Emerging Markets Daily - March 10

Foreign Investors Flee India Stocks, 'No Progress' on Russia-Ukraine Talks, Modi's BJP Leads in State Elections, S. Korea New President, Oil Could Hit $240 By Summer

The Top 5 Stories Shaping Emerging Markets from Global Media - March 10

A Billion Dollars a Day, Foreign Investors Flee Indian Stocks

Bloomberg

“India’s $3.2 trillion stock market is witnessing an unprecedented foreign selloff as the surge in oil prices fuels worries of an inflation shock in the major energy-importing nation.”

“While global funds have been net sellers of local equities since the start of October, when the benchmark S&P BSE Sensex hit an all-time high, the pace of outflows has intensified since the start of the war in Ukraine. India relies on imports to meet about 85% of its oil needs.”

“Overseas investors have offloaded $2 billion of local shares in just two days this week, according to the latest exchange data compiled by Bloomberg, after a record withdrawal of $2.9 billion last week. With this, $19 billion has flown out since Sept. 30, about half of the foreign money local shares lured since the pandemic lows in March 2020. That’s pushed down the rupee to an all-time low.”

“The current exodus has hit a record, exceeding the foreign outflows seen during the 2008 global financial crisis, according to Bloomberg Intelligence analysts Nitin Chanduka and Kumar Gautam. In past instances, FII selling has generally eased when peak-to-trough outflows approached $8-$10 billion, with the sole exception of the 2008 crisis.”

“Even so, sustained buying by domestic investors has helped Indian stocks avoid a sharp rout in recent weeks. While the Sensex is down about 10% from its October peak, the gauge is little changed so far this month. That’s when the broader MSCI Asia Pacific Index has lost 4.1% in March.”

“Domestic funds have infused a net almost $21 billion into local equities since end-September.”

“While the impact of the war in Ukraine could weigh on domestic earnings for up to two quarters, foreign investors may return when tensions cool, said Rupen Rajguru, head of equity investments at Julius Baer Wealth Advisors India Pvt.” Ashutosh Joshi reports.

No Progress as Top Ukraine, Russia Diplomats Meet in Turkey

Al Jazeera

“Ukraine’s foreign minister said he discussed a 24-hour ceasefire with his Russian counterpart but no progress was made as Moscow’s representative defended its invasion and said it was going as planned.”

“The foreign ministers of Russia and Ukraine met for face-to-face talks in Turkey on Thursday in the first high-level contact between the two sides since Moscow invaded its ex-Soviet neighbour last month.”

“Ukraine’s Dmytro Kuleba said he secured no promise from Russia’s Sergey Lavrov to halt firing so aid could reach civilians, including the main humanitarian priority – evacuating hundreds of thousands of people trapped in the besieged port city of Mariupol. ‘We also talked on the ceasefire but no progress was accomplished on that,’ Kuleba told reporters after meeting Lavrov.”

“‘It seems that there are other decision-makers for this matter in Russia,’ Kuleba added in apparent reference to the Kremlin.He described the meeting as ‘difficult’ and accused Lavrov of bringing ‘traditional narratives’ to the table. ‘I want to repeat that Ukraine has not surrendered, does not surrender, and will not surrender,’ said Kuleba.” Al Jazeera reports.

Modi’s BJP Leading in Key Battleground State Election

Nikkei Asia

“Indian Prime Minister Narendra Modi's party is headed for a big election win in India's most populous and bellwether state of Uttar Pradesh, potentially setting the tone for the 2024 national election, in which Modi's party will seek a third consecutive 5-year term.”

“Uttar Pradesh -- home to over 200 million people and which is currently ruled by Modi's Bharatiya Janata Party -- along with four other Indian states, Punjab, Uttarakhand, Manipur and Goa, held staggered polls between Feb. 10 and Mar. 7. Vote counting began Thursday morning, with the BJP leading in nearly 250 seats out of 403 in Uttar Pradesh, according to the Election Commission of India.”

“The BJP won over 300 seats in the 2017 Uttar Pradesh elections. It is the first time since 1985 that a party has reclaimed the state. In Uttarakhand, the BJP is set to form a government for a second straight five-year term and is on course to emerge as the single largest party in Manipur and Goa.”

“…A BJP victory in Uttar Pradesh would enhance its chances of winning the 2024 national elections, as Uttar Pradesh accounts for 80 of the 540-plus parliamentary seats that will be contested in 2024.”

“..The BJP's performance under the leadership of Modi and its firebrand, saffron-clad Uttar Pradesh Chief Minister Yogi Adityanath, is significant coming against the backdrop of high unemployment, price rises, and criticism of the central government's handling of COVID-19 in April-May last year. Its victory also comes despite protests against three controversial farm laws that were repealed in November.” Kiran Sharma reports.

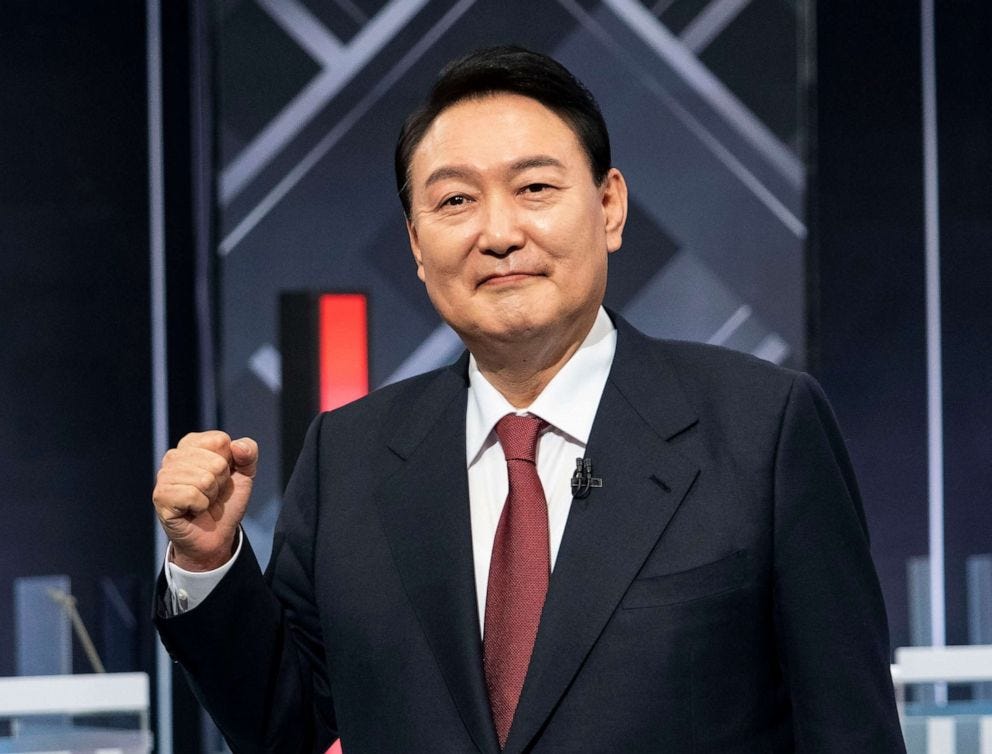

South Korea Incoming President Seen As Closer to U.S, Wary of China and N. Korea

CNBC

“South Korea’s incoming president Yoon Suk-yeol is expected to revive a conservative stance on foreign policy — and that could change the country’s relations with the U.S. and China, analysts said.”

“Relations with North Korea, the U.S. and China will be of particular importance, according to Tom Rafferty, Asia regional director at The Economist Intelligence Unit.”

“Yoon has signaled he would pursue closer relations with the United States. That could include buying another THAAD missile defense system as a countermeasure against North Korea, said Karl Friedhoff, fellow in public opinion and Asia policy at the Chicago Council on Global Affairs.”

“But a cozier relationship with the U.S. could affect Seoul’s relations with China, South Korea’s largest export market, Rafferty told CNBC’s ‘Street Signs Asia’ on Wednesday. Yoon could try to take a tougher line on China, but Friedhoff said the incoming president would soften when faced with the economic consequences.” Chelsea Ong reports.

In Worst Case Scenario, Oil Prices Could Hit $240 This Summer

Rig Zone

“Oil prices could hit $240 per barrel this summer in the worst-case scenario if Western countries roll out sanctions on Russia’s oil exports en masse. That’s according to Rystad Energy’s head of oil markets, Bjørnar Tonhaugen, who made the statement in an extraordinary market note sent to Rigzone on Wednesday.”

“‘Market volatility is at an all-time high, with prices surging on the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West,’ Tonhaugen said in the statement. ‘Although fortunately not the most likely scenario, traders, analysts and decision-makers alike should prepare for elevated prices based on the current landscape,’ he added in the statement.

“‘This is the largest energy crisis in decades and the impact on the world’s most important commodity is going to be unprecedented,’ Tonhaugen continued. In the note, the Rystad head outlined that if more Western countries join the U.S. and impose oil embargoes on Russia, it would create a 4.3 million barrel per day hole in the market 'that simply cannot be quickly replaced by other sources of supply.’”

“‘If 4.3 million barrels per day of Russian oil exports to the West are halted by April 2022, and where China and India only keep current import levels intact, Brent would need to spike to $240 per barrel by the summer of 2022 to destroy demand,’ Tonhaugen added.”

“‘The higher prices go, the larger the chances of the global economy entering a recession already in the fourth quarter of 2022,’ Tonhaugen said.”

“Oil at $240 per barrel would trigger a global recession and self-destruct the price level within just a few months, after which prices would fall sharply,” he added.

“In a briefing note sent to Rigzone last Friday, Goldman Sachs outlined that if traders continue to resist buying Russian oil, or if energy sanctions materialize, crude prices could increase to as much as $150 per barrel in the coming months.” Andrea Exarheas reports.

“A year from now you may wish you had started today.” —Karen Lamb