Emerging Markets Daily - January 10

EM Bond Fund Bets on Sri Lanka Default, Putin Vows to Block 'Color Revolutions,' Mongolia's Sizzling Stocks, IMF's EM Warning, Whither Nigeria After Buhari?

The Top 5 Stories Shaping Emerging Markets from Global Media - January 10

Top EM Bond Fund Bets on Sri Lanka Default Windfall; China FM in Colombo

Bloomberg and Asharq Al-Awsat

“A top emerging-market money manager who scooped up gains with Ecuador’s restructured bonds is now waiting for Sri Lanka to default to load up on the nation’s debt.”

“Carlos de Sousa, who oversees a $3.8 billion developing-nation bond fund at Vontobel Asset management in Zurich, expects the South Asian country to run out of money to pay creditors by mid year -- even after the central bank vowed to meet this month’s obligations. The Venezuela-born investor already owns the bonds and is waiting for a default-led selloff to buy more, betting the average recovery value of the notes could top current prices.”

“Most of Sri Lanka’s external bonds have lost about half of their value since the beginning of the pandemic to trade around 50 cents on the dollar as foreign-exchange reserves dwindled…Sri Lanka has $15 billion in external bonds outstanding, with the next principal payment due in two weeks. On Wednesday, the central bank governor tweeted that $500 million had been set aside to pay back holders on Jan. 18. In July, the nation has another principal payment of $1 billion.”

“…Other frontier-market bonds rewarded investors with stellar returns last year. Zambia’s bonds soared over 30 cents in the week following the election of a market-friendly president, handing creditors returns that approached 50%. In Belize, a debt restructuring spurred double-digit gains for investors.”

“For this year, de Sousa’s highest-conviction trades include overweight positions in Argentina and Tunisia, where he expects deals with the IMF to materialize in 2022. He’s also scooped up bonds from the Bahamas, a country he says is too rich to have a double-digit yield, as well as GDP warrants from Ukraine, dollar bonds from Petroleos Mexicanos, Egypt debt and euro-denominated notes from the Ivory Coast.” Bloomberg reports.

Meanwhile, Asharq Al-Awsat reports that “Chinese Foreign Minister Wang Yi was in Sri Lanka on Sunday seeking to advance China's ambitious Belt and Road Initiative, as the island nation looked to Beijing for help as it tries to rescue itself from a foreign currency and debt crisis.”

“Wang arrived in Sri Lanka on Saturday from the Maldives on the last leg of a multi-city trip that also took him to Eritrea, Kenya and Comoros in Africa. In Sri Lanka, Wang was scheduled to meet President Gotabaya Rajapaksa and Prime Minister Mahinda Rajapaksa. Later, Wang and Prime Minister Rajapaksa were to speak at Colombo’s Port City, a reclaimed island developed with Chinese investment.”

“The diplomatic visit comes as Sri Lanka faces one of its worst-ever economic crises, with foreign reserves down to around $1.6 billion, barely enough for a few weeks of imports. It also has foreign debt obligations exceeding $7 billion in 2022, including repayment of bonds worth $500 million in January and $1 billion in July.”

“The declining foreign reserves are partly due to infrastructure built with Chinese loans that don’t generate revenue. China loaned money to build a sea port and airport in the southern Hambantota district, in addition to a wide network of roads.”

“Central Bank figures show that current Chinese loans to Sri Lanka total around $3.38 billion not including loans to state-owned businesses, which are accounted for separately. ‘Technically we can claim we are bankrupt now,’ said Muttukrishna Sarvananthan, principal researcher at the Point Pedro Institute of Development. ‘When you have foreign reserves in the red, that means you are technically bankrupt.’”

“The situation has left households facing severe shortages. People wait in long lines to buy essential goods like milk powder, cooking gas and kerosene. Prices have increased sharply and the Central Bank says the inflation rate rose to 12.1% by the end of December from 9.9% in November. Food inflation increased to over 22% in the same period.” Asharq Al-Awsat reports.

Putin Vows to Block “Color Revolutions” After Sending Troops to Kazakhstan

Financial Times

“Russian president Vladimir Putin vowed that a Moscow-led security bloc would protect its allies from ‘colour revolutions’ in its neighbourhood after sending troops to quell unrest in Kazakhstan last week.”

“He said that the Russia-led forces were securing key infrastructure to ‘normalise the situation’ and help ‘restore order to the country’. Putin’s remarks, his first public comments since the unrest began, underscored Moscow’s willingness to back its allies in former Soviet states against street protests, which the Russian leader blamed on external meddling.”

“‘Of course, we understand that the events in Kazakhstan aren’t the first and will be far from the last attempt to interfere in the internal affairs of our states,’ Putin said. He claimed that protesters had used ‘Maidan technologies’, a reference to a 2014 uprising that toppled a pro-Russian president in Ukraine, and cited other pro-democracy movements that ousted Moscow-aligned rulers in Georgia, Ukraine and Kyrgyzstan in the 2000s.”

“‘We won’t let anyone destabilise the situation in our home and won’t allow the so-called colour revolution scenario to play out,’ Putin said. At least 164 people were killed, including three children, and almost 8,000 arrested in Kazakhstan, according to the country’s authorities.” The FT reports.

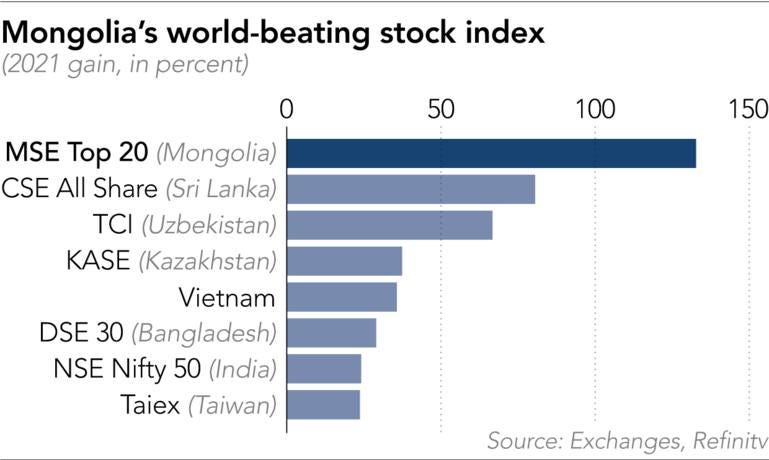

Mongolia Stock Market Sizzles With 133% Gain

Nikkei Asia

“Mongolia has long been a force on the world's resource markets, due to its ample deposits of coal, copper and gold. These days, though, it is the country's stock market that is turning heads.”

“The MSE Top 20 Index, the national benchmark, soared 132.7% last year, by far the world's best performance, as the Mongolia Stock Exchange, set up shortly after the end of one-party communist rule, marked its 30th anniversary.”

“Mongolia made it through most of 2020 unscathed by COVID outbreaks. But last year, lockdowns and pandemic-related disruptions to cross-border trade with China amid an election campaign prompted the government to dole out aid to citizens, including utility bill waivers and cash handouts.”

“Many foreign investors gave up on Mongolia in recent years as sluggish commodity prices and policy uncertainty took the shine off the country. FTSE Russell dropped Mongolia from the candidate list for its global frontier market share indexes and at least three Mongolia-focused offshore stock funds shut down.”

“The Hong Kong-based Asia Frontier Fund, however, doubled down, giving Mongolia the highest weighting of the 15 markets where it invests, with stakes in top cashmere producer Gobi, APU, leather company Darkhan Nekhii and baked goods maker Talkh Chikher.” Nikkei Asia reports.

EM Economies Must Prepare for Fed Policy Tightening

IMF Blog

“For most of last year, investors priced in a temporary rise in inflation in the United States given the unsteady economic recovery and a slow unravelling of supply bottlenecks.”

“Now sentiment has shifted. Prices are rising at the fastest pace in almost four decades and the tight labor market has started to feed into wage increases. The new Omicron variant has raised additional concerns of supply-side pressures on inflation. The Federal Reserve referred to inflation developments as a key factor in its decision last month to accelerate the tapering of asset purchases.”

“These changes have made the outlook for emerging markets more uncertain. These countries also are confronting elevated inflation and substantially higher public debt. Average gross government debt in emerging markets is up by almost 10 percentage points since 2019 reaching an estimated 64 percent of GDP by end 2021, with large variations across countries.”

“But, in contrast to the United States, their economic recovery and labor markets are less robust. While dollar borrowing costs remain low for many, concerns about domestic inflation and stable foreign funding led several emerging markets last year, including Brazil, Russia, and South Africa, to start raising interest rates.” IMF Blog reports.

Whither Nigeria After Buhari?

Africa Confidential

“With presidential and national assembly elections due in February 2023, political campaigns will go into overdrive this year as alliances are made and deals struck. Outgoing President Muhammadu Buhari and his allies will use his incumbency to try to influence the ruling All Progressives' Congress's (APC) choice of candidates.”

“With presidential and national assembly elections due in February 2023, political campaigns will go into overdrive this year as alliances are made and deals struck. Outgoing President Muhammadu Buhari and his allies will use his incumbency to try to influence the ruling All Progressives' Congress's (APC) choice of candidates.”

“Already there is a row over Buhari's refusal to sign an amendment to the electoral reform bill which would allow electronic voting and transmission of results, as well as direct primary elections to choose a party's candidates, instead of conferences of delegates run by state governors. “

“Much as the dramas of the election campaigns will dominate the political scene, they will not overwhelm concerns over the country's deepening insecurity and slow economic recovery from the side-effects of the pandemic.”

“…The economy's modest economic recovery last year and government hopes that 2022 real GDP growth could exceed 3% hit the reality of rising debts, rocketing servicing costs and below-target revenues. The African Develoment Bank warned that Nigeria was spending over 73% of its revenues on debt service last year.”

“Official figures showing 5% and 4% growth in the second and third quarter respectively, point to a modest bounce back from recession in 2020. The International Monetary Fund (IMF) and World Bank forecast growth of just of 2.5% this year, which could fall lower due to disruption from the Omicron variant of Covid-19 and rising insecurity.” Africa Confidential reports.

The Michael Jordan of Emerging Markets Investing

ICYMI, we ran an extensive interview with legendary emerging markets investor Mark Mobius over the weekend. Check it out:

“I have discovered in life that there are ways of getting almost anywhere you want to go, if you really want to go.”

― Langston Hughes