Emerging Markets Daily - January 6

Indonesia Coal Exports in Limbo, Crypto Falls, Russia Asserts Hard-Line on Ukraine, Kazakhstan Protests and Oil and Uranium, EM CB Asset Purchases Risky: IMF

The Top 5 Stories Shaping Emerging Markets from Global Media - January 6

Indonesia Talks on Coal Exports Postponed As Scores of Ships in Limbo

Reuters

“Indonesian authorities postponed a meeting with coal mining companies on Wednesday, as scores of ships moored off the coast remained in limbo as they waited to see whether the government would lift a ban on coal exports.”

“The government has said it would review the ban on Wednesday and was due to meet mining companies in the morning ahead of a decision, which is keenly awaited by top top economies in the region that rely on Indonesian supplies.”

“Indonesia, the world's top exporter of thermal coal and China's largest overseas supplier, announced on Saturday a ban on coal exports in January to avoid outages at its own generators, sending coal prices in the region surging.”

“Amid high demand for electricity in winter, Japan's embassy in Jakarta on Wednesday urged the energy ministry to lift the export ban for high caloric coal, which is not used by local generators.”

"‘The sudden export ban has a serious impact on Japan's economic activities as well as people's daily life,’ the embassy said in a letter, adding at least five vessels already loaded should be given immediate departure permits.”

“Japan imports approximately two million tonnes of coal per month from Indonesia, the embassy added. Asia's economic powerhouses China, India, Japan, and South Korea together received 73% of Indonesian coal exports in 2021, ship tracking data from Kpler showed.”

Bitcoin and Other Crypto Fall Sharply as Fed Signals Spook Broader Markets

CNBC

“Bitcoin and other cryptocurrencies fell sharply on Thursday as hawkish minutes from the Federal Reserve’s December meeting hit global risk assets. Bitcoin was trading at $43,058.75, down 8% from the 24 hours previous, according to Coin Metrics data. It at one point sunk to as low as $42,496, reaching the lowest level in more than a month.”

“Other cryptocurrencies fell too. Ethereum dropped nearly 12% to $3,411.92 while solana sank 12% to $148.58. The crypto sell-off comes after stocks fell on Wednesday following the release of minutes from the Fed’s December meeting in which the central bank indicated it would dial back its supportive monetary policy, including reducing the amount of bonds it holds.”

“The Fed also indicated that it may have to raise interest rates sooner than expected. Meanwhile, the benchmark 10-year Treasury yield ticked above 1.7% on Wednesday.”

“Growth assets such as technology stocks tend to be hit when rates rise, as future earnings becomes less attractive to investors when yields are higher. That sentiment has filtered through to cryptocurrencies, which are seen as risker assets.”

“‘Overall, I think the global markets have shown weakness in light of the recent Fed moves to raise interest rates. Hence, I do think the drop yesterday is quite correlated. We’ve seen U.S. markets fall yesterday and as a result, all other risk asset classes fared equally poorly including crypto,’ said Vijay Ayyar, vice president of corporate development and international at cryptocurrency exchange Luno.” CNBC reports.

Geopolitics: Ukraine Concerns Must Be Addressed Urgently, Russian Official Says

Wall Street Journal

“Russia’s lead negotiator for coming talks with the U.S. said that Moscow’s demands on Ukraine must be addressed urgently and warned the Biden administration against resorting to the economic pressure it has threatened to try to get the Kremlin to back down.”

“In advance of Monday’s talks with the U.S. in Geneva, Deputy Foreign Minister Sergei Ryabkov sketched out an unyielding stance. He said the North Atlantic Treaty Organization’s military ties to Ukraine represent a threat to Russia even if the country isn’t formally admitted into the alliance.”

“Mr. Ryabkov rebuffed the Biden administration’s calls for the Kremlin to reverse its military buildup near Ukraine’s borders, saying Russia has the right to decide how to deploy forces on its own territory.”

“Mr. Ryabkov noted that he will be accompanied to the talks by Deputy Defense Minister Alexander Fomin and other military officers. The U.S. side will be led by Deputy Secretary of State Wendy Sherman, though Mr. Ryabkov said he has yet to be presented with a full list of the U.S. participants.”

“‘We need to figure out quite rapidly whether there is a basis to work on some of those issues,’ Mr. Ryabkov said Wednesday in an interview with The Wall Street Journal. ‘Our military will be there, and then we will see whether there is any basis to continue on a diplomatic track.’”

“Russia has in recent weeks amassed a force of about 100,000 troops near Ukraine, according to U.S. and European officials. Current and former U.S. officials have accused Russian President Vladimir Putin of generating a crisis when NATO isn’t moving to grant Ukraine membership despite an alliance statement in 2008 that it will one day be admitted. President Biden has also ruled out putting offensive missiles in Ukrainian territory that could strike Russia.” WSJ reports.

Kazakhstan: Oil, Uranium Production Unaffected by Protests

“Uranium prices have risen after violent demonstrations in the central Asian country, initially spurred by protests against fuel price hikes, as Kazakhstan is responsible for about 40 percent of global supplies of the metal.”

Arab News

“Kazatomprom, the world's biggest uranium producer, said on Thursday it was operating normally with no impact on output or exports despite unrest in Kazakhstan. Uranium prices have risen after violent demonstrations in the central Asian country, initially spurred by protests against fuel price hikes, as Kazakhstan is responsible for about 40 percent of global supplies of the metal.”

“Spot prices hit $45.5 per pound on Wednesday, the highest since Nov. 30, according to a Platts assessment. But the country's political turmoil does not seem to have so far affected key industries.”

“Despite the turmoil, which has seen Russia send paratroopers into the country to quell a violent uprising, there are no indications that oil production has been affected so far, Reuters reported.”

“Kazakhstan is a member of OPEC+, a group that includes the Organization of the Petroleum Exporting Countries, Russia and other producers. ‘The political situation in Kazakhstan is becoming increasingly tense,’ Commerzbank said, adding: ‘And this is a country that is currently producing 1.6 million barrels of oil per day.’

“The global benchmark Brent crude futures rose $1.09, or 1.4 percent, to $81.89 a barrel, by 1054 GMT.”

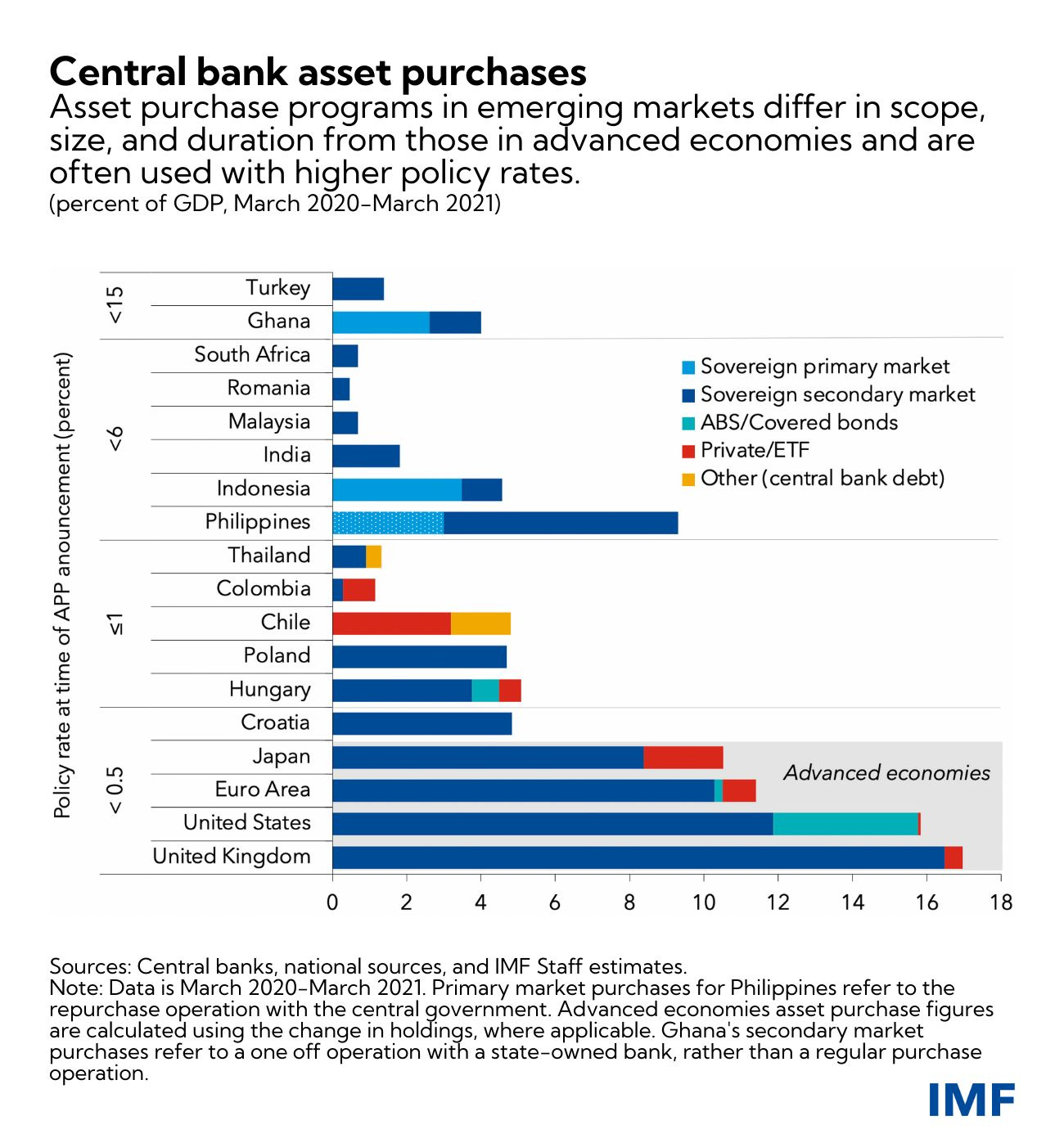

EM Central Bank Asset Purchases Carry Significant Risks

IMF Blog

“Central banks in many emerging market and developing economies have been reluctant to use asset purchases in past crises for fear of engendering a market backlash. As it turned out, targeted asset purchases in these countries during the COVID crisis helped reduce financial market stresses without precipitating noticeable capital outflow or exchange rate pressures.”

“This overall positive experience suggests that these central banks will also consider asset purchases in future episodes of market turbulence, as discussed in a recent Global Financial Stability Report.”

“However, while asset purchases can help these central banks achieve their mandated objectives, they also pose significant risks.”

“One obvious risk is to the central banks’ own balance sheet: central banks can lose money if they buy sovereign or corporate debt when interest rates are low across maturities, and then policy interest rates rise sharply. A weaker balance sheet may make the central bank less willing or able to deliver on its mandated objectives when policy tightening is needed due to concerns that the required policy actions will hurt its own financial position.” IMF Blog reports.

“The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.” Bertrand Russell