Emerging Markets Daily - January 16

Vitol Sees Oil Prices Rising, Ukraine Says Russia Behind Cyber-Attack, Crypto Rises in Brazil, GCC Economies Accelerating, Mozambique Kicks Off Offshore Gas Project

The Top 5 Stories Shaping Emerging Markets from Global Media - January 16

Trader Vitol Sees Oil Prices Rising Even Higher on Tight Supply

Bloomberg

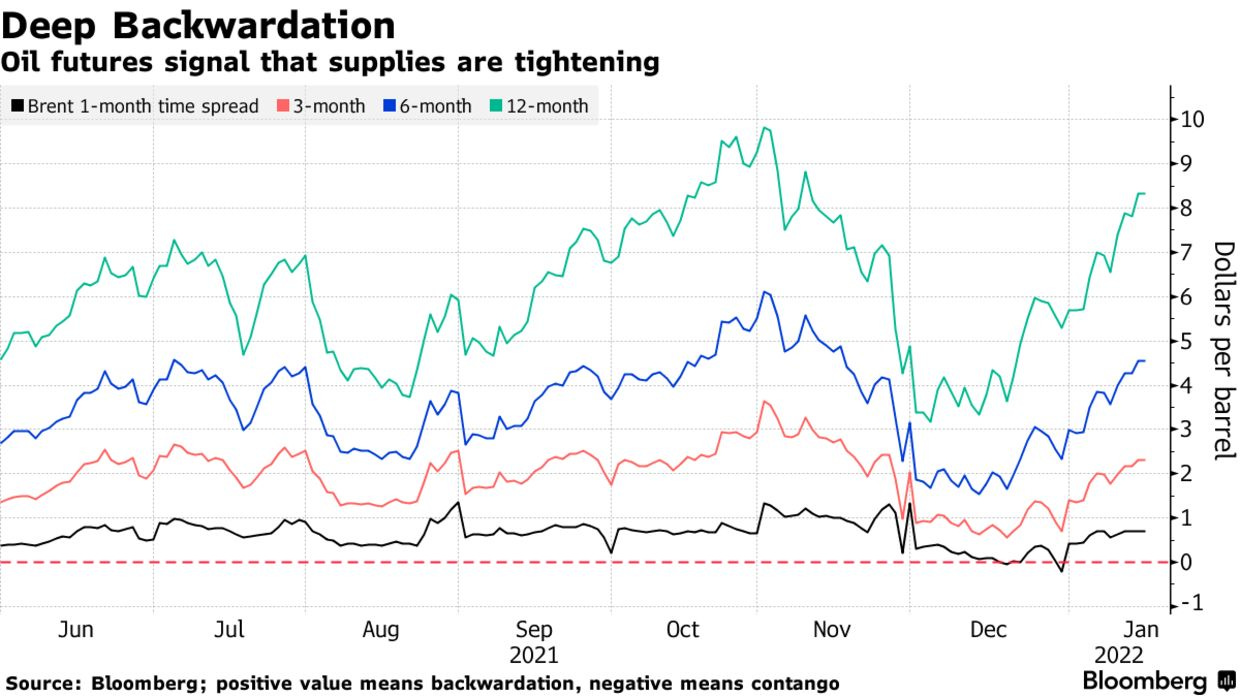

“The world’s biggest independent oil trader said crude prices, already up more than 10% this year, could rise even more because of tight supplies. ‘These prices are justified,” Mike Muller, head of Asia for Vitol Group, said Sunday. ‘Strong backwardation is very much justified,’ he said, referring to a bullish pattern whereby near-term futures are more expensive than later ones.”

“Oil posted a fourth-straight gain last week, its longest rising streak since October, amid signs consumption will hold up despite the spread of the omicron variant of the coronavirus. At the same time, spare capacity is dwindling as some of the world’s biggest producers struggle to boost output.”

“Brent crude has jumped 11% this year to over $86 a barrel, extending last year’s gain of 50%. Muller said that while natural gas prices have climbed enough to cause some industrial users -- including in Pakistan and Europe -- to cut back on consumption, the oil market hadn’t reached that point.”

“What’s happening with gas ‘serves to remind us that people will abstain from buying expensive energy at some point,’ he said on a webinar hosted by Dubai-based consultancy Gulf Intelligence. ‘The question is at what point that affects the oil market.’”

“The White House will probably release more oil from its Strategic Petroleum Reserve than the 50 million barrels it announced in November, Muller said. President Joe Biden took that step to cool gasoline prices, which are around their highest in seven years in the U.S.” Bloomberg reports.

Ukraine Says All Signs Point to Russia on Recent Cyber-Attack

Financial Times

“Ukraine said it has evidence a cyber attack against government websites on Friday was likely carried out by Russia, amid fears that Moscow may be planning military action against the country after security talks with the US and Nato failed.”

“‘At the moment we can say that all evidence points to Russia being behind the attack,’ Ukraine’s digital transformation ministry said in a statement on Sunday. ‘Moscow continues to wage hybrid war and is actively growing its information and cyber space capabilities.’”

“Ukraine’s western allies have yet to formally attribute the attack to Russia but warned that it could be a prelude to further military aggression after Moscow massed 100,000 troops near the border.”

“The cyber attack, which took down about 70 government websites on Friday, came as the White House warned Russia was positioning operatives in eastern Ukraine as part of a ‘false-flag operation’ to create a ‘pretext for invasion’.”

“The US and EU have vowed to pass ‘crippling’ sanctions against Russia on a far greater scale than after the 2014 annexation of Crimea if it renews its aggression against Ukraine.”

“Russia seized control of the Ukrainian peninsula of Crimea in 2014 and has since been helping separatists in the eastern region of Donbas wage a war against Kyiv’s central government.”

“Russia has denied it is planning to invade Ukraine but warned of an unspecified ‘military-technical response’ if the US does not meet president Vladimir Putin’s demands to roll back Nato’s eastward expansion and pledge never to admit former Soviet countries, including Ukraine.” The FT reports.

Cryptocurrency Gains Wider Acceptance Across Brazil

Coin Telegraph

“Throughout 2021, the Brazilian cryptocurrency market managed to distance itself from the police pages and finally win acceptance with the general public, whether in the financial market or even in the greatest national passion: soccer.”

“Last year, Bitcoin (BTC) acted as a strong alternative to the Brazilian real that ended 2021 by breaking negative records and reaching a devaluation of 6.5% by December, making it the 38th worst currency in the world.”

“In a year of ups and downs for Bitcoin, the biggest cryptocurrency hit a bottom of 167,000 real in January and soared along with global markets to 355,000 real in May. Faced with Bitcoin’s dip, the BRL/BTC pair was stuck below 200,000 reals until August, when it began to rise to a new historic high of 367,000 real on Nov. 8.”

“Faced with the need for economic protection, Brazilians turned to crypto. 10 million Brazilians now participate in the crypto market, according to CoinMarketCap.”

“In traditional financial markets, the Brazilian Stock Exchange debuted exchange-traded funds (ETFs) linked to Bitcoin and Ether (ETH). There are already five ETFs listed on B3, some of them positioned among the most profitable in the entire Brazilian stock market in 2021.”

“The Central Bank of Brazil also announced new developments in the digital real, a central bank digital currency (CBDC), which could be launched as early as 2023. The Brazilian Central Bank also announced that it will continue working to incorporate blockchain technology into its services by carrying out a series of tests through a dedicated team at the monetary authority.” Coin Telegraph reports.

Pace of Growth in GCC to Accelerate in ‘22

The National

“Gulf Co-operation Council economies are expected to grow at a faster pace in 2022 as they continue to recover from the coronavirus pandemic on the back of higher oil prices and the expansion of their non-oil sector, Emirates NBD has said.”

“Gulf economies are forecast to grow 5.1 per cent on average this year, after rebounding to 2.3 per cent in 2021 and following a 4.9 per cent contraction the previous year when the pandemic began, Dubai’s biggest lender by assets said in the report, written by its chief economist and head of research Khatija Haque.”

“‘The recovery in the GCC economies gained momentum in the second half of 2021 as travel restrictions eased, tourism rebounded and domestic demand strengthened,’ the report said.”

“Emirates NBD expects the UAE economy to continue to recover in 2022 accelerating to 4.6 per cent this year from an estimated 1.9 per cent in 2021. That's slightly higher than the central bank's estimates which put growth at 4.2 per cent this year, higher than the 3.8 per cent previously forecast for 2022.”

“Saudi Arabia and other countries in the region have also supported their economies by introducing initiatives and stimulus packages while focusing on structural reforms, reducing budget deficits and adhering to tighter spending plans.” Fareed Rahman reports.

Mozambique Kicks Off First Offshore Gas Project

African Business

“A floating plant for liquefying natural gas arrived in Mozambican waters on January 3 after a seven week maritime voyage from South Korea.”

“Constructed by Samsung Heavy Industries (SHI), it is the first offshore project to come online in the nation’s embattled gas industry. It is also the first floating LNG facility to be deployed in the deep waters of the African continent, and the third in the world.”

“Lying above the 450 billion cubic meters (Bcm) of resources in the Coral field in Area 4 of the Rovuma Basin, the plant has the capacity to liquefy 3.4 million tons of natural gas per year from subsea gas producing wells per year.

“Area 4 of the Rovuma Basin is operated by Italian oil and gas giant Eni, who signed a 20-year agreement to sell 100 per cent of LNG production to British Petroleum (BP) in 2016.”

“The plant will extract gas from Area 4 of the Rovuma basin, located off the shore of the Cabo Delgado province of northern Mozambique, starting in the second half of the year. Mozambique’s fledgling oil and gas industry has the potential to produce more than 30 million mt of LNG a year. But the country’s ambitions to join the ranks of the world’s largest LNG exporters have been thwarted by a growing Islamist insurgency in the gas-rich Cabo Delgado province that began in October 2017.”

“The project comes as Mozambique’s government assures oil majors that the security situation in the Cabo Delgado region is under control after four years of disruption and halted projects.” Shoshana Kedem reports.

“It is never too late to be what you might have been.”

― George Eliot