Emerging Markets Daily - March 17

Egypt to Seek IMF Help, Turkey and Nigeria Sell Bonds, Battered China Tech Investors Get A Boost, Oyo of India Eyes IPO, Sri Lanka Faces Protests and IMF Bail-Out

The Top 5 Stories Shaping Emerging Markets from Global Media - March 17

Egypt To Seek IMF Help To Weather Fallout from Ukraine War

The National

“With its economy under pressure from the fallout of the war in Ukraine, Egypt is in talks with the International Monetary Fund on possible support from the lender.”

“The confidential talks are at a preliminary stage and delegates from the two sides are looking at several options, including a standby loan or a credit line that can be tapped if needed.”

“Fitch Ratings said this week that a new IMF programme for Egypt is among ‘the policy options available to the Egyptian authorities to shore up the country’s external position’. There is also the possibility of Egypt’s Gulf allies using an influx of funds from higher oil prices to help Cairo, it said.”

“…Egypt’s contact with the IMF comes at a time when the Ukraine war, higher energy prices and supply chain disruption caused by the Covid-19 pandemic are combining to push food prices higher, especially wheat-based items such as bread, a main staple for most of the country’s 102 million people.” Hamza Hendawi reports.

Junk-Rated Turkey, Nigeria Defy Market Chaos to Sell Dollar Debt

Bloomberg

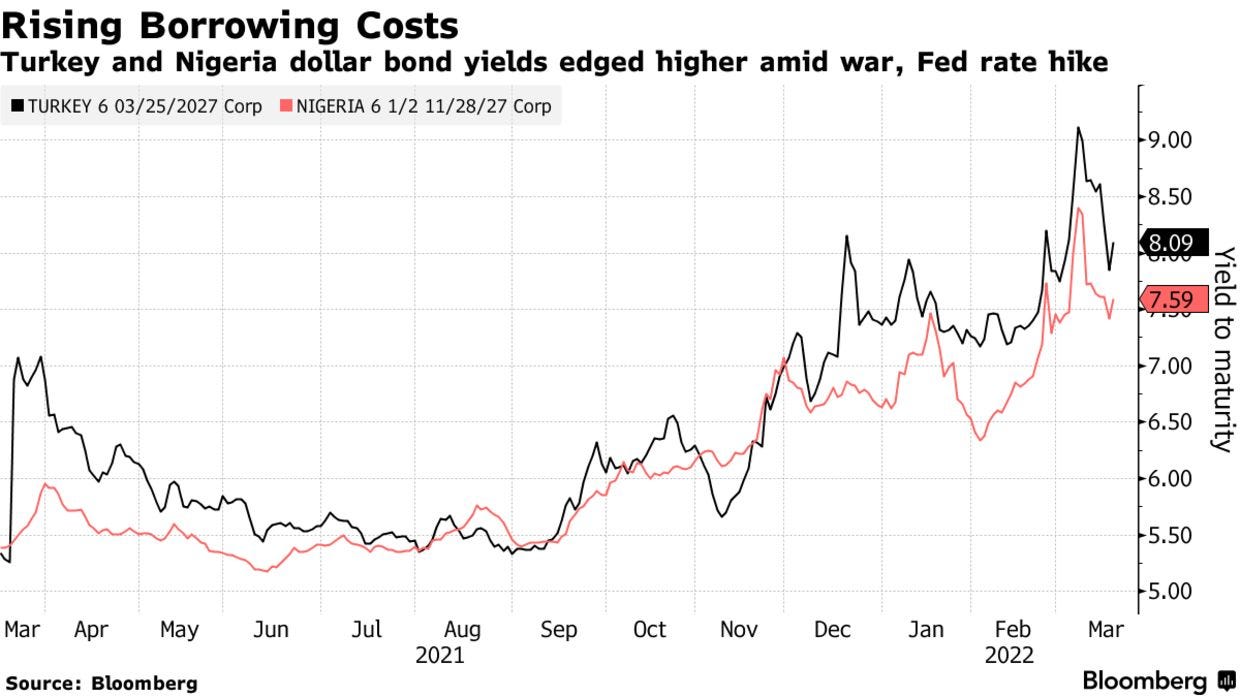

“Two junk-rated developing nations are selling dollar bonds just as the Federal Reserve kicks off its rate liftoff, shrugging off higher borrowing costs and a choppy market.”

“Turkey and Nigeria are offering greenback-denominated debt on Thursday, with both showing a willingness to pay a juicy premium over similarly-dated outstanding notes. Turkey, which is rated B+ by S&P Global Ratings, plans to sell bonds due 2027 for a yield of 8.875%, while B- rated Nigeria is marketing notes due 2029 at 8.75%, according to people familiar with the deal who asked not to be identified because they aren’t authorized to speak about it.”

“The timing of the deals surprised investors given that yields are rising worldwide as the Fed raises interest rates and commodity-price increases since Russia’s Ukraine war threaten to increase inflation. While Nigeria stands to benefit from the rally in oil prices, as Africa’s largest producer, it needs to raise money to close budget shortfalls that have risen since the pandemic.”

“…Turkey sold $3 billion in sukuk dollar bonds just a month ago, its largest overseas debt placement on record, paying a higher yield than most similar bonds…For Nigeria’s new notes due 2029, meantime, the country is willing to pay a premium of around 90 basis points over its dollar bonds due a year earlier, which currently trade at a 7.83% yield.” Aline Oyamada reports.

Beleaguered China Tech Investors Get Another Dose of Support from Regulator

South China Morning Post

“China will encourage publicly traded companies to buy back their shares and money managers to invest in their own funds, offering investor-friendly policies to bolster the world’s second-largest capital market amid an unprecedented rout.”

“The government will continue to widen access to the capital market and maintain Hong Kong’s market stability through stronger cross-border collaboration, the China Securities Regulatory Commission (CSRC) said on its website late Wednesday.”

“The CSRC’s statement came hot on the heels of a Wednesday meeting chaired by China’s economic tsar Liu He, in which he pledged to uplift the market and the economy.”

“Most importantly, the vice-premier asked that market-sensitive regulatory policies to be ‘coordinated with financial regulatory authorities in advance’ to manage market reactions and expectations, according to the official readout of the meeting by Xinhua News Agency.” Zhang Shidong reports.

Oyo Rejigs Top Brass Ahead of IPO

Business Standard (India)

“Travel tech major Oyo on Thursday announced that Ankit Gupta, currently the CEO of its Hotels and Homes vertical, will now be heading its India business as CEO.”

“The company said it is elevating Rohit Kapoor to a global role as the company’s marketing head, from his current position of CEO – India & Southeast Asia. The company also announced that its Global Chief Business Officer, Ankit Tandon, will take on the additional responsibility of Southeast Asia with specific focus on Indonesia and the Middle East region as its CEO.”

“…Meanwhile, the SoftBank- and Sequoia-backed company is considering slashing its IPO valuation by half or even shelving the debut, according to a Bloomberg report.” Deepsekhar Choudhury reports.

Sri Lanka Forced Into IMF U-Turn After Financial Crisis Sparks Protests

Financial Times

“Sri Lanka has begun talks with the IMF over a debt relief package after protests over a deepening economic crisis forced Gotabaya Rajapaksa’s government into a policy U-turn.”

“The president told the country on Wednesday night that he was ‘attempting to immediately resolve this crisis and provide relief to the people.’”

“…Sri Lanka has for months faced mounting economic pain as its depleted foreign currency reserves triggered shortages of imports and fuel, power blackouts and double-digit inflation. Thousands of protesters and opposition parties gathered in Colombo this week calling on Rajapaksa’s government to resign over its handling of the economy.”

“The government has until now insisted that Sri Lanka would be able to navigate the crisis without IMF assistance. But its strategy, which involved securing bilateral aid from countries such as India and a post-pandemic revival in tourism, was dismissed by many investors and analysts as unrealistic.”

“The island nation had debt and interest repayments worth about $7bn due this year, its finance minister Basil Rajapaksa told the Financial Times in January. But analysts estimate that usable foreign currency reserves have fallen as low as $500mn.” Benjamin Parkin reports.

Tweet of the Day - “Something big is happening…” Looking at China In A New Light?

“Life isn't about finding yourself. Life is about creating yourself.”

― George Bernard Shaw