Emerging Markets Daily - February 7

EM At Center of Crypto Growth, Potential US-Iran Deal and Oil Prices, Indonesia Economy, TotalEnergies Ramps Up in Africa, AD Ports Raises $1B+ In Share Sale

The Top 5 Stories Shaping Emerging Markets from Global Media - February 7

Emerging Markets At Forefront of Massive Crypto Growth

Oxford Business Group

“Emerging markets were at the forefront of last year’s massive growth in global cryptocurrency adoption. With this growth widely tipped to continue into 2022, a range of countries will see their crypto markets mature or expand.”

“For example, Nigeria – Africa’s biggest cryptocurrency market – was the world’s leading country for cryptocurrency adoption in 2020, with Vietnam and the Philippines coming second and third, respectively.”

“The worldwide growth in cryptocurrency continued throughout 2021. By the end of the year the segment’s total market capitalisation had grown by 187.5%, while the entire market was worth a combined $2trn.”

“Meanwhile, according to leading research firm Chainalysis, worldwide adoption had jumped by over 880% year-on-year by August. Throughout 2021 the most rapid adoption rates were once again seen in emerging markets. In Chainalysis' annual ranking, Vietnam, India and Pakistan were first, second and third, respectively, while the US was the only mature economy in the top 10.”

“…In light of this and other considerations, many anticipate that cryptocurrency use will expand in emerging markets going forward. Indeed, there are already signs of what shape this expansion might take in different economies.

“In December last year, for instance, it was announced that the Dubai World Trade Centre will become a crypto zone and regulator for cryptocurrencies and other virtual assets. Elsewhere, last year the Philippine Stock Exchange similarly announced that it is seeking to become a platform for trading crypto assets. However, it is still waiting on authorities to issue rules regarding crypto trading.”

“Crypto is not without its detractors, however. At the end of January Tobias Adrian – head of the IMF’s monetary and capital markets department – told the Financial Times that cryptocurrencies are causing ‘destabilising’ capital flows in emerging markets. The IMF has also recently urged El Salvador to reverse its decision – taken in September last year – to become the first country to accept Bitcoin as legal tender.” Oxford Business Group reports.

Potential Iran-US Deal Could Take Steam Out of the Oil Rally

Reuters

“New signals that talks between U.S. and Iranian officials may be nearing a conclusion could take steam out of the oil rally, traders said, after U.S. and Brent crude reached multi-year highs on Friday.”

“Anticipation that Washington and Tehran have made progress on reviving a deal restricting the OPEC country's nuclear weapons development would boost crude supply. If the United States lifts sanctions on Iran, it could boost oil shipments, adding to global supply.”

“…On Friday, the United States restored sanctions waivers allowing international nuclear cooperation with Iran on projects designed to make it harder for Iran's nuclear sites to be used to develop weapons.”

“Another senior State Department official on Friday said the waiver was needed to permit technical discussions about reviving the deal but was not a signal that the United States was on the verge of reaching an agreement on its restoration.”

“Speaking on condition of anonymity, a European official said top envoys to the Vienna talks - which are indirect because Iran has so far refused to sit down with U.S. diplomats - were likely to meet on Tuesday in the Austrian capital.”

"‘President (Joe) Biden still wants us to negotiate in Vienna ... That's a symbol or a sign of our continued belief that it is not a dead corpse, that we need to revive it because it is in our interest,’ Rob Malley, U.S. envoy for Iran, told MSNBC Sunday night.”

“Iran’s foreign minister said on Saturday that a U.S. move to restore sanctions waivers to Tehran was not enough and Washington should provide guarantees for the revival of the 2015 nuclear deal with major powers.” Laura Sanicola reports.

Indonesia Economy Bounces Back in 2021 With Solid Growth

Nikkei Asia

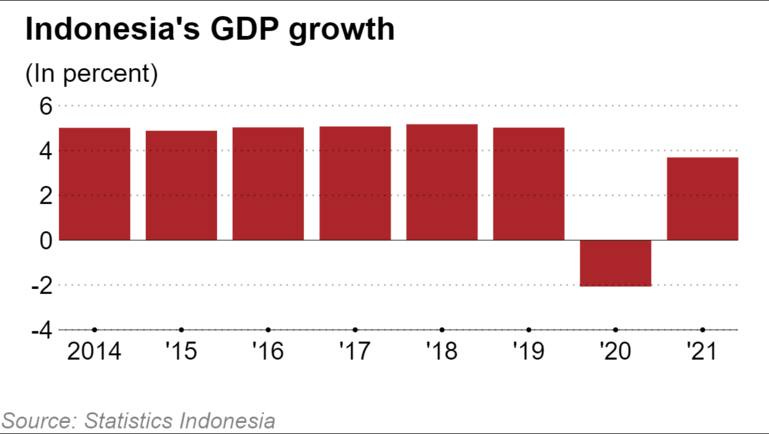

“Indonesia's economy returned to growth in 2021, rebounding from its first contraction in two decades the year before as coronavirus-induced restrictions eased and business got back into gear.”

“The gross domestic product of Southeast Asia's largest economy climbed 3.69% from a year earlier, government data showed on Monday, bouncing back from a 2.07% contraction in 2020. The finance ministry had previously forecast growth at 3.7%.”

“…Meanwhile, the country's fourth-quarter GDP, also released on Monday, showed a year-on-year growth rate of 5.02%, accelerating from the third quarter as daily COVID cases dropped dramatically from highs during the summer. This was higher than the median forecast of 4.90% by 17 economists polled by Reuters.”

“GDP growth is expected to accelerate this year, but concerns remain as Indonesia enters a third wave of COVID-19 driven by the highly transmissible omicron variant. Daily new cases have risen close to 30,000 in recent days, compared to below 300 at the start of the year.”

“..The U.K.'s Capital Economics said in a memo on Monday that Indonesia's economic recovery is ‘now entering a more difficult phase,’ adding that drags on the economy will come from falling commodity prices and a tighter monetary policy.” Shotaro Tani reports.

French Giant TotalEnergies Ramping Up Africa Projects

“TotalEnergies is creating a commercial juggernaut in Africa that will see it invest billions of dollars in the next five years. The company with operations in at least 14 African countries is looking to invest over $10 billion in East Africa’s energy sector, promising thousands of jobs and major investment opportunities for local contractors.”

The East African

“Uganda this week moved a step closer to joining the league of oil producers after global oil majors TotalEnergies and China’s CNOOC signed the final investment decision with the government in Kampala.”

“The long-awaited move, delayed by a myriad of hurdles, including tax disputes, security, operational and funding challenges and opposition from climate activists, has paved the way for investments towards first oil in 2025.”

“The progress in the Ugandan projects has given the French oil giant the credence it needs in efforts to firm up plans to increase its footprint on the continent’s energy sector.”

“Analysts say TotalEnergies is poised to become a major player in the exploration and exploitation of fossil fuels in East and Southern Africa after recently announcing that it was resuming development of natural gas fields in northern Mozambique, which was disrupted by militant insurgency.”

“But calm has since returned after Rwandan military and Southern African Development Community forces routed ISIS-affiliated insurgents from the troubled Cabo Delgado Province.”

“Incidentally, two days before the Kampala deal on February 1 TotalEnergies CEO Patrick Pouyanne had visited Rwanda, where he announced upcoming energy joint projects with the Kagame administration.”

“TotalEnergies is creating a commercial juggernaut in Africa that will see it invest billions of dollars in the next five years. The company with operations in at least 14 African countries is looking to invest over $10 billion in East Africa’s energy sector, promising thousands of jobs and major investment opportunities for local contractors.”

“…In Uganda, besides the Tilenga, Kingfisher and Eacop, which the joint venture partners are investing in, there is a separate private consortium-led $4 billion investment in the 60,000 barrels of oil per day oil refinery at Kabaale.”

“There are also other private sector ventures in infrastructure such as hotels and other facilities to support the oil projects, pushing the total oil-related investments to around $20 billion over the next three to five years, according to Energy Minister Ruth Nankabirwa.” Julius Barigaba reports.

Abu Dhabi Ports Raises $1.1 Billion in Share Sale

Bloomberg

“Abu Dhabi Ports Group, controlled by sovereign wealth fund ADQ, raised 4 billion dirhams ($1.1 billion) from a share sale and plans to list on the emirate’s stock market on Tuesday.”

“The proceeds will be used to finance growth, allowing Abu Dhabi Ports to ‘accelerate local and international expansion plans,’ according to a statement. The company offered 1.25 billion shares at 3.20 dirhams ($0.87) each, people familiar with the matter said last month.”

“Abu Dhabi, the wealthiest of the United Arab Emirates’ seven sheikhdoms, has been at the center of a push to revive IPOs. The city’s exchange -- also owned by ADQ -- is offering sweeteners that include flexibility on the minimum stake size required for share sales and promises to reduce or forgo listing fees.”

“AD Ports, established in 2006, contributes about 14% of Abu Dhabi’s non-oil economic growth, according to the firm’s website. The company has recently become more active in capital markets, selling a debut bond of $1 billion in April and signaling plans to issue more debt to support investment.” Shaji Mathew reports.

“When one door of happiness closes, another opens, but often we look so long at the closed door that we do not see the one that has been opened for us.”

Helen Keller