Emerging Markets Daily - February 8

Logistics Pros Bullish on China/SE Asia, US-Listed China Stocks Pop, Macron-Putin Ukraine Talks, EM Banks Vulnerable to Fed Tightening, Vietnam's Vin Group Losses

The Top 5 Stories Shaping Emerging Markets from Global Media - February 8

Logistics Pros Bullish on China, SE Asia, and India Growth

Air Cargo News

“The latest Emerging Markets Logistics Index from logistics firm Agility and consultant Transport Intelligence found the supply chain sector was split over global economic prospects in the year ahead.”

“Of the 756 professionals in the logistics industry that took part, 29.7% felt 2022 will see moderate to strong growth in the global economy. However, 28.9% felt that a global recession in 2022 is likely.”

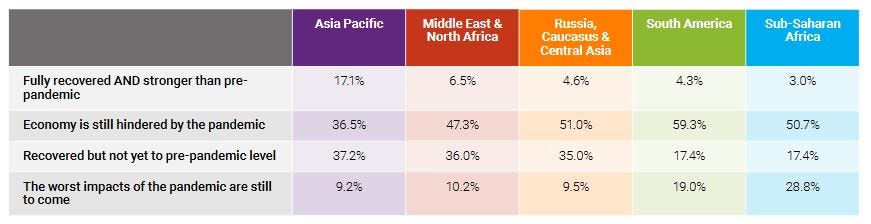

“Looking at specific ‘emerging’ regions, the general consensus was that economies are showing signs of recovery but have yet to reach pre-pandemic levels and were still hindered by the pandemic.”

“‘Asia Pacific’s regional economy exhibits the strongest economic recovery from the Covid-19 pandemic of the five regions examined but is still below the pre-pandemic level, according to survey respondents,’ the report stated.”

Source: Agility/Ti

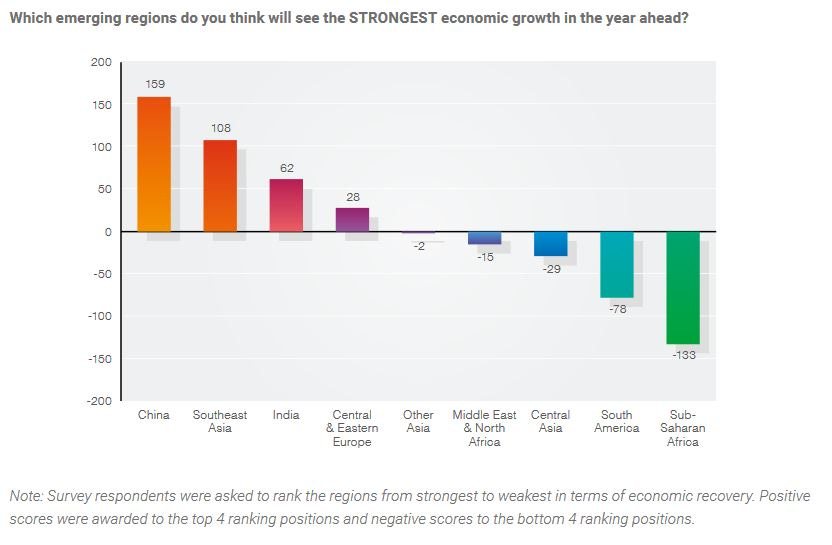

Source: Agility/Ti

“China, Southeast Asia and India (in that order) were expected to report the strongest recovery in 2022, while Sub-Saharan Africa, South America and Central Asia the weakest.”

“When it comes to freight rates, 19.9% expect airfreight prices to normalise in the second half of this year while 24% expect it to take until 2023. Just over 11% feel higher rates are here to stay.”

“Respondents were split on when container port congestion, which is one factor that has fuelled airfreight demand, would ease, with 29.2% expecting it to happen in the second quarter of 2022, 27.7% expecting improvements in the second half and 19.8% predicting next year or later.” Damian Brett reports.

U.S-Listed Chinese Stocks Pop as State Funds Buy Stocks

Bloomberg

“Chinese stocks listed in the U.S. are finally getting a much-needed dose of good news after state-backed funds were said to have entered the local market to buy shares to help stem declines that have accelerated in recent weeks.”

“American depositary receipts of large-cap technology stocks surged, with Alibaba Group Holding Ltd., JD.com Inc. and Pinduoduo Inc. gaining at least 1% Tuesday. Meanwhile, shares of embattled ride-hailing firm DiDi Global Inc. and search engine giant Baidu Inc. each rose by about 1% or more.”

“The buying by China’s so-called ‘national team’ comes as the domestic stock market reopened for trading after being closed for a week for its annual Lunar New Year holiday. Before that break, the nation’s benchmark equity gauge had fallen into a bear market amid growing concern about the economy and a resurgence of Covid-19 cases.”

“U.S. investors are hoping that renewed support from state funds will also help halt the selloff seen in shares listed outside of Mainland China. The Nasdaq Golden Dragon China Index -- which tracks firms on U.S. exchanges that conduct a majority of their business in China -- has plunged about 60% from a record last year, including a drop of 6% to begin 2022. The gauge rose as much as 3.3% Tuesday.” Matt Turner reports.

France Says Putin Moving To De-Escalate Ukraine Crisis, But Moscow Demurs

Financial Times

“French officials said Vladimir Putin had moved towards de-escalating the Ukraine crisis by promising not to undertake any new ‘military initiatives’ and agreeing to withdraw thousands of Russian troops from Belarus after the completion of planned exercises.”

“If an agreement — brokered during talks with his French counterpart Emmanuel Macron on Monday — is confirmed by Putin, it could ease tensions in the region after Russia amassed more than 100,000 troops on Ukraine’s borders.”

“Dmitry Peskov, Kremlin spokesperson, told the Financial Times that Putin and Macron were ‘prepared to continue dialogue’ on the French proposals but that the discussions had yet to fully assuage Moscow’s concerns. He told reporters on Tuesday that Putin and Macron had yet to reach an agreement.”

“‘It’s impossible, because France is a member of the EU, and of Nato, where it is not the leader. A different country in that bloc is the leader. So how can we speak about any ‘agreements’?’ Peskov said. Russia and Belarus are this month conducting huge joint military exercises involving a contingent of as many as 30,000 Russian troops.”

“Peskov said Russian forces, some of which have travelled from as far as the Pacific in recent weeks, would leave after the drills but declined to give a date for their withdrawal. Asked about a reported French proposal to give Ukraine a neutral status akin to Finland’s during the cold war, Peskov said Kyiv’s pledge to retake the annexed Crimean peninsula amounted to ‘anti-Finlandisation’ and warned that western countries were not taking Russia’s security concerns seriously enough.”

“‘For now, of course, we can’t state that we’re sensing any real ways towards a solution,’ Peskov said. ;Tensions are rising day by day [ . . . ] so de-escalation is really, really needed.’”

“Neither Putin nor Macron referred directly to a deal at a news conference after five hours of talks, although France’s president said Putin had assured him of his willingness to talk about de-escalation. Putin was combative and critical of Nato, blaming the west and Ukraine for the crisis, but said Russia would do ‘everything possible to reach compromises acceptable to everyone’ on European security. The FT reports.

EM Banks Could Be Hit Hard by US Interest Rate Hikes, Moody’s Says

Reuters

“Banks in Latin America and emerging Europe are most exposed to dollarization among developing economies, making them vulnerable to weaker local currencies and increasing withdrawals in the face of tighter U.S. monetary policy, Moody's said on Monday.”

“Interest rate hikes from the U.S. Federal Reserve are likely to slow capital flows to emerging markets, weakening countries' currencies and economic growth, and potentially triggering credit risk at highly dollarized banks, Moody's said.”

"‘Banks with large volumes of foreign-currency loans and deposits on their balance sheets are vulnerable to a spike in credit losses and pressure on their profitability and liquidity when the local currency drops sharply in value,’ Moody's analysts wrote.”

"‘It becomes harder for unhedged borrowers to repay foreign-currency loans, and depositors are prone to withdraw funds. High dollarization also threatens financial stability in times of crisis if central banks have insufficient reserves of foreign currency to bail out banks with dollar shortfalls.’”

“Moody's found that dollar deposits are highest across banks in Latin America, emerging Europe and the former Soviet countries, though relatively low in Asia Pacific and moderate in Africa. Higher exposure in Gulf states is offset by strong foreign currency reserves.” Reuters reports.

Vietnam’s Vin Group Loses $1B, Pledges to Ramp Up EVs

Nikkei Asia

“Top Vietnamese conglomerate Vingroup suffered a pretax loss of roughly 23.9 trillion dong ($1.05 billion) at its manufacturing segment last year due to sluggish sales of gasoline-powered cars at home and growing investments in the emerging electric vehicle business.”

“Vingroup's sales of gasoline autos rose 21% to about 36,000 units in 2021. But the group's assembly plant built during 2019 in northern Vietnam is operating far below capacity, as it can produce 250,000 vehicles a year.”

“The company is drastically downsizing its manufacturing segment, which consists mostly of autos. In May, Vingroup said it will stop making smartphones and televisions. Losses in manufacturing have expanded more than 70% from 2020.”

“Vingroup will cease production of gasoline vehicles this year and concentrate resources on the EV business launched in late 2021. Orders for electric vehicles, including those in Western markets, totaled roughly 35,000 units as of early January, according to Vingroup.”

“The group will continue engaging in upfront investments, including those for building a lithium-ion battery factory and developing a U.S. sales network. Pham Nhat Vuong, the founder and chairman of Vingroup, told local media that further losses in the automotive business are anticipated in the near term.” Nikkei Asia reports.

“Your time is limited, so don’t waste it living someone else’s life.” - Steve Jobs