Emerging Markets Daily - July 6

Will China Rule the World?, S. Africa Opens Power to Private Sector, Singapore's 'Silicon Valley of Food,' Pemex Flexes Muscle, China Eyes Afghanistan After US Withdrawal, and more

The Top 5 Emerging Markets Stories from Global Media - July 6

When Will China Rule the World? Maybe Never

Bloomberg

“When will China overtake the U.S. to become the world’s biggest economy?”

“Few questions are more consequential, whether it’s for executives wondering where long-term profits will come from, investors weighing the dollar’s status as global reserve currency, or generals strategizing over geopolitical flashpoints.”

“In Beijing, where they’ve just been celebrating the 100th anniversary of the Chinese Communist Party, leaders are doing their best to present the baton-change as imminent and inevitable. ‘The Chinese nation,’ President Xi Jinping said last week, ‘is marching towards a great rejuvenation at an unstoppable pace.’”

“…But that outcome is far from guaranteed. China’s reform agenda is already languishing, tariffs and other trade curbs are disrupting access to global markets and advanced technologies, and Covid stimulus has lifted debt to record levels.”

“The nightmare scenario for Xi is that China could follow the same trajectory as Japan, also touted as a potential challenger to the U.S. before it crashed three decades ago. A combination of reform failure, international isolation and financial crisis could halt China before it reaches the top.” Eric Zhu and Tom Orlik report

South Africa Opens Power Grid to Private Players to Improve Energy Security

The National

“The misery of ongoing power cuts that are damaging Africa’s largest industrial economy may finally be coming to an end, with industry now allowed to generate its own energy.”

“South Africa generates most of its electricity from a fleet of ageing coal-fired plants, which are prone to breakdowns. When this happens, state energy utility Eskom cuts power to large parts of the country, sometimes for many as eight hours a day.”

“However, President Cyril Ramaphosa made a surprise announcement in June that companies could produce up to 100 megawatts without requiring a regulatory licence. To put it into perspective, a typical gold mine, which is among the largest users of electricity, requires between 20MW and 30MW for operations.” Gavin du Venage reports

Singapore Cultivates 'Silicon Valley of Food' in a Hungry Asia

Nikkei Asia

“…With ‘so much regulatory red tape’ and global caution surrounding lab-grown meat, Chee, 43, was convinced getting the green light would take years. He figured his mission at Eat Just, which he joined in 2016, was to concoct inspiring dishes that would ‘plant the seed for another generation.’”

“So in December, when Singapore became the only country to approve the sale of such protein, Chee was dumbstruck. Many industry observers were less surprised.”

“‘It's no coincidence that Singapore is the world's first cultivated meat market,’ said Mirte Gosker of the nonprofit Good Food Institute Asia Pacific (GFI APAC). ‘The government has invested the resources necessary to create a welcoming ecosystem for food innovation.’”

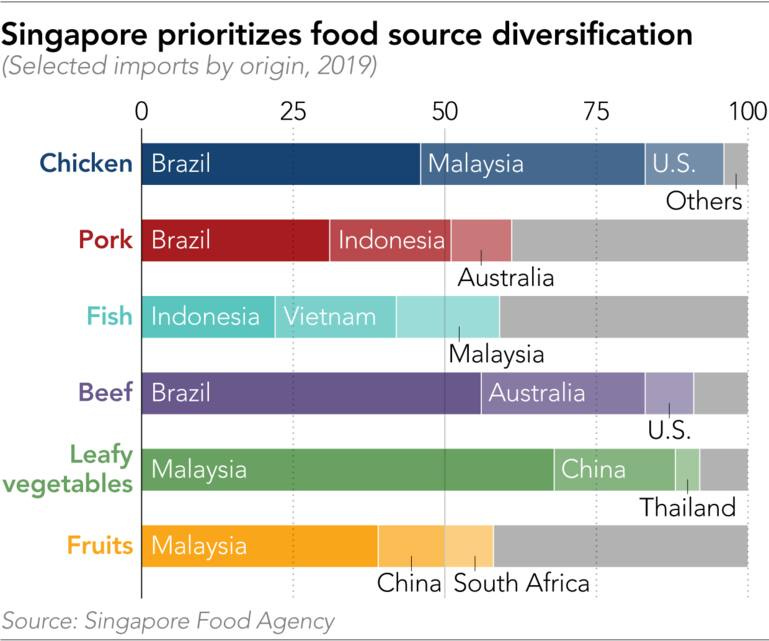

“Singapore's foray into lab meat and alternative proteins -- those that come from plants, insects, algae and fungi -- is part of a concerted push to shore up its food resilience.” Sandy Ong reports

Pemex Retains Operation in Important Zama Oil Field

El Pais

“The Ministry of Energy favors the parastatal company over the claims of the American Talos Energy, which contemplates legal actions.”

“Pemex has won the fight for control of the large Zama oil field, in the Gulf of Mexico. After several months of suspense, the Ministry of Energy has designated the state company as the operator of what is one of the largest recent discoveries, with estimated resources of up to 800 million barrels.”

“In the official letter, issued last Friday, the Mexican government assesses the financial and technical capacity of the state-owned company and ignores the claims of the consortium led by the American Talos Energy, which discovered the deposit and which this Monday has threatened legal action. Otherwise, the decision is consistent with the nationalist energy policy of President Andrés Manuel López Obrador, who seeks to limit private participation in the sector.” Jon Martin Cullell reports (In Spanish)

China Watches Afghanistan Anxiously as the US Withdraws

Financial Times

“It is not without reason that Afghanistan is known as the ‘graveyard of empires’. The ancient Greeks, the Mongols, the Mughals, the British, the Soviet Union and most recently the US have all launched vainglorious invasions that saw their ambitions and the blood of their soldiers drain into the sand.”

“But after each imperial retreat, a new tournament of shadows begins. With the US pulling out of Afghanistan, China is casting an anxious gaze towards its western frontier and pursuing talks with an ascendant Taliban, the Islamist movement that was removed from power in 2001.”

“The burning questions are not only whether the Taliban can fill the power vacuum created by the US withdrawal but also whether China — despite its longstanding policy of ‘non-interference’ — may become the next superpower to try to write a chapter in Afghanistan’s history.” Stephanie Findlay, Christian Shepherd, and James Kynge report

What We’re Also Reading….

AB InBev Hit Hard By Covid, SAB Debt, Global Headwinds

Mail and Guardian (South Africa)

“In the five years since Anheuser-Busch InBev (AB InBev) closed on a $100-billion merger with South African Breweries (SAB), the Belgian multinational’s share price has plummeted while its competitors’ stock has gone up.”

“The troubles facing the world’s largest brewer are complex: For years beer sales slumped due to the changing tastes of health-conscious consumers. Having a presence all over the world has made AB InBev vulnerable to economic headwinds in emerging markets. The company has also been saddled with a pile of debt from the 2016 SAB deal.”

“Covid-19 has only added pressure. Another ban on alcohol sales, announced by President Cyril Ramaphosa last Sunday, will hit AB InBev’s South African business for at least another two weeks.”

“Experts have linked the AB InBev woes to the SAB deal, which the company’s then-chief executive Carlos Brito said at the time would cement its position as ‘a truly global brewer’. But the merger was not all it was cracked up to be.” Sarah Smit reports.

Millions of Thai Companies Facing Ruin Amid Covid Surge

Bangkok Post

“Many small and medium-sized enterprises, the backbone of Thailand’s economy, are struggling with crushing debt loads that could force them out of business as the latest wave of Covid infections dims the prospects for an economic recovery.”

“‘This round is much worse than last year, and millions of operators are suffering,’ said Sangchai Theerakulwanich, chairman of the Federation of Thai SME, who submitted a proposal last month for the government to boost support to smaller businesses. ‘If the situation is prolonged to the end of the year the nation will be in crisis, with 80% of us going bankrupt.’”

“Thailand’s SMEs, many of them concentrated in the tourism industry, have been hit especially hard since the country closed its borders last year, sending the economy to its deepest contraction in more than two decades. The situation has worsened with daily cases and deaths at record levels, leading the government to impose fresh restrictions in late June.”

“The Bank of Thailand has called repeatedly to boost liquidity to SMEs, which are seen as crucial to any economic recovery. So far, though, efforts to channel billions of dollars of credit at low interest rates, institute loan-payment holidays and offer credit guarantees have failed to breathe life into the sector.” The Bangkok Post reports.

Morocco Economy To Grow 5.3% This Year

North Africa Post

“Morocco’s economic growth will slow to 7.2% in the third quarter this year after 12.6% growth in the second quarter, Morocco’s high commission for planning said. The growth rate is expected to be achieved on the back of a 19% rise in agricultural output and will help improve the overall growth rate in the third quarter from -6.7% the same period last year.”

“Domestic demand remains the main trigger for economic activity, the agency said, noting however a steady improvement of foreign demand notably in the car industry and agri-food segments. The central bank expects growth to stand at 5.3% this year after contracting by 6.3% last year, citing prospects of a better crop year.” The North Africa Post reports.

Uzbekistan Economy To Grow 5.6% in 2021

Tashkent Times

“The European Bank for Reconstruction and Development published its latest Regional Economic Prospects (REP) report, according to which the economy of Uzbekistan is set to grow by 5.6 per cent in 2021 and 6 per cent in 2022. The REP is expecting private consumption and investment to rebound as well.”

“According to the report key sectors of the national economy such as services, general industry, construction and agriculture have all recorded growth this year. It notes that important market reforms, including privatisation of state-owned enterprises and banks, continue despite the pandemic.”

“In Central Asia overall, the outlook has also been revised up, although the recovery is far from uniform. The region’s economy is seen growing 4.5 per cent in both 2021 and 2022, thanks to higher commodity prices, which benefit commodity exporters, as well as recovering remittances.” Tashkent Times reports.