions of four new units at nuclear power plants in China ‘with the participation of Rosatom State Corporation.’”

“Putin's statement added that ‘foreign policy coordination’ will also be ‘an important part of the visit.’” Nikkei Asia reports.

Top EM Debt Trade Hinges on Turkish Lira Truce

Bloomberg

“Turkish companies make up nine of the top 10 best emerging-market debt trades this year after bank earnings surged and a fragile calm descended on the country’s embattled currency.”

“While a global debt sell-off, defaults in Chinese real estate and simmering tensions over Ukraine have caused a 2.7% loss for developing market assets in the past six weeks, Turkish company debt has gained 5.7%. All but one of the top nine Turkish performers are lenders, with Akbank TAS leading gains after bank profits surged amid cheap central bank funding.”

“Turkish markets have stabilized since late December when President Recep Tayyip Erdogan launched a campaign to stem a slide in the currency sparked by the central bank cutting interest rates at his behest amid spiraling inflation.”

“….investors can draw comfort from history, as previous lira crises have produced few defaults for Turkish bonds in dollars or euros. Since 2007, only three bonds in those currencies for a total of $507 million have ended up suspending payments, according to data compiled by Bloomberg.” Bloomberg reports.

India’s Top Airline Indigo Swings Back to Profit For First Time in 2 Years

Reuters

“IndiGo, India's biggest airline, expects its revenue to recover from April this year as demand for travel rebounds, its CEO Ronojoy Dutta said on Friday, after the carrier reported its first quarterly profit in two years.”

“Airlines, whose profits have been ravaged by the coronavirus pandemic over the last two years, were seeing signs of recovery when the Omicron variant disrupted travel late last year.”

“Dutta said the airline saw a steep fall in bookings after Dec. 15 as India imposed curbs amid rising infections. And while travel is returning slowly due to pent up demand, he expects revenue to be lower in the January to March quarter before recovering.”

“IndiGo parent Interglobe Aviation (INGL.NS), which operates IndiGo, reported a net profit of 1.28 billion rupees ($17 million) in the three months to Dec. 31, compared with a loss of 6.27 billion rupees a year earlier.”

“Profits were also helped by stronger yields on international flights which were limited in number but saw strong traffic resulting in higher margins, said Dutta, who is hopeful that the government will soon ease restrictions on international travel.” Reuters reports.

Latin America Leaders Go for Economic Gold During Winter Olympics

Financial Times

“The opening pageantry of the Beijing Olympics at the Bird’s Nest stadium on Friday marks the start of serious business for two Latin American presidents making their own unusual bids for success during the Winter Games.”

“Argentina’s Alberto Fernández and Ecuador’s Guillermo Lasso are in China seeking support for national economic priorities — a sign of how Beijing’s influence is growing in Latin America.”

“Fernández will meet China’s president Xi Jinping on Sunday, where he is expected to sign Argentina up to the Belt and Road Initiative. Argentina will become the largest Latin American nation to join China’s flagship investment and infrastructure project so far.”

“Lasso, who will also meet Xi as well as China’s premier Li Keqiang, is on a two-pronged mission. He wants to renegotiate the terms of $4bn of Ecuadorean debt, while launching talks with China on a free trade agreement (FTA).”

“…For the Argentines in particular, the timing of the Beijing trip is delicate. The Fernández administration has just reached an outline agreement with the IMF to restructure $44.5bn of debt, but a final staff-level agreement is still pending and the IMF has said it was still working with its counterparts in Buenos Aires.”

“…As well as signing up to Belt and Road, the Argentines may seek more lending from China. The two countries have a $19bn currency swap arrangement in place that dates from 2009 and Buenos Aires wants to expand it by around $3bn.”

“Argentina's net foreign reserves are almost exhausted and estimates suggest that they fell below $6bn in December, while the country must make a $2.8bn payment to the IMF next month.”

“If the agreement with the fund falls through or is blocked by Argentina’s congress, Fernández might need a back-up plan to avert a debt crisis.”

“Debt is also an issue for Ecuador. During the leftwing government of Rafael Correa from 2007 to 2017, the Andean nation became heavily indebted to China and agreed to repay many loans with oil. Lasso has said Correa agreed unfavourable terms for Ecuador and wants to repay in cash instead, freeing up more oil to sell on the spot market, where prices are high.”

“Lasso’s other stated aim is an FTA, after years of steadily rising Ecuadorean trade with China.” The FT reports.

“The man who moves a mountain begins by carrying away small stones.”

Confucius