Emerging Markets Daily - June 23

The Proliferation of SuperApps, Energy Execs See $100 Oil, Moody's Slashes India Growth Forecast, Venezuela Exodus Hits Record, The World Mimics Japan-Style Economics

The Top 5 Emerging Markets Stories from Global Media - June 23

Why Every Platform Wants to be a SuperApp

Rest of World

“‘We were selling a dream.’ That’s how Emeka Ajene and his co-founder Greg Costamagna described traipsing around the motorbike parks of Lomé, Togo’s capital city, in 2018, trying to convince skeptical motorcycle drivers to join their new ride-hailing service. That ride-hailing service would be the first feature of an ambitious super app called Gozem, which would rapidly expand to offer food delivery, e-commerce, and financial services.”

“Picking Togo — population 8 million, gross national income per capita $1,670 (2019) — wouldn’t be your obvious choice in West Africa for a consumer-facing tech startup, much less a multipurpose super app. To the west, Ghana offers a larger, fast-growing and stable economy, while one country over to the east is Nigeria, Africa’s largest economy and home to the continent’s most vibrant tech hub…”

“…But here’s the thing: the desire to position Gozem’s offering as a super app is part of a broader trend in developing and emerging markets that are trying to catch up with the rest of the world. They are also inspired in part by Chinese behemoths, WeChat and Alipay, who between them serve nearly 2 billion users a month across China and parts of Southeast Asia.”

“Real and wannabe super apps have proliferated across the world, from El Salvador to Kenya, over the last few years, spurred on most recently by Covid-19 lockdowns that accelerated the need for more real-world digital consumer services. The challenge in many markets has been to get around digital infrastructure barriers, including expensive internet data, phones with limited storage, and low financial inclusion rates.”

“But when you overcome those structural challenges — even partly — successful super apps become uniquely good at managing user flow, said Mark Greeven, a professor of innovation and strategy at the IMD Business School in Lausanne, Switzerland. ‘I’m leveraging these users to third parties of other services, whether they’re taxi drivers or buying airline tickets,’ he said. ‘I can get all these things through to you conveniently, then every transaction might become a commission, and the more I expand, the more I add to my super app, and the more I know about my customer.’” Yinka Adegoke writes.

Oil Execs Join Traders in Seeing Oil Price Rising to $100 a Barrel

“The bosses of some of the world’s biggest oil companies said crude prices are likely to keep rising because a lack of investment will curtail future supply.”

“The chief executive officers of Royal Dutch Shell Plc and TotalEnergies SE joined major commodity traders and banks in predicting that oil could go as high as $100 a barrel, although they also said volatile markets could drive prices back down again.”

“Low investment is ‘going to exacerbate supply and demand tightness as the economies pick back up again, and then in time we’ll see supply pick up and rebalance,’ Exxon Mobil Corp. CEO Darren Woods said at the Qatar Economic Forum Tuesday. ‘In the shorter term, probably, higher prices’ are more likely.”

“Trading house Trafigura Group said oil could top $100 a barrel over the next year. Bank of America Corp. also forecast this week that prices could jump to that level and Goldman Sachs Group Inc. said it doesn’t rule it out. West Texas Intermediate crude has climbed more than 50% this year as widespread vaccinations increase mobility and boost demand. Benchmark Brent crude is up 46% to more than $75 a barrel, the highest in around 2-1/2 years.” Kevin Crowley and Francois de Beaupuy report.

Moody’s Slashes India 2021 Growth Forecast, Though Still a Robust 9.6%

Hindustan Times

“Moody's Investors Service on Wednesday slashed India's growth projection to 9.6 per cent for 2021 calendar year, from its earlier estimate of 13.9 per cent, and said faster vaccination progress will be paramount in restricting economic losses to June quarter.”

“In its report titled 'Macroeconomics – India: Economic shocks from second Covid wave will not be as severe as last year's', Moody's said high-frequency economic indicators show that the second wave of Covid-19 infections hit India's economy in April and May. With states now easing restrictions, economic activity in May is likely to signify the trough.”

"‘The virus resurgence adds uncertainty to India's growth forecast for 2021; however, it is likely that the economic damage will remain restricted to the April-June quarter. We currently expect India's real GDP to grow at 9.6 per cent in 2021 and 7 per cent in 2022,’ Moody's said.”

“Earlier this month, Moody's had projected India to clock a 9.3 per cent growth in the current fiscal ending March 2022, but a severe second Covid wave has increased risks to India's credit profile and rated entities.” Hindustan Times reports.

Venezuela Exodus Reaches Record Levels

The Guardian

“The continuing exodus of millions of Venezuelans is reaching ‘a tipping point’ as the response to the crisis remains critically underfunded.”

“More than 5.6 million have left the country since 2015, when it had a population of 30 million, escaping political, economic and social hardships. It has become the largest external displacement crisis in the region’s history, and the most underfunded.”

“…the total funding per capita for Syrian refugees was more than 10 times that for Venezuelans – at $3,150 compared with $265, based on figures for 2020. Venezuela is second only in the world to Syria in terms of external displacement.” Saeed Kamali Dehghan reports

The World is Embracing Japan-style Economics

Nikkei Asia

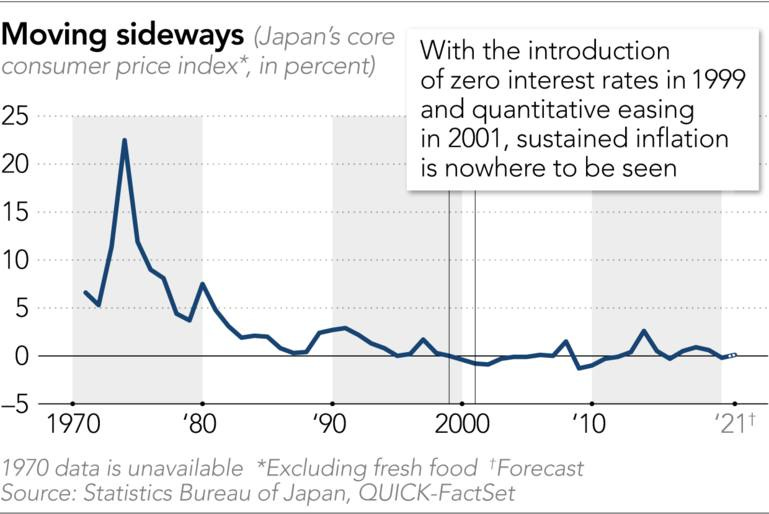

“…Around the same time that Gyomu Super opened its doors to people on ever-smaller budgets, Japan's government launched an audacious monetary policy experiment in an effort to reflate its dented economy. Japan became the birthplace of zero-interest rates, introduced in 1999, and of quantitative easing, launched in 2001 -- both radical ideas at the time.”

“Twenty years later both policies have become standard central bank practice around the world, first with the global financial crisis, and now in an effort to defray the economic cost of the pandemic. But in Japan, two decades of ‘magic money’ -- as this combination of policies was dubbed last year by the journal Foreign Affairs -- has brought stagnation.”

“…As the world emerges from COVID-19 era economic stimulus measures, Japan's experience looms large. Last year, total debt worldwide surged by 35 percentage points to over 355% of global GDP according to the Institute of International Finance, driven by governments borrowing to get their slumping economies through the pandemic. Now, central bankers around the globe are fretting about inflation, stoked by stimulus spending, rising commodity prices and consumer demand. However, in Japan, which has more experience with stimulus policies than any other country in the world, inflation is the furthest thing from anyone's mind. Instead, people have other concerns: low wages, low pensions, and low economic growth with few opportunities.” Mitsuru Obe reports

What We’re Also Reading….

How Alibaba Won Latin American E-commerce

Jing Daily

“…E-commerce in Latin America reached $200 billion and became the second-fastest-growing market in 2020, according to the study Beyond Borders 2020/2021, released by the fintech company EBANX. Naturally, the pandemic caused dramatic growth in first-time online purchasers. According to this study, 52 million people in Latin America shopped online for the first time during the pandemic, a digital shopper increase of up to 30-percent in some countries.”

“…As opposed to the unfavorable views of China that have reached historic highs in the US and Europe, Latin America sees the “Chinese brand” in a positive light. The Council on Foreign Relations says that ‘innovation and technology are emerging sources of China’s influence in LAC,’ with Chinese companies ‘becoming an emerging source of finance for local startups.’” Adina-Laura Achim reports

Rosneft Begins Hunt for Contractors for Massive Vostok Oil Project

Zawya / Reuters

“Rosneft has kicked off meetings with foreign contractors and suppliers for its massive Vostok Oil project, the Russian energy producer said on Monday.”

“It aims to begin shipping oil from the planned project in 2024 via the Northern Sea Route, an alternative to the Suez Canal which shortens travels to the energy-hungry markets of Asia.”

“It has met large contractors from Italy, Germany, China, South Korea and Japan as part of its road show, Rosneft said.”

“Rosneft estimates the project's resources at 6.2 billion tonnes of oil and plans to build three airfields, two sea terminals, a railway, some 50 vessels and facilities to generate 3,600 megawatts of power.” Vladimir Soldatkin and Olesya Astakhova report