Emerging Markets Daily - November 12

S. Africa Stocks Break Records, Asian Airlines Lagging, Shipping To Be Clogged into 2022, Turkey Curbs Flights to Belarus Amid EU Border Crisis, Bitcoin in Indonesia

The Top 5 Stories Shaping Emerging Markets from Global Media - November 12

South African Stocks Hit All-Time High on Richemont Surge

Bloomberg

“South African stocks rallied to a record on Friday, driven by sharp gains in Richemont, after the luxury giant’s earnings beat expectations.”

“The benchmark FTSE/JSE Africa All Share Index rose 1.1% to a record 69,906.47 as of 1:22 p.m. in Johannesburg. Richemont, the largest stock in the index, soared as much as 10%. A bout of weakness in the local currency added to its allure, along with fellow so-called rand hedges Naspers Ltd., Prosus NV and British American Tobacco Plc, which were also among the leading gainers.”

“‘All of these benefit from a weaker rand, which is why we are also seeing selected sectors such as local-facing financials come under pressure as money is shifted toward rand-hedge shares,’ Unum Capital strategist Lester Davids said in emailed comments. The rand steadied after sliding as much as 1.6% against the dollar Thursday.”

“The main South African index has now recovered more than 80% from the lockdown-induced lows plumbed in March 2020 as investors bet on an economic recovery from the pandemic. Sentiment also got a boost this week from Finance Minister Enoch Godongwana’s medium-term budget speech, with Avior Capital Markets saying investors responded positively to his pledges to accelerate reforms to bolster the economy, while reining in debt.” Adelaide Changole reports.

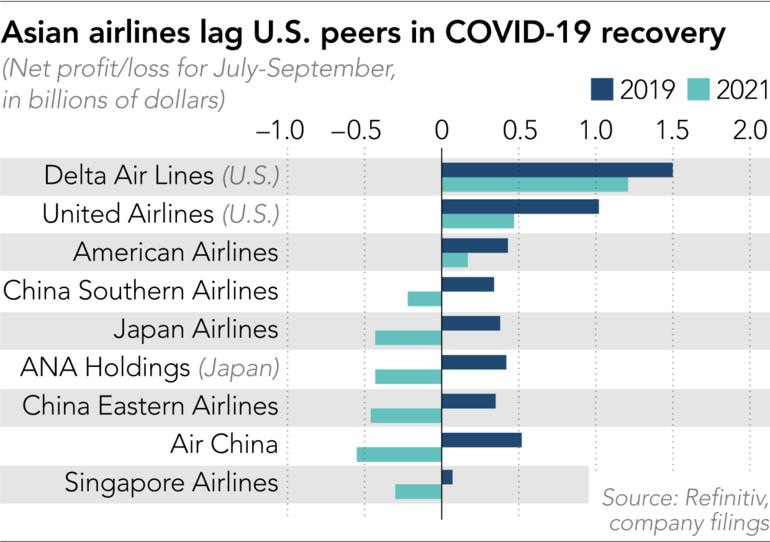

Asian Airlines Lagging Global Peers Amid Covid Curbs

Nikkei Asia

“Asia's airlines are struggling to emerge from the COVID-19 pandemic, with the biggest operators reporting significant losses -- again -- for the July-September quarter, reflecting the region's prolonged travel curbs.”

“Nearly two years since the onset of the pandemic, Western countries now lead the world's recovery from the crisis, with major U.S. airlines logging net profits in the quarter. But in Asia, strict safety measures to limit the spread of the delta variant continued to curtail demand for domestic and international travel in core markets, from China to Japan to Southeast Asia. Airlines are streamlining their operations, hoping to speed the return to profit if recent reopening moves by local governments unleash pent-up demand.”

“On Thursday, Singapore Airlines reported a net loss of 428 million Singapore dollars ($316 million) for the three months through September, marking the seventh consecutive quarterly loss. Its operational passenger capacity was 32% of pre-pandemic levels as of September.”

“The city-state's flagship carrier does not have domestic routes so its earnings most heavily reflect the weak cross-border travel in Asia, which is generally seen as more risk-averse than the West.”

“Meanwhile, domestic flights in China suffered from the government's zero-tolerance strategy for COVID outbreaks, which sparked strict community lockdown and travel curbs. Despite schools' summer break and mid-Autumn festival holidays, outbreaks in several provinces in southern and eastern China dampened travel demand.”

"We are seeing an improvement in the fourth quarter in Asia-Pacific. Domestic traffic is picking up again, and we are finally starting to see the first signs of international travel returning,’ said Brendan Sobie, an independent aviation analyst. ‘But it's very slow and gradual,’ he noted.”

“When it comes to their performance in the stock market, most Asian airlines' shares remain below January 2020 levels, with some exceptions such as Korean Air, which gained from steady cargo business.” Kentaro Iwamoto reports.

Container Shipping to Remain Clogged Into 2022

Sea Trade Maritime News

“Emile Hoogsteden, Vice President Commercial of the Port of Rotterdam, told an online media briefing that container volumes had grown 7.8% in the first three quarters of 2021 and were up 4% in terms of tons.”

“This growth though has come against a background of issues with empty container repositioning, events such as the blockage of the Suez Canal by the Ever Given, and closure of much of Yantian Port due to a Covid-19 outbreak leading to growing port congestion and supply chain dislocation globally.”

“Hans Nagtegaal, Director Containers Port of Rotterdam, highlighted that container line schedule reliability has been at all time low this year and remains so. According to analysts Sea-Intelligence global container line schedule reliability stood at 34% in September as an average across 34 different trades.”

“He said the port sees the situation continuing through 2022. Nagtegaal likened the supply chain to gears or cogs that have become tightened together and need oil to allow them to run smoothly again.”

“‘We actually need some oil, and the oil that we need is schedule reliability. That would be the first step where we see a global change this effect. We need somewhere that the schedule reliability can be picked up,’ he said.”

“However, he noted that it didn’t help that 25% of global containership capacity is essentially out of the market waiting outside ports for berths. This highlights a chicken and egg situation with lines blaming their poor schedule reliability on delays and congestion at ports.” Sea Trade Maritime News reports.

Turkey Curbs Migrant Flights to Belarus to Stem EU Border Crisis

Financial Times

“Turkey has banned citizens of Iraq, Syria and Yemen from flights from its airports to Belarus, in a move to stem the flow of migrants to the EU’s borders.”

“Thousands of people have travelled from the Middle East via Minsk to Belarus’s borders with Poland, Lithuania and Latvia in recent months in hope of entering the EU.”

“European officials say the surge is being orchestrated by Minsk in retaliation for the bloc’s support for the Belarusian opposition. Brussels has been lobbying countries used as transit points on the route to Minsk to help stop the flows.”

“On Friday, Turkey’s Civil Aviation Authority said nationals from Iraq, Syria and Yemen would not be able to buy tickets from Turkey to Belarus until further notice…”

“Istanbul has become an important travel hub connecting Europe with the Middle East and Africa as Turkish Airlines has dramatically increased its international footprint in recent years.”

“The national flag carrier enacted its own ban on passengers from Syria, Iraq and Yemen on Thursday night, according to a person familiar with the matter…Margaritis Schinas, vice-president of the European Commission, on Friday visited the Lebanese capital Beirut as part of a wider tour of the region aimed at persuading countries to help stem the number of migrants. He is due to travel to Iraq next.” James Shotter and Laura Pitel report.

Indonesia’s Largest Crypto Exchange Reacts to Bitcoin Fatwa Ruling

Jakarta Globe

“Indonesia's largest crypto asset exchange by the number of users, has reacted to the latest fatwa from one of Indonesia's largest Islamic scholars bodies that declared crypto assets, like bitcoin, ethereum, or Cardano, used as a medium of transactions as haram or forbidden by Islamic law.”

“According to Indonesia Ulema Council (MUI), cryptocurrencies are still halal as long as they are used as assets or investments under certain circumstances, not as a means of payment. Fatwa is a nonbinding ruling from a recognized authority on an issue in Islamic law.”

“MUI said only crypto assets with similar properties as sil'ah, or goods, are allowed to be traded. In response, Indodax CEO Oscar Darmawan emphasized that crypto assets are not used as currency within Indonesia anyway.”

"‘In Indonesia, crypto assets are indeed not for currency as Bank Indonesia regulations align with MUI deliberations which forbid crypto as a currency. In Indonesia, the Rupiah is the only recognized currency,’ he said. ‘At Indodax, we trade many types of crypto assets. The largest trading volume at Indodax comes from crypto assets that have physical assets as underlying assets,’ Oscar said.” Jakarta Globe reports.

“Sometimes the wrong train takes you to the right station.” - From Saajan, played by the late Irfan Khan, in the acclaimed Indian film, The LunchBox.