Emerging Markets Daily - March 8

US/UK To Ban Russia Oil, Pakistan PM Faces Ouster, LME Halts Nickel Trade on Soaring Price, Wheat/Food Prices and Instability, Kenya and S. Africa Airways

The Top 5 Stories Shaping Emerging Markets from Global Media - March 8

US And UK Poised for Ban on Russia Oil Imports

Bloomberg

“The U.S. and the U.K. will impose a ban on imports of Russian energy Tuesday without the participation of European allies, according to people familiar with the matter.”

“The U.S. ban will include Russian oil, liquefied natural gas and coal, according to two people, who spoke on condition of anonymity. The decision was made in consultation with European allies, who rely more heavily than the U.S. on Russian energy, another person said.”

“The U.S. is a smaller buyer than Europe and the bigger risk to prices rallying lies in coordinated action between U.S. and Europe. Russian oil made up about 3% of all the crude shipments that arrived in the U.S. last year and imports of Russian oil and petroleum products represented about 8% of the U.S. total.”

“The U.K. today will also move in concert with the U.S. and the ban will be phased in over the coming months, according to a person who requested anonymity speaking about policy that hasn’t yet been announced. The ban won’t apply to Russian gas, the person said.”

“For now, much of the impact of a U.S. ban was priced in by the market over the weekend and into Monday’s trading, sending the global benchmark to nearly $140 a barrel. Traders are saying the question now is about how long the ban lasts and whether oil from Iran and Venezuela could help fill the gap.”

“Administration officials in private discussions have said they should stress efforts to speed the transition to renewables and to expand domestic energy production, according to two people familiar with the conversations. But the White House isn’t planning any fresh initiatives.” Bloomberg reports.

Pakistan PM Faces Ouster Amid Fears of Failing Economy

Nikkei Asia

“Opposition parties in Pakistan's parliament are set to topple the government of Prime Minister Imran Khan, as critics charge his policies are stoking inflation and amount to ‘selling out Pakistan's sovereignty’ to the International Monetary Fund in the country. The opposition is in the final stages of drafting a ‘no-confidence’ motion against Khan's government, which will be tabled in the National Assembly this week, Nikkei Asia learned from people familiar with the matter.”

“There are 162 opposition politicians behind the move, which needd the support of 24 members of government and can easily topple Khan's administration.”

“Main opposition parties include the Pakistan People's Party (PPP), Pakistan Muslim League Nawaz and JUI-F. Contenders to take over as premier include Bilawal Bhutto Zardari of the PPP and Shehbaz Sharif of the PMLN. On Monday, Bhutto blamed the Khan government for causing inflation and poor stewardship of the economy, as well as its dealings with the IMF.”

“…Analysts fear that toppling the government could further destabilize the economy, which is just emerging from COVID-19 doldrums…Government officials said that toppling Khan could lead to an outflow of investments. The country's foreign exchange reserves had risen to $22.88 billion (based on figures from State Bank of Pakistan) from $16.38 billion in fiscal 2018 when Khan assumed power.” Nikkei Asia reports.

LME Suspends Nickel Trade as Prices Soar

CNBC

“The London Metal Exchange on Tuesday suspended the trading of nickel after prices more than doubled to surpass $100,000 per metric ton. The LME said in a statement that trading will be suspended for at least the remainder of the day.”

“…The exchange said it had been monitoring the evolving situation in Russia and Ukraine and it was evident that this had affected the nickel market, citing extreme price moves in Asian trading hours.”

“Commodity prices have been spiraling upward on supply fears related to Russia’s onslaught of Ukraine, with the ongoing war and an array of Western sanctions raising disruption fears.”

“Traders, brokers and clerks on the trading floor of the open outcry pit at the London Metal Exchange Ltd. in London, U.K., on Monday, Feb. 28, 2022.” Chris J. Ratcliffe | Bloomberg | Getty Images

“Three-month nickel on the London Metal Exchange briefly jumped to a record high above $100,000 per metric ton on Tuesday, before paring some gains. Alongside energy, Russia is a key producer and exporter of metals and grains. Indeed, Russia is the world’s third-largest producer of nickel — a key ingredient in stainless steel and a major component in lithium-ion batteries.”

“Ole Hansen, head of commodity strategy at Saxo Bank, described the surge in nickel prices as ‘absolutely crazy….It is a very dangerous market right now because this is a market that is not driven by supply and demand, it is driven by fear,’ Hansen told CNBC’S ‘Squawk Box Europe’ on Tuesday.” CNBC reports.

Wheat Soars to Record, Pushing Food Prices Up and Posing Instability Risks

Bloomberg and Al Jazeera

“Wheat jumped to an all-time high, exceeding levels during the global food crisis in 2008, as Russia’s intensifying war in Ukraine cuts off one of the world’s top breadbaskets and delivers an extreme supply shock.”

“…Prices have skyrocketed more than 60% in the past two weeks as the war effectively shut off more than a quarter of the world’s supply of the food staple used in everything from bread to cookies and noodles.”

“Global food costs are already at a record, and the jump in prices since Russia’s invasion is only going to send them higher, pushing more people into hunger and increasing government spending on subsidies for consumers.”

“The elevated prices are triggering concerns about growing food insecurity and stir memories from more than a decade ago, when price spikes led to food riots in more than 30 nations, including in Africa and the Middle East, and contributed to political strife and uprisings in the Arab Spring.” Bloomberg reports.

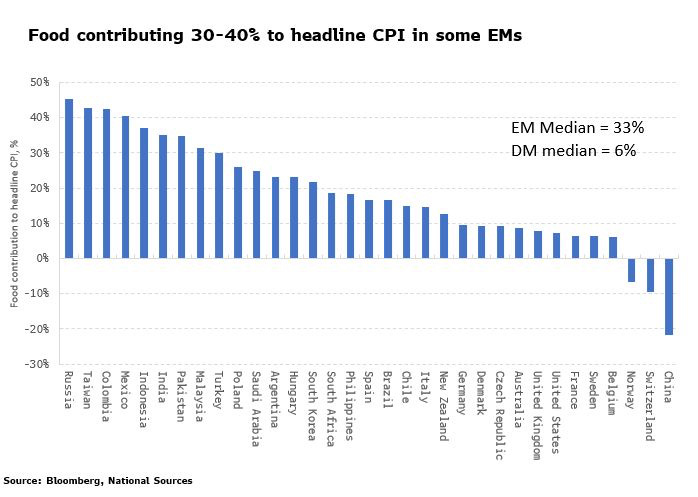

Meanwhile, as Al Jazeera reports: “As was seen in the Arab Spring in the early 2010s, rising food prices can be hugely destabilizing. The impact they are having on broader inflation is growing and therefore the risk they pose to EM governments is mounting. For the median EM country, food is almost a third of current year-on-year headline CPI. In Russia, almost half of the current 8.7 level of CPI is coming from food, whereas in the US, UK and much of Europe food is only 10% or less of headline CPI currently.”

“And as currencies weaken, the risk of an inflation spiral in EMs rises as the cost of imported goods climbs even more.” Bloomberg/Al Jazeera report.

Kenyan Airways and South African Join Hands to Survive

African Business

“In a year in which Africa’s airlines continue to struggle against the long impact of Covid-19, the stakes are particularly high for two of the continent’s biggest airlines, which are tentatively pooling their resources in a fight to survive.”

“Kenya Airways (KQ) and South African Airways (SAA) signed a Strategic Partnership Framework in South Africa last November, which if implemented, is expected to improve the financial viability of the two carriers by cutting costs, increasing the size of the available fleet at their disposal through code sharing, and potentially leading to a new pan-African airline group by 2023.”

“Kenyan President Uhuru Kenyatta told his listeners during his New Year’s address that KQ and SAA will ‘join hands’ to overcome the economic difficulties they both face. Through the arrangement, tourism, trade, and social engagement in Africa can be boosted, he said. Spokespersons from the airlines have denied that a full merger is on the cards but have talked up the planned cooperation.”

“With 42.3% less traffic volume across Africa from January through to December 2021, and following a stuttering start to 2022 in the wake of Omicron, Africa’s airlines are again battling cash-flow issues.”

“…Airline partnerships are difficult to pull off, especially when they are flag carriers. The Air France-KLM Group has seen significant growth since getting together in 2004. But their unity has been tested by working disputes between the two carriers. A sense of injustice has festered following allegations that French pilots are paid more than the Dutch, and disputes over legacy cost structures have stoked further division among staff.”

“An academic study showed that 50% of strategic alliances fail due to cultural differences, mistrust or poor operational integration. Airlines based in high-income countries operating in liberalised skies, with large domestic traffic bases, fare much better.”

“…More important than partnerships to the future profitability of Africa’s airlines is liberalising air traffic on the continent, says Eric Tchouamou Njoya, lecturer in air transport economics at the UK’s University of Huddersfield. Africa has at least 350 mostly small airlines that face a high cost of operation and market protectionism.” Will McBain reports.

“A person needs a little madness, or else they never dare cut the rope and be free.” - Nikos Kazantzakis