Emerging Markets Daily - June 16

Indian Billionaire Adani Company Shares Diving, China Seeks to Tame Commodities Rally, Mexico Recovery, Emirates Airline Posts Record Loss, S. Korea Gamemaker IPO, Iran under Rouhani, and more...

The Top 5 Emerging Markets Stories from Global Media - June 16

Indian Billionaire Adani Company Shares That Sizzled, Now Diving

Bloomberg

“The slump in shares of companies controlled by Indian billionaire Gautam Adani deepened on Wednesday with three of them tumbling by the daily limit for the third straight day.”

“Adani Total Gas Ltd., Adani Power Ltd. and Adani Transmission Ltd. hit the lower circuit after dropping 5% each even as the group denied a local report Monday that said accounts of three Mauritius-based funds that own the group’s stocks were frozen.”

“The dramatic rout marks a halt to the dizzying rally in shares of some of the Adani Group of companies that had added almost $40 billion to the billionaire’s wealth this year through Friday that made him the second-richest person in Asia. His net worth, based on Tuesday’s closing share prices, is $71.5 billion.”

“The conglomerate refuted The Economic Times report on Monday, which said National Securities Depository Ltd. froze the accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund. It called the report ‘blatantly erroneous’ and followed up with another statement Tuesday citing communication from India’s national depository that the three funds’ demat accounts are ‘suspended for debit.’” Nupur Acharya reports.

China To Release Metal Reserves in Bid to Tame Commodities Rally

Wall Street Journal

“China said it would begin to sell major industrial metals from state stockpiles, an effort to squelch factory-gate price increases that have hit a 13-year high and are stoking fears of global inflation.”

“As the world’s biggest buyer of a range of industrial commodities, China is using its market heft to try to quell the sharp rise in global metal prices over the past 12 months, including a 67% surge in copper, a bellwether for macroeconomic health. Economic stimulus measures and a broad resumption of global economic activity from pandemic lows have spurred a spree of buying in China and elsewhere.”

“China’s latest move targets copper, aluminum and zinc, among other metals, and outlines a program of public auctions to domestic metal processors and manufacturers, the National Food and Strategic Reserves Administration said Wednesday. Still, Beijing’s move comes as some metal prices, including copper, had already begun to decline in recent weeks, amid market sentiment that global supply levels didn’t warrant such rallies.”

“Beijing’s vast buying power over metals doesn’t necessarily guarantee its ability to tame global prices. London spot prices for aluminum traded largely flat on Wednesday from a month earlier, but have risen 5% from early June as investors shrugged off the likely impact of Chinese sales.” Chuin-Wei Yap and Yifan Wang report.

Mexico Robust Recovery Driven by US Stimulus and Re-openings

Financial Times

“Business gloom has been so pervasive in Mexico since Andrés Manuel López Obrador won the presidency in 2018 on a strident anti-establishment platform that a recent burst of optimism about the country’s growth prospects feels like a ray of sunshine breaking through the clouds.”

“Last October, the IMF was forecasting that Mexico would grow just 3.5 per cent in 2021 after shrinking a seasonally adjusted 8.5 per cent last year during the pandemic. Yet as the economy rapidly opens up, coronavirus infections remain low and the effects of the giant US stimulus ripple across the border, many economists and bankers here now see Mexico expanding almost twice as fast.”

“‘The combination of continued reopening with strong remittances and a US-led global recovery has allowed Mexico to close the gap with other Latin American economies, outperforming all of them in the first half of 2021,’ said Marcos Casarín, chief economist for the region at Oxford Economics.”

“The consultancy’s recovery tracker shows Mexico is returning to pre-pandemic levels of activity more quickly than any other Latin American country. ‘Mexico will grow 6.0 per cent this year and it could be higher,’ said former finance minister and academic Carlos Urzúa, citing the spillover effects of US fiscal stimulus and increased remittances from Mexicans working across the border.”

“These could reach $55bn this year and are ‘much more important than oil’, he added. But few believe this year’s US-inspired growth spurt heralds a bright new dawn for Mexico. The expansion, bankers and economists say, is almost entirely thanks to President Joe Biden’s policies, rather than López Obrador’s.”

“The biggest beneficiaries are Mexico’s export-oriented manufacturing companies in the north of the country and the tourism industry, while firms servicing the domestic market struggle with depressed demand.”

Aviation Recovery Likely to 'Take Years' as Emirates Posts $6bn Loss

Arabian Business

“Recovery for all airlines, including Emirates, will take years as the ongoing pandemic continues to mandate flight restrictions and border closures, an aviation expert said on Tuesday after Dubai’s flagship carrier announced their first financial losses in three decades.”

'“The Emirates Group posted a loss of $6 billion (AED22.1bn) for the financial year ending March 31, compared with an AED1.7bn profit for last year. Revenues for the financial year stood at $9.7bn, a 66 percent drop from the same period last year.”

“‘Emirates’ reliance on the hub-and-spoke model has frustrated the airline over the past year as they try to navigate a recovery,’ aviation expert Linus Bauer, founder and managing director of Bauer Aviation Advisory, told Arabian Business.”

“During the pandemic, one of Emirates’ key challenges was the lack of a domestic market to keep flights moving locally while international borders shut, he said.”

“International long-haul flights are expected to take the longest to recover.” Lauren Holtmeier reports

Game Maker Krafton Aims For Up To $5bn in South Korea's Biggest IPO

Nikkei Asia

“Krafton, the South Korean company behind blockbuster video game ‘PlayerUnknown's Battlegrounds’, said on Wednesday its IPO would raise up to 5.6 trillion won ($5 billion) at the top of an indicative range, which would be a record for the country.”

“…At the top of the range, this would be South Korea's largest listing, beating Samsung Life Insurance's 4.9 trillion won IPO in 2010.”

“…South Korea is experiencing its hottest IPO market on record with analysts expecting at least 20 trillion won to be raised in 2021, or about four times above 2020 levels.” Nikkei Asia reports

What Else We’re Reading….

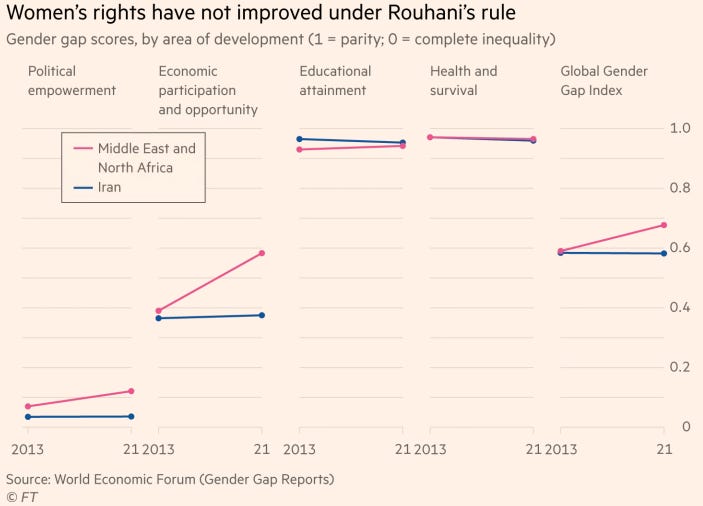

From Celebrations to Soaring Prices: How Iranians Fared under Rouhani

Financial Times

“Shortly after Iran’s centrist president Hassan Rouhani was elected in 2013, the country’s football team qualified for the World Cup, a sign, many said, that the new leader had brought them good luck.”

“After eight years of worsening relations with the west under a bellicose Mahmoud Ahmadi-Nejad, many citizens believed Rouhani’s election signalled a return to normality. People danced in the streets as the new president vowed to ‘unlock’ Iran’s problems. They hoped for improved relations between the theocratic state and the west.

“…Now, as Rouhani prepares to step down after presidential elections on June 18, data show the now deeply unpopular leader has fallen short on many of his promises.” Najmeh Bozorgmehr, Monavar Khalaj, and Chelsea Bruce-Lockhart report

Plans for Indian-made, Google-powered Smartphone Hit Supply Chain Snag

SCMP / Bloomberg

“Billionaire Mukesh Ambani’s plan to conquer the Indian market with a locally assembled Google-powered smartphone is facing headwinds, with supply-chain disruptions and rising component prices suppressing production volumes, people familiar with the matter said.”

“Ambani’s Reliance Industries originally envisioned sales in the hundreds of millions in the first years for the inexpensive device but now targets a small fraction of that at launch, the people said. The co-branded phone is set for its unveiling at the conglomerate’s June 24 shareholder meeting, followed by an official debut as early as August or September, the people said, asking not to be named as the plan isn’t public.”

“The tycoon wants to remake the world’s fastest-growing smartphone market much the way he did wireless services – with aggressive pricing. But any delay in the effort would be a significant setback for Reliance and its Indian manufacturing partners. Chinese rivals like Xiaomi, Oppo and OnePlus have established their brands and set up local manufacturing facilities as they pursue the same audience of consumers upgrading from basic 2G devices.” SCMP / Bloomberg report

Filipinos Rushed Home During the Pandemic. Now They’re Going Abroad Again

Bloomberg

“Lala Abalon spent five years bouncing between temporary office jobs in Dubai before she found steady work as a customer service agent at a real estate company. Then the pandemic struck, and she, along with hundreds of thousands of other Filipino guest workers in the Persian Gulf and elsewhere, was sent packing.”

“Nine months after returning to her parents’ home in the Philippines, she can’t wait to go back overseas. ‘I don’t see a future here,’ says Abalon, 33, who now manages her family’s noodle shop north of Manila. ‘Life is difficult in the Philippines. The pay is better and everything is more accessible abroad.’”

“…There’s a downside, however: The exodus of so many citizens—including scientists and engineers—has hollowed out the domestic workforce, causing a shortage in skilled professionals. Health workers also are leaving for better pay abroad, even as many localities lack doctors and nurses.” Andreo Calonzo and Siegfrid Alegado report