Emerging Markets Daily - March 14

Chinese Stocks Plummet on Panic Selling, Japan Call to ME Allies: More Oil, The Big Nickel Short, Ex-Marxist Wins Colombia Primary, Russia Gas Flows to Europe Steady

The Top 5 Stories Shaping Emerging Markets from Global Media - March 14

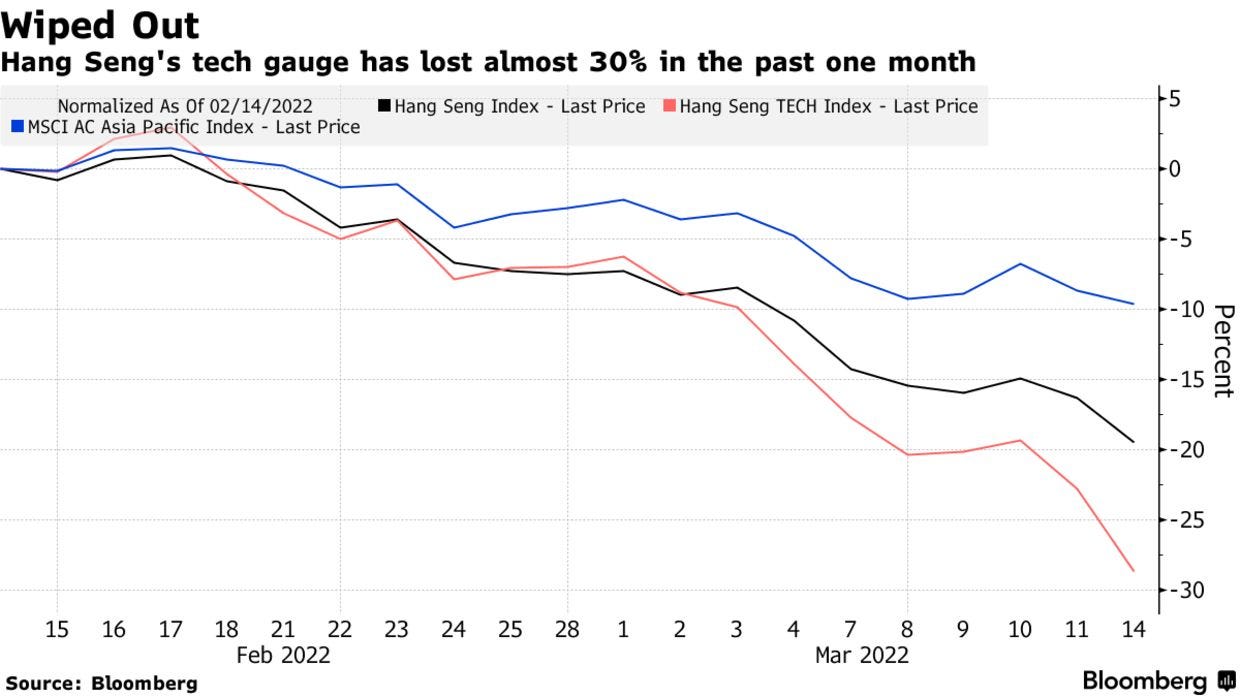

Panic Selling Grips Chinese Stocks in Biggest Plunge Since 2008 - $2.1 Trillion in Value Lost Since Last Year’s Peak

Bloomberg

“Chinese stocks listed in Hong Kong had their worst day since the global financial crisis, as concerns over Beijing’s close relationship with Russia and renewed regulatory risks sparked panic selling.”

“The Hang Seng China Enterprises Index closed down 7.2% on Monday, the biggest drop since November 2008. The Hang Sang Tech Index tumbled 11% in its worst decline since the gauge was launched in July 2020, wiping out $2.1 trillion in value since a year-earlier peak.”

“The broad rout follows a report citing U.S. officials that Russia has asked China for military assistance for its war in Ukraine. Even as China denied the report, traders worry that Beijing’s potential overture toward Vladimir Putin could bring a global backlash against Chinese firms, even sanctions. Sentiment was also hurt by a Covid-induced lockdown in the southern city of Shenzhen, a key tech hub, and the northern province of Jilin.”

“That comes on top of a spate of regulatory worries. Tencent Holdings Ltd. is reportedly facing a possible record fine for violations of anti money-laundering rules, which pushed the stock down nearly 10% on Monday. There’s also a risk of Chinese firms delisting from the U.S., as the Securities and Exchange Commission identified some names as part of a crackdown on foreign firms that refuse to open their books to U.S. regulators.”

“On Friday, the Golden Dragon Index, which tracks American depository receipts of Chinese firms, slumped 10% for a second consecutive day -- something that’s never happened before in its 22-year history. It fell as much as 13% Monday after posting its steepest weekly decline since at least 2001. China’s benchmark CSI 300 Index closed 3.1% lower on Monday. The onshore yuan also fell to its weakest in a month as sentiment toward Chinese assets turned sour.”

“The MSCI China Index has seen its valuation more than halve from a Feb. 2021 peak. The gauge is trading at about 9 times its 12-month forward earnings estimates, versus a five-year average of 12.6.” Bloomberg reports.

Japan to Call on Middle East Oil Producers to Raise Output

Asahi Shimbun

“Japan will ask oil producing countries in the Middle East to ramp up production in the face of surging prices triggered by Russia’s invasion of Ukraine, Prime Minister Fumio Kishida said March 13.”

“‘I am ready to lead diplomatic efforts myself to secure supplies from oil producers in the Middle East with whom Japan has maintained steady ties with regard to natural resources,’ Kishida said at a meeting of his Liberal Democratic Party in Tokyo.”

“Kishida also said the government will diversify energy sources and their suppliers to help Japan become more resilient in energy crises. But he reiterated that the government will not join the United States and some European countries in imposing sanctions against Russia hitting Russia’s energy sector.”

“…Japan relies on Russia for about 8 percent of its natural gas needs and about 4 percent of its crude oil needs.” Taishi Sasayama reports.

The Big Nickel Short - JP Morgan Leads Talks on Nickel Crisis Damage - Billions on the Line

Wall Street Journal

“Some of the world’s biggest banks worked over the weekend to resolve a crisis in the nickel market that leaves them on the hook for billions of dollars owed by a Chinese metals giant.”

“JPMorgan Chase, Standard Chartered, PLC and BNP Paribas SA, were among the banks and brokers seeking to reach an agreement with Tsingshan Holding Group, people familiar with the discussions said. Trades placed by the Chinese steel and nickel producer on the London Metal Exchange contributed to an uncontrollable rise in prices that led the exchange to halt trading and cancel eight hours’ worth of transactions last Tuesday.”

“Nickel, a cog in the world economy for its use in stainless steel and electric-vehicle batteries, hasn’t traded since. The meltdown bled into the financial system, leaving Tsingshan’s banks and brokers with several billion dollars in unpaid margin, the upfront cash brokers require to make trades, some of the people familiar with the discussions said.”

“The talks between Tsingshan’s creditors, led by JPMorgan, have focused on extending the Chinese company credit lines so that it can pay them the margin it owes, some of the people familiar with the discussions said. One plan under discussion was to secure this lending against Tsingshan’s steel and nickel assets in China and Indonesia, some of the people said.”

“Despite Tsingshan’s troubles, with nickel prices close to records, extending such credit could be highly profitable given the company’s vast production capabilities, some of the people said.”

“Nickel prices began to rise after Russia, a major producer of the metal, invaded Ukraine, a high-profile example of how the war and punishing Western sanctions have upended the world’s commodity markets, sending prices for metals and energy to their highest levels in years.”

“The rally morphed into a crisis for the LME last week. Producers such as Tsingshan often sell forward contracts as a way to lock in prices on the physical nickel they mine and refine. In effect, they hold positions that benefit when prices fall, and lose money when prices rise.”

“Some of Tsingshan’s brokers desperately tried to buy those nickel contracts back to stem losses and avoid escalating margin calls. That buying pushed prices for benchmark three-month forward contracts up 66% in a single session.” Wall Street Journal reports.

Former Marxist Guerilla Sweeps Colombia Election Primary

“He has pledged to wind down Colombia’s oil industry by halting all exploration, and said the country should focus on manufacturing and agriculture instead. Economists say the policy would have a huge impact. Fossil fuels generate about half of Colombia’s export revenue.”

Financial Times

“Leftwinger Gustavo Petro won an emphatic victory in a Colombian primary election on Sunday, confirming he is the man to beat in this year’s presidential vote, while his coalition did well in legislative elections and will be one of the biggest blocs in the next parliament.”

“With just over 99 per cent of votes counted in the leftwing primary, Petro had taken over 80 per cent of the vote in a contest between five candidates. He will now go on to the first round of the presidential election on May 29 and most opinion polls suggest he is favourite to win.”

“…If he wins the presidency, Petro, a senator, former congressman and ex-mayor of Bogotá, would take Colombia sharply leftwards after four years of rightwing rule under President Iván Duque.”

“He has pledged to wind down Colombia’s oil industry by halting all exploration, and said the country should focus on manufacturing and agriculture instead. Economists say the policy would have a huge impact. Fossil fuels generate about half of Colombia’s export revenue.”

“The 61-year-old has also pledged wholesale land reform, a wealth tax on the largest 4,000 fortunes in the country and the repeal of laws from two decades ago that liberalised the labour market.” Gideon Long reports.

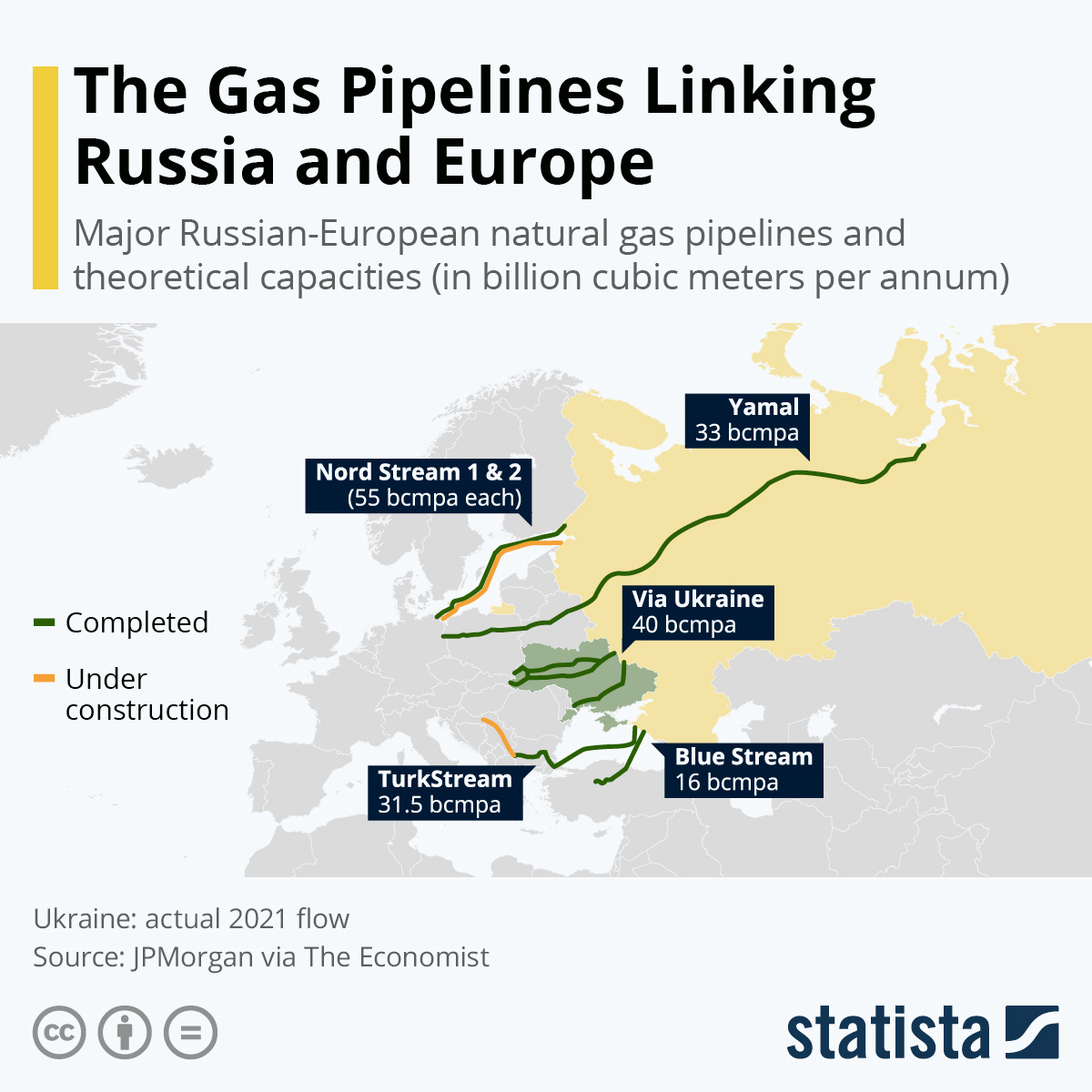

Russia Gas Flows to Europe via Pipeline Remain Steady

Hellenic Shipping News/Reuters

“Russian gas flows into Germany via Nord Stream 1 and Poland and into Slovakia via Ukraine were steady early on Monday, pipeline operator data showed on Friday morning.”

“Russian natural gas company Gazprom GAZP.MM said it was continuing gas shipments via Ukraine, with volumes at 109.5 million cubic metres per day, marginally down from 109.6 million a day earlier.”

“Flows through the Nord Stream 1 pipeline which crosses the Baltic Sea to Germany were steady at 73,050,476 kilowatt hour per hour (kWh/h), operator data showed.”

“On the Yamal-Europe pipeline, which traverses Belarus and Poland, westward flows into Germany at the Mallnow border point stood at 8,664,192 kWh/h, data from operator Gascade showed, slightly higher than on Friday.”

“The pipeline usually accounts for about 15% of Russia’s supply of gas to Europe but had been operating in reverse mode at Mallnow from Dec. 21, which helped drive up European gas prices.” Hellenic Shipping News and Reuters report.

“All we have to decide is what to do with the time that is given us.” - The Fellowship of the Ring, J.R.R. Tolkein