Emerging Markets Daily - February 6

China's Oil Inventories Dwindling, EM Stocks Rising Amid Fed Storm, New US Strategy To Counter China, MENA Growth: Fitch, Peru Copper Output Rising

The Top 5 Stories Shaping Emerging Markets from Global Media - February 6

China May Need to Rebuild Oil Inventories, Vitol Says

Bloomberg

“Oil prices, already up around 20% this year, could be boosted by China potentially replenishing its inventories and financial investors increasing their long positions, according to Vitol Group.”

“The world’s biggest independent oil trader said there’s a chance China looks to build up stockpiles following the Lunar New Year holiday. ‘I think it’s fair to state that China is at bare-minimum’ in terms of the volumes of oil state-owned enterprises need to hold, Mike Muller, Vitol’s head of Asia, said Sunday on a podcast hosted by Dubai-based consultant Gulf Intelligence. ‘All eyes are on what happens in China after the Chinese New Year. There’s a feeling that some restocking will be required.’”

“Crude posted a seventh-straight gain last week, with Brent climbing above $93 a barrel. Many traders believe it’s a matter of time before prices reach triple digits. Demand has largely held up in spite of the spread of the omicron variant of the coronavirus, while many major producers are struggling to raise output.”

“For China, the world’s biggest oil importer, prices aren’t yet high enough to dent consumption, according to Muller. ‘It doesn’t look like they’ve had their foot off the pedal,’ he said. ‘Up until the very last day before Chinese New Year, the state owned enterprises seemed interested in buying crude at these prices.’”

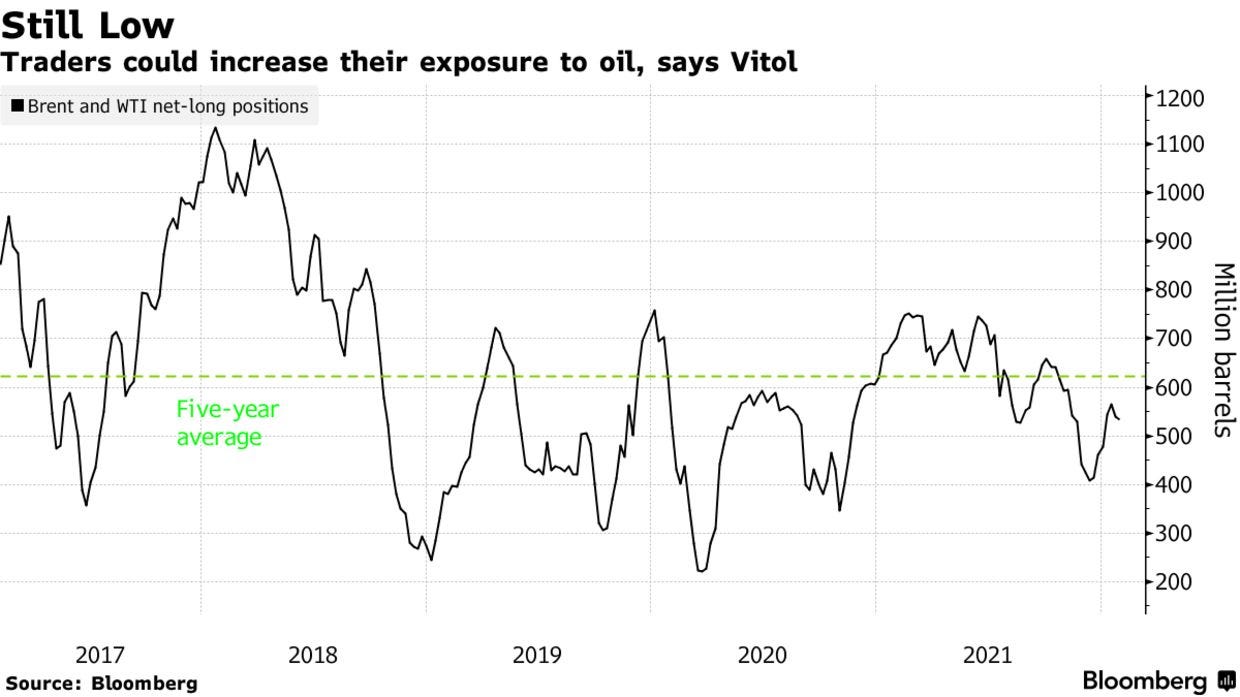

“Hedge funds and other investors could increase their exposure to oil given how tight the market is and with inflation rising globally, according to Vitol. Money managers have raised their net-long positions for crude since mid-December, but to levels still below the average for the past five years, according to data compiled by Bloomberg.” Paul Wallace reports.

EM Investors Dive for Stocks Amid Fed Storm

Reuters

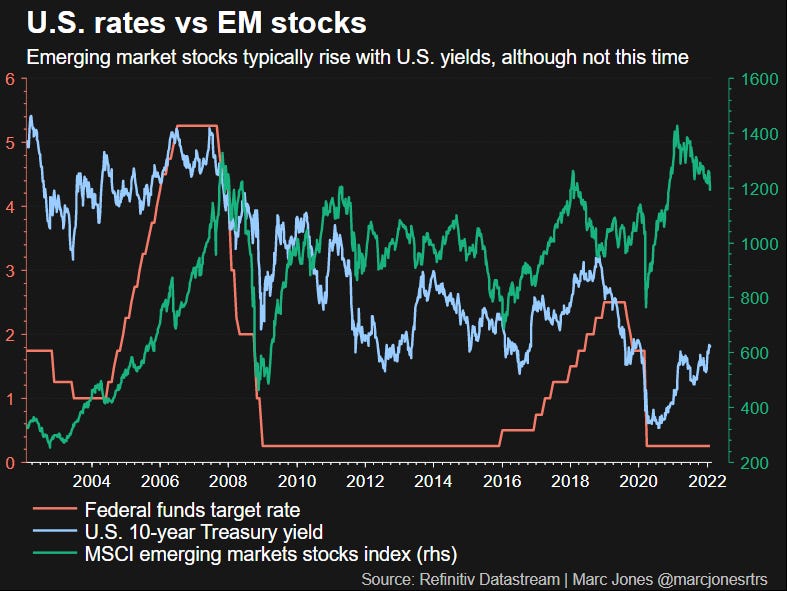

“Developing world investors, buffeted by various ‘taper tantrums’ over the last decade, are now nervously watching as the rainmaker of global markets - the U.S. Federal Reserve - readies its most aggressive rate hike cycle in 17 years.”

“More hot jobs data on Friday drove the benchmark for world borrowing costs, the 10-year U.S. Treasury yield , to its highest level in two years, prompting yet more gnashing of teeth among emerging market money managers already having a tough year.”

“Deutsche Bank's analysts point out that while some currencies managed to save face here and there, anyone who took the approach of hedging forex risk would have seen only one year that started worse than this one since 2010.”

“Fed tightening has not been bad news for all EM assets though. EM stocks measured by MSCI's 25-country MSCIEF are flat for the year, which means they have done 5% better than their developed market peers, which is something of a pattern according to Morgan Stanley's analysts.”

"‘The outperformance of EM (stocks) after the first (Fed) hike is notable,’ they said, noting that in Fed hike cycles since 1980, the MSCIEF has been up 17% on average six months after the first rate increase is delivered. Morgan Stanley analysts have not yet made the call to ‘buy EM,’ but they say ‘it suggests that the time to get more bullish on EM may be approaching.’”

“The massive outperformance from Latin American stocks in January could be a harbinger of more EM gains.”

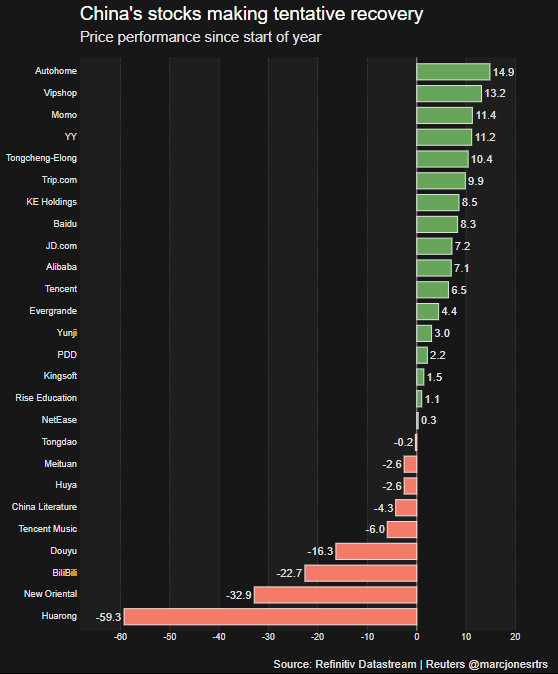

“One silver lining in last year's rout of Chinese stock markets is that many investors think they have a good chance of rebounding this year with authorities there now providing support to the economy again.”

“Swiss-based European fund heavyweight Pictet upgraded its view on Chinese stocks to ‘positive’ this week on the basis of that support, and because they would probably be a good hedge in the event of a full-blown Russia-Ukraine military conflict.”

“However, a more aggressive tightening cycle by the Fed and other top central banks could quickly reignite bond market pressures, said JPMorgan's head of emerging market local markets and sovereign debt strategy, Jonny Goulden.” Reuters reports.

Geopolitics: U.S To Unveil New Asia-Pacific Strategy to Counter China

Wall Street Journal

“The Biden administration is preparing to unveil its first broad economic strategy for the Asia-Pacific region, a move awaited by U.S. allies and American business groups that are uneasy about China’s expanding influence in the region.”

“With the new Indo-Pacific Economic Framework, the U.S. aims to work more closely with friendly nations on issues including digital trade, supply chains and green technology. The framework is aimed at filling the hole in U.S. Asia strategy left by its 2017 departure from the Trans-Pacific Partnership, a robust trade agreement the U.S. had helped to design as a counterweight to China.”

“While details of the plan have yet to be released, the framework isn’t expected to try to return the U.S. to the TPP. A cross-section of economists, diplomats and trade experts say the administration faces a battle in creating an effective pact that brings together many of Asia’s economies to set the rules of engagement for commerce and new technology.”

“President Biden isn’t expected to offer tariff cuts and other traditional market-opening tools to trading partners, which are opposed by U.S. labor groups and their Democratic allies as well as some Republicans on grounds that they come at the expense of U.S. jobs and manufacturing.”

“At the same time, these so-called market-access measures are considered essential to building stronger U.S. relations in the region, particularly with less-developed nations in South and Southeast Asia seeking to sell more agricultural and manufacturing products in the U.S. market.” Yuka Hayashi reports.

MENA Economies Set to Outpace Global Growth This Year

The National

“The Middle East and North Africa is set to be the only region in the world to record a rise in economic growth this year, driven by higher oil prices and an acceleration in business-friendly reforms, bucking the global trend of slower expansion.”

“The Mena region's economies are forecast to expand 4.3 per cent in 2022, from an estimated 3.7 per cent in 2021, amid higher oil output and a sustained recovery in the non-oil sector, Fitch Ratings said in its Mena Key Themes 2022 report.”

“Oil-exporting countries in the region are forecast to lead the growth as their economies expand 4.4 per cent in 2022, from an estimated 3.5 per cent in 2021, it said. ‘Mena will be the only region worldwide to see growth rate rising in 2022,’ the rating agency said. ‘This is in contrast to other regions worldwide, where growth will slow down or remain flat.’”

“Oil prices, which have already rallied about 20 per cent so far this year, are likely to surpass $100 per barrel due to strong global demand, market strategists said last week. Continuing worries about supply disruptions fuelled by frigid US weather and political tension among major world producers have fuelled the oil price gains.”

“Moreover, countries in the region are pursuing long-term economic transformation efforts. The UAE, the Arab world’s second-biggest economy, has embarked on economic, legal and social structural reforms aimed at strengthening its business environment, to attract foreign investment, draw high-skilled talent and incentivise companies to set up or expand their operations in the country.”

“…Growth in Egypt, the Arab world's third-biggest economy, will average 5.3 per cent in the financial years of 2021-2022 and 2022-2023, mainly due to a rebound in investment, rising tourist arrivals and strong private consumption, Fitch said.”

“However, a ‘a two-speed recovery’ will unfold across the Mena region this year as many of the smaller economies will not fully rebound to their pre-pandemic real economic output, the report said.” Deena Kamel reports.

Peru Copper Output Up Almost 7% Despite Social Unrest

Mining.com

“Copper output in Peru, the world’s second largest producer after Chile, increased almost 7% to 2.3 million tonnes in 2021 despite several protests that paralyzed some of the country’s key operations.”

“According to the latest report by the Ministry of Energy and Mines of Peru(MINEM), precious metals output also increased last year, with gold production rising 9.7% and silver growing by 21.5% in 2021.”

“…Protests against mining companies have skyrocketed since President Pedro Castillo took office in July. The socialist leader swept to power pledging to strike a new deal with the copper mining sector and redistribute profits to Andean communities like those around Antamina, MMG’s Las Bambas and Glencore’s Antapaccay.”

“Social unrest in the nation’s mining areas deepened global concerns around a looming deficit of copper, considered a key metal in the world’s transition to greener technologies.”

“According to estimates from CRU Group, the copper industry needs to spend more than $100 billion to close what could be an annual shortage of 4.7 million tonnes by 2030.”

“Used in everything from construction materials to batteries and engines, copper is both an economic bellwether and a key ingredient in the push toward renewable energies and electric vehicles.”

“If producers fail to address the deficit, prices will keep rising and present a challenge to the world leaders, who are counting on a worldwide energy transition to fight climate change.” Mining.com reports.

“I never guess. It is a shocking habit destructive to the logical faculty.”

Arthur Conan Doyle