Emerging Markets Daily - January 23

A Bullish Saudi IPO Season Looms, India Tech Stocks Beaten Down, China-Russia Trade Booms, Execs Flee Hong Kong, African Carriers Vie for Air Freight Market

The Top 5 Stories Shaping Emerging Markets from Global Media - January 23

Saudi Arabia Will Remain King of Mideast IPO Deals: Goldman Sachs

Bloomberg

“Saudi Arabia will remain the busiest of the Middle East’s stock markets, even as the United Arab Emirates pushes more companies to go public, according to Goldman Sachs Group Inc.”

“John Wilkinson, the bank’s London-based head of emerging-market equity capital markets, called 2021 a ‘standout year’ for the Persian Gulf. Initial public offerings by ACWA Power, Solutions by STC and Saudi Tadawul Group Holding Co. in Saudi Arabia, as well as several others in Abu Dhabi, pushed Middle East and North African equity issuance to about $23 billion.”

“'Most of the marquee offerings have posted strong post-IPO performances, sparking further interest from international investors, Wilkinson said.”

“…Riyadh has had more listings than any of its Gulf rivals in the past year. Saudi Arabia’s economy, the biggest in the Middle East, has been boosted by the surge in oil prices to over $85 a barrel and the government easing coronavirus lockdowns. The Tadawul All Share Index is up 8% this year, making it one of the world’s best performers, data compiled by Bloomberg show.”

“Goldman was a bookrunner on oil giant Aramco’s record $29 billion IPO in 2019. It was also an adviser on many of the prominent offerings in Riyadh and Abu Dhabi in 2021, including Saudi Telecom Co., Adnoc Drilling and Fertiglobe. In early November, the Dubai government said it aims to sell shares in 10 state-backed companies, part of a bid to revive trading volumes and catch up with Riyadh and Abu Dhabi.”

“Deals for the skyscraper-studded emirate’s main utility, called DEWA, and its road-toll firm are among the IPOs in the works. Those listings could reshape the Dubai Financial Market General Index, which as of now is dominated by real estate firms, telecommunication companies and banks.” Bloomberg reports.

India Tech Stocks Take Beating Amid Global Decline

Inc42

“It’s been a week that all Indian tech stocks would like to forget. With crashes all around, tech stocks have caused headaches for investors, as many are losing their patience.”

“A sharp drop in the technology-focused Nasdaq index has resulted in panic among technology investors around the world. The decline in the US has had a ripple effect across the globe.”

“In the past week, the Nasdaq index, which is considered a benchmark for the tech industry, has fallen by nearly 7%. Stock markets have been under pressure since the beginning of 2022 as central banks such as the US Federal Reserve are expected to raise interest rates to contain inflationary pressures.”

“The decline is expected to affect liquidity and already there has been a trend of profit-booking or sell-offs in the tech sector.”

“Zomato and Paytm in particular have been on a downward spiral…Aarin Capital Partners chairman and former Infosys CFO Mohandas Pai told Inc42 that the fall in stock prices will lead to more reasonable valuation of startups in India and more caution on the part of investors that will price IPOs, especially anchor investors.” Inc42 reports.

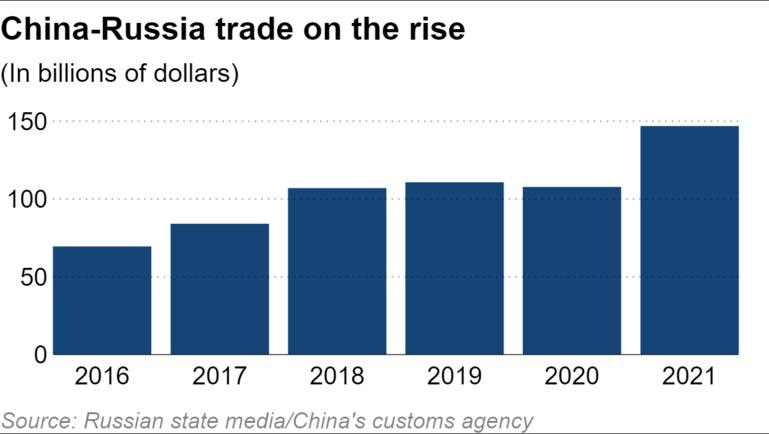

China-Russia Trade Hits Record $140 Billion as Ukraine Crisis Looms

Nikkei Asia

“Trade between China and Russia is reaching new highs as friction with the West brings the countries closer.”

“Turnover between China and Russia reached a record $146.88 billion in 2021, up 35.8% from the previous year, according to recent data from China's General Administration of Customs….Next month, Russian President Vladimir Putin is set to attend the opening ceremony of the Winter Olympics in Beijing and meet with Chinese President Xi Jinping. The leaders are expected to sign a number of high-profile political and economic deals, potentially including a final contract for the Power of Siberia-2 natural gas pipeline.”

“Analysts say the standoff between Russia and the West over Ukraine, which could bring new sanctions against Moscow, is likely to tighten the Kremlin's bond with Beijing even more.”

“Over the past decade, Moscow and Beijing have sought to supplement political ties with greater economic cooperation. Trade between the two countries has increased by 167% since 2010, with the most significant growth in the past few years. The increase in trade was aided by a series of energy mega projects, such as the $55 billion Power of Siberia-1 natural gas pipeline, the $25 billion Eastern Siberia-Pacific Ocean Pipeline and the $13 billion Amur gas processing plant.”

“Russia and China have vowed to raise their trade turnover to $200 billion by 2024. Recent economic trends alone suggest the countries are likely to reach that goal, according to Chris Devonshire-Ellis, founding partner of Dezan Shira & Associates, an advisory firm that works with investors across Asia.” Nikkei Asia reports.

More Executives Flee Hong Kong Amid Stringent Covid Rules

Wall Street Journal

“Stringent rules to try to keep Hong Kong free of Covid-19 are driving away more foreign executives, chipping away at the city’s decades-old status as one of the world’s top business hubs.”

“Flight bans, lengthy quarantine stays for arrivals and repeated school closures are pushing more people to a breaking point as the pandemic enters its third year and the city clings to a zero-Covid strategy abandoned by nearly all countries save for China. A growing outbreak at a public housing estate has prompted the government to lock down buildings and send more people into quarantine.”

“Executives complain the travel restrictions have prevented them from keeping tabs on operations in other countries or visiting business partners and potential clients, even in mainland China. Meanwhile, there is the ever-present risk of being sent to quarantine if they happen to cross paths with a Covid-19 sufferer in Hong Kong just by visiting a pet store or eating lunch out.”

“More than half of executives polled in a survey by an American business group in Hong Kong released Wednesday said the city’s Covid-19 policies made them personally more likely to leave. Almost a third said they were struggling to fill senior roles and had delayed investments in Hong Kong. The survey was conducted late last year, before the most recent round of restrictions that has barred flights from the U.S., U.K. and six other countries.” WSJ reports.

Africa Carriers Scramble For Lead in Air Freight Competition

The East African

“The battle for the air freight market share among African airlines is intensifying, thanks to Covid-19 disruptions that have driven up ocean freight rates. Many airlines are now upgrading their fleets and expanding destinations as shortage of containers in the region continues to bite.”

“In its latest market summary, the International Air Transport Association (IATA) said demand for air freight has stayed above pre-crisis levels. ‘African airlines saw international cargo volumes increase by 26.7 percent end of last year, which is the largest increase of all regions. International capacity was 9.4 percent higher than pre-crisis levels, Africa is the only region in positive territory, albeit on small volumes,’ read part of the IATA market summary.”

“Shippers Council of East Africa Chief Executive Gilbert Lagat said, apart from cost and efficiency, time to receive consignments has boosted the air freight business considering persistent road and ocean delays.” The East African reports.

“Be yourself; everyone else is already taken.” ― Oscar Wilde