Emerging Markets Daily - March 29

Buy the Dip on China Tech?, More Progress on Suez Reopening, China Slows Metals Bull Run, Abu Dhabi's Murban Crude Debuts as Benchmark, Bangladesh at 50: Booming Economy But Challenges Remain

The Top 5 Emerging Markets Stories from Global Media - March 29

Buy The Dip on China Tech? And Economic Recovery Could Lift EM

“The massive selloff in U.S.-listed shares of Chinese technology companies isn’t linked to their fundamentals and makes for a bigger buying opportunity, according to Citigroup Inc,” Bloomberg reports.

“The brokerage reiterated buy ratings on Baidu Inc., Tencent Music Entertainment Group and Vipshop Holdings Ltd. following what it called an ‘unfortunate dislocation’ of their share prices. Gary Dugan, chief executive officer at the Global CIO Office in Singapore, along with a few other fund managers echoed Citi’s views.”

“‘While we are not sure whether the huge volatility of share price movement of many technology stocks during the last few days could trigger more forced selling pressure or de-risk selling sentiment from other funds in the next few days, we do believe and are reassured that none of the sell-down is fundamental related,’ Citi analysts including Alicia Yap wrote in a note.”

Meanwhile, Bloomberg reports that “A recovery in the world’s second-largest economy could lend support to emerging markets after a rocky week that saw equities wipe out almost all of their annual gains and the Turkish lira tumble anew.”

“Data from China, set to be published on Wednesday, will probably show a rebound in both the manufacturing and non-manufacturing sectors, supporting the broader backdrop of improving global growth. Meantime, the developing world’s better corporate outlook may lure investors to buy the dip.”

“Last week, MSCI Inc.’s developing-nation stock index slumped amid declines in Turkey, Argentina and China. A selloff in the Turkish lira sent emerging-market currencies to their fifth loss in six weeks, and dollar bonds also edged lower. The recent weakness is encouraging stock-picking in some developing nations that are poised to rebound. Strategists at Goldman Sachs Group Inc. tout attractive valuations in South Africa and Russia while others favor China.”

Hopes Rise on Suez Opening After Partial Refloating of Ship

“A huge container ship blocking Egypt’s Suez Canal for nearly a week has been partially refloated, raising hopes that the busy waterway will soon be reopened for a big backlog of ships,” Reuters reports.

“The 400-metre (430-yard) long Ever Given became jammed diagonally across a southern section of the canal in high winds early last Tuesday, halting traffic on the shortest shipping route between Europe and Asia.”

“The Suez Canal Authority (SCA) said on Monday the vessel had been mostly straightened along the eastern bank of the canal and further tugging operations would resume once the tide rose later in the day…”

“Around midday Monday, tugs could be seen maneuvering around the ship, some with tow lines attached, churning the water beneath them.”

China Pumps, Then Slows, Metals Bull Run

“Nearly a year-long bull run among industrial metals is faltering this month as the unwinding of a stimulus in China slows demand, underscoring the increasingly pivotal role its state-led economy plays in global commodity booms,” The Wall Street Journal reports.

“China last year put some $500 billion in state investment to prop up its pandemic-pummeled economy. The stimulus drew imports of everything from crude oil to steel. With Beijing wanting to be a global leader in clean energy, many in the resources industry viewed the boom as the start of a yearslong growth arc, or ‘super cycle,’ especially among metals crucial to electrification and batteries.”

“A budding global economic recovery helped the rally. But China, which accounts for as much as 60% of the world’s resource consumption, has in recent weeks pulled back from its investment-led playbook, as policy makers refocus on containing bad loans and retooling the economy onto a consumer-led footing. Amid fresh concern that some battery-making metals could be globally oversupplied, benchmark metals fell in March from records a month earlier—nickel by 18%, cobalt 13% and copper 9%.”

“‘You’d call it a supercycle only if you forget about the corrections,’ said Alicia Garcia-Herrero, Asia-Pacific chief economist at investment bank Natixis. ‘The fundamental signs are of a cyclical recovery, but we are also talking about a world that needs less commodities.’”

Abu Dhabi’s Murban Crude Debuts as Benchmark, Signaling “New Era”

“From Monday, Murban crude, trading under the symbol ‘ADM’, will join the ranks of prominent oil price benchmarks Brent and West Texas Intermediate in a ‘new era’ for global energy markets,” The National reports.

“A light crude, which accounts for half of the UAE's oil production, Murban will have a contract for future delivery bought and sold on the ICE Futures Abu Dhabi exchange from Monday. The exchange, run by Intercontinental Exchange (ICE) is a historic first for the Middle East, as Murban, the UAE's flagship crude grade, produced from onshore wells by the Abu Dhabi National Oil Company, is used to price and hedge oil being traded into Asian markets.”

“Two-thirds of global oil is traded in reference to the Brent benchmark, which is calculated on the basis of fields in the North Sea that are in decline. WTI, which tracks US crude grades, is more indicative of domestic supply and demand in the world's largest producer of oil and gas.”

“The Middle East accounts for the largest share of global production at 31.9 per cent, according to BP Statistical Review of World Energy 2020. The UAE, which is the third-largest producer within Opec accounts for nearly 4.2 per cent of global output…”

“The new Murban contract will be be based on a two-month delivery, with the first one for June delivery expiring at the end of April. From New York to Singapore, traders will be able to buy and sell Murban futures contracts, 22 hours a day, five days a week.”

Bangladesh At 50: Booming Economy, Exports, But Challenges Remain

“Bangladesh is marking the 50th anniversary of its independence from Pakistan, buoyed by economic progress and a relatively successful response to the coronavirus pandemic -- but aware of the progress still needed to lift more of its 163 million people, 2% of the global population, out of poverty,” Nikkei Asian Review reports.

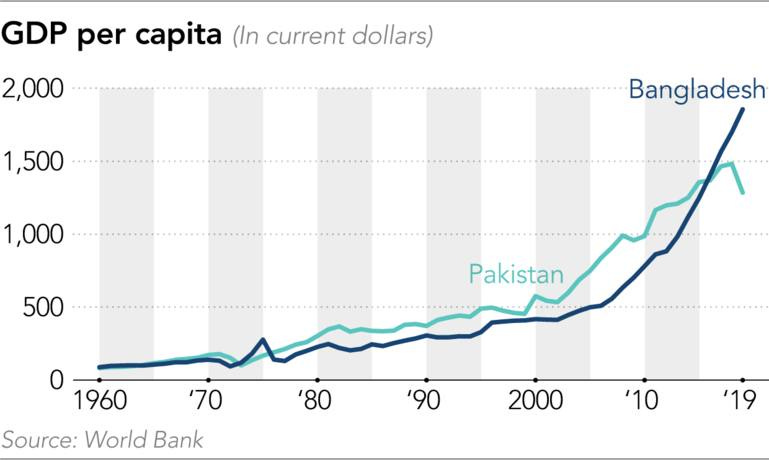

“Since 1971, when Bangladesh became independent, it has outstripped Pakistan in generating growth, with apparel exports and a surge in remittances helping to drive the economy. Bangladesh's growth rate exceeded 8% in 2019, according to World Bank data. When the country seceded from Pakistan, its gross domestic product per capita was about three-quarters of Pakistan's; by 2019, it was almost 45% more.”

“The country reached lower middle-income country status in 2015 -- defined by the World Bank as having gross national income per capita of between $1,036 and $4,045. The category also includes India, Pakistan and the Philippines. Bangladesh is also on track to be moved out of the United Nation's Least Developed Countries list in 2026…”

Source: Nikkei Asian Review

“Trade accounted for nearly 37% of Bangladesh's GDP in 2019, compared with about 30% for Pakistan. The country's export earnings are overwhelmingly reliant on its ready-made garment industry, with clothing products making up more than 80% by value, according to 2019 data from the World Trade Organization. That has grown from under 40% in 1990.”

What We’re Also Reading…

Daniel Yergin’s op-ed on the Suez Canal Shutdown

“Containerization was only born in 1956, the same year as the Suez Crisis, with the loading of the first container ship in the Port of Newark in New Jersey. In terms of tonnage, 50% going through the canal today are container ships, and 18% oil.”

“This partly reflects the changing pattern of world oil trade, with more Middle East oil now heading to Asia. The canal is also important for shipments of liquefied natural gas going west,” Yergin writes in CNBC.com

Rethinking the New Minerals Boom

“The new demand supporting the energy transition does not change the act of mining. Extracting minerals, such as lithium, cobalt or copper, is still a dirty business with significant environmental and human impact.”

“This new boom threatens to open new extractive frontiers, in the global south but also in North America and Europe. There is an urgent need to deal with the potential widespread destruction and human rights abuses that could be unleashed.”

“Although it is crucial to tackle the climate crisis, and rapidly transition away from fossil fuels, this cannot be achieved by just expanding our reliance on other materials. The energy crisis is fundamentally a resource-usage crisis.” Andy Whitmore writes in the FT’s Commodities Note.

Famed Lebanese Street Food Brand, Barbar, to Expand to GCC States

“Born during Lebanon's civil war, the Barbar restaurant is now expanding from its humble beginnings across the Gulf, bringing the popular Beiruti street food to Saudi Arabia and the UAE.”

“The 43-year-old Barbar will open its doors on Dubai’s Hessa Street around mid-May. In partnership with Kitch, the iconic Beirut restaurant will further expand in the GCC with eight restaurants and cloud kitchens planned for the UAE and 20 in Saudi Arabia, four of which will start operating in Riyadh in the second quarter of this year. Kitch said it will also open two Barbar restaurants in Qatar by the beginning of 2022.”

“Mohammad Ghaziri launched Barbar in 1979 during the Lebanese civil war as a small manouche bakery in front of the famous Piccadilly theatre in the heart of Beirut. Within the first few years of opening, the restaurant gained fame and was visited by singers, artists, and celebrities who performed at the theatre.” Arabian Business reports.

A New World Bank Study on Singapore’s Start-Up Ecosystem

The Evolution and State of Singapore’s Start-Up Ecosystem, co-authored by Jamil Wyne, Toni Eliasz, and Sarah Lenoble.

“This case study aims to document the state and evolution of Singapore’s startup ecosystem. It also identifies key characteristics that both distinguish the Singapore start-up ecosystem, as well as provide policymakers from other countries with a glimpse of specific measures they can pursue – identifying both its successes as well as lingering challenges - and to distill the lessons learned to inform policymaking in emerging markets that seek to emulate Singapore’s success to date.”

Note to Fellow Travelers/Readers: If you see a book or a study or article or Netflix series or vintage poster or anything Emerging World-y that you think we should see or feature, please send us a note at newsilkroadexchange@gmail.com