Emerging Markets Daily - January 4

Global Stock Party Not Over, Brazil Oil Auction Boosts Economy, Singapore's Sea Distances from Tencent, DP World Invests in Senegal Port, Turkey Inflation Soars

The Top 5 Stories Shaping Emerging Markets from Global Media - January 4

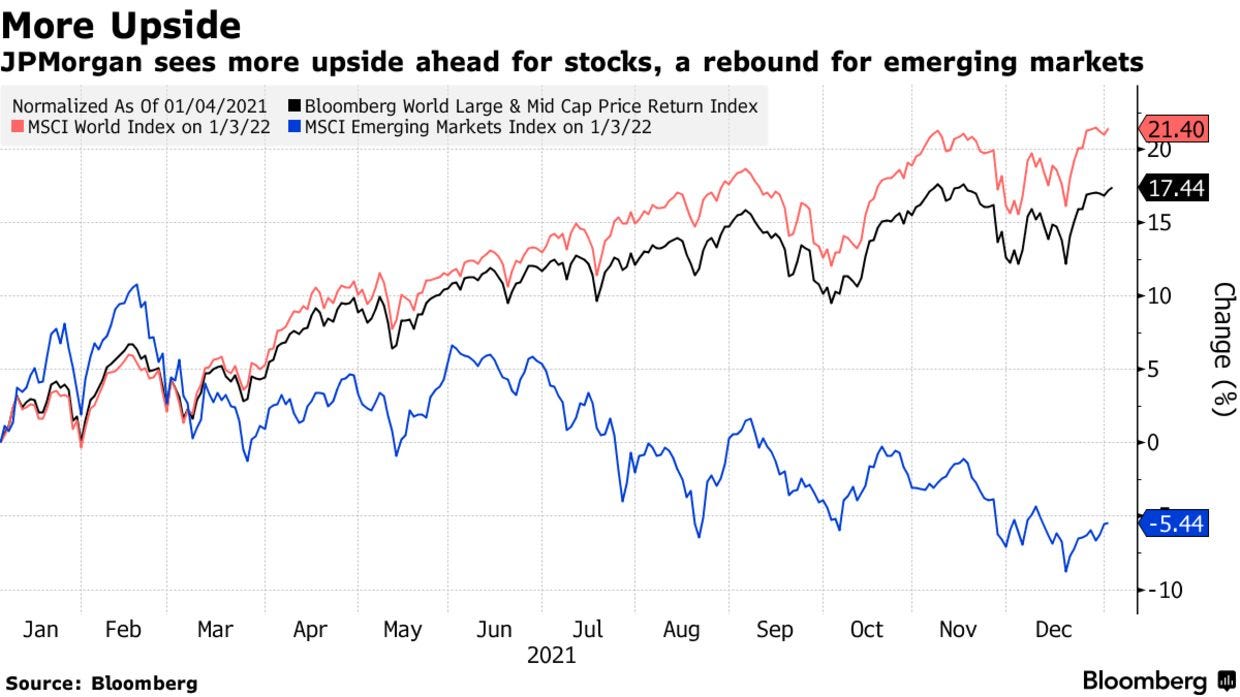

JP Morgan Says Global Stock Market Party Far From Over

Bloomberg

“Everything is falling into place for further gains in global stocks this year, according to JPMorgan Chase & Co strategists. ‘Stay bullish -- positive catalysts are not exhausted,’ strategists led by Mislav Matejka wrote in a note to clients on Tuesday.”

“Downside risks -- including a hawkish turn by central banks, a slowdown in China’s economy, or more significant coronavirus restrictions -- will either fail to materialize or are already priced in to stocks, they said.”

“The positive outlook comes as benchmark indexes in both the U.S. and Europe trade at record highs, following last year’s ferocious rally on the back of unprecedented fiscal stimulus and a solid rebound from the pandemic-induced slump.”

“JPMorgan’s strategists are not alone: Credit Suisse Group AG this week reiterated a bullish view on U.S. stocks, while Societe Generale SA on Tuesday repeated a forecast for a 6.6% return for European stocks this year, writing that ‘this bull market is not over.’ Strategists at Goldman Sachs Group Inc. and the BlackRock Investment Institute also see upside, albeit at a more muted pace.”

“Among JPMorgan’s key calls is an overweight position on U.K. and euro-area equities, as well as on banks, miners and autos. The strategists see a good entry point in emerging-market stocks, with China deceleration ‘by now largely behind us.’ They also like reopening trades.” Bloomberg reports.

Brazil Economic Outlook Boosted by Big-Ticket Investments

Financial Times

”Brazil’s successful auction of deep sea oil prospects last month was hailed as a sign of oil majors’ appetite for crude. But for Brazilian officials, the auction was also a watershed moment for the government’s programme of infrastructure and natural resources concessions.”

“A previous attempt to execute the complex auction had flopped in 2019. ‘Our joy can’t be disguised,’ said Bento Albuquerque, Brazil’s minister for mines and energy, heralding the $2bn in fees raised for the cash-strapped government and the further $35bn in investments to be made by the likes of Shell and TotalEnergies in the country’s oil and gas sector.”

“In contrast with the government’s more vaunted plans for structural economic reforms, which have floundered for years in Congress, the programme to attract private companies to invest in — and operate — major infrastructure projects has boomed.”

“Since the beginning of President Jair Bolsonaro’s administration in 2019, 131 concessions have been auctioned, generating more than $145bn in investments and $26bn in fees for the government.”

“Despite a strong bounceback from the initial impact of the pandemic, many economists are forecasting Latin America’s largest economy will again contract this year, buffeted by the combined impact of soaring inflation and interest rates and weak consumer confidence.” The FT reports.

Singapore’s Sea Aims To Reduce Tencent Shareholding Amid Global Expansion

Nikkei Asia

“Singaporean online gaming and e-commerce group Sea plans to reduce the voting rights held by Tencent Holdings, its large Chinese shareholder, as the company aims to expand globally.”

“In a statement issued on Tuesday, New York-listed Sea said it will propose a share structure change at the upcoming annual general meeting in February, by which Tencent's voting power in the company would be reduced to ‘less than 10%.’”

“As of March last year, Tencent had 23.3% of the voting rights in Sea, according to Sea's annual report. Sea has dual-class shares, comprising Class A shares and Class B shares, the latter of which is entitled to three votes per share. Currently, Class B shares are owned by Tencent and Sea's founder and CEO Forrest Li, collectively representing 52% of the total voting power.”

“The proposed share structure change comes as Sea aggressively expands its Shopee e-commerce business beyond its home turf of Southeast Asia, capitalizing on the global digitalization shift. Over the past months, the company launched its e-commerce platform in France, Spain, Poland and India, following its entry into several Latin American markets.”

“However, having a Chinese tech company as a shareholder with major control appears to have raised some concerns, as tensions between China and several other countries escalate.”

“In India, where the government banned Chinese apps, a local business body in December called for a ban of Shopee in the country, claiming that the e-commerce brand was controlled by Tencent, according to local reports.” Nikkei Asia reports.

DP World Launches Its Biggest Port Project in Africa

The National

“Global ports operator DP World has begun construction of Senegal's Ndayane deepwater port, the Dubai-based company's biggest port investment in Africa to date and a project that is set to boost the country's position as a major trade hub and gateway to West Africa.”

“DP World and the Senegal government have laid the first stone to mark the start of construction of the new Port of Ndayane, the company said in a statement on Tuesday. The investment of more than $1 billion in two phases to develop Port of Ndayane is also the largest single private deal in the history of Senegal, it said.”

“‘With the Port of Ndayane, Senegal will have state-of-the-art port infrastructure that will reinforce our country's position as a major trade hub and gateway in West Africa,’ Senegal's President Macky Sall said. ‘It will unlock significant economic opportunities for local businesses, create jobs, and increase Senegal’s attractiveness to foreign investors.’”

“The step follows the concession agreement signed in December 2020 between DP World and the Senegal government to build and operate a new port at Ndayane, about 50 kilometres from the existing Port of Dakar. DP World has been significantly expanding its footprint in Africa as it seeks to tap into lucrative trade routes in the region. It has existing investments in Egypt, Algeria, Djibouti, Rwanda, Somaliland, Mozambique and Senegal, according to its website.”

“In October, DP World partnered with UK-based development finance institution and impact investor CDC Group to create a $1.7bn investment platform for Africa. It will invest in origin and destination ports, inland container depots, economic zones and other logistics across Africa to increase trade, create new job opportunities and broaden access to essential goods, DP World said at the time.” The National reports.

Turkey Inflation Rate Near 20 Year High As Lira Crisis Continues

Wall Street Journal

“Turkey’s inflation climbed to a nearly two-decade high in December on the back of a weakening lira that is driving up the cost of food and other basic goods and destabilizing the wider economy.”

“Annual inflation rose to 36.08% last month, up from 21.3% in November, the Turkish Statistical Institute said Monday—the highest inflation rate since 2002, according to economists.”

“The rampant inflation raises new concerns that it could overwhelm a government rescue plan unveiled last month to stabilize the battered local currency. The lira was down less than 1% against the dollar on Monday. The currency mounted a significant comeback after the government announced the rescue plan but was still down more than 40% against the U.S. dollar last year.”

“The inflation figures show how the crisis continues to heap economic pressure on ordinary Turkish people. It has forced some to queue for subsidized bread, cut back on meat and flee to Europe in search of a better life.” WSJ reports.

“Though nobody can go back and make a new beginning... Anyone can start over and make a new ending.” ― Chico Xavier