Emerging Markets Daily - March 1

Wider Russia Sell-Off Looms, Rouble Freefall Slows, Turkish Opposition Vs. Erdogan, Sea Ltd Eyes Rising E-Commerce Amid Stock Fall, Kazakshtan Air Traffic Triples

The Top 5 Stories Shaping Emerging Markets from Global Media - March 1

Russia Faces Exclusion From Leading Fund Indices as Sanctions Tighten

South China Morning Post

“Russian bonds and equities face a potentially wider sell-off in the coming weeks as sanctions isolate banks and exporters and hurt the nation’s currency, prompting index compilers to remove affected securities from their global indices.”

“Intercontinental Exchange (ICE) said it would exclude sanctioned entity debt covered by the US Office of Foreign Assets Control, UK or European Union from its fixed income indices from February 28. These would include any new debt issued by Russia’s central bank, sovereign wealth fund or the finance ministry.”

“…MSCI, which froze all Russian securities last week, is seeking feedback from market participants on whether to remove Russian stocks from its indices after reviewing its accessibility and investability, it said on Tuesday. More updates are due by the end of the week, it said.”

“‘Many asset managers are under pressure to unload Russian assets in their portfolios,’ said Redmond Wong, market strategist at Saxo Markets. Removal from indices ‘will trigger large selling when the equity market potentially resumes trading next week.’”

“Meanwhile, FTSE Russell on Friday said it was evaluating the impact of sanctions on its indices and would update its proposed treatment by the end of this week. It said on February 24 that none of the current constituents in the FTSE Russell Equity Indices falls within the scope of the sanctions on Russian individuals and entities.” Cheryl Heng reports.

Russian Rouble Free-fall Slows After Central Bank Intervention

The National

“Russia's rouble clawed back lost territory on Tuesday after plummeting more than 28 per cent the day before. The currency was trading at 96.83 to the US dollar at 3.50pm UAE time after it hit a record low of 118 against the greenback in early trading yesterday.”

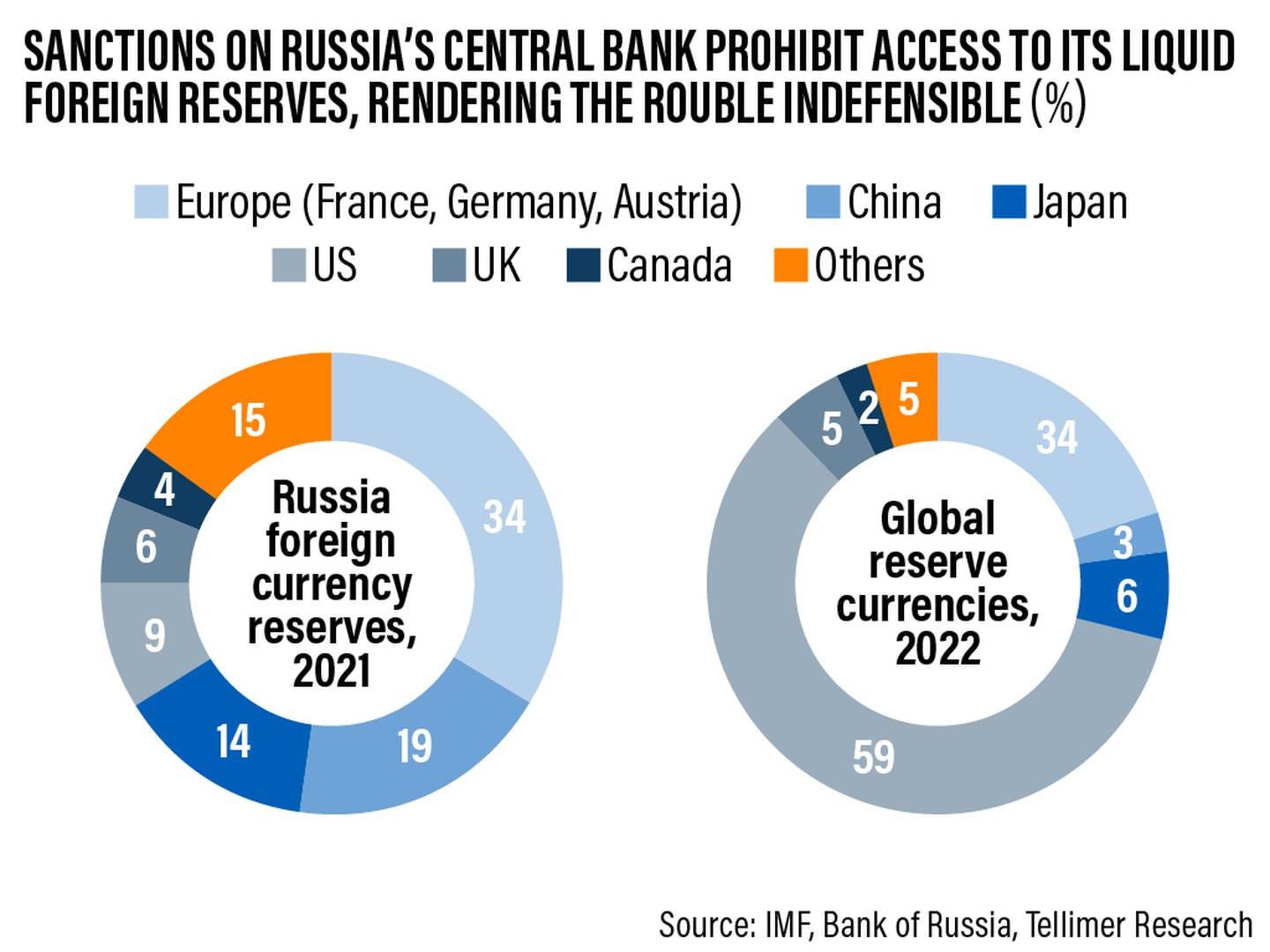

“On Monday, Russia’s central bank imposed capital controls and more than doubled interest rates to 20 per cent, their highest in nearly two decades, after the US and EU allies imposed tighter sanctions in response to its military offensive in Ukraine.”

"‘Markets may well feel that the worst of the bad news is now out there, especially on the sanctions front. I am not so sure of that, but the market is always right, and we have to respect the momentum from a short-term perspective,’ said Jeffrey Halley, senior market analyst at Oanda.”

“However, Hasnain Malik, head of equity research at Tellimer Research said the currency's devaluation ‘is likely not over after the sanctioning of the central bank and the likely move from fiscal surplus to deficit amid the continuation of the war in Ukraine.’”

“The Institute of International Finance said it believes US and EU sanctions on Russia’s central bank will make it more difficult for the Bank of Russia to use its foreign currency reserves to soften the blow to the country’s financial system.” Massou A Derhally reports.

Turkish Opposition Presents ‘Historic Pact’ to Defeat Erdogan

Financial Times

“Six Turkish opposition parties pledged to overhaul the country’s electoral laws and institutions as they signed an ‘historic’ pact aimed at bringing an end to president Recep Tayyip Erdogan’s almost two decades in power.”

“Leaders of the country’s biggest political parties — with the exception of a key pro-Kurdish party — on Monday vowed to limit Erdogan’s role and restore the rule of law after what they say is years of democratic backsliding as the president established a system of one-man rule.”

“‘We are determined to build a strong, liberal, democratic and fair system that establishes the separation of powers with an effective and participatory legislature, a stable, transparent and accountable executive, an independent and impartial judiciary,’ their joint declaration said.”

“Kemal Kilicdaroglu, of the secularist Republican People’s party (CHP) and Meral Aksener, of the right-wing IYI party, were among the party leaders who signed a pact that marked the most significant moment in an effort by Erdogan’s rivals to unite against him that began five years ago.”

“Seren Selvin Korkmaz, executive director of the Istanbul-based think-tank IstanPol, described the declaration as ‘a historic day for Turkey’, adding that the fragmentation and polarisation of Turkey’s opposition had hampered their ability to present a credible challenge to Erdogan.”

“…The president’s rivals face an uphill struggle in convincing voters that they could fix the country’s economy and, if they win, repairing institutions, analysts say. Despite the show of unity, tensions remain over who will be the opposition’s joint presidential candidate.” Laura Pitel reports.

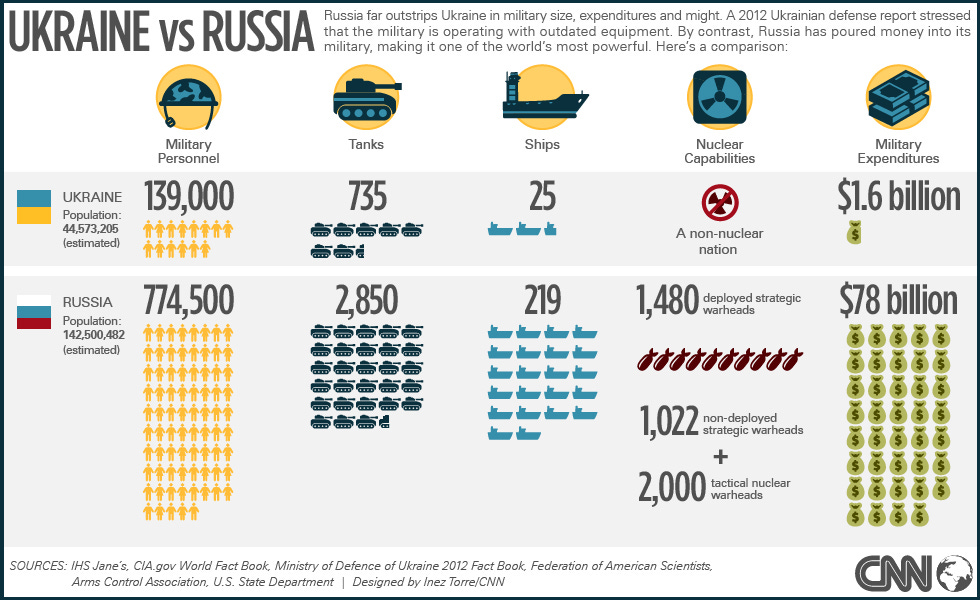

Graphic of the Day - Ukraine vs Russia - Military in Numbers - Via CNN

Sea Ltd. Predicts Rising E-Commerce Sales to Soothe Investors

Bloomberg

“Sea Ltd. said it expects e-commerce revenue growth to continue unabated as it expands in Latin America, trying to reassure investors after losing half its market value in a matter of months.”

“The Singapore-based company expects e-commerce sales, its main source of revenue, to rise to $8.9 billion to $9.1 billion in 2022 from $5.1 billion in 2021, according to its statement on Tuesday. The company said digital entertainment bookings will be as much as $3.1 billion, a drop from 2021.”

“Total revenue in the fourth quarter more than doubled to $3.2 billion. Net loss widened to $617.6 million from $523.6 million as Sea spent more to gain market share in new geographies.”

“Sea is trying to cement its early success in Brazil, where it launched its online shopping business in 2019. The company is facing intense competition from Latin American e-commerce giant MercadoLibre Inc. Meanwhile, Sea’s online-shopping arm Shopee is pulling out of the France, retreating from a major market just months after launching its maiden foray into Europe.” Bloomberg reports.

Flights Over Kazakhstan Triple As Airlines Avoid Russian Airspace

Simple Flying

“As the war in Ukraine rages on and sanctions are levied across the board, airlines have been looking for airspace in Asia to continue flying through. This has made Kazakhstan's airspace extremely valuable in recent days, with flights tripling to over 450 daily.”

“The last 96 hours have been chaos across Europe, including in the sky. The EU and UK have both banned all Russian aircraft from their skies, a move that has been reciprocated. This has meant carriers have to create new flight paths with the airspace currently available to them. Given Russia's location, flights to East Asia have been most affected by the current restrictions.”

“Kazakhstan has emerged as the key to continue operating flights between Western Europe and Asia. Airlines have been flying through the continent and out over the Caspian Sea before entering Kazakh and Mongolian airspace.”

“According to Reuters, the number of flights overflying the country has risen from 150 to over 450 in the last few days alone. If these restrictions remain in place for longer, which is likely, the country will be in a crucial position for global traffic.”

“It was only two months ago that Kazakhstan was battling its own domestic crisis, which saw the closure of its airport to commercial flights. However, the war in Ukraine has shaken global dynamics, and airlines are taking advantage of the key country to maintain essential services.” Pranjal Pande reports.

“Courage is resistance to fear, mastery of fear, not absence of fear.” - Mark Twain