Emerging Markets Daily - March 31

IMF To Raise Global Growth Forecast, China Economy To Eclipse U.S This Decade, China Eyes Africa as Iron Ore Hub, Saudi Shares Rise on Stimulus Plan, India Unicorn Plans U.S IPO

The Top 5 Emerging Markets Stories from Global Media - March 31

Global Economy on “Firmer Footing,” IMF Says, But Divergences Loom

The National (UAE)

“The global economy is on a ‘firmer footing’, supported by $16tn in government stimulus and a rapid Covid-19 vaccine rollout that has prompted the International Monetary Fund to upgrade its growth forecast for this year and next, its managing director said.”

“The Washington-based fund, which in January projected global growth of 5.5 per cent in 2021, warned there is a divergence in the pace of recovery for developed and emerging economies and said uncertainties remain.”

“‘We now expect a further acceleration: partly because of additional policy support – including the new fiscal package in the United States – and partly because of the expected vaccine-powered recovery in many advanced economies later this year,’ Kristalina Georgieva, the IMF's managing director said on Tuesday...”

“Countries across the world are rolling out mass inoculation programmes to control the spread of the pandemic, which last year pushed the global economy into its deepest recession since the 1930s. Global trade has since recovered, with faster-than-anticipated growth in China and other markets including the US improving the outlook.”

“While the overall outlook has brightened, recovery prospects are ‘diverging dangerously’ not only within nations but also across countries and regions. ‘In fact, what we see is a multi-speed recovery, increasingly powered by two engines – the US and China. They are part of a small group of countries that will be well ahead of their pre-crisis gross domestic product levels by the end of 2021,’ she said. ‘But they are the exception, not the rule.’” Sarmad Khan reports in The National.

China On Track To Surpass U.S As Largest Economy This Decade

Bloomberg

“China’s V-shaped recovery from the coronavirus pandemic has accelerated this century’s most significant economic shift: its rapid catch-up and likely toppling of the U.S. as the world’s biggest economy,”

“As the only major economy to have expanded in 2020 while the rest of the world was experiencing contractions not seen since the Great Depression, China increased its share of global output and narrowed the gap with the U.S. Some economists now predict China’s economy will likely become the world’s biggest by 2028—two years earlier than previously forecast—with Nomura Holdings Inc. saying the crossover could be as early as 2026, depending on the strength of its currency against the dollar.”

“It’s a prospect causing much anxiety in Washington. In his first press conference since taking office, President Joe Biden vowed he won’t let China overtake the U.S., promising more spending on innovation and infrastructure to boost the American economy…”

“Biden is doubling down on measures imposed by the Trump administration to cut China’s access to key technologies such as microchips. China is also meeting fiercer opposition elsewhere: In Europe, Chinese companies face tighter investment screening, and in Asia rivals Japan, India and Australia are combining with the U.S. to create a geopolitical bloc aimed at limiting China’s influence.”

“That’s not stopping Beijing, where the leadership has put forward ambitious targets to double the size of the economy by 2035. The government is increasing spending on scientific research and innovation as it seeks to become a global leader in areas from artificial intelligence to biotechnology and green energy.”

“‘The world today is undergoing major changes not seen for a century, but time and trends are on our side,’ President Xi Jinping told party officials in January. Last year saw several milestones signifying China’s rising global influence: it attracted more foreign investment than the U.S. for the first time and the number of Chinese companies on Fortune’s list of the world’s largest overtook the U.S.”

“And for all the talk of supply-chain diversification amid the trade war, China’s share of global trade actually increased at a record pace as the world snapped up its masks, medical equipment and work-from-home gear.” Jin Wu and Tom Hancock report for Bloomberg

Geopolitics: China Eyes Africa as Iron Ore Hub to Replace Australia

From Nikkei Asia

“There was a time when Japan, like China today, was the rising power in the East that kept military planners in the West awake at night...But Japan had a critical weakness: a lack of steel.”

“Japan had imported large quantities of American steel under a special agreement between the two governments prior to 1917, when the U.S. imposed a steel embargo that stemmed the flow to the Asian country…”

“Chinese state planners looking to learn from history would quickly notice that the glaring vulnerability for Beijing today is its dependence on iron ore from Australia. While Beijing has tried to squeeze and punish Canberra for proposing an international investigation into the roots of COVID-19, it has been unable to wrestle itself away from Australian iron ore, which accounts for over 60% of China's imports.”

“As Australia deepens its connection to the Quad grouping with the U.S., Japan and India, forming a de facto anti-China tag team in the Indo-Pacific, Beijing has found it increasingly uncomfortable to depend so much on Canberra for iron ore -- the basic material behind its own military buildup.”

“But that dependence may very well change by 2025, says Peter O'Connor, senior analyst of metals and mining at Australian investment firm Shaw and Partners. ‘They are very serious’ about diversifying supply and flattening the cost curve of iron ore, O'Connor told Nikkei Asia.”

“The top focus for China's diversification push is Guinea, an impoverished but mineral rich country in West Africa, O'Connor said. A 110 km range of hills called Simandou is said to hold the world's largest reserve of untapped high-quality iron ore.”

“Commodity watchers have known of Guinea's potential for many years, but the lack of infrastructure has hamstrung such development efforts. A roughly 650 km railroad would need to be built from scratch, as well as a modern port from which the iron ore would be shipped.”

“Cost calculations have always discouraged potential entrants, such as Rio Tinto. But Beijing has more incentive to carry out the project than mere return on investment calculations, as China needs to avoid the fate of Japan in the early 20th century.” Ken Moriyasu reports in Nikkei Asia.

Saudi Shares Rise on News of $3.2 Trillion Stimulus Program

From Arab News (Saudi Arabia)

“Saudi shares rose 1.5 percent on Wednesday following the announcement of a SR12 trillion ($3.2 trillion) stimulus package for the private sector.”

“Saudi Crown Prince Mohammed bin Salman launched the “Shareek” program on Tuesday evening which will see 24 of the Kingdom’s biggest names such as Aramco and SABIC, leading a massive investment drive.”

“Private sector businesses will be helped to invest SR5 trillion between now and 2030, along with SR3 trillion from the country’s sovereign wealth fund, the Public Investment Fund (PIF), and SR4 trillion as part of a new national investment strategy, Crown Prince Mohammed bin Salman said.”

“The Saudi market rose on the news with the Tadawul All-Share Index gaining 1.5 percent in early trade, led by the banking, utilities, and petrochemicals sectors…”

“Saudi Investment Minister Khalid Al-Falih said that the new investment program would play a big part in diversifying the economy and boosting competitiveness.” Arab News reports.

India Unicorn Plans $15 Billion US IPO

From Bloomberg

“InMobi Pte, which provides mobile-advertising services globally, is planning to list in the U.S. by the end of the year, according to a person familiar with the plan, potentially the first among a slew of Indian startups targeting initial public offerings.”

“The tech upstart, India’s first private company to reach unicorn status with venture funding, could kick off the IPO process in a few weeks, when its board is set to meet to consider a listing, said the person, who asked not to be identified talking about a confidential matter. The offering size could be as large as $1 billion, valuing InMobi at $12 billion to $15 billion, the person said.”

“A successful debut could make InMobi the first of India’s unicorns to directly list in a U.S. stock exchange, highlighting the country’s shift beyond information technology and outsourcing services. The sale would be a windfall, at least on paper, for InMobi’s biggest backer SoftBank Group Corp., which owns about 40% of the company…”

“The pandemic has been a boon for ad-technology companies including InMobi as it has accelerated a shift to mobile in gaming, video streaming and shopping. Advertisers have been quick to follow and capitalize on the trend.”

“InMobi, which operates in markets including China, the U.S., South Korea, Australia and India, uses algorithms to deliver targeted advertising to users’ phones. The company also helps advertisers create ads and monetize site traffic, providing real-time reports on campaign performance.” Saritha Rai reports in Bloomberg.

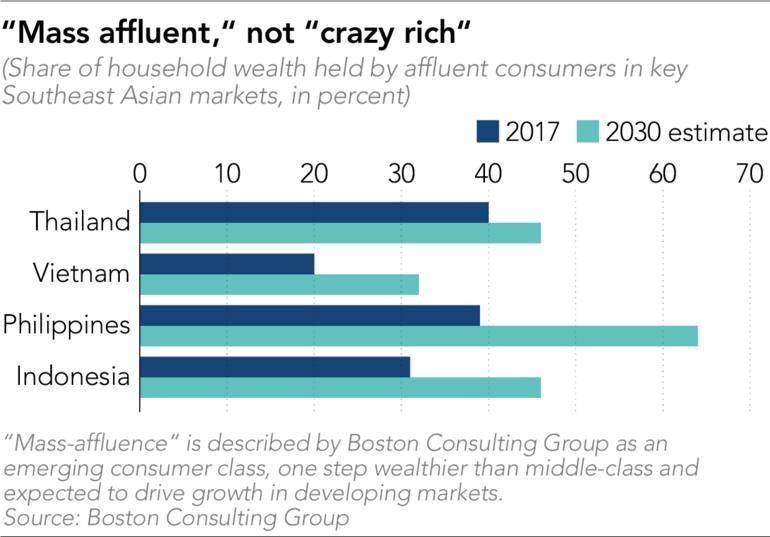

Chart of the Day: From Nikkei Asian Review

Al-Monitor Podcast Talks With Emerging World

Note from Afshin Molavi: I was delighted to join Emerging World ‘fellow traveler’ Andrew Parasiliti for his excellent “On the Middle East” podcast. We talked Middle East economies, Dubai as a Key Global Hub, The Suez Crisis, the Iran-China Deal, Emerging Markets, and our humble caravanserai in the corner of the vast internet: Emerging World.

Here’s the blurb below for the podcast episode:

On China-Iran ties: follow the money, not the MOU’s, says Afshin Molavi

On the Middle East with Andrew Parasiliti, an Al-Monitor Podcast

Afshin Molavi, senior fellow at the Johns Hopkins University SAIS Foreign Policy Institute and founder of Emerging World newsletter, discusses why we shouldn’t oversell the Iran-China agreement; the prospects for employment and growth in the MENA region following the coronavirus pandemic; the post-covid prospects for Dubai and Egypt; China’s role in the region; the ‘disruption-proof trends in emerging markets; and more!

Check it out here.